Tesla, Inc. $133.42

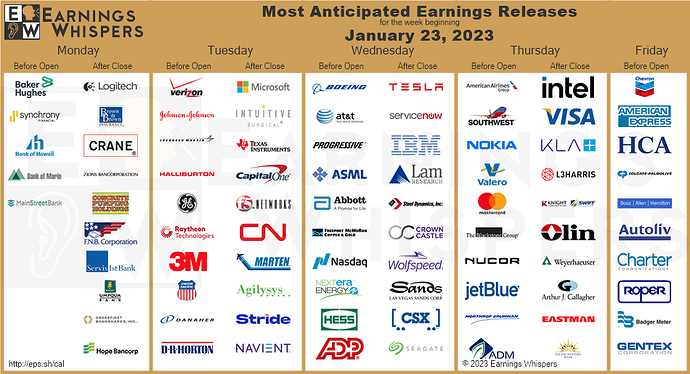

![]() Tesla, Inc. (TSLA) is confirmed to report earnings at approximately 4:05 PM ET on Wednesday, January 25, 2023. The consensus earnings estimate is $1.17 per share on revenue of $26.16 billion and the Earnings Whisper ® number is $1.04 per share. Investor sentiment going into the company’s earnings release has 37% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 33.46% with revenue increasing by 47.64%. Short interest has increased by 28.1% since the company’s last earnings release while the stock has drifted lower by 35.9% from its open following the earnings release to be 43.6% below its 200 day moving average of $236.59. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 20, 2023 there was some notable buying of 46,376 contracts of the $95.00 call expiring on Friday, June 20, 2025. Option traders are pricing in a 9.7% move on earnings and the stock has averaged a 6.1% move in recent quarters.

Tesla, Inc. (TSLA) is confirmed to report earnings at approximately 4:05 PM ET on Wednesday, January 25, 2023. The consensus earnings estimate is $1.17 per share on revenue of $26.16 billion and the Earnings Whisper ® number is $1.04 per share. Investor sentiment going into the company’s earnings release has 37% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 33.46% with revenue increasing by 47.64%. Short interest has increased by 28.1% since the company’s last earnings release while the stock has drifted lower by 35.9% from its open following the earnings release to be 43.6% below its 200 day moving average of $236.59. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 20, 2023 there was some notable buying of 46,376 contracts of the $95.00 call expiring on Friday, June 20, 2025. Option traders are pricing in a 9.7% move on earnings and the stock has averaged a 6.1% move in recent quarters.

Microsoft Corp. $240.22

![]() Microsoft Corp. (MSFT) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $2.29 per share on revenue of $53.48 billion and the Earnings Whisper ® number is $2.25 per share. Investor sentiment going into the company’s earnings release has 46% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 7.66% with revenue increasing by 3.39%. Short interest has decreased by 0.1% since the company’s last earnings release while the stock has drifted higher by 3.9% from its open following the earnings release to be 6.0% below its 200 day moving average of $255.45. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 4, 2023 there was some notable buying of 15,878 contracts of the $235.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 5.0% move on earnings and the stock has averaged a 4.4% move in recent quarters.

Microsoft Corp. (MSFT) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $2.29 per share on revenue of $53.48 billion and the Earnings Whisper ® number is $2.25 per share. Investor sentiment going into the company’s earnings release has 46% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 7.66% with revenue increasing by 3.39%. Short interest has decreased by 0.1% since the company’s last earnings release while the stock has drifted higher by 3.9% from its open following the earnings release to be 6.0% below its 200 day moving average of $255.45. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 4, 2023 there was some notable buying of 15,878 contracts of the $235.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 5.0% move on earnings and the stock has averaged a 4.4% move in recent quarters.

Boeing Co. $206.76

Boeing Co. (BA) is confirmed to report earnings at approximately 7:30 AM ET on Wednesday, January 25, 2023. The consensus earnings estimate is $0.30 per share on revenue of $20.00 billion and the Earnings Whisper ® number is $0.56 per share. Investor sentiment going into the company’s earnings release has 65% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 103.90% with revenue increasing by 35.20%. Short interest has decreased by 9.5% since the company’s last earnings release while the stock has drifted higher by 40.6% from its open following the earnings release to be 31.4% above its 200 day moving average of $157.33. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 4, 2023 there was some notable buying of 13,789 contracts of the $245.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 5.0% move on earnings and the stock has averaged a 4.5% move in recent quarters.

Boeing Co. (BA) is confirmed to report earnings at approximately 7:30 AM ET on Wednesday, January 25, 2023. The consensus earnings estimate is $0.30 per share on revenue of $20.00 billion and the Earnings Whisper ® number is $0.56 per share. Investor sentiment going into the company’s earnings release has 65% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 103.90% with revenue increasing by 35.20%. Short interest has decreased by 9.5% since the company’s last earnings release while the stock has drifted higher by 40.6% from its open following the earnings release to be 31.4% above its 200 day moving average of $157.33. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 4, 2023 there was some notable buying of 13,789 contracts of the $245.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 5.0% move on earnings and the stock has averaged a 4.5% move in recent quarters.

Verizon Communications $40.00

Verizon Communications (VZ) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $1.21 per share on revenue of $35.37 billion and the Earnings Whisper ® number is $1.24 per share. Investor sentiment going into the company’s earnings release has 68% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 7.63% with revenue increasing by 3.82%. Short interest has decreased by 4.4% since the company’s last earnings release while the stock has drifted higher by 12.6% from its open following the earnings release to be 8.5% below its 200 day moving average of $43.73. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 10, 2023 there was some notable buying of 9,506 contracts of the $43.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 4.6% move on earnings and the stock has averaged a 3.3% move in recent quarters.

Verizon Communications (VZ) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $1.21 per share on revenue of $35.37 billion and the Earnings Whisper ® number is $1.24 per share. Investor sentiment going into the company’s earnings release has 68% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 7.63% with revenue increasing by 3.82%. Short interest has decreased by 4.4% since the company’s last earnings release while the stock has drifted higher by 12.6% from its open following the earnings release to be 8.5% below its 200 day moving average of $43.73. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 10, 2023 there was some notable buying of 9,506 contracts of the $43.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 4.6% move on earnings and the stock has averaged a 3.3% move in recent quarters.

Johnson & Johnson $168.74

Johnson & Johnson (JNJ) is confirmed to report earnings at approximately 6:25 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $2.22 per share on revenue of $23.91 billion and the Earnings Whisper ® number is $2.27 per share. Investor sentiment going into the company’s earnings release has 43% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 4.23% with revenue decreasing by 3.60%. Short interest has decreased by 22.9% since the company’s last earnings release while the stock has drifted higher by 2.3% from its open following the earnings release to be 2.2% below its 200 day moving average of $172.51. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 20, 2023 there was some notable buying of 5,167 contracts of the $162.50 put expiring on Friday, January 27, 2023. Option traders are pricing in a 2.6% move on earnings and the stock has averaged a 1.8% move in recent quarters.

Johnson & Johnson (JNJ) is confirmed to report earnings at approximately 6:25 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $2.22 per share on revenue of $23.91 billion and the Earnings Whisper ® number is $2.27 per share. Investor sentiment going into the company’s earnings release has 43% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 4.23% with revenue decreasing by 3.60%. Short interest has decreased by 22.9% since the company’s last earnings release while the stock has drifted higher by 2.3% from its open following the earnings release to be 2.2% below its 200 day moving average of $172.51. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 20, 2023 there was some notable buying of 5,167 contracts of the $162.50 put expiring on Friday, January 27, 2023. Option traders are pricing in a 2.6% move on earnings and the stock has averaged a 1.8% move in recent quarters.

Lockheed Martin Corp. $443.28

![]() Lockheed Martin Corp. (LMT) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $7.41 per share on revenue of $18.28 billion and the Earnings Whisper ® number is $7.70 per share. Investor sentiment going into the company’s earnings release has 57% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 2.35% with revenue increasing by 3.11%. Short interest has increased by 21.3% since the company’s last earnings release while the stock has drifted higher by 10.0% from its open following the earnings release to be 0.9% above its 200 day moving average of $439.42. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 9, 2023 there was some notable buying of 5,479 contracts of the $510.00 call and 5,214 contracts of the $410.00 put expiring on Friday, March 17, 2023. Option traders are pricing in a 3.8% move on earnings and the stock has averaged a 5.0% move in recent quarters.

Lockheed Martin Corp. (LMT) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $7.41 per share on revenue of $18.28 billion and the Earnings Whisper ® number is $7.70 per share. Investor sentiment going into the company’s earnings release has 57% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 2.35% with revenue increasing by 3.11%. Short interest has increased by 21.3% since the company’s last earnings release while the stock has drifted higher by 10.0% from its open following the earnings release to be 0.9% above its 200 day moving average of $439.42. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 9, 2023 there was some notable buying of 5,479 contracts of the $510.00 call and 5,214 contracts of the $410.00 put expiring on Friday, March 17, 2023. Option traders are pricing in a 3.8% move on earnings and the stock has averaged a 5.0% move in recent quarters.

Halliburton Company $40.69

![]() Halliburton Company (HAL) is confirmed to report earnings at approximately 6:45 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $0.67 per share on revenue of $5.58 billion and the Earnings Whisper ® number is $0.69 per share. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 86.11% with revenue increasing by 30.47%. Short interest has increased by 8.8% since the company’s last earnings release while the stock has drifted higher by 16.8% from its open following the earnings release to be 19.5% above its 200 day moving average of $34.04. Overall earnings estimates have been revised higher since the company’s last earnings release. On Tuesday, January 3, 2023 there was some notable buying of 3,871 contracts of the $30.00 put expiring on Friday, February 10, 2023. Option traders are pricing in a 5.2% move on earnings and the stock has averaged a 2.0% move in recent quarters.

Halliburton Company (HAL) is confirmed to report earnings at approximately 6:45 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $0.67 per share on revenue of $5.58 billion and the Earnings Whisper ® number is $0.69 per share. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 86.11% with revenue increasing by 30.47%. Short interest has increased by 8.8% since the company’s last earnings release while the stock has drifted higher by 16.8% from its open following the earnings release to be 19.5% above its 200 day moving average of $34.04. Overall earnings estimates have been revised higher since the company’s last earnings release. On Tuesday, January 3, 2023 there was some notable buying of 3,871 contracts of the $30.00 put expiring on Friday, February 10, 2023. Option traders are pricing in a 5.2% move on earnings and the stock has averaged a 2.0% move in recent quarters.

Baker Hughes $31.07

![]() Baker Hughes (BKR) is confirmed to report earnings at approximately 7:00 AM ET on Monday, January 23, 2023. The consensus earnings estimate is $0.41 per share on revenue of $6.06 billion and the Earnings Whisper ® number is $0.43 per share. Investor sentiment going into the company’s earnings release has 53% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 64.00% with revenue increasing by 9.80%. Short interest has decreased by 41.7% since the company’s last earnings release while the stock has drifted higher by 17.0% from its open following the earnings release to be 19.2% below its 200 day moving average of $38.46. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, December 30, 2022 there was some notable buying of 11,042 contracts of the $31.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 6.6% move on earnings and the stock has averaged a 4.4% move in recent quarters.

Baker Hughes (BKR) is confirmed to report earnings at approximately 7:00 AM ET on Monday, January 23, 2023. The consensus earnings estimate is $0.41 per share on revenue of $6.06 billion and the Earnings Whisper ® number is $0.43 per share. Investor sentiment going into the company’s earnings release has 53% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 64.00% with revenue increasing by 9.80%. Short interest has decreased by 41.7% since the company’s last earnings release while the stock has drifted higher by 17.0% from its open following the earnings release to be 19.2% below its 200 day moving average of $38.46. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, December 30, 2022 there was some notable buying of 11,042 contracts of the $31.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 6.6% move on earnings and the stock has averaged a 4.4% move in recent quarters.

General Electric Co. $77.68

General Electric Co. (GE) is confirmed to report earnings at approximately 6:30 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $1.11 per share on revenue of $21.68 billion and the Earnings Whisper ® number is $1.14 per share. Investor sentiment going into the company’s earnings release has 45% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 54.56% with revenue increasing by 6.78%. Short interest has increased by 3.7% since the company’s last earnings release while the stock has drifted higher by 3.6% from its open following the earnings release to be 29.9% above its 200 day moving average of $59.81. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 5, 2023 there was some notable buying of 7,722 contracts of the $75.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 5.4% move on earnings and the stock has averaged a 4.7% move in recent quarters.

General Electric Co. (GE) is confirmed to report earnings at approximately 6:30 AM ET on Tuesday, January 24, 2023. The consensus earnings estimate is $1.11 per share on revenue of $21.68 billion and the Earnings Whisper ® number is $1.14 per share. Investor sentiment going into the company’s earnings release has 45% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 54.56% with revenue increasing by 6.78%. Short interest has increased by 3.7% since the company’s last earnings release while the stock has drifted higher by 3.6% from its open following the earnings release to be 29.9% above its 200 day moving average of $59.81. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 5, 2023 there was some notable buying of 7,722 contracts of the $75.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 5.4% move on earnings and the stock has averaged a 4.7% move in recent quarters.

AT&T Corp. $19.23

AT&T Corp. (T) is confirmed to report earnings at approximately 6:30 AM ET on Wednesday, January 25, 2023. The consensus earnings estimate is $0.58 per share on revenue of $31.49 billion and the Earnings Whisper ® number is $0.60 per share. Investor sentiment going into the company’s earnings release has 29% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 25.64% with revenue decreasing by 23.12%. Short interest has decreased by 5.2% since the company’s last earnings release while the stock has drifted higher by 18.6% from its open following the earnings release to be 0.5% above its 200 day moving average of $19.14. Overall earnings estimates have been revised higher since the company’s last earnings release. On Thursday, January 19, 2023 there was some notable buying of 33,238 contracts of the $19.00 put expiring on Friday, January 27, 2023. Option traders are pricing in a 4.8% move on earnings and the stock has averaged a 4.8% move in recent quarters.

AT&T Corp. (T) is confirmed to report earnings at approximately 6:30 AM ET on Wednesday, January 25, 2023. The consensus earnings estimate is $0.58 per share on revenue of $31.49 billion and the Earnings Whisper ® number is $0.60 per share. Investor sentiment going into the company’s earnings release has 29% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 25.64% with revenue decreasing by 23.12%. Short interest has decreased by 5.2% since the company’s last earnings release while the stock has drifted higher by 18.6% from its open following the earnings release to be 0.5% above its 200 day moving average of $19.14. Overall earnings estimates have been revised higher since the company’s last earnings release. On Thursday, January 19, 2023 there was some notable buying of 33,238 contracts of the $19.00 put expiring on Friday, January 27, 2023. Option traders are pricing in a 4.8% move on earnings and the stock has averaged a 4.8% move in recent quarters.