Today I caught some Twitter wind about a massive share unlock on #CVT Cvent. They’re a deSpac through DGNS from Q4 2021.

I’m doing some digging now. Here’s what I found.

TL;DR

- Shares Outstanding = 481,140,000

- Shares Unlocked on Monday, June 6 = 461,392,605 — that’s 96% of the shares outstanding!

Links:

[size=4]Lock-Up Expiration DD[/size]

On page 70 of the 10-K under the Risks section:

In connection with the consummation of the Reverse Recapitalization Transaction, Vista received approximately 397.7 million shares of Company Common Stock. The Company also entered into a registration rights agreement with Vista and certain other stockholders, pursuant to which it granted certain registration right to Vista and the other stockholders party thereto. Following the expiration of any lockup period applicable to shares of Company Common Stock held by Vista, it or its affiliates may sell large amounts of Company Common Stock in the open market or in privately negotiated transactions. The registration and availability of such a significant number of shares of common stock for trading in the public market may increase the volatility in the Company’s stock price or put significant downward pressure on the price of its stock. In addition, the Company may use shares of its Common Stock as consideration for future acquisitions, which could further dilute its stockholders. After the applicable lock-up periods expire, an additional 461,392,605 shares of Common Stock (including 37,389,301 shares issuable upon exercise of options) will be eligible for sale in the public market. If our existing stockholders sell substantial amounts of our Common Stock in the public market, or if the public perceives that such sales could occur, this could have an adverse impact on the market price of our Common Stock, even if there is no relationship between such sales and the performance of our business.

As of December 31, 2021, Vista owned approximately 82.7% of our outstanding Common Stock. Accordingly, the Company is a “controlled company” for purposes of the Nasdaq listing requirements. As such, the Company is exempt from the obligation to comply with certain corporate governance requirements, including the requirements that a majority of its board of directors consists of independent directors, and that it has nominating and compensation committees that are eachcomposed entirely of independent directors. These exemptions do not modify the requirement for a fully independent audit committee. If the Company ceases to be a“controlled company,” it must comply with the independent board committee requirements as they relate to the nominating and compensation committees, subject tocertain “phase-in” periods.

According to this tweet, Vista Equity acquired their stake in April 2016 when $CVT was valued at 1.65B. The current marketcap is 2.4B. That’s about a ~1.5X return. I found the source of the timeline here.

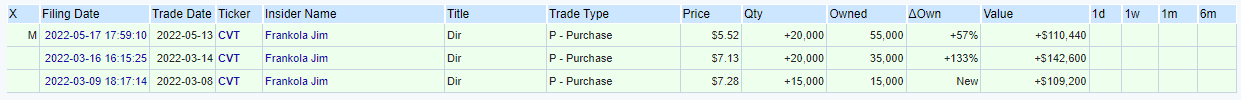

This is an interesting sale opportunity as typically with deSpac unlocks, it’s PIPE investors that formed part of the SPAC merger deal that are unloading. This time it’s a legacy shareholder, who may be itching to exit with profits especially in this macro environment that punishes unprofitable debt-heavy companies.

S-1/A notes The Offering:

The “certain exceptions” of a sale earlier than June 6 relate to the stock trading above a certain price for a certain time, which never happened as the stock basically traded below $10 the entire time:

Each party to the Investor Rights Agreement (other than the Sponsor and certain of its affiliates) has agreed that such party shall not transfer, or makepublic any intention to transfer, any Lock-Up Shares (as defined below) for 180 days following the Closing Date (until June 6, 2022); provided that, such restrictions applicable to 33% of the Lock-up Shares received by each such person at Closing shall terminate (but not earlier than the three-monthanniversary of the Closing) if the volume-weighted average price of the shares of Common Stock equals or exceeds $13.00 per share for any 20 trading days within any 30-trading day period after the Closing Date (such restrictions are referred to as the “Investor Lock-Up”). The Investor Lock-Up applies to all 397,745,049 shares issued to Vista in connection with the Closing of the Business Combination.

In addition, the Sponsor and certain of its affiliates have agreed that they shall not transfer, or make a public announcement of any intention to transfer, any Lock-up Shares until December 8, 2022, provided that such restrictions will terminate if the closing price of the shares of Common Stock equals or exceeds $12.00 per share for any 20 trading days within any 30-trading period commencing on or after April 7, 2022.

[size=4]Some Fundamentals DD[/size]

- Revenue growth is miniscule from 2020 to 2022.

- Negative EBITDA

- Gross Profit Margins are somewhat declining.

- Debt = 300M. Cash = 193M

- They just announced a 500M debt refinancing on May 31, 2022, which means they are taking on new debt to pay off their old debts, and take on a better interest rate.

[size=4]Trading DD[/size]

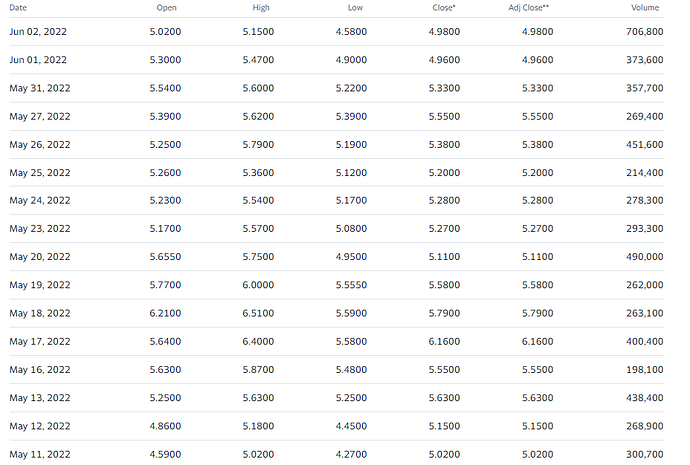

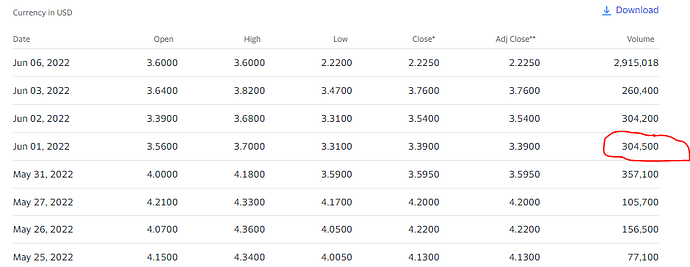

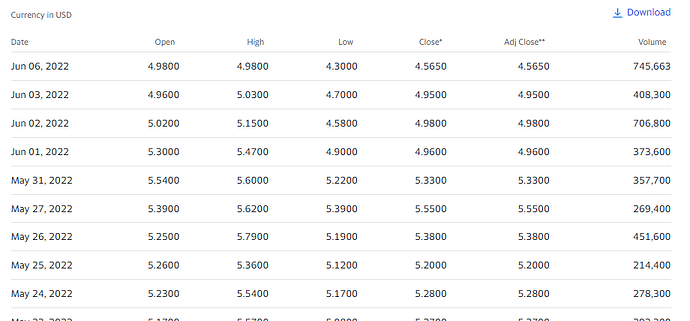

Typical trading volume is around ~300K to 400K. An unlock of 460M is relatively massive.

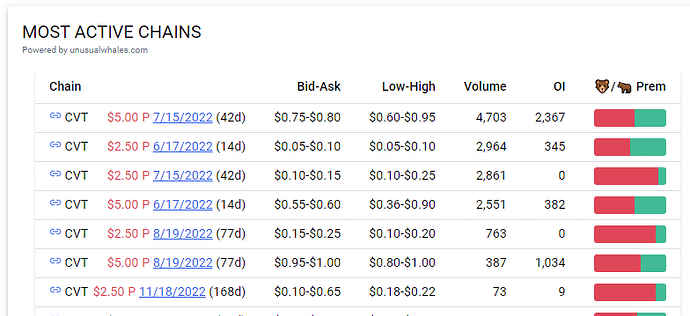

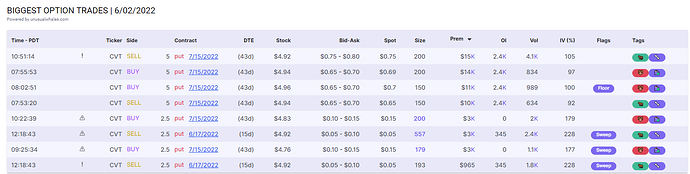

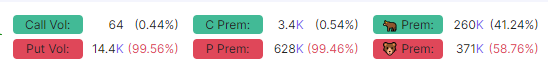

Options flow is clearly puts heavy.

July 5p is popular.