Got busy so I don’t have much time to do some $DNA DD but here are notes, writing them as I go.

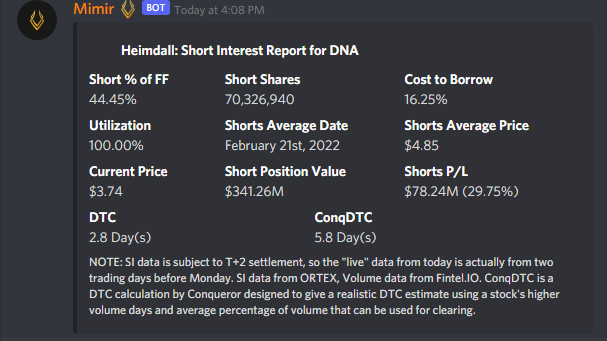

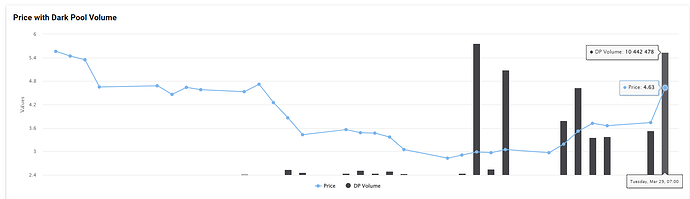

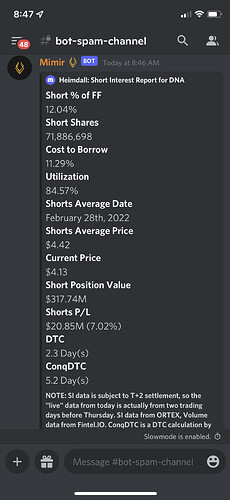

DNA has high high SI% of 44.45% and low Shorts Average Price of $4.85. This tells me that shorts really hate this thing given that NAV was $10 per SPAC deal.

So, why would people short DNA, and do they have reason to cover?

On October 6, 2021, Scorpion Capital published a big short report on DNA. On November 28, 2021, Ginkgo responded to the short report. This article seems to be a comprehensive summary of the whole debacle.

[size=4]My Takeaway[/size]

First of all, I don’t really understand what Gingko actually does but my understanding is that it’s something related to cell programming. Anyways, Gingko has two streams of revenue: Foundry and Biosecurity.

Biosecurity has been mostly focused on COVID, so investors do not care too much about their Biosecurity revenues at this time. What investors care about is Foundry.

One criticism made by Scorpion Capital surrounded “related party” Foundry revenues, something we shared concerns about in our last piece on Ginkgo Bioworks. The idea is basically this.

Ginkgo Bioworks funds STARTUPX with $100 million. Then, STARTUPX becomes a client of Ginkgo Bioworks and starts returning the money which Ginkgo Bioworks reflects as revenues. There’s nothing wrong with this per se, but we can all see why this raises some concerns. That’s why our focus is mainly on Foundry revenues with all related party revenues removed.

In short (heh), it looks like investors want to see organic growth of Foundry revenue without Ginkgo having to buy their revenue.

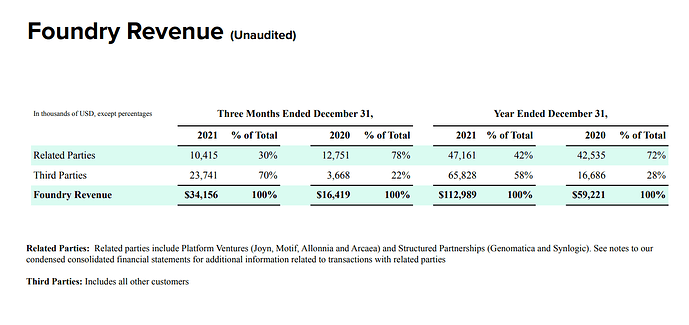

Very quickly from page 40 of the Q4 2021 ER report published last night, we see that this growth thesis is proving true. Observe the ratio of revenue % of Related Parties vs Third Parties:

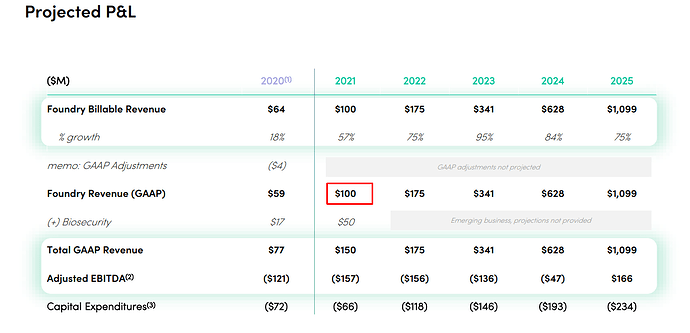

Ginkgo posted $113M of Foundry revenue in 2021. This exceeds the 100M projected per page 48 of their SPAC investor deck, and we are all so familiar with overblown SPAC investor decks:

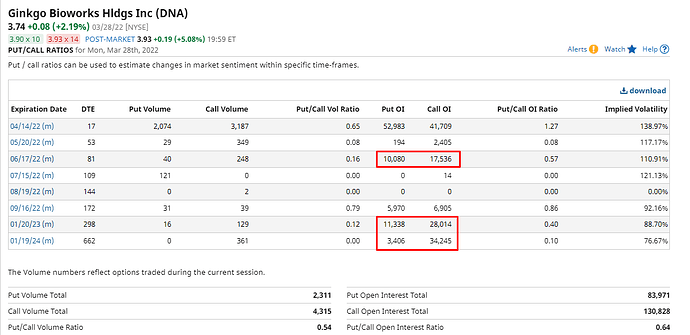

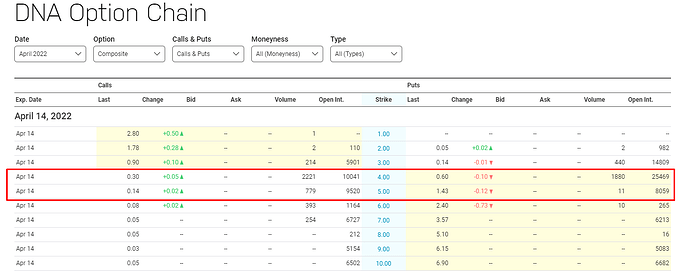

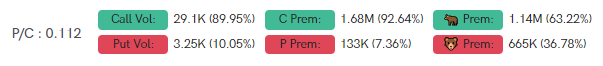

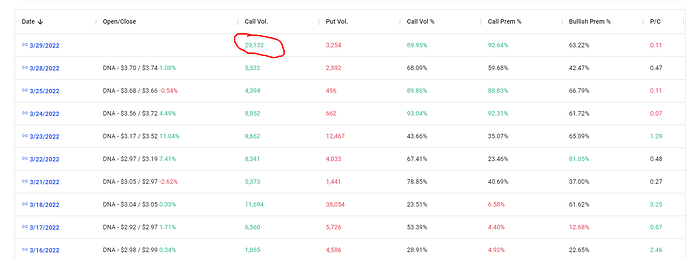

On Barchart we can see that options flow leans bearish for 04/14, but the longer out we go, the more bullish it gets:

Note the OI on the calls and puts for the 4 and 5 strikes on 04/14:

[size=4]My Trading Takeaway[/size]

From my quick DD above, I think shorts have reason to cover:

-

Major short thesis was the disbelief in Ginkgo pulling organic third-party Foundry revenue. This idea does not seem to be holding water based on the latest ER report.

-

Shorts are profitable on their position (up about 30% at market close) along with #1 that the short thesis is breaking down. It’s time to take profits and move on.

-

DTC is 2.8 days with ConqDTC at 5.8 days. If DTC was intraday, I’d think there would be less pressure to cover since you have more flexibility in just getting out and can afford to wait for an ideal candle to exit. With larger DTC you run the risk of having to cover at a higher price by pumping the stock yourself while covering.

-

There are 53,000 put options for 04/14 that can be closed and dehedged. There are also 42,000 call options, but I think there is a higher chance for calls to be held for more gains or also loaded up fresh. Basically, there are reasons to be long than short now. 4 and 5 strikes are most popular and those are the next to be ITM. To be clear, this is not a gamma squeeze play, but we know that options activity does contribute to stock price movements.

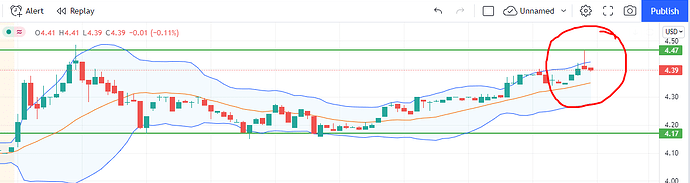

Therefore, tomorrow I will watch DNA and if an uptrend is confirmed, I will probably buy calls.

- Key levels above: 4.17, 4.47, 5.18

- Key levels below: 3.46, 2.92