Fellow traders from the endless halls of Valhalla,

Next month might be an opportunity for SPY puts.

First of all, why would anyone bet against SPY going down. SPY only goes up.

Before I take over Ethannn as the dunce king let me explain.

In October we saw a ‘‘big’’ dip on SPY. A few big factors were in play here for SPY to go down

-

The U.S. possibly defaulting on its debt.

-

The Evergrande crisis being the start of a global recession.

-

Inflation fears.

To address point 1.

Raising the debt limit used to be routine in Washington, but over the years it has become more of a partisan battleground, resulting in perennial crises that threaten to undermine global faith in American markets and thrust the U.S. economy into recession.

On the past debt ceiling debacle the US senate started it’s discussion at the end of September 2021 on raising the debt ceiling, prolonged political games and discussion increased the fears of the U.S. defaulting on its debt.

The ‘’deadline’’ that was set on October 18 was not a set-in-stone deadline.

It was more of a best guess estimate of when the money would have ran out, which made it far harder for congress to know exactly when they needed to act to avert a potential financial catastrophe – and that increased the odds that lawmakers could accidentally trigger a default by not acting soon enough.

For a SPY put play on this we don’t actually need the U.S. to default ( which is very unlikely anyway.)

Prolonged discussion on the increasing U.S. debt, the Biden administration struggling to find a way to increase the ceiling can all create enough uncertainty to make the market go down short term.

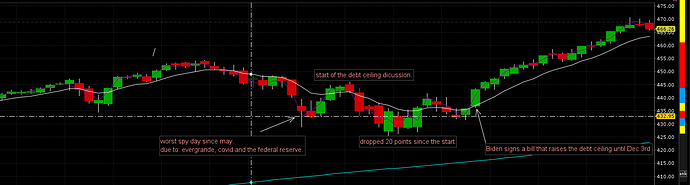

First let’s take a look at the chart.

When it say’s ‘’start of the debt ceiling discussion’’ it was actually a bill to raise the ceiling being blocked by the senate, the bill already passed the house.

The senate needs a 60/40 majority vote where the house doesn’t.

The senate is able to vote with a simple majority on some matters but this can be blocked by the other party in what is called a ‘’fillibuster’’

This blockade started the discussion on what to do about the increasing debt, with a ‘’deadline’’ on the 18th of October.`

First, let’s explain why the Republicans might block a vote in December.

Both party’s know the debt ceiling has to be raised, but no one wants to give in.

-

Biden opposed a raise in the past, McConnel said this: “In 2003, 2004, and 2006, Mr. President, you joined

Senate Democrats in opposing debt limit increases and made Republicans do it ourselves,” his letter read.

It stated Biden’s view at that time that the party in power should take responsibility, as the GOP insists now. -

The Democrats refused to work together with the Republicans on law making and use reconciliation to pass most bills. McConnel states: because Democrats are working on a partisan basis to pass an expansive social spending bill, they should take care of any debt ceiling increases on a partisan basis, too.

So why not just use reconciliation to address the debt ceiling?

Sure, but Democrats have rejected this idea, calling it “too risky.” President Biden doesn’t like the move. It’s a lengthier, more complex way to hold the vote, but the White House said it has not been completely ruled out.

“The reconciliation process would mean essentially starting from scratch,” White House press secretary Jen Psaki said.

Effectively, Republicans wanted Democrats on the record as having increased the debt limit by trillions of dollars in order to portray them during the midterms as big spenders. (according to the Democrats)

“Republicans’’ position is simple,” Senate Minority Leader cocaine Mitch McConnell wrote to President Joe Biden on Monday. “We have no list of demands. For two and a half months, we have simply warned that since your party wishes to govern alone, it must handle the debt limit alone as well.”

After the governors loss in Virginia the Democrats need a win, it would be in their best interest to raise it as soon as possible. The opposite can be said for the Republicans, prolonged discussion might make the Democrats appear weak and indecisive.

Now what might be a play here.

There isn’t really a deadline for a vote which makes this play a little harder.

At first the U.S. was set to default on Dec 3rd. Yellen told Congress on Tuesday that the “X date” for when the U.S. will no longer be able to pay its bills is Dec. 15, nearly two weeks later than her initial forecast of Dec. 3.

As this date nears and congress doesn’t find an early way out of this problem, uncertainty and doubt might affect the market. Just like it did in October, the difference being that in October a bill to raise the ceiling was postponed. This was the catalyst for the market to go down until another bill was signed to temporarily raise the ceiling. We don’t have that catalyst right now.

So getting long term puts a few weeks before the deadline might be a play, if they find a way out you sell the puts for a small loss. If the market does go down as discussion prolongs we might be able to capitalize on that.

As stated in the first paragraph on what made it go down in October. Evergrande seems to be less of a fear now. This might add to SPY not going down.

I’m quite busy in my personal life so I don’t have the time I wanted to dedicate to this DD, it’s more speculation. All opinions are appreciated, except Ethannn’s.

I’m also not a U.S. citizen so please point me on any political aspects that I got wrong.

Brummel

EDIT 20/11:

McConnell has a number of reasons to find a way out.

He doesn’t want another battle over the debt limit that would draw the attention and ire of former President Trump, according to Republican senators.

He also fears the threat of a national default could convince Senators. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.) to support a exception to the filibuster rule to let Democrats raise the debt limit without any GOP votes.

McConnell met with Senate Majority Leader Charles Schumer (D-N.Y.) in Schumer’s Capitol office on Thursday afternoon to discuss the expiring debt limit and other issues. It was the first time the two leaders held a sit-down meeting in the Capitol since January 2021, when they met for a half-hour in McConnell’s office to negotiate a power-sharing agreement to organize the 50-50 Senate.

They previously hadn’t met since March 2020, when Schumer walked over to McConnell’s office to negotiate the CARES Act.

“We had a good discussion about several different issues that are all extant as we move toward the end of the session,” McConnell told reporters. “We agreed to kind of keep talking, working together to try to get somewhere.”

Republican senators say the meeting is a sign of how much McConnell wants to work out a deal with Schumer that would let Democrats raise the debt ceiling without requiring any Republican votes.

“They’re looking for ways we don’t have to vote,” said one Senate Republican familiar with the talks.

McConnell has little time.

Treasury Secretary Janet Yellen informed congressional leaders Tuesday that the federal government will run out of the ability to pay all of its debt obligations on Dec. 15.

One proposal Republicans are floating is to allow an extremely expedited reconciliation process that would let Democrats to use the same special pathway they plan to use for President Biden’s climate and social spending bill to raise the debt limit.

Under this scenario, Democrats would be allowed to use the reconciliation process to raise the debt limit without having to hold a time-consuming series of procedural votes on the Senate floor.

Instead of taking two weeks to amend the budget resolution to set up a new reconciliation vehicle, a process that would ordinarily require two vote-a-ramas on the floor, Republicans would allow the procedures to be compressed into one or a few days.

“My proposal is the Democrats can pass the debt limit all by themselves and that’s what they should do,” said Sen. Pat Toomey (R-Pa.). “I’ve suggested that Republicans yield back time and not drag it out, and I’m confident we would do that.”

In October, McConnell rounded up the necessary GOP votes to advance the legislation. Republican senators say there’s no way that McConnell will be able to do that again.

“You don’t have 10 Republicans who are going to vote for it,” said the GOP senator, who requested anonymity to comment on the negotiation

Taken from CNBC.

It does look very unlikely that they don’t reach an agreement. For now, nothing of interest is going to happen most likely.

As the date closes we shall reassess.