Lets talk about Disney.

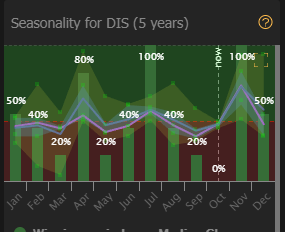

Earnings for this entertainment beast is coming up on November 10th.

Our first point of discussion is every one’s favorite topic just for reference. COVID impact.

With the closure of the parks. Disney hit a one year low of 79.07. This is not uncommon due to the impact to major industries across the stock market. Why is this important? It gives us a baseline for Disney as a company and we can see their attempt at a recovery with their business segments. Due to the major loss revenue in their mandatory closure of parks, they had to shift focus to retain revenue through their Intellectual Property and Streaming services. With an increase of people staying home due to COVID, they saw a drastic increase of Disney+ subscribers. In May, they began to gradually open parks again at reduced capacity.

Now, lets talk about how Disney makes its money these days .

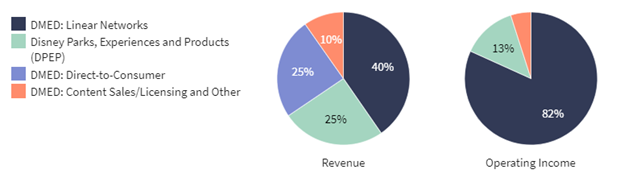

Starting in FY21, the mouse reorganized into two major business segments, Disney Media and Entertainment Distribution (DMED) and Disney Parks, Experiences, and Products (DPEP). DMED has sub categories that fall into this segment; Linear Networks, Direct-to-Consumer, and Content Sales/Licensing. DMED is by far where Disney makes the bulk of their money.

Further into the categories taken from Investopedia along with some financials from Q3:

DMED: Linear Networks

Disney’s Linear Networks segment operates a long list of properties, including: domestic and international cable networks such as Disney, ESPN, and National Geographic; ABC broadcast television network and eight domestic television stations; and a 50% equity investment in A+E Television Networks. The Linear Networks segment posted revenue of $7.0 billion in Q3 FY 2021, up 15.7% compared to the year-ago quarter. Operating income fell 33.4% to $2.2 billion. The segment accounts for about 40% of total revenue and 82% of total operating income.

DMED: Direct-to-Consumer

Disney’s Direct-to-Consumer (DTC) segment is comprised of its various streaming services, including: Disney+; Disney+Hotstar; ESPN+; Hulu; and Star+. The DTC segment posted revenue of $4.3 billion in Q3 FY 2021, up 56.9% from the same three-month period a year ago. The segment reported an operating loss of $293 million, an improvement from the operating loss of $624 million reported in the year-ago quarter. The DTC segment accounts for 25% of total revenue.

DMED: Content Sales/Licensing and Other

Disney’s Content Sales/Licensing and Other segment sells film and television content to third-party TV and subscription video-on-demand services. The segment also includes the following operations: theatrical distribution; home entertainment distribution, such as DVD and Blu-ray; music distribution; staging and licensing of live entertainment events on Broadway and around the world; post-production services through Industrial Light & Magic and Skywalker Sound; and a 30% ownership interest Tata Sky Ltd., an India-based operator of a direct-to-home satellite distribution platform. The Content Sales/Licensing and Other segment posted revenue of $1.7 billion in Q3 FY 2021, down 23.0% from the year-ago quarter. Operating income fell 58.2% to $132 million. The segment accounts for nearly 10% of Disney’s total revenue and under 5% of its total operating income.

Disney Parks, Experiences and Products (DPEP)

Disney’s Parks, Experiences and Products segment is comprised of theme parks and resorts in Florida, California, Hawaii, Paris, Hong Kong, and Shanghai. It also includes a cruise line and vacation club. Revenue comes mainly from selling theme park admissions, food, beverages, various merchandise, resort and vacation stays, and royalties from licensing intellectual properties. The Parks, Experiences and Products segment reported revenue of $4.3 billion in Q3 FY 2021, falling 307.6% from the year-ago quarter. The segment posted operating income of $356 million, a significant improvement from the operating loss of $1.9 billion in Q3 FY 2020. The segment accounts for about 25% of Disney’s total revenue and about 13% of total operating income.

In total, Disney’s reported revenue was reported to be 17 billion passing up Q2’s revenue of 15 billion and expectation of 16.7 billion.

Tldr; Disney Q3 was fantastic. Increased revenue from Disney+ and becoming profitable in their DPEP for the first time since the pandemic.

Stock reaction to Q3 Earnings:

Disney closed at 179.29 on August 12th. Earnings came out after hours, and opened at 186.29 the next trading day at a 4% increase. Trading day closed out at 181.08 and continued to decline for the next few days before an attempt to recover.

On September 21st, Disney closed at 169.03 due to the CEO providing ill-forward guidance on the growth of their Disney+ subscribers. In my opinion, this is due to the increase of people leaving their homes and going back to work.

Since that drop, Disney has been trading sideways closing at 170.28 at the time of this writing (11/4/2021)

LOOKING FORWARD

Here is where my opinion on the outlook of Disney starts.

I see an increase in revenue for Q4 with slightly bearish forward guidance given, which may already be priced in.

Revenue:

Disney has been obviously killing it with the DMED segment with increased ad revenue in their networks, great box office performances for Shang-Chi, Jungle Cruise, and Black widow, and their continued released of programming in their streaming services.

Their DPEP is also starting to ramp up from their incredible loss of revenue during the pandemic and their slow climb on lifting guest restrictions throughout their parks in accordance with local guidance. As stated earlier in the post, Q3 showed profit for this business segment.

Forward Guidance:

Disney seems to be back in the swing of things. Although they have pushed back production and release of major titles, the box office performance of their 3 titles this past quarter proves that viewers and fans will still pay money to see these films. Park/Cruise attendance and revenue is steadily increasing. They even created a new program called the Genie Pass which is bullshit where you must pay for fast passes (as a Disney World fan who goes every other year, I highly disagree with this but whatever)

With the market reaction to the CEOs guidance on Disney+ subscribers, it is clear investors care about the streaming service. Since the market reacted to release of that interview, I believe any expectation of Disney+ growth is already priced in but will still stand to be bearish depending on the ER.

TLDR; Disney profitable in both financial segments in Q3 and slated to continue to beat ER with Q4. However, people might find the guidance bearish on the status of their streaming services.

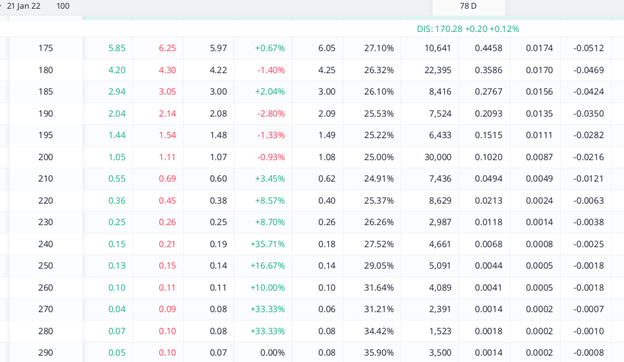

Options Chain for November 19th and January 22

As you can see, there is some bullish sentiment for earnings and a long position in January.

- 65k OI for the 180 strike for 11/19

- 22k OI for the 180 strike for 01/21

- 30k OI for the 200 strike for 01/21

Disclosure: I do not currently hold any positions in Disney but am looking for a long position. Play earnings at your own risk. Disney has remained on my watch list for quite a while. Also, I am no expert and this is my first DD.

References:

Why Is Disney Stock Trading Lower in 2021? | The Motley FoolHow Disney Makes Money: Media, Entertainment, Parks, and Experiences (investopedia.com)

Disney Stock: What Wall Street Says Ahead Of Earnings - MavenFlix - TheStreet Streaming