Morgan Stanley $91.66

![]() Morgan Stanley (MS) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $1.25 per share on revenue of $255.78 billion and the Earnings Whisper ® number is $1.37 per share. Investor sentiment going into the company’s earnings release has 34% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 39.90% with revenue increasing by 1,622.89%. Short interest has decreased by 6.4% since the company’s last earnings release while the stock has drifted higher by 18.7% from its open following the earnings release to be 9.3% above its 200 day moving average of $83.89. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 11, 2023 there was some notable buying of 25,195 contracts of the $100.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 3.7% move on earnings and the stock has averaged a 1.8% move in recent quarters.

Morgan Stanley (MS) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $1.25 per share on revenue of $255.78 billion and the Earnings Whisper ® number is $1.37 per share. Investor sentiment going into the company’s earnings release has 34% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 39.90% with revenue increasing by 1,622.89%. Short interest has decreased by 6.4% since the company’s last earnings release while the stock has drifted higher by 18.7% from its open following the earnings release to be 9.3% above its 200 day moving average of $83.89. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 11, 2023 there was some notable buying of 25,195 contracts of the $100.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 3.7% move on earnings and the stock has averaged a 1.8% move in recent quarters.

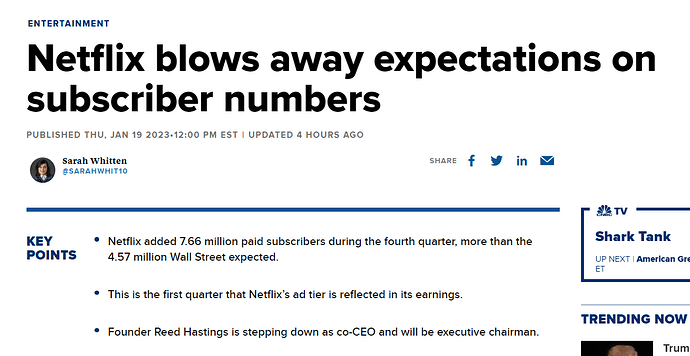

Netflix, Inc. $332.82

![]() Netflix, Inc. (NFLX) is confirmed to report earnings at approximately 4:00 PM ET on Thursday, January 19, 2023. The consensus earnings estimate is $0.45 per share on revenue of $7.82 billion and the Earnings Whisper ® number is $0.67 per share. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat The company’s guidance was for earnings of approximately $0.36 per share. Consensus estimates are for earnings to decline year-over-year by 66.17% with revenue increasing by 1.44%. Short interest has decreased by 15.8% since the company’s last earnings release while the stock has drifted higher by 25.6% from its open following the earnings release to be 35.8% above its 200 day moving average of $245.09. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 11, 2023 there was some notable buying of 14,450 contracts of the $600.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 10.1% move on earnings and the stock has averaged a 13.8% move in recent quarters.

Netflix, Inc. (NFLX) is confirmed to report earnings at approximately 4:00 PM ET on Thursday, January 19, 2023. The consensus earnings estimate is $0.45 per share on revenue of $7.82 billion and the Earnings Whisper ® number is $0.67 per share. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat The company’s guidance was for earnings of approximately $0.36 per share. Consensus estimates are for earnings to decline year-over-year by 66.17% with revenue increasing by 1.44%. Short interest has decreased by 15.8% since the company’s last earnings release while the stock has drifted higher by 25.6% from its open following the earnings release to be 35.8% above its 200 day moving average of $245.09. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 11, 2023 there was some notable buying of 14,450 contracts of the $600.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 10.1% move on earnings and the stock has averaged a 13.8% move in recent quarters.

Goldman Sachs Group, Inc. $374.00

![]() Goldman Sachs Group, Inc. (GS) is confirmed to report earnings at approximately 7:15 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $5.25 per share on revenue of $11.44 billion and the Earnings Whisper ® number is $5.97 per share. Investor sentiment going into the company’s earnings release has 34% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 51.43% with revenue decreasing by 17.42%. Short interest has decreased by 11.9% since the company’s last earnings release while the stock has drifted higher by 16.3% from its open following the earnings release to be 14.2% above its 200 day moving average of $327.60. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, December 28, 2022 there was some notable buying of 3,650 contracts of the $400.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 3.2% move on earnings and the stock has averaged a 2.8% move in recent quarters.

Goldman Sachs Group, Inc. (GS) is confirmed to report earnings at approximately 7:15 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $5.25 per share on revenue of $11.44 billion and the Earnings Whisper ® number is $5.97 per share. Investor sentiment going into the company’s earnings release has 34% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 51.43% with revenue decreasing by 17.42%. Short interest has decreased by 11.9% since the company’s last earnings release while the stock has drifted higher by 16.3% from its open following the earnings release to be 14.2% above its 200 day moving average of $327.60. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, December 28, 2022 there was some notable buying of 3,650 contracts of the $400.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 3.2% move on earnings and the stock has averaged a 2.8% move in recent quarters.

Silvergate Capital Corporation $13.20

![]() Silvergate Capital Corporation (SI) is confirmed to report earnings at approximately 6:25 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $0.67 per share on revenue of $104.73 million. Investor sentiment going into the company’s earnings release has 26% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 1.52% with revenue increasing by 111.42%. Short interest has increased by 423.8% since the company’s last earnings release while the stock has drifted lower by 79.0% from its open following the earnings release to be 81.3% below its 200 day moving average of $70.65. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 5, 2023 there was some notable buying of 15,931 contracts of the $15.50 call expiring on Friday, January 20, 2023. Option traders are pricing in a 25.8% move on earnings and the stock has averaged a 18.5% move in recent quarters.

Silvergate Capital Corporation (SI) is confirmed to report earnings at approximately 6:25 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $0.67 per share on revenue of $104.73 million. Investor sentiment going into the company’s earnings release has 26% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 1.52% with revenue increasing by 111.42%. Short interest has increased by 423.8% since the company’s last earnings release while the stock has drifted lower by 79.0% from its open following the earnings release to be 81.3% below its 200 day moving average of $70.65. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 5, 2023 there was some notable buying of 15,931 contracts of the $15.50 call expiring on Friday, January 20, 2023. Option traders are pricing in a 25.8% move on earnings and the stock has averaged a 18.5% move in recent quarters.

Citizens Financial Group Inc $41.72

![]() Citizens Financial Group Inc (CFG) is confirmed to report earnings at approximately 6:20 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $1.30 per share on revenue of $2.22 billion and the Earnings Whisper ® number is $1.34 per share. Investor sentiment going into the company’s earnings release has 32% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 3.17% with revenue increasing by 23.61%. Short interest has increased by 4.9% since the company’s last earnings release while the stock has drifted higher by 11.7% from its open following the earnings release to be 8.2% above its 200 day moving average of $38.54. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, January 11, 2023 there was some notable buying of 1,000 contracts of the $35.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 5.4% move on earnings and the stock has averaged a 3.2% move in recent quarters.

Citizens Financial Group Inc (CFG) is confirmed to report earnings at approximately 6:20 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $1.30 per share on revenue of $2.22 billion and the Earnings Whisper ® number is $1.34 per share. Investor sentiment going into the company’s earnings release has 32% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 3.17% with revenue increasing by 23.61%. Short interest has increased by 4.9% since the company’s last earnings release while the stock has drifted higher by 11.7% from its open following the earnings release to be 8.2% above its 200 day moving average of $38.54. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, January 11, 2023 there was some notable buying of 1,000 contracts of the $35.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 5.4% move on earnings and the stock has averaged a 3.2% move in recent quarters.

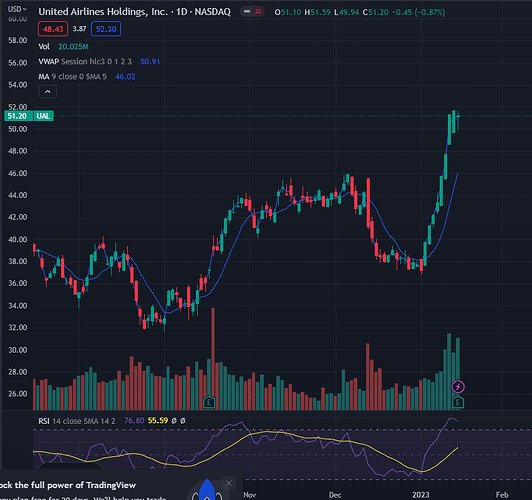

United Airlines $51.65

![]() United Airlines (UAL) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $2.07 per share on revenue of $12.26 billion and the Earnings Whisper ® number is $2.31 per share. Investor sentiment going into the company’s earnings release has 72% expecting an earnings beat The company’s guidance was for earnings of $2.00 to $2.10 per share. Consensus estimates are for year-over-year earnings growth of 229.38% with revenue increasing by 49.66%. Short interest has increased by 28.1% since the company’s last earnings release while the stock has drifted higher by 31.4% from its open following the earnings release to be 27.2% above its 200 day moving average of $40.60. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, January 11, 2023 there was some notable buying of 17,492 contracts of the $42.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 6.4% move on earnings and the stock has averaged a 5.4% move in recent quarters.

United Airlines (UAL) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $2.07 per share on revenue of $12.26 billion and the Earnings Whisper ® number is $2.31 per share. Investor sentiment going into the company’s earnings release has 72% expecting an earnings beat The company’s guidance was for earnings of $2.00 to $2.10 per share. Consensus estimates are for year-over-year earnings growth of 229.38% with revenue increasing by 49.66%. Short interest has increased by 28.1% since the company’s last earnings release while the stock has drifted higher by 31.4% from its open following the earnings release to be 27.2% above its 200 day moving average of $40.60. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, January 11, 2023 there was some notable buying of 17,492 contracts of the $42.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 6.4% move on earnings and the stock has averaged a 5.4% move in recent quarters.

Charles Schwab Corp. $82.98

Charles Schwab Corp. (SCHW) is confirmed to report earnings at approximately 8:45 AM ET on Wednesday, January 18, 2023. The consensus earnings estimate is $1.10 per share on revenue of $5.53 billion and the Earnings Whisper ® number is $1.10 per share. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 27.91% with revenue increasing by 17.46%. Short interest has decreased by 4.6% since the company’s last earnings release while the stock has drifted higher by 17.6% from its open following the earnings release to be 14.2% above its 200 day moving average of $72.64. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 6, 2023 there was some notable buying of 3,654 contracts of the $83.00 put expiring on Friday, January 27, 2023. Option traders are pricing in a 4.1% move on earnings and the stock has averaged a 3.8% move in recent quarters.

Charles Schwab Corp. (SCHW) is confirmed to report earnings at approximately 8:45 AM ET on Wednesday, January 18, 2023. The consensus earnings estimate is $1.10 per share on revenue of $5.53 billion and the Earnings Whisper ® number is $1.10 per share. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 27.91% with revenue increasing by 17.46%. Short interest has decreased by 4.6% since the company’s last earnings release while the stock has drifted higher by 17.6% from its open following the earnings release to be 14.2% above its 200 day moving average of $72.64. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 6, 2023 there was some notable buying of 3,654 contracts of the $83.00 put expiring on Friday, January 27, 2023. Option traders are pricing in a 4.1% move on earnings and the stock has averaged a 3.8% move in recent quarters.

Signature Bank $118.37

![]() Signature Bank (SBNY) is confirmed to report earnings at approximately 5:00 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $4.92 per share on revenue of $726.29 million and the Earnings Whisper ® number is $4.90 per share. Investor sentiment going into the company’s earnings release has 47% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 13.36% with revenue increasing by 13.52%. Short interest has increased by 83.1% since the company’s last earnings release while the stock has drifted lower by 17.5% from its open following the earnings release to be 33.6% below its 200 day moving average of $178.34. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 10, 2023 there was some notable buying of 5,047 contracts of the $60.00 put expiring on Friday, June 16, 2023. Option traders are pricing in a 12.0% move on earnings and the stock has averaged a 4.2% move in recent quarters.

Signature Bank (SBNY) is confirmed to report earnings at approximately 5:00 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $4.92 per share on revenue of $726.29 million and the Earnings Whisper ® number is $4.90 per share. Investor sentiment going into the company’s earnings release has 47% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 13.36% with revenue increasing by 13.52%. Short interest has increased by 83.1% since the company’s last earnings release while the stock has drifted lower by 17.5% from its open following the earnings release to be 33.6% below its 200 day moving average of $178.34. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 10, 2023 there was some notable buying of 5,047 contracts of the $60.00 put expiring on Friday, June 16, 2023. Option traders are pricing in a 12.0% move on earnings and the stock has averaged a 4.2% move in recent quarters.

Procter & Gamble Co. $150.88

Procter & Gamble Co. (PG) is confirmed to report earnings at approximately 6:55 AM ET on Thursday, January 19, 2023. The consensus earnings estimate is $1.58 per share on revenue of $20.58 billion and the Earnings Whisper ® number is $1.60 per share. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 4.82% with revenue decreasing by 1.78%. Short interest has increased by 12.1% since the company’s last earnings release while the stock has drifted higher by 14.6% from its open following the earnings release to be 4.8% above its 200 day moving average of $143.93. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 10, 2023 there was some notable buying of 15,157 contracts of the $160.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 3.1% move on earnings and the stock has averaged a 2.7% move in recent quarters.

Procter & Gamble Co. (PG) is confirmed to report earnings at approximately 6:55 AM ET on Thursday, January 19, 2023. The consensus earnings estimate is $1.58 per share on revenue of $20.58 billion and the Earnings Whisper ® number is $1.60 per share. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 4.82% with revenue decreasing by 1.78%. Short interest has increased by 12.1% since the company’s last earnings release while the stock has drifted higher by 14.6% from its open following the earnings release to be 4.8% above its 200 day moving average of $143.93. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 10, 2023 there was some notable buying of 15,157 contracts of the $160.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 3.1% move on earnings and the stock has averaged a 2.7% move in recent quarters.

Guaranty Bancshares, Inc. $35.54

![]() Guaranty Bancshares, Inc. (GNTY) is confirmed to report earnings at approximately 7:00 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $0.88 per share on revenue of $33.95 million and the Earnings Whisper ® number is $0.92 per share. Investor sentiment going into the company’s earnings release has 27% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 6.02% with revenue increasing by 7.59%. Short interest has decreased by 44.2% since the company’s last earnings release while the stock has drifted lower by 2.6% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release.

Guaranty Bancshares, Inc. (GNTY) is confirmed to report earnings at approximately 7:00 AM ET on Tuesday, January 17, 2023. The consensus earnings estimate is $0.88 per share on revenue of $33.95 million and the Earnings Whisper ® number is $0.92 per share. Investor sentiment going into the company’s earnings release has 27% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 6.02% with revenue increasing by 7.59%. Short interest has decreased by 44.2% since the company’s last earnings release while the stock has drifted lower by 2.6% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release.