Ticker: DUOL

Description of why you are requesting DD: more experienced DD needed, website traffic numbers, Plus marketing pages

FYI: Noob alert

@ sugar mountain was checking on this company already so I’ve decided to help out a bit.

This is a short description of the company: https://www.businessofapps.com/data/duolingo-statistics/

-It’s a freemium model, with Plus a monthly subscription.

-It’s an interesting company because it’s scalability allows it to print cash. The platform’s learning structure is literally the same for all languages, and they have plans to expand subjects beyond languages into math, science… ex: Duolingo is working on a math app for kids | TechCrunch

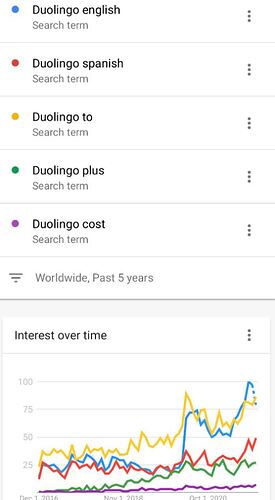

Gtrends are looking better than ever:

I’ve reviewed recent sentiment on twitter and it seems pretty positive.

Also most of the people are having a great time with the company’s social activity (posts comments, suggestions, etc.)

https://twitter.com/brendangahan/status/1456290184329236481/photo/1

Possible red flag(medium term): Lock-up period of 180 day (end of January 2022), but the company allowed employees with vested shares to sell 25% in the first 7 trading days, and again toward the end of the 180 day lockup.

Number of vested employee shares weren’t disclosed, but at least the 7 day window puts less pressure on the stock come January. I actually like this method of lockup…less pop and pumping on IPO week and gives employees a good exit opportunity.

More DD from experienced guys would be really helpful together with website traffic numbers, Plus marketing pages.

Thanks in advance for your help!

. Q3 Revenue Rose 40 Percent to $63.6 Million.

. Q3 Revenue Rose 40 Percent to $63.6 Million.