There are a couple of things to consider when choosing between a dabit and a credit spread.

IV is high: sell the credit spread. You’re locking in the extra value of high IV in your sale. If IV falls, you’ll make money on the trade whether the stock moves or not.

IV is low: buy the debit spread. You’re buying at a low price and if IV happens to rise while you’re holding, you can sell at a higher price whether or not the stock moves much.

With debit spreads you pay the max loss to receive up to the max gain. With credit spreads, you receive the max gain up front and hopefully not give back up to the max loss.

In both cases the max gain and max loss are equal. The credit spread has the slight advantage of lower commissions when the options expire worthless.

One of the many drawbacks of a credit spread is that it will tie up so much capital. I understand the many points and certain benefits of them, such as not getting exercised on your position. I think credit spreads are fine to use if you have little capital to work with and are extremely conservative. There are just too many other option strategies out there that I feel are far better, along with providing higher return on investment.

If you have extreme confidence about a direction, then OTM debit spreads will usually have a better reward:risk ratio. Writing OTM credit spreads is net theta positive and short vega, while buying OTM debit spreads are net theta negative and long vega.

let’s look at a couple examples:

Debit Spread:

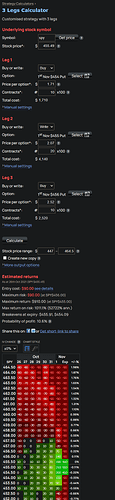

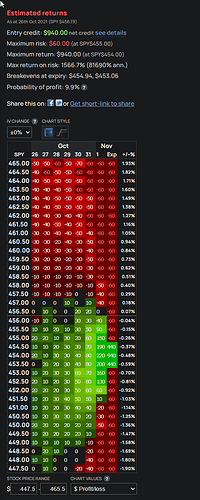

Spy November 1st butterfly with puts 454p/455p/456p

Credit Spread:

spy november 1st iron butterfly 454p/455p/455c/456c

One thing that options sellers need to worry about that buyers don’t is pin risk. I’ll do a separate thread on that.