[size=4]WARNING: DD IS FOR A LONG TERM INVESTMENT AND THERE ARE NO OPTIONS[/size]

[size=4]What is Datametrex?[/size]

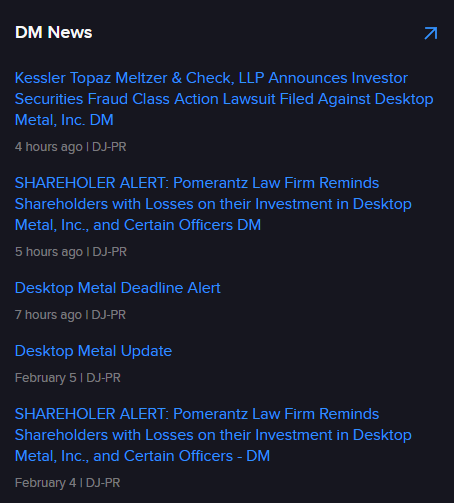

Datametrex is a pennystock with a tiny 80M marketcap. It trades under $DTMXF in USD as OTC and under $DM in CAD on the TSX. They are a data analytics company that is gaining social sentiment as the “Canadian Palantir”. Datametrex is already profitable, cash-rich, and has zero debt. Pretty impressive for a small company like this, I think.

Only reason I know about this company is because my girlfriend’s dad really likes it, and this is his one and only non blue chip company that he invests in. So I took an interest, and have been following it loosely for the past year. Significant news for the company just came out, so I am compiling my notes in this thread in case anyone has something to add, and to neatly store my notes.

[size=4]How do they make money?[/size]

Datametrex has 2 main sources of revenue as summarized:

- AI and technology contracts (specializing in data analytics related to social media analysis, use cases here: https://www.datametrex.com/use-cases), and

- COVID testing kits.

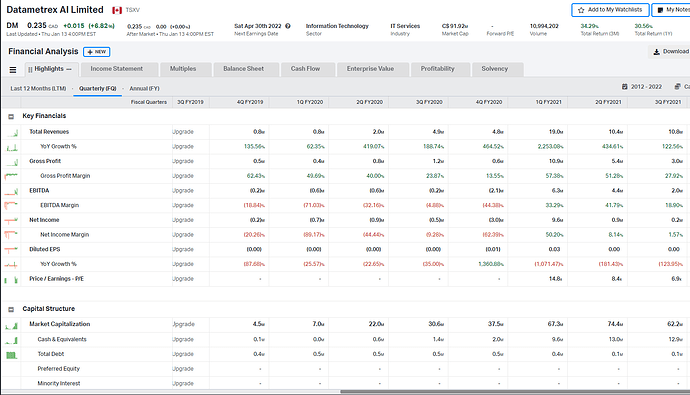

Let’s take a peep at their financials, courtesy of Koyfin:

Very quickly we can see that 2021 has been a stellar year for them, with YoY revenue growth in the hundreds and thousands of percent. However, this has largely been due to COVID testing. The impression that I got from scouring the internet is that investors don’t care about COVID revenues and are waiting for their AI and tech revenues to grow.

However, the COVID revenues have granted them an impressive balance sheet with 12.9M in cash and 0.1M in debt.

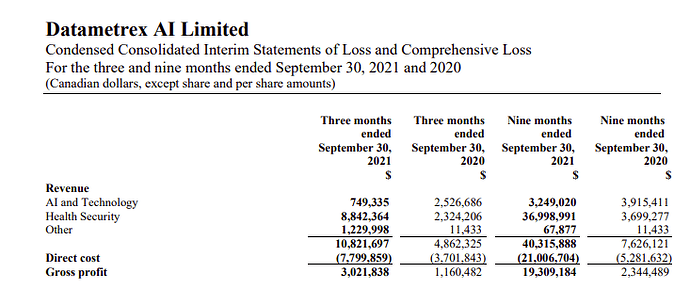

Here are their 2021 revenues to date, taken from their Q3 ER:

From January to September 2021, only 3.2M out of 40M in revenue was from AI and technology contracts. So this is the number that investors want to see grow.

Here are some existing clients and partners:

[size=4]Brand New 40M AI Contract[/size]

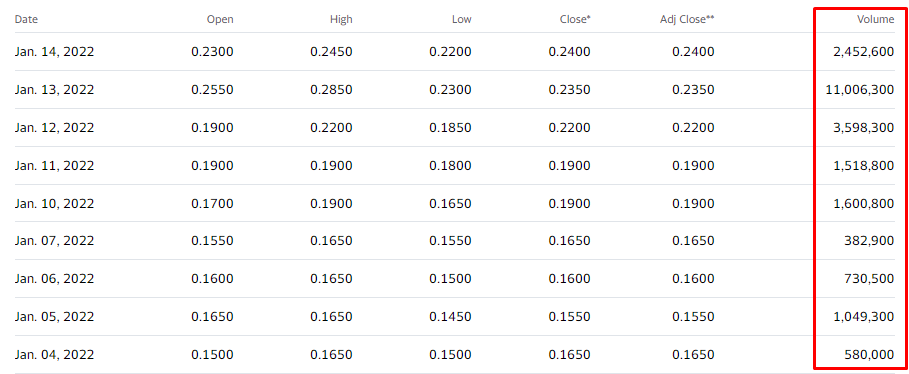

Today, Datametrex announced that they were selected as the winner of a classified government contract with the Canadian Department of National Defence for full potential value of 40M. Datametrex Selected to Proceed on Government Project Worth Total of $40M

I think this is huge for a growing data analysis company with a marketcap of only 80M. Remember that in the first 3 quarters of 2021, only 3.2M in revenue was from this type of contract and this is the number we want to see grow. However, I’m not sure how many phases and over how many years the contract is as the information is classified. Regardless, I think being selected for such a sizeable contract is huge for Datametrex’s credibility and potential to win more contracts in the data analysis space with higher class clients.

[size=4]Price Target[/size]

Ok this is the part I am not very good at. So bare with me and take below with a grain of salt.

At a marketcap of 83M, the stock closed at $0.184 USD per share, and has a Price-To-Sales ratio of about 2.1, based on an estimated annual revenue of ~40M.

For comparison, Palantir is priced at a Price-To-Sales ratio of about 21, and Snowflake is at 100 (which is ridiculously overvalued btw).

If we apply a conservative Price-To-Sales of 15 to Datametrex’s ~40M revenue, we get a market cap of 600M. Price target would be $1.38 USD per share, representing 7.5X upside.

[size=4]Conclusion[/size]

Datametrex is a pennystock that could be one of those moonshot types. I’m probably gonna throw a little bit of money at it and see what sprouts out from it.