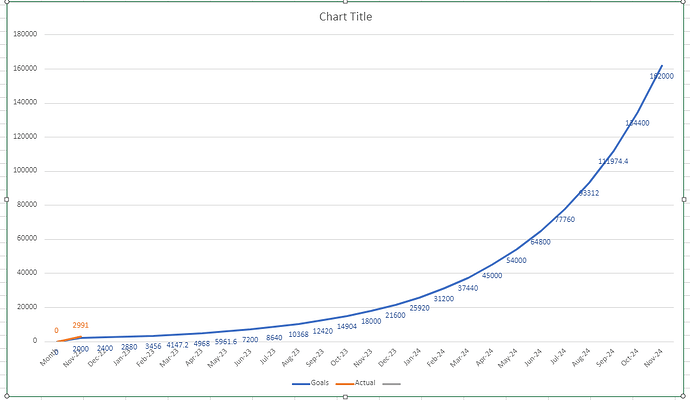

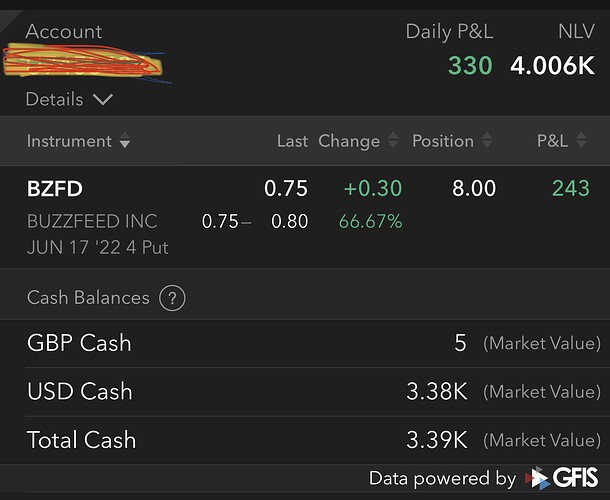

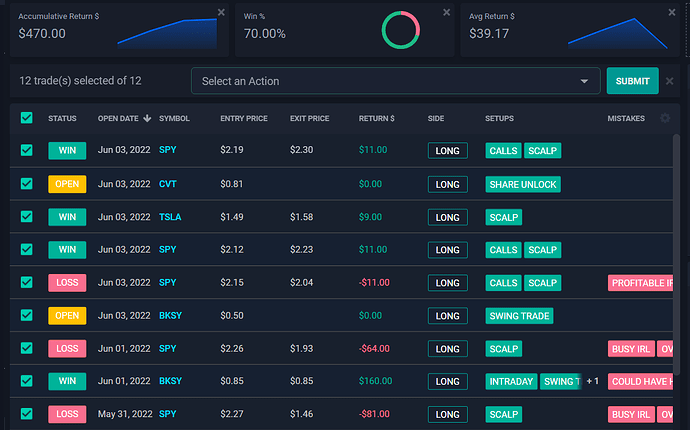

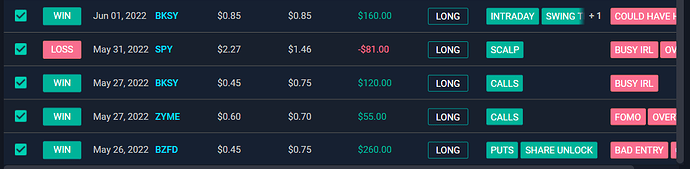

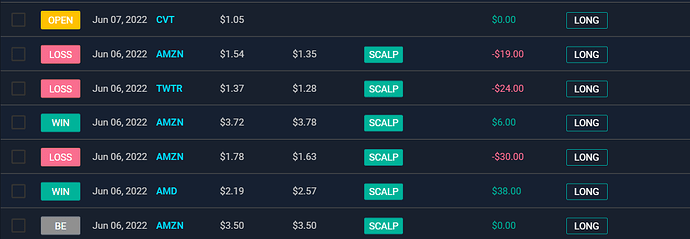

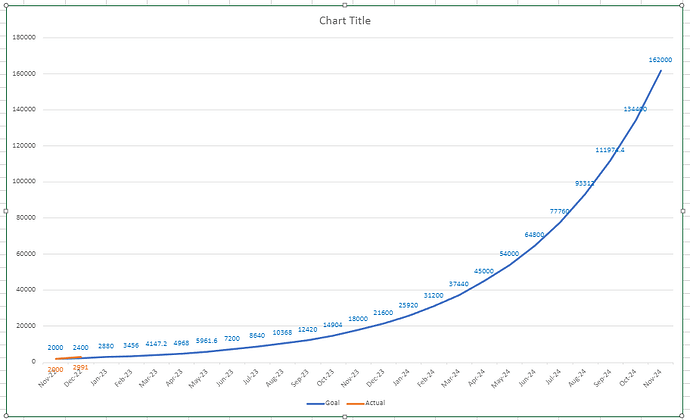

Month starting December : $2991

Goal Low: $2880

Goal High : $3600

Current : $2757[color=#900d09] (-7.57%)[/color]

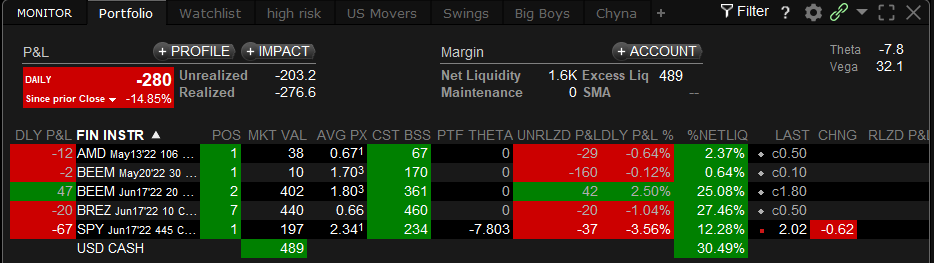

Daily : [color=#900d09]-$233[/color]

[color=#e69boo][size=8]Summary[/size][/color]

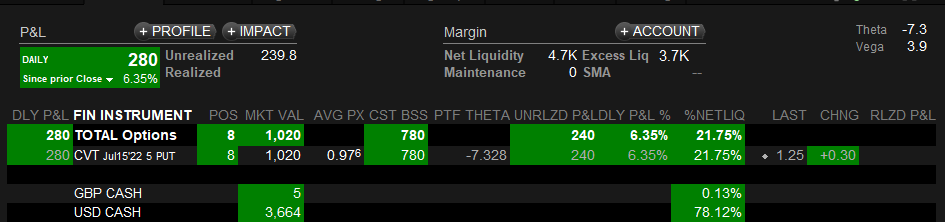

Overtraded a little today, knew it was gonna be a bit unpredictable today so should have just taken my Ws at open and left it. Played some 1DTEs on trades I wasnt getting great entries in which meant I had to close out ones which would have been winners. Should go for next weeks expiry if it’s not a great setup atleast.

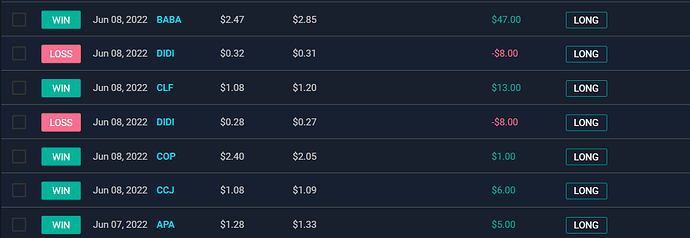

[color=#74B72E][center][size=12]The Good[/size][/center][/color]

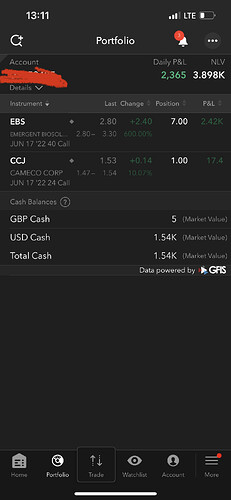

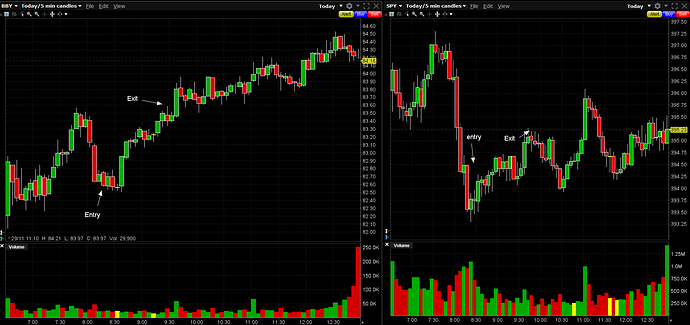

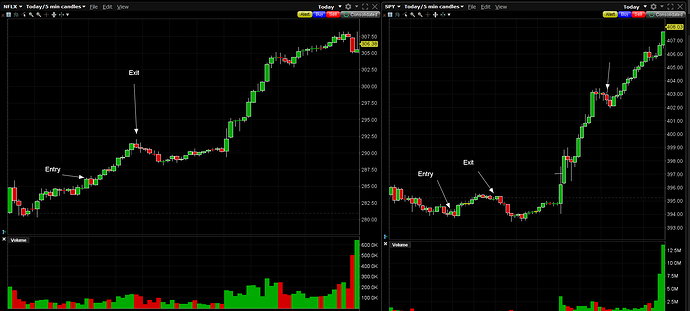

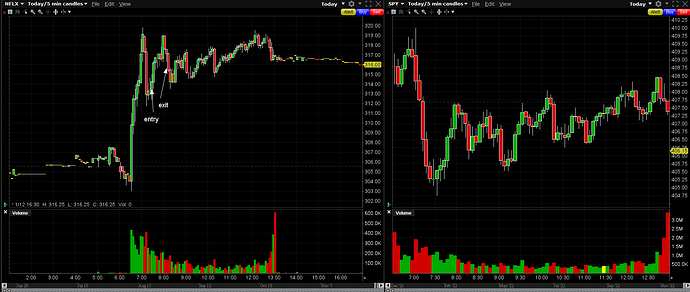

[size=6]NFLX[/size]

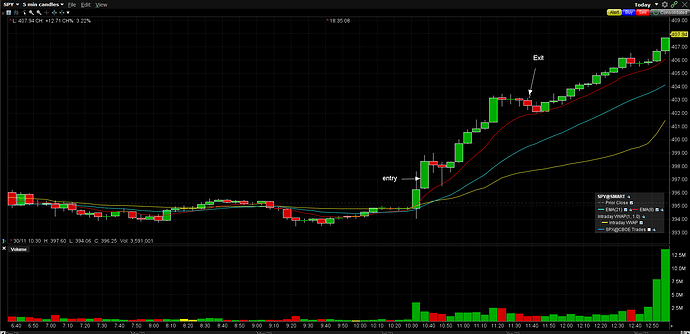

Saw NFLX was strong out the open again today, looking like it might continue it’s bullrun. Took calls when SPY hit support at 405. Played out well except I should have exited at the double top.

[color=#900D09][size=12][center]The Bad[/center][/size][/color]

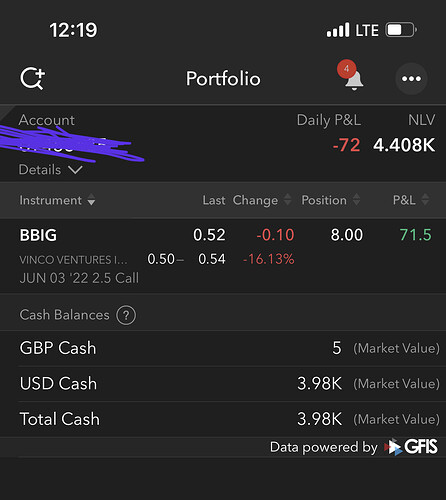

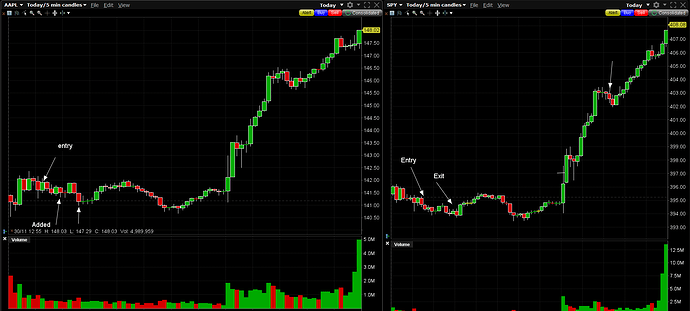

[size=4]TGT[/size]

TGT has been dipping at open and then strong the rest of the day for past few days, I thought we were seeing that again however I entered 1DTE calls on a bad entry and got shaken out, had I been in weeklies I could have added on the double bottom.

[color=#e69boo][size=8]&The Watchlist[/size][/color]

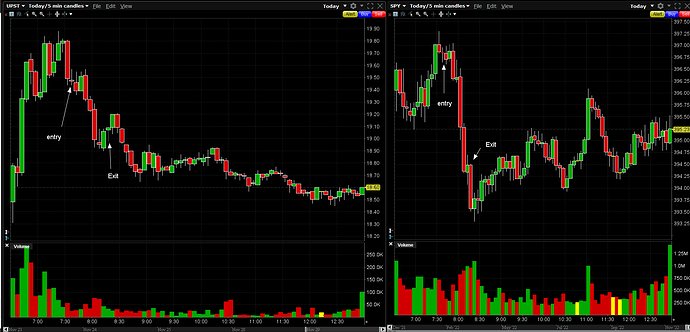

NFLX - looking for bullrun to continue or a breakdown again, not sure about swinging puts right now but I think it’s overbought. We saw a triple top as SPY went higher today which has signaled a top on UPST before it really dumped.

ULTA - smashed earnings again and at ATHs in a bear market, it had a really good run over several days after last earnings and that could continue again.

TGT - looking to play another bounce

ZM - Looking for another run at open to take some puts into next week, probably some shorts getting squeezed out with the JPOW speech.

MANU - Looking to enter Jan calls if we get another dip down to 21.5 area, chart is looking really good IMO. Setting higher lows and higher highs. So I think this run continues.