I suspected this would move up on launch. I’m going to watch for a good puts entry as I highly doubt it holds these levels after some morning FOMO.

Ive been looking into a DWAC play, I think a lot of us have been waiting on the sidelines for a play. Now that the app has officially launched a week ago, has any1 started a position either long or short on this yet? I was wondering if…

- The sec does find foul play if they really would stop the merger entirely, or if there would be fines/penalties or something? Could DWAC go to $10 again in other words

- if the Merger wasn’t allowed to go through for some reason, who else would try and take TMGT public as far as Spac’s go

The app has been out a week, very limited users, long waiting list (from what I’ve heard), and lots of problems. I know that improvements are being made, that some users complain about already being banned, and that they are as far as I can tell still trying to go full online be end of March, or at least I’ve seen nothing new on that front.

The security as is on the threshold list… and the Call v Put premium is fairly staggering at the moment.

The underlying is trading at $93 currently, and an April 14th $90 call is priced about $11.50, while a $90 put is priced at about $20.

- Ended up taking some $50 puts for April 14th, the puts keep getting battered down so I may scale up a position over time if more negatives come out, or close it if the launch goes very well. As of now, the launch is crap, huge waiting list, apps dropped an awful lot in the rankings, and average app engagement is very low. Also, the main draw for individuals is Trump and he’s posted only once. Also more articles came out just recently about how upset he is at this rollout.

I averaged down with a couple more April 14th puts. More negative headlines and all, App is out of the top 100 list as well.

I’m up on my puts at the moment, they finally went green after holding and adding over the past week. I think that this is finally real selling, and its tied to the Indices selling off undoubtedly, however this was always propped it felt like, during past spy sell offs, as if it were a safe haven for money for a minute. That narrative may have finally changed, and it looks like there is real selling.

With that said DWAC is about 30% off the recent high made last Wednesday of 101.87 intraday. I still havent seen many positives other than a long “waitlist”. But it seems the app is not working out the way it was expected to. I’m holding my position for now and may still add to it if the stock gets some upward movement so long as the narrative to me stays the same.

Any1 else take any positions, long or short?

Not DWAC, but its little brother CFVI - buy orders for 7/15 10C filled.

Went for CFVI because it is much closer to NAV - at $11.32 now. And the DWAC crowd manages to excite themselves once a month or so, and CFVI gets to ride on those coattails. July allows four months for something interesting to happen.

closed about 2/3 of my put today for profit, still plenty of time left on the April 14ths, towards the end of the Day this article came out and the ticker started to recover. I’ll look to add to my position over time, if more negative comes out. I still believe the app is a flop and the hype is over, but I’m doing my best too not underestimate the hype Trump gets on tickers, good or bad.

Edit 3.11 - Closed out of all but 1 contract now

I entered new puts a couple days ago, specifically the

04.14.22 - $65p

04.14.22 - $50p

Its officially the end of the month…which was their “launch date” that was changed from a previous launch date. Lots of negative headlines out still, including the SEC reg’s changing to hold SPAC’s accountable for their claims. I am weary of this as it still has high IV being priced in, and something positive could send this up towards the $100’s again, however; I’m managing a small position short because most of what I’m seeing is still negative as far as headlines.

Some Recent headlines - Also, Trump (who is the main draw for this play) has not posted since his very first time, makes me wonder if Legal is telling him not to and what that may imply, because I see no benefit in not using your own platform that you are pushing to go public

https://twitter.com/danprimack/status/1509176566106005512?s=20&t=Ni_29cra_b8YUfeWHwV79Q

(axios)

(general space sentiment, not immediately related I suppose)

and massive amounts of bearing options activity

Edit 04.01 - Closed my 65p and all buy 1 of my $50p.

Just throwing this out there as it came in after hours today, 10k non-timely filing. In it it says they expect to file within the 15 day extension (so April 14th?). Wonder what might be happening with their accounting, and if the SEC probe is over

https://www.sec.gov/Archives/edgar/data/1849635/000119312522091951/0001193125-22-091951-index.htm

I updated my earlier post, but I’ve sold all my puts with the exception of 1 $50p for 04.14.22 today, after the break of 60 and then reclaim. Something I’ve noticed today is that DWAC is no longer listed as a Threshold Security, and now has shares available through my Lightspeed broker to short, at $150/1k shares. I believe it has been a threshold security for the past couple months, it was on the list still when I took the position earlier this week. I believe that means shorts have covered into this recent sell off.

I still believe this ultimately ends up sub $35, but the timing is tricky and the IV is expensive, so I’m holding my $50p as a bit of a lotto since I collected profit on the rest of my options. I will more than likely look to enter puts again

With new Twitter/musk news I could see DWAC and truth social being disbanded if Musk acquires enough stake to uncensor Twitter. Trump could really careless about having his own platform if allowed back on Twitter I imagine. Gonna look at little ways out puts here to see how this develops

Truth Social is part of a whole Trump media conglomerate that Trump has envisioned. I’m not sure he’d be so willing to abandon it even if he did get unbanned. I do agree that long expiry puts are a good play for DWAC though.

They lost the energy of the crowd with their wait-list and they’re about the juiciest hacktivist target in the world.

Ive taken more $50p for 04.14.22, and also some $40p for the same expiration. I think this is the nail in the coffin for DWAC, which moved up only on hype. All previous points still stand, and I think that those that have been sitting comfortable at low entries are going to start pulling profits from this on recent headlines of Musk taking stake in Twitter and Execs leaving DWAC.

Also - This stock is still not threshold anymore, with borrows currnently running me $150/1k shares, I think there will be new shorts on this adding downward pressure

Closed all my DWAC puts, the 50’s and 40’s here at sub $49. Will watch for a re-entry, but it may not come today or it could continue its fall, perhaps to 45 then 40

Could be good entry here for DWAC puts just had pretty large bounce up for some reason

Short report from Kerrisdale out today, causing a drop to the 45 support DWAC has shown for the last couple of weeks. I agree, I don’t think the deal goes through, and DWAC gets crushed. I don’t know exactly how to time this, DWAC has been range bound between 45-50 for the most part since the 5th of April.

https://twitter.com/KerrisdaleCap/status/1516794004121300999?s=20&t=n9EXHsVS02GfN5Pu4isfuA

I am going to start some OTM 5.20.22 puts on this. I agree with their price target of $10, the options are pricey, and this could end up squeezing shorts like GSX. My plan is to scale into a position slowly, and this play relies very much on the SEC or something else killing this deal.

Edit - Including Link for Kerrisdale short report –

Here’s what I researched. DWAC filed the 10-K on 4/13. DWAC is expecting to merge with Trump’s media company before 9/20. There still is no S-4 filing and if DWAC doesn’t merge with Trump’s media company then they would have to immediately pivot to a different company which they would have to declare prior to 9/8. At which point they could extend the merger agreement for a different company to 3/8/23. So basically the longer it takes for an S-4 the less like a merger is actually going to happen.

This thread hasn’t been updated in 8 days, that is about when DWAC switched over to Rumble cloud/servers, and “cleared” their waitlist of at least apple iPhone users. I posted this on Trading floor and will add it here

DWAC - I noticed this morning trumps account is up to 1.97m followers now, so users still trending up, still #1 in free apps in apple store, I may hedge my puts with some OTM calls on a pullback to 40-43. I find most interesting…that Trump still hasnt “truthed” since over 2 months ago, and over last night his account started following another user “Truth Social Support” his first follow was “Truth Social”. I’m very curious why he hasnt used the platform, or if he is going to start using it now considering it got another follow. It wasnt an automatic thing either, my account did not automatically start following @truthsupport

A couple things to note -

- Trumps users from pre-rumble was about 1.05m users following, as of this post its 1.97m users in the past 8-9 days.

- Trump has state since Elon Musk and TWTR agreed on purchase, he will not return to Twitter, he will be staying on Truth Social

- Trump has still not used his platform for another “truth” since his first and only “Truth” over 2 months ago. I believe Fox reported that he will be using it within a week from their reporting about 3 days ago.

- From April 27th to April 28th, Trumps account has since followed 1 more account, for a total of 2. That is the only sign of life I have seen from his account since its inception and first “Truth”. This indicated the account is active as of now, wether its actually him or not I don’t know.

- His first follow is @truthsocial which has been followed since its creation. His second follow last night, is @truthsupport. I checked, and this is not an “automatic” follow, in that my account did not automatically follow this account.

Using trump is a fairly good metric IMO, for subscriber growth, you are required to follow 2 users when you sign up to make it into the platform. #1 is Trump, he’s at the top of this list, followed by Truth Social, then Fox, and etc. etc. - I however cannot tell how much of this is real/actual users, I don’t know how to look into that, but I would not count out fake sign-ups as part of these #'s.

This is just a bit of info I rounded up, hope it helps make informed decisions. I may end up looking over tweets and seeing if I can’t collect a timeline of user growth to try and chart it out, but I probably won’t lol.

The Donald has made his second TRUTH today. Seems like these guys finally got their shit together enough to have a platform that at least functions (I signed up for an account a couple months ago, and it finally came off waitlist like last week, and based on the donald’s follower numbers it seems like people are able to sign up now).

In the long run this thing is almost certain to fail, but in the short term this could get another major pump now that Trump is actually using it.

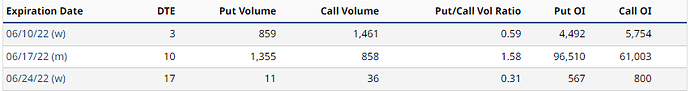

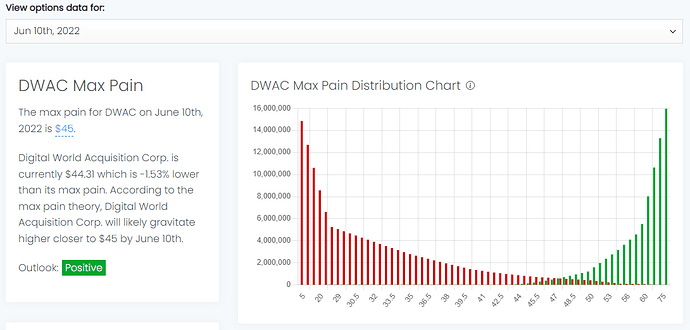

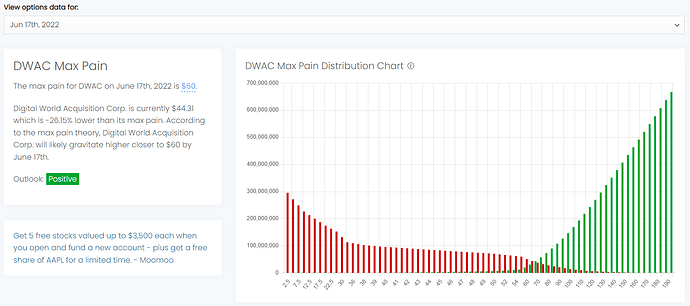

Looks like DWAC has been absolutely pinned to the $44ish level for the last three weeks. This is surprising for a ticker like DWAC which has tended to flail around a lot.

This is also a little surprising given the option OI spread.

The premium distribution supports a $44 pin from the “max pain” point of view for June 10. I’m not a huge fan of the concept because it is far from consistently reliable and only works some of the time, but this seems to be one of those times where there is alignment.

Now… OI is 16x higher for next week’s expiration on June 17, and if premiums are any indication and we can lean on “max pain” any, price should unpin and go higher.

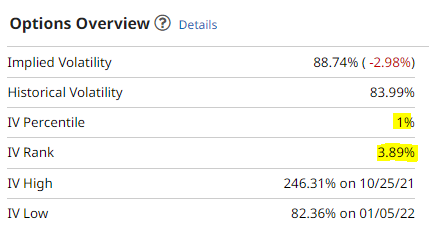

IV is historically low, especially on the Call side, so could be a chance to get in before it spikes again.

Of course, the higher Put IV is a reflection of the fact that everyone expects DWAC to crater further, but this could be a chance to profit from being a contrarian - there is a small chance that the underlying technicals may push this higher. Especially if there is some positive news catalyst.