Work in progress, this is just the bare bones

Introduction

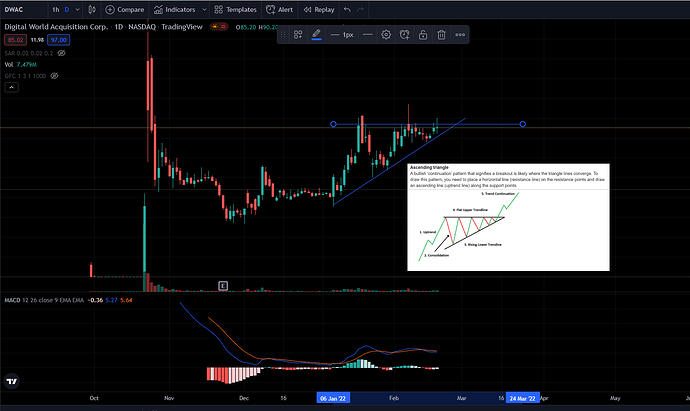

Ah, DWAC. The SPAC we all thought was going to crash after it was up to $14 and then watched it run to $170 from the side-lines the next day, good times. All is not lost though; I believe there’s going to be another window to make some money from this horrible mess of a media platform. I believe at the least this is going to be a “sell the news” play or at best the platform flops completely on launch.

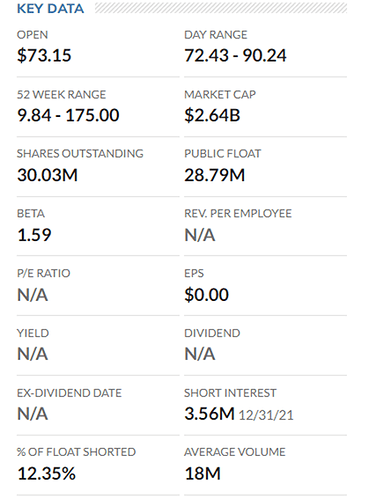

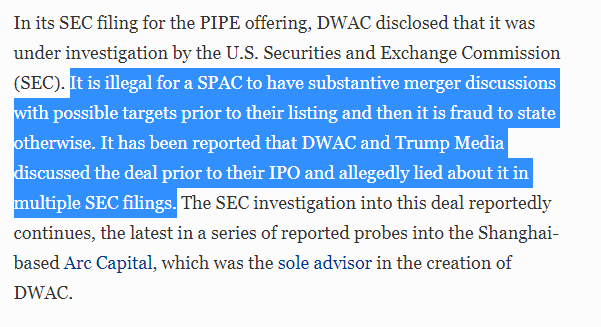

Digital world acquisition Corp ($DWAC) is the SPAC with their sights on taking Donald Trump’s Trump Media & Technology Group public (TMTG). Recently, since the announcement of the site’s launch shares have climbed from $50 all the way to $90.

What is truth social?

“TRUTH Social is America’s “Big Tent” social media platform that encourages an open, free, and honest global conversation without discriminating against political ideology.” – From their website.

Truth social is the sequel nobody asked for to “From the desk of Donald Trump”… a website that trump posted on for a month before it was shut down but in short It’s a twitter-like PPM model of social media.

The Bear Case

Truth social has had some bad press come about it since it’s announcement.

Mastodon

Truth Social is built using Mastodon’s source code, but in October, Mastodon published a statement Truth Social was in violation of Mastodon’s software license because Truth Social claimed it was proprietary and because Truth Social didn’t share its source code back. Mastodon said it sent a formal letter to Truth Social’s chief legal officer asking that it share the source code, and Truth Social has since added an “open-source section to it’s website.”

GETTR

A similar social media platform was launched by Trump’s former aide Justin Miller. Currently has only around 4 million total users in total . Comparing this to a company like Twitter with over 300m monthly active users .

Parler

Another similar social media platform with 20 million total users with 2.3 million active accounts.

Overvaluation

Currently there are 37.2 million shares outstanding but they could balloon to 193 to almost 225 million, depending on which stock price and earnout scenario plays out, this would give DWAC a valuation of close to $15 billion. This kind of valuation is insane for a company that only expects to make $114m in 2023, and they’re assuming they’re going to grow which if the other right wing platforms are anything to base this off, it doesn’t look likely.

Wild speculation

Big tech clearly doesn’t want Trump on any of their platforms, it could get pulled from app stores fairly quickly.

The launch is probably going to attempted to be thwarted by hackers because it’s Trump, I couldn’t find anything on the number of employees, I’m not computer savvy but It can’t be a good thing to have your source code public for everyone to see.

I’ve been trying to find the number of people they employ but couldn’t find anything, they couldn’t even be bothered to make the beta private at people were able to get into it just by typing a URL. Doesn’t sound very secure to me.

A PPM model for social media seems insane since the generally accepted model for social media is that they make money from selling data and advertising, how many people are going to pay for something all their friends are on that they get for free?

The play

Right now IV is jacked to the tits so picking up puts is not worth the risk. I’m hoping IV dies down towards the end of this month and it continues to run towards launch, start of February so we can pick up puts. However, I still think they’re going to be expensive.