Disclosure: I hold no positions; this DD is purely for entertainment/education purposes. This is not financial advice.

Now that that’s out of the way, let’s get into what you all came for.

Who is Dollar General:

If you don’t know about Dollar General, then you should really consider moving out from under that rock you’re living in, but here’s a breakdown of what they do. Dollar General is considered a Variety Store, along with other discount retailers like Walmart, Costco, Dollar Tree, etc. According to their website, Dollar General’s “Mission” is:

Serving Others . For our customers, this means placing them at the center of all we do, working every day to deliver value and convenience through our more than 15,000 neighborhood general stores. For our employees, this means respect and the opportunity to grow and develop their careers (we’ll get into why that’s kind of cap later) and for our communities, this means helping support the communities we call home.

Dollar General stands for convenience, quality brands and low prices. Dollar General’s stores aim to make shopping a hassle-free experience. We design small, neighborhood stores with carefully -edited merchandise assortments to make shopping simpler. We don’t carry every brand and size, just those our customers want the most.

As you can see, Dollar General seems like a run-of-the-mill store with a lot of heavy hitters as competition, such as Costco, Walmart, or maybe even Target, too. So why is this worth a look?

Ingenious Growth or a Ruse?

As per the Company’s Q2 Earnings announcement, the General is growing its Company, opening new stores in higher-income areas and, therefore, propping up it’s already existing sales and growing its consumer base. Here are some highlights from the call in terms of its growth:

“During the quarter, we made significant progress on many key initiatives, including the completion of our initial rollout of DG Fresh and the opening of our first pOpshelf store-within-a-store concept. In addition, we executed more than 750 real estate projects, including new store openings in our pOpshelf concept and larger footprint Dollar General formats. We remain focused on delivering value and convenience for our customers, while driving long-term sustainable growth and value for our shareholders. We feel very good about the underlying strength of the business, and we are excited about our plans for the second half of fiscal 2021.”

“During the second quarter of 2021, the Company opened 270 new stores, remodeled 477 stores and relocated 25 stores.”

“In addition, the Company is reiterating its plans to execute 2,900 real estate projects in fiscal year 2021, including 1,050 new store openings, 1,750 store remodels, and 100 store relocations.”

A little more about the pOpshelf concept:

We believe shopping should be an experience you enjoy. A time to wander. Explore. Linger. A momentary escape just for you.

If Dollar General is for essential materials, pOpshelf is about marginal items. Things like house décor, gifts, clothing, etc. This “store-within-a-store” only has 30 locations so far, but is aimed towards higher income customers that usually don’t shop at the General’s locations.

Not only is the General expanding on its consumer base, but it’s holding onto its faithful consumers while doing so. As per a WSJ video about Dollar General’s growth, Dollar General “goes where Walmart’s aren’t”, taking advantage of rural areas away from population centers in order to be the main provider in these so called “Food Deserts”. The General also adds an average of 2.5 stores a day, with around 4 times as many Dollar General’s as there are Walmart’s. While the General has more than 15,000 stores in the US, more than three quarters of those stores serve communities of 20,000 people or less, significantly increasing sales and retaining a faithful consumer base.

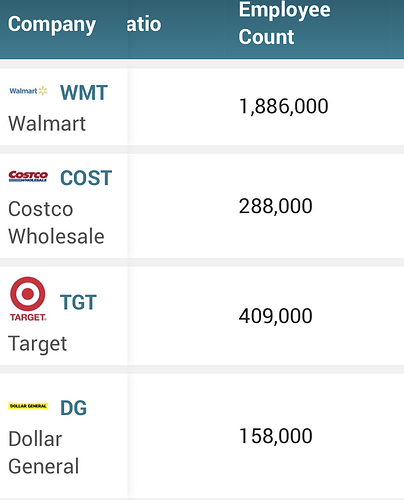

O.K, but wouldn’t more locations eat into margins? Not necessarily. Since the General has few items it buys in bulk, has significantly less perishables than normal grocery stores, leases stores, and has significantly less employees than it’s competitors (with an employee median annual income of $16,688) and usually only has less than five full-time employees per store.

Now, why is the General, the Company that already grow 16% during the pandemic while also being mostly a Brick-and-Mortar store, an earnings gamble?

Bull Case:

· Opening more locations

· Better Fundamentals YoY

· Currently buying back shares

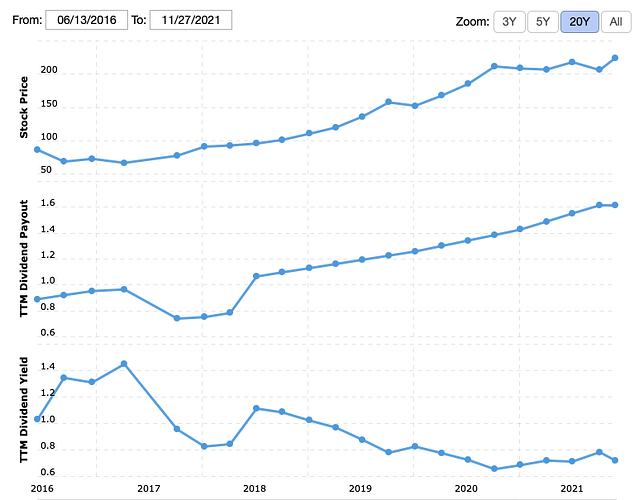

· Increasing Dividend for seven consecutive years

· Increasing products it offers (pOpshelf, more fresh produce, medication)

· Increasing market share

· Inflation

During the Q2 Earnings Call, the General said the following, “In addition, the Company is reiterating its plans to execute 2,900 real estate projects in fiscal year 2021, including 1,050 new store openings, 1,750 store remodels, and 100 store relocations.” In addition to the increase in the number of stores, those increase remodels should also be of focus. The store-within-a-store concept, pOpshelf, is coming to more stores, which will bring in more higher income consumers. More fresh produce is being introduced into the stores as well, which could potentially lower margins but could also increase its consumer base.

The General is also introducing more items in the Medicine section, which is a very good thing for its market share. Undergoing its health care initiative, the General is rapidly expanding its market share, overtaking ground currently held by CVS (while this pharmacy giant is giving up its shares through the closing of a number of its stores). “Around 65% of Dollar General’s stores — more than 10,000 locations — are in health and medical “deserts,” where people have to drive 30 or 40 minutes to get basic services”, said the Head General himself (CEO of Dollar General Todd Vasos). Serving these communities with the medicines they need will at least give a bump to guidance.

The General also announced its currently going through a stock buyback in its recent earnings call, “In the second quarter of 2021, the Company repurchased $700 million of its common stock, or 3.3 million shares, at an average price of $211.44 per share, under its share repurchase program. The total remaining authorization for future repurchases was $979 million at the end of the second quarter of 2021. Under the authorization, repurchases may be made from time to time in open market transactions, including pursuant to trading plans adopted in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934, as amended, or in privately negotiated transactions. The timing, manner and number of shares repurchased will depend on a variety of factors, including price, market conditions, compliance with the covenants and restrictions under the Company’s debt agreements and other factors. The authorization has no expiration date.”

Inflation is also helping the discount stores, with inflation raising consumer prices 6% YoY, and consumers feeling the hit from inflation are making more purchases from discount stores heading into the holiday season.

Here’s a summary of the fundamentals discussed in the Earnings Call:

· Net Sales Decreased 0.4% to $8.7 Billion

· Same-Store Sales Decreased 4.7%; Increased 14.1% on a two-year stack basis1

· Operating Profit of $849.6 Million, or 9.8% as a percentage of net sales

· Diluted Earnings Per Share (“EPS”) of $2.69, representing a two-year compound annual growth rate of 27.7%, or 24.3% compared to Q2 2019 Adjusted Diluted EPS2

· Year to Date Cash Flows From Operations of $1.3 Billion

· Board of Directors Declares Quarterly Cash Dividend of $0.42 per share

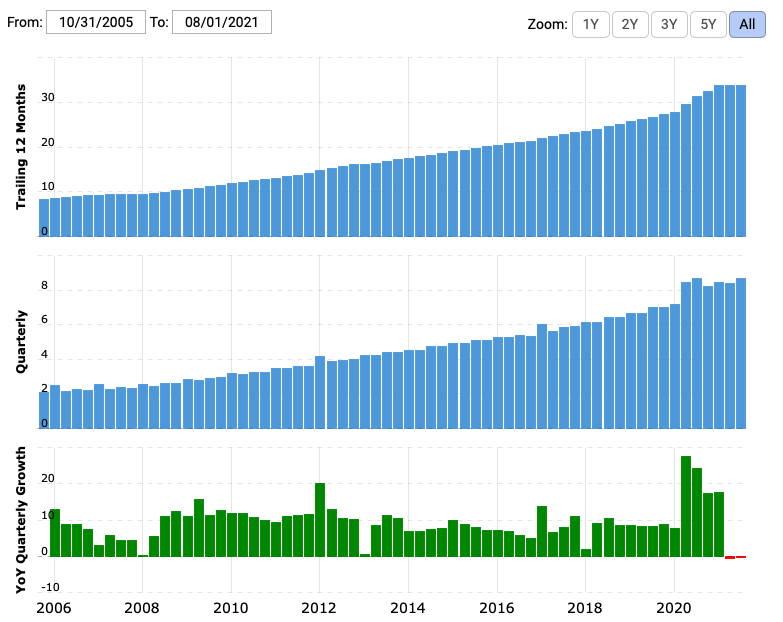

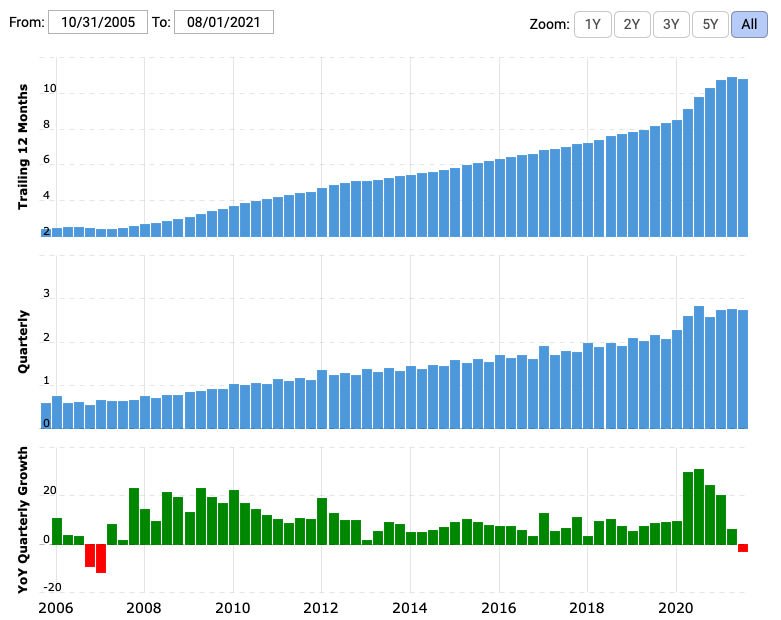

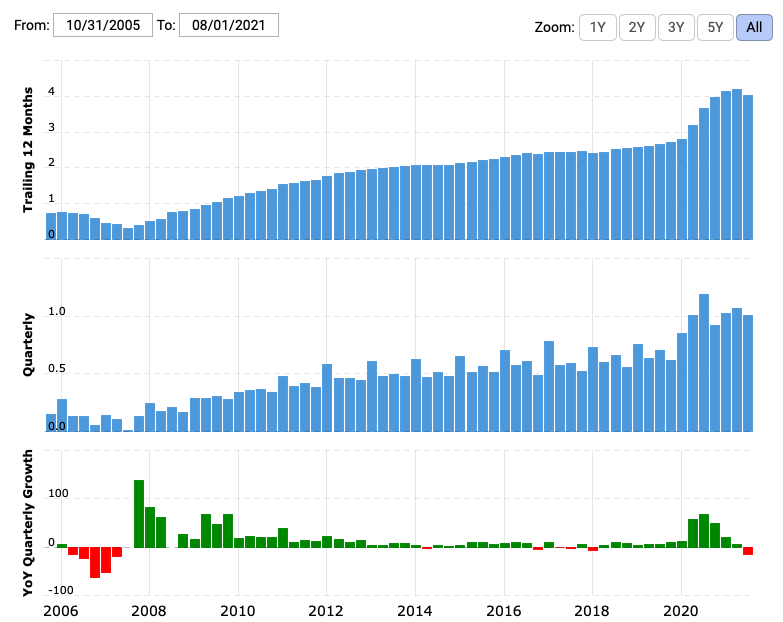

Here’s a visualization of the fundamentals YoY, thanks to Macrotrends:

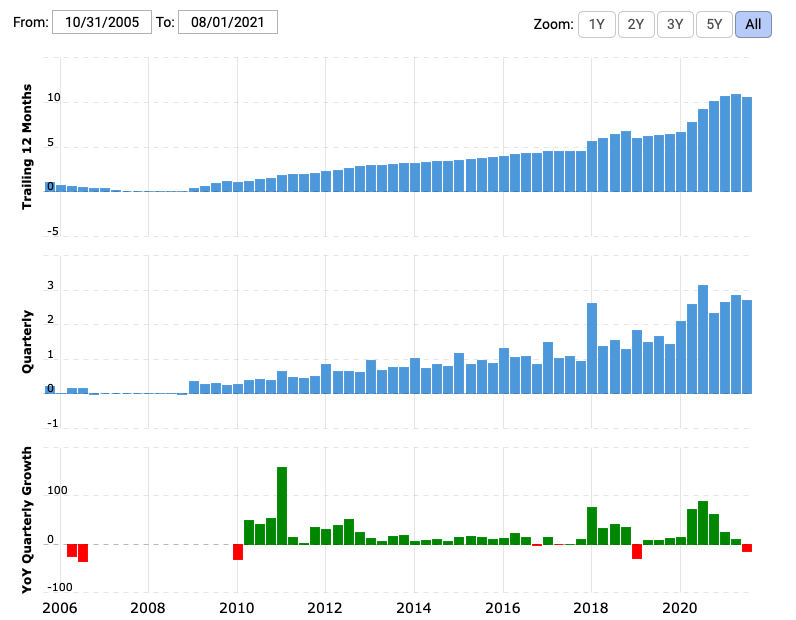

Revenue:

Gross Profits:

EBITDA:

EPS:

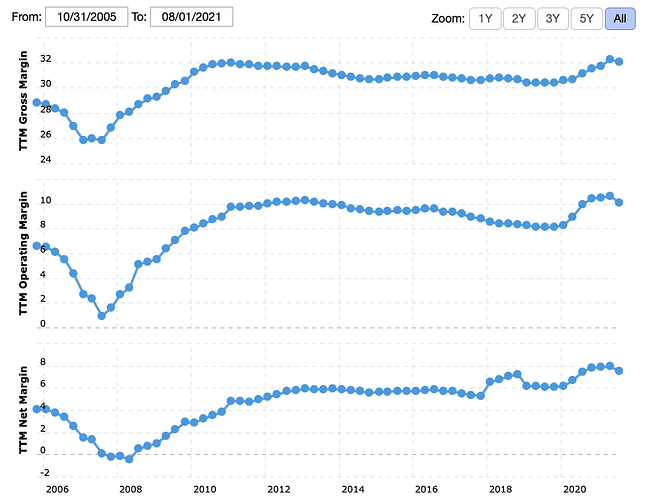

Margins:

Dividend History:

Bear Case:

- · Averse Market Reaction

- · Increasing Interest Rates

- · COVID uncertainty

- · Supply Chain

- · Employment Levels

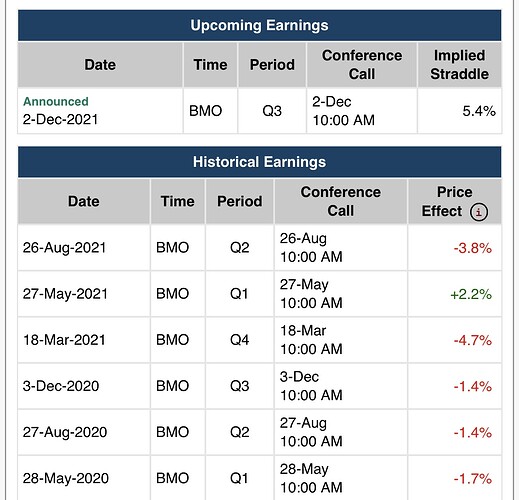

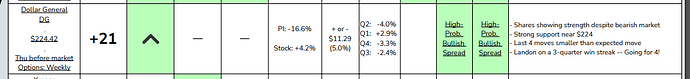

Even with decent earnings and a slight bump with guidance last earnings, DG stock has sold off from its ATHs (along with the rest of the market during the correction) and only recently entered an uptrend (along with the rest of the market). Here are the reactions from the last earnings:

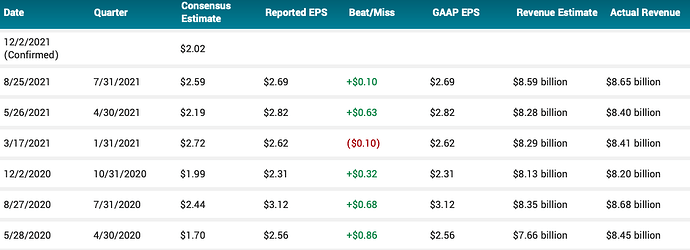

Compared to Earnings vs. Estimates:

Obviously, this trend implies earnings are a “sell the news” type of event after the uptrend leading to earnings. This could happen again, with the wave going up to earnings (Dec 02 BMO) and a sell-off the day of.

Dollar General also gives companies and individuals the opportunity to lease stores. Rising rates from Papi Powell and the Fed could hit guidance from the cash flow taken in from these real estate projects.

Covid has certainly been friendly for DG, with the Company seeing growth even through the Pandemic and lockdowns, however guidance from the Company still sees Covid uncertainty as a threat to its growth:

“Significant uncertainty continues to exist regarding the severity and duration of the COVID-19 pandemic, including its impact on the U.S. economy, consumer behavior and the Company’s business, which makes it difficult for the Company to predict specific financial outcomes for the fiscal year ending January 28, 2022 (“fiscal year 2021”). In addition, such outcomes could be impacted by several variables, which include, but are not limited to, any additional government stimulus payments, economic recovery, employment levels, COVID-19 vaccine status, further disruptions to the global supply chain, and the ongoing impact of the COVID-19 pandemic, including new variants of concern (fuck Omicron btw) and any corresponding governmental measures such as closures of schools or businesses.”

Supply chain is also potentially going to keep fucking with the General, with truck jobs for the General being infamously overworked,. Employees are also overworked in their stores, and the median salary doesn’t help that stress. This overworking trend could lead to more employees leaving, and this recent trend of employees leaving the workforce en masse is certainly not going to help (November was a 52 year low for newly unemployed claims so this could be starting to change). Given the low number of employees the General already has, an even lower number of employees could lead to a hit to the Company’s financials.

TLDR: Potential Earnings gamble, ride the wave up to earnings, then puts on day of? Either way, the General is a great long-term hold. All hail the General.

Links for further reading and to come to your own conclusions:

https://www.chartmill.com/stock/quote/DG/fundamental-analysis

https://www.cnn.com/2021/11/19/business/cvs-store-closings-dollar-general-retail/index.html