I bought a 60 strike for next week. Expecting SPY to tug this down with it. If this happens, I’ll likely get into longer term puts or wait for this to be funny and try to rally.

That’s kind of what happened today gave pretty good entry on that bounce for no apparent reason.

I believe this was part of the fundraising with the junk bond selling. They disclosed last week they were putting up some of their own money for the acquisition of Adesa and would buy the preferred shares. Also substantially smaller percentage than the amount of shares they sold at 200-300.

Pretty decent article discussing the fact they keep pissing billions of dollars away.

cross-post

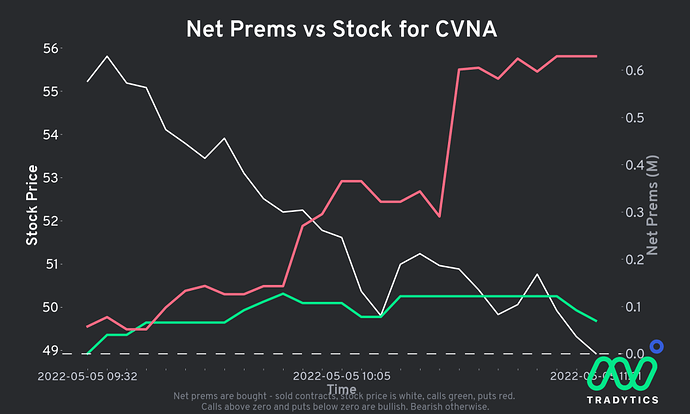

CVNA broke off the general market a little overnight premarket was down 4 percent after its first relatively strong day as of late yesterday. It stayed down and never bounced. Have pretty consistently been able to get good put entry’s. More hesitant this week as I don’t know when it finds bottom. I think it has further room to drop. As it’s still most likely overvalued. Also was downgraded to their lowest PT yet. And doesn’t leave much upside from its current pricing.

Gonna flip the script here on the market reversal. Although I think this company is garbage and ultimately heading towards bankruptcy and no existence. Todays reversal on bullish FOMC news in my opinion. Not many companies have been hit harder than CVNA 50% decline in 1 month. Although I think overvalued. Don’t feel the drop anymore without some kind of bearish catalyst. However the closing of the Adesa deal in the eyes of most is a bullish short term catalyst seems to be going to happen with junk bonds and fundraising. Got a good pop on the news they were purchasing for short term I may take a 70c or 2 here for end of may tends to pump with the market and I think we are in for a pump. As much as it pains me personally to bet on an upside. We play both ways to make money.

Thanks to the 17% dump CVNA took today, while was no doubt helped by the SPY bleed-out, the 50Ps I got 7 days earlier got limit sold for 2x again. Fourth swing so far.

The Garcias keep on giving. Will wait for another green day to load up again.

Fwiw, much put buying today too, which probably helped make the premiums go that wee bit higher.

Nice job. Today was the first day in weeks that I haven’t had CVNA puts in my port at some point. However didn’t wholly expect the entire market to tank.

So I got to kicking this around today trying to divulge a strategy here instead of kicking myself for not having puts for its single greatest day drop since We started playing it. Although I am very greatful to the Garcia for the gifts they have given. It seemed to trend downward more than a lot of the market. I mean essentially almost everything down however CVNA was down nearly 20 percent.

My consensus is with rapid rate hikes incoming confirmed. This tends to hit housing and automotive the hardest because those are the two biggest things people borrow money for… As we have already established above these guys are bleeding cash daily and riddled to the gils in debt. They admittedly over paid for inventory in Q1. Most of which is floorplanned or essentially margined to a creditor that they pay a small amount of interest on. With rate bumps floorplan rates bump. This means their daily cost of doing business is on the rise. With cash flow already negligible and cost of business rising. It leads to even more money.

Secondly on the riddle with debt portion. They have tons of it and means cost to borrow likely increases for them. Rate increases are intended to slow demand. Well if you are heavy in any inventory already and demand stifles. You are essential screwed. If automotive market and values drop through the floor these guys are in a world of hurt. And I think that is what investors realized. I was a bit cautious here with its run up with market yesterday. But I do think after more thought rising rates are just throwing fuel on the fire for these guys.

The pattern with CVNA seems to be that it has spurts of positive days, but inevitably, it is dragged down. So I’ve stopped getting puts that are anything less than 21 DTE or so.

There is a certain inevitability to the demise that is captured across a range of factors:

- Price action, of course (Fig 1)

- The latest junk bond has gotten … junker - yield is now > 11%. (Which is more of a sign of the market’s discounting their credit worthiness even more than what they tried to capture - they still pay the 10.25%) (Fig 2)

- The latest bond covenants were structured specifically with bankruptcy in mind, and restructuring specialists Apollo took > 1B of those. Garcias have also bankrupted previous car dealerships and bought the assets back pennies to the dollar.

- Unless a miracle happens and they 2-3x their cashflow, as you note, they will simply run out of cash.

Now, they have bought a few months with all this cash, so next time I go in I will probably even longer DTEs, but it is difficult to see how they do not undertake serious restructuring, all the way to bankruptcy, by Fall.

Fig 1. Recent CVNA price action (SPY in Orange)

Fig 2. CVNA Bonds

(Source)

The KAR CEO noted in the earnings release:

“We expect to close the transaction selling our U.S. physical auction business to Carvana within the next week,”

(Source)

Because it is difficult to gauge how the market will respond to this, will not initiate any positions until the close happens. Best case situation - this gives it a nice 10-20% bump over a short period of time, giving us a nice perch to short from again .

Welp. Forgot completely about KAR earnings impact on this. Thought I was able to get what I felt were good fills on 30p today after it’s intial 15 percent drop at open and then run up 10 percent.

In agreement with you. Will probably let this run on the news or at least watch and see. Hopefully we get our prototypical drop at open To exit the ones I’m holding currently.

Side note made me look at KAR earnings that were god awful roughly 80 percent miss if I am calculating correctly. From CVNA standpoint seems to be adding another money pit to their already existing portfolio of business. This is before the planned May withdrawal of most legacy auto companies and cutting of ties from Adesa.

Seems they have finalized probably run some on this.

CVNA reducing their workforce by 2500 heads,

Post by a CVNA employee who was suddenly laid off: Reddit - Dive into anything

The Garcias are apparently not real great to work for from the sounds of it not least bit surprised I think this just adds fuel to the fire that they are heading down the pathway to bankruptcy. Junk bonds heavy losses layoffs any thing other than an exceptionally stellar Q2 further tumbles the ship. Looks like they had 2 8k filed today in regards to Adesa/bond deal and employee layoff and a 10q.

The 8-k are really non eventful other than bad news or employees being laid off. And stuff we already had uncovered. However I do have some experience in reading automotive financials and the general idea of them which was on the 10-q link below. The interesting part of this is in Q4 their assets exceeded their liabilities in Q1 that’s not the case by a decent amount. I’m not all that versed in reading SEC filings so maybe someone else smarter can take a peak at the 10-q. I also noticed in the print section that they posted wholesale revenue for selling to drivetime and acquisition revenue by buying from drivetime. Which the Garcias own both. Seems like washing dollars. All in all their financials don’t look good.

I’m gonna keep riding these guys to the ground. I’d expect the Put chain to add some lower level where I may look at put leaps for end of the year. We have no financials reporting here til August. If it every gets any kind of bounce Which I’ve been waiting for I’ll continue to look at put entry’s. Edit they added strikes down to 20 to the chain.

Upon reading some more of this. Looks like they have also been writing their own loans and then selling them off. This could cause a problem in short term as if loans written before rate hikes end up selling at losses could compound their woes.

Also noticed their floorplan agreement runs through September and seem to be paying a hefty rate on any aged inventory as we know from their own statements they were heavy in ineventory and down in sales.