I’m looking to sell covered calls on AMD. I see under the Expiry field on TD Advanced Dashboard (Canadian version of ToS), there are expiries with the “(Non-standard)” tag. Searching up what this means, Schwab says non-standard options are (https://help.streetsmart.schwab.com/edge/1.6/Content/Non-Standard%20Expiring%20Options.htm):

Schwab currently has two broad categories of non-standard expiring options available for trading:

- Weekly expiring options

- Quarterly expiring options

Here comes the part I am confused:

Comparing a “standard” and “non-standard” option with the same expiry date, the “non-standard” option has a significantly higher bid/ask price. Why is that?

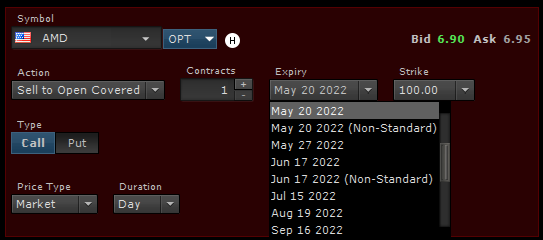

Non-standard:

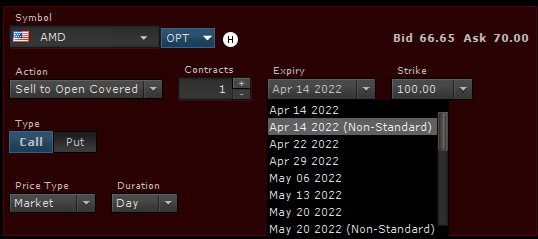

Standard:

When I compare “standard” and “non-standard” options with a further out expiry, the bid/ask on the non-standard is still significantly higher than its standard counterpart.

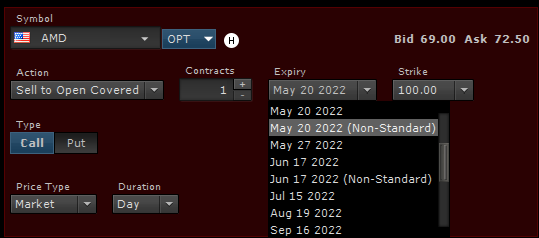

Non-standard:

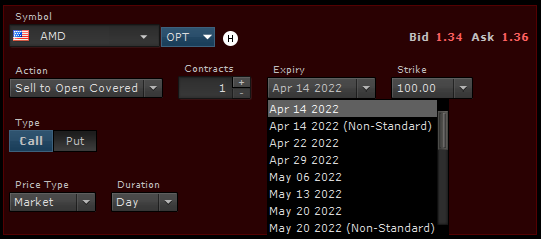

Standard: