Alright folks, given the recent spike in liquidity and trading volume for FLUX on Arbitrum, I was asked to provide my very first DD here. We will discuss several important points, and I will also include a summary (TL;DR) at the end. However, I hope you stick around for the entire write-up.

I really liked Ranger_Oz’s Disclaimer on his Shiba DD post, so I’ll paraphrase some of that here: This isn’t investment advice. I’m not a developer. Nor do I day trade crypto. In fact, I prefer to scalp SPY and hang onto nuggets like BKKT. I’ve been in crypto since late 2013. Started with Doge, then bought my first bitcoin for $378 in 2015. Over the past few years, I’ve lived through the market pumps, followed by inevitable dumps (corrections), where 95%+ of projects undergo the “inevitable culling” like Ranger_Oz has pointed out. Losing a sizeable amount of money taught me how to choose winners and stay away from what I call the “shit hitlist…” No matter how hyped projects may seem now, you need to ask yourself why they’ll still be around in 3-5 years and objectively justify your answer. This is where the majority of people start relying on a crystal ball instead of basing their decisions on existing IRL metrics.

Now for some background:

Datamine (DAM) is a DeFi token that began its life in summer of 2020 and was created on the Ethereum (ETH) L1 blockchain by an anonymous developer known only as “Hodlforjesus“. It was built utilizing OpenZeppelin ERC777 standard (there are still only a handful of tokens that utilize this new standard). The goal was to solve monetary inflation in a decentralized manner.

Tokenomics:

The premise, as follows: DAM has a fixed supply of 16 million tokens. Users can lock DAM in a smart contract to start running a Mint. A Mint generates a secondary token, FLUX, whose supply started at 0. Users can also burn FLUX, thereby temporarily increasing their personal Minting rate while lowering everyone else’s (effectively creating a dynamic, global, 24/7 competition between all Mint owners).

DAM effectively represents a decentralized version of a central bank, that creates a currency (FLUX), whose supply dictates its very own demand. At first, this smelled like a zero-sum game to me because of the way FLUX is used. However, I discovered later that 1% liquidity pools and transactional throughput avoid this problem.

DAM has a fixed supply that ultimately grinds down into any DEX pool via trading. Eventually the liquidity pool becomes large enough that people have no incentive to unlock, thereby slowly increasing the USD value of DAM.

Regarding FLUX pool; as the pool grows (supply), minting FLUX results in lower inflation (once you have a large enough pool, the amount you mint in comparison to the total supply, and ongoing burned FLUX is negligible). FLUX has already hit negative inflation twice this year.

Growth:

What precluded rapid growth of this project over the past year, IMO, have been the L1 gas fees. While it’s impressive that over $1.4 million USD in FLUX has been voluntary burned by users within the ecosystem (Ecosystem Analytics - Datamine Network), I think that figure would have been much higher already if it didn’t cost $50-150 to interact with the smart contracts.

The DAM L1 Pool is a high volatility pool due to locked-in amount (13 mil tokens, nearly 80%). Any pump is countered by users unlocking and selling. You can’t just pump it (look at price history going back to April 2021). There has to be constant market demand sustained over a long period of time, which ultimately is a good thing for growth of any token.

The FLUX L1 Pool is a low volatility pool (check out the FLUX chart in log scale); the price over the past year has nearly resembled that of a stable coin, while not being pegged to anything (that’s quite the accomplishment).

Why I am Excited:

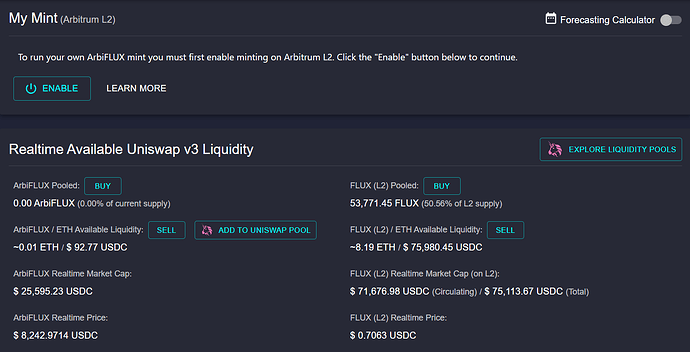

With the upcoming release of the L2 Deflationary layer on Arbitrum, users will now have the option to bridge L1 FLUX to the L2 layer, and lock L2 FLUX in order to Mint a third token, ArbiFLUX (whose price has not yet been determined by the market). This creates a new decision dichotomy, that will be very interesting to watch unfold. Instead of selling FLUX for profit (32% APY currently), or burning FLUX to increase your personal Mint Rate, users can bridge L1 FLUX to L2 Arbitrum FLUX, and 1) either add to the liquidity pool to earn 1% of trading fees, or 2) lock L2 FLUX to start their own ArbiFLUX Mint.

I think this is where my excitement is currently focused because ArbiFLUX is built from a token that is held by value (check out the retained liquidity metric in Market Metrics). Without DAM, you can’t create FLUX, and without FLUX, you can’t create any ArbiFLUX. It took a little over 1.5 years to mint 762k circulating FLUX (which currently has about 40% inflation), and now the added Arbitrum layer will drive inflation down even more.

This schema above (DAM → FLUX → ArbiFLUX) is basically a way to remove inflation from the system.

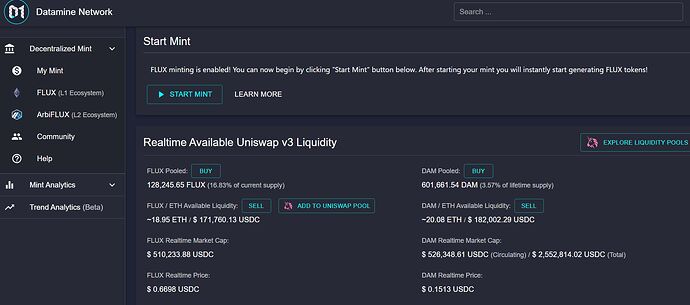

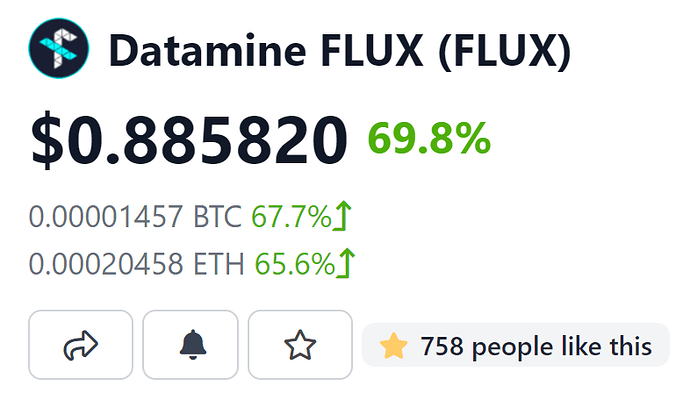

Just in the past 24 hours, Arbitrum trading of FLUX exploded to 70k in trading volume and 66k in locked liquidity.

I like numbers. Thankfully, Datamine provides data to support long-term project viability, via the Market Metrics and Mint Analytics tabs on their main page. Some important metrics:

- Locked-in DAM % is going up: 79.38% of all DAM in existence is locked, up from 70% a few months ago.

- The total number of active mints has been very stable, in mid 700’s.

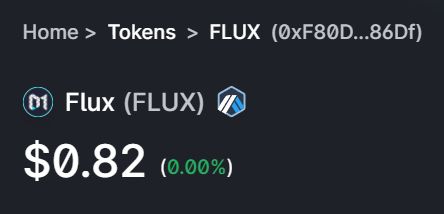

- Price of FLUX ($0.83) is almost at value creation ($1.19), once price > value creation that means on average each FLUX minted is now worth more than it’s original price.

- Current inflation for FLUX is relatively low at 40% (and only goes down as supply increases). ArbiFLUX will have even lower inflation.

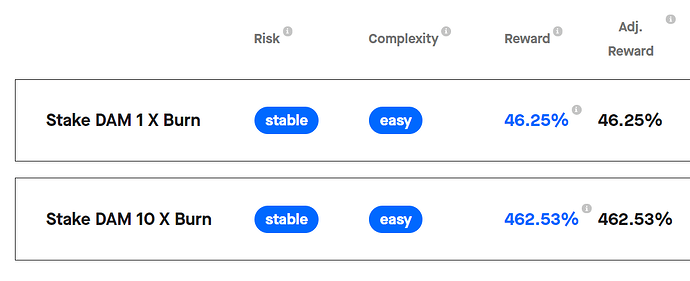

- Mint APY % is going up (currently 32%), and not down like other “farming” tokens plagued by hyperinflationary tokenomics.

- FLUX % burned has remained fairly stable at 60%.

- Uniswap V3 FLUX/ETH Retained Liquidity has been increasing (more ETH is entering the pool than leaving). Up $40k since October 2021.

- The FLUX total supply has had linear, predictable growth (after 1.5 years, only 762k FLUX has been minted).

- Both DAM and FLUX are currently sitting around $500k mcap based on circulating supply. If based on total supply, DAM mcap is just 2.4m.

- Liquidity is growing quickly:

174k in L1 FLUX/ETH pool.

179k in DAM/ETH pool.

64k in Arbitrum L2 FLUX/ETH pool.

Pros: (in order)

-

Real-world Use Case: I use their analytics daily. I strategically plan my burns and mints. It’s an actual product that nets steady APY. And it has proven (twice already) that it can solve inflation through Decentralized Mints by entering periods of negative inflation. Over the next year, FLUX inflation should remain in the low double-digits, but the focus and attention should now be turned to ArbiFLUX (which has a really good shot at becoming a single-digit inflation asset, or perhaps even deflationary) and serve as the base “dollar” of DeFi. Flux Liquidity Pools ensure that enough M0 money supply is in the market, which is a good thing because as the pool grows, this results in low volatility.

-

Moon Possibility: Due to low price, low supply, strong tokenomics (currently yielding 32.75% APY on L1 layer for staking DAM (Datamine (DAM) Staking Interest Calculator | Staking Rewards), I think it’s only a matter of time before this project reaches escape velocity. With the upcoming launch of L2 Arbitrum layer, transacting on the network will be even cheaper and faster compared to L1 gas fees, and will generate users additional APY through minting of the third token, ArbiFLUX (Price TBD). DAM and FLUX Uniswap liquidity pools showcase how transactional throughput benefits Liquidity Providers by earning 1% on each trade, incentivizing users to add liquidity.

-

Audited Contracts: Unlike many other tokens that get rug-pulled, you can sleep easy knowing that both DAM and FLUX smart contracts have been audited by SlowMist.

Datamine also received one of the highest DefiSafety scores of 81% -

Decentralization: No single person or core group of people own the majority of DAM or FLUX; the smart contracts can never be changed or altered. There is no “back door.” Here’s an interview the dev did with stakingrewards a while back. The dev is also very active in Discord and replies to anyone’s questions.

Cons: (in order)

-

The community funds all of their own projects and development is self-sustained by the ecosystem itself, resulting in much slower growth compared to the majority of other projects. There is no marketing budget, per se.

-

High gas fees act as a significant barrier for buying DAM or FLUX on L1.

Summary: (TL;DR)

Overall, FLUX (and the entire Datamine ecosystem) has very strong potential, evident through their big and complex network of real-time data. Think of Datamine Network as a more sophisticated rebase, that is not pegged to the inflationary USD. FLUX will now give rise to ArbiFLUX, a more refined asset that drives inflation even lower and increases APY. This system guarantees transactional throughput through 1% liquidity pools. I can’t think of any other currency whose supply dictates its own demand, and does so in a completely decentralized manner.