First and foremost I thought this warranted a different thread than the other CVNA mostly newsworthy fundamentally bearish thread. Based upon the fact that I witnessed on TF this morning everyone’s astonishment at it running 40 percent at open. Which was prefaced in the other thread. Really made me wonder if people are utilizing the forums as they should because it’s a goldmine. So I thought I’d tag it with squeeze which it is potentially and get others attention.

The company is a heaping pile of shit, but as @The_Ni and I have correlated on the downtrend we also weeks ago noted that any sort of not absolutely awful news could push it upward with shorts being underwater already. Unfortunately neither expected anything less than what we got. Bad news bad earnings etc. and it went up. And went up fast

However it is absolutely setup to squeeze like many of us haven’t seen in a while. Typical squeezes we have all witnessed are garbage companies that lose money. Which is primarily where the SI comes from. That goes right a long with CVNA. GME AMC BBBY SPRT IRNT none of which really make money or ever did. Well that attracts shorts.

I know this ticker better than any ticker I watch I know how it moves etc. cuz I have spent months as noted in other thread riding it down. Watching it daily even when I have no position. But I am also not willing to miss an opportunity to profit off something make money on the way down make money on the way up.

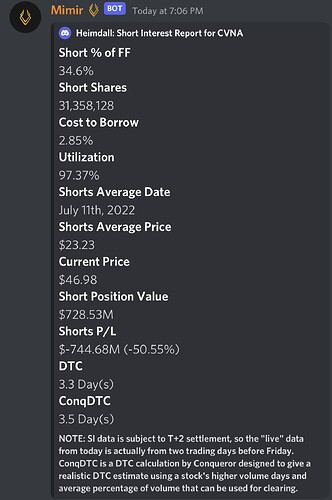

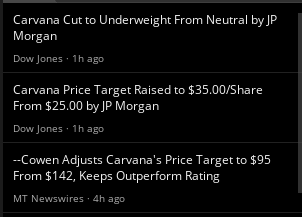

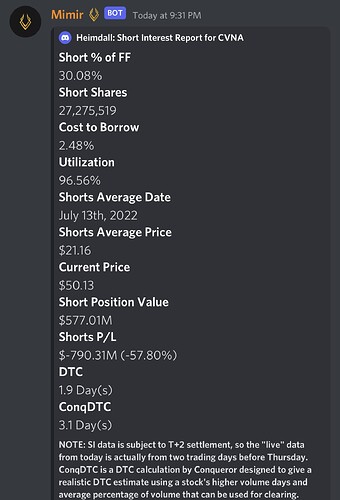

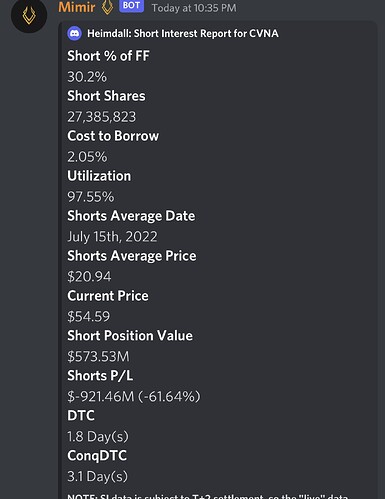

Now the technicals CVNA has accumulated a significant amount of SI over last several months. To the tune of 30+ million shares on a float of roughly 80 million. That’s steadily approaching 50% SI. There was likely some short covering at open today to push it so violently. However the float is relatively small at the moment when talking about companies with large market caps… Has a fairly large institutional and Insider ownership and within the last year has traded at 300 plus per share. There were many funds and institutions that invested in this company for years now at elevated prices. For example in 2018 it was trading at higher levels than it is now. Does that mean it’s worth a long term investment? Nope not at all. But the setup to really run is there.

I’d expect this SI to change when we see the actual numbers as that was from this evening. And most likely this mornings run had some kind of covering with 8 million in volume in so short of time but there was likely some FOMO and likely some thinking their earnings weren’t so awful. However there are certainly shorts up and down the entry’s. The SI and the average price will I’d think make its way around socials throughout the weekend as when a stock runs 40 percent it begins to get talked about. Then you look at the fact that shorts are 50 percent in the hole. And a significant DTC could make this really run.

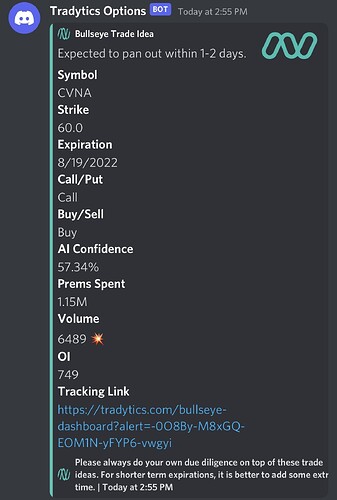

Even options bot has called out a strike

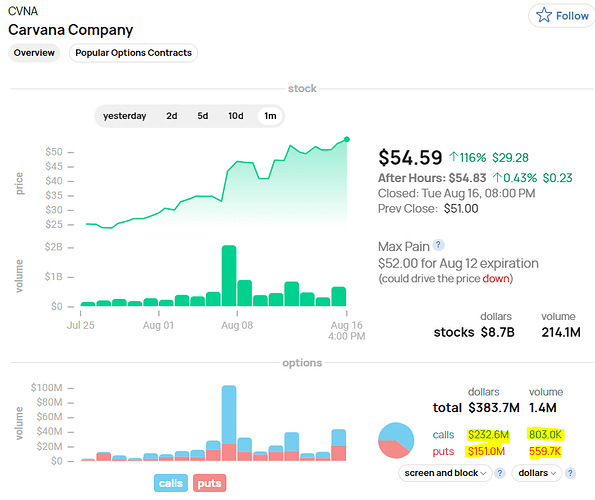

Now as far as the ITM strikes maybe someone can provide some data or feedback from that standpoint. The IV is always jacked to the gills on CVNA has and always will be for most part. Which means big money to be made on the upside. The underlying price has risen

65 % in last week and 70+% in last month. This to me says lots of strikes ITM. The weeklies stop at roughly 50 however the monthly’s go well over a 100. Anyways wanted to throw this up as I hope we are early and can all make some money.

Edited: forgot to add the downside. Way I see it there are 2 things that derail this.

-

Garcia boys dumping into the float. Which they have massive amounts of shares held personally. And aren’t scared to sell them.

-

some kind of offering as a cash strapped company losing millions per quarter. The quickest way to

Cash is dilution.

Both really risks and likely IMO.

@Conqueror can you take a look at this and see if it’s worth adding to trade alerts. I think it has potential to run a lot.