Walgreens Boots Alliance Inc $37.36

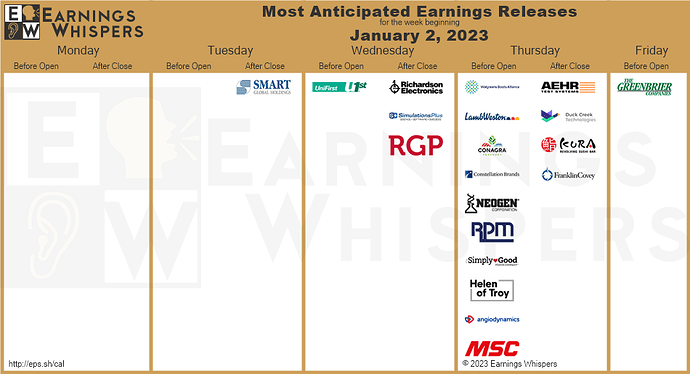

![]() Walgreens Boots Alliance Inc (WBA) is confirmed to report earnings at approximately 7:00 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $1.14 per share on revenue of $33.00 billion and the Earnings Whisper ® number is $1.16 per share. Investor sentiment going into the company’s earnings release has 64% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 32.14% with revenue decreasing by 2.66%. Short interest has increased by 20.3% since the company’s last earnings release while the stock has drifted higher by 17.1% from its open following the earnings release to be 5.4% below its 200 day moving average of $39.51. Overall earnings estimates have been revised higher since the company’s last earnings release. On Thursday, December 29, 2022 there was some notable buying of 2,495 contracts of the $47.50 call expiring on Friday, July 21, 2023. Option traders are pricing in a 5.5% move on earnings and the stock has averaged a 6.0% move in recent quarters.

Walgreens Boots Alliance Inc (WBA) is confirmed to report earnings at approximately 7:00 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $1.14 per share on revenue of $33.00 billion and the Earnings Whisper ® number is $1.16 per share. Investor sentiment going into the company’s earnings release has 64% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 32.14% with revenue decreasing by 2.66%. Short interest has increased by 20.3% since the company’s last earnings release while the stock has drifted higher by 17.1% from its open following the earnings release to be 5.4% below its 200 day moving average of $39.51. Overall earnings estimates have been revised higher since the company’s last earnings release. On Thursday, December 29, 2022 there was some notable buying of 2,495 contracts of the $47.50 call expiring on Friday, July 21, 2023. Option traders are pricing in a 5.5% move on earnings and the stock has averaged a 6.0% move in recent quarters.

Lamb Weston Holdings, Inc. $89.36

![]() Lamb Weston Holdings, Inc. (LW) is confirmed to report earnings at approximately 8:30 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.74 per share on revenue of $1.16 billion and the Earnings Whisper ® number is $0.80 per share. Investor sentiment going into the company’s earnings release has 78% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 48.00% with revenue increasing by 15.24%. Short interest has increased by 12.7% since the company’s last earnings release while the stock has drifted higher by 10.3% from its open following the earnings release to be 19.1% above its 200 day moving average of $75.05. Overall earnings estimates have been revised higher since the company’s last earnings release. On Tuesday, December 20, 2022 there was some notable buying of 1,861 contracts of the $85.00 put and 1,510 contracts of the $95.00 call expiring on Friday, January 20, 2023. Option traders are pricing in a 7.6% move on earnings and the stock has averaged a 7.1% move in recent quarters.

Lamb Weston Holdings, Inc. (LW) is confirmed to report earnings at approximately 8:30 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.74 per share on revenue of $1.16 billion and the Earnings Whisper ® number is $0.80 per share. Investor sentiment going into the company’s earnings release has 78% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 48.00% with revenue increasing by 15.24%. Short interest has increased by 12.7% since the company’s last earnings release while the stock has drifted higher by 10.3% from its open following the earnings release to be 19.1% above its 200 day moving average of $75.05. Overall earnings estimates have been revised higher since the company’s last earnings release. On Tuesday, December 20, 2022 there was some notable buying of 1,861 contracts of the $85.00 put and 1,510 contracts of the $95.00 call expiring on Friday, January 20, 2023. Option traders are pricing in a 7.6% move on earnings and the stock has averaged a 7.1% move in recent quarters.

UniFirst Corporation $192.99

UniFirst Corporation (UNF) is confirmed to report earnings at approximately 8:00 AM ET on Wednesday, January 4, 2023. The consensus earnings estimate is $1.95 per share on revenue of $524.76 million and the Earnings Whisper ® number is $1.97 per share. Investor sentiment going into the company’s earnings release has 69% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 2.50% with revenue increasing by 7.94%. Short interest has decreased by 30.3% since the company’s last earnings release while the stock has drifted higher by 7.2% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release.

UniFirst Corporation (UNF) is confirmed to report earnings at approximately 8:00 AM ET on Wednesday, January 4, 2023. The consensus earnings estimate is $1.95 per share on revenue of $524.76 million and the Earnings Whisper ® number is $1.97 per share. Investor sentiment going into the company’s earnings release has 69% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 2.50% with revenue increasing by 7.94%. Short interest has decreased by 30.3% since the company’s last earnings release while the stock has drifted higher by 7.2% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release.

Conagra Brands, Inc. $38.70

![]() Conagra Brands, Inc. (CAG) is confirmed to report earnings at approximately 7:30 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.65 per share on revenue of $3.25 billion and the Earnings Whisper ® number is $0.68 per share. Investor sentiment going into the company’s earnings release has 51% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 1.56% with revenue increasing by 6.25%. Short interest has increased by 6.2% since the company’s last earnings release while the stock has drifted higher by 14.4% from its open following the earnings release to be 11.6% above its 200 day moving average of $34.69. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, December 30, 2022 there was some notable buying of 9,009 contracts of the $38.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 5.0% move on earnings and the stock has averaged a 3.2% move in recent quarters.

Conagra Brands, Inc. (CAG) is confirmed to report earnings at approximately 7:30 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.65 per share on revenue of $3.25 billion and the Earnings Whisper ® number is $0.68 per share. Investor sentiment going into the company’s earnings release has 51% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 1.56% with revenue increasing by 6.25%. Short interest has increased by 6.2% since the company’s last earnings release while the stock has drifted higher by 14.4% from its open following the earnings release to be 11.6% above its 200 day moving average of $34.69. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, December 30, 2022 there was some notable buying of 9,009 contracts of the $38.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 5.0% move on earnings and the stock has averaged a 3.2% move in recent quarters.

Constellation Brands, Inc. $231.75

![]() Constellation Brands, Inc. (STZ) is confirmed to report earnings at approximately 7:30 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $2.89 per share on revenue of $2.40 billion and the Earnings Whisper ® number is $2.97 per share. Investor sentiment going into the company’s earnings release has 37% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 7.37% with revenue decreasing by 4.27%. Short interest has decreased by 1.8% since the company’s last earnings release while the stock has drifted lower by 0.3% from its open following the earnings release to be 3.5% below its 200 day moving average of $240.17. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, December 19, 2022 there was some notable buying of 752 contracts of the $230.00 put expiring on Friday, January 6, 2023. Option traders are pricing in a 4.3% move on earnings and the stock has averaged a 2.6% move in recent quarters.

Constellation Brands, Inc. (STZ) is confirmed to report earnings at approximately 7:30 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $2.89 per share on revenue of $2.40 billion and the Earnings Whisper ® number is $2.97 per share. Investor sentiment going into the company’s earnings release has 37% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 7.37% with revenue decreasing by 4.27%. Short interest has decreased by 1.8% since the company’s last earnings release while the stock has drifted lower by 0.3% from its open following the earnings release to be 3.5% below its 200 day moving average of $240.17. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, December 19, 2022 there was some notable buying of 752 contracts of the $230.00 put expiring on Friday, January 6, 2023. Option traders are pricing in a 4.3% move on earnings and the stock has averaged a 2.6% move in recent quarters.

Simply Good Foods Company $38.03

![]() Simply Good Foods Company (SMPL) is confirmed to report earnings at approximately 7:00 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.39 per share on revenue of $301.94 million and the Earnings Whisper ® number is $0.42 per share. Investor sentiment going into the company’s earnings release has 77% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 9.30% with revenue increasing by 7.35%. Short interest has decreased by 14.2% since the company’s last earnings release while the stock has drifted higher by 12.8% from its open following the earnings release to be 4.4% above its 200 day moving average of $36.44. Option traders are pricing in a 22.5% move on earnings and the stock has averaged a 6.9% move in recent quarters.

Simply Good Foods Company (SMPL) is confirmed to report earnings at approximately 7:00 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.39 per share on revenue of $301.94 million and the Earnings Whisper ® number is $0.42 per share. Investor sentiment going into the company’s earnings release has 77% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 9.30% with revenue increasing by 7.35%. Short interest has decreased by 14.2% since the company’s last earnings release while the stock has drifted higher by 12.8% from its open following the earnings release to be 4.4% above its 200 day moving average of $36.44. Option traders are pricing in a 22.5% move on earnings and the stock has averaged a 6.9% move in recent quarters.

RPM International Inc. $97.45

RPM International Inc. (RPM) is confirmed to report earnings at approximately 6:45 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $1.10 per share on revenue of $1.81 billion and the Earnings Whisper ® number is $1.15 per share. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 39.24% with revenue increasing by 10.40%. Short interest has decreased by 11.7% since the company’s last earnings release while the stock has drifted higher by 5.7% from its open following the earnings release to be 9.4% above its 200 day moving average of $89.08. Overall earnings estimates have been revised higher since the company’s last earnings release. Option traders are pricing in a 3.8% move on earnings and the stock has averaged a 2.1% move in recent quarters.

RPM International Inc. (RPM) is confirmed to report earnings at approximately 6:45 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $1.10 per share on revenue of $1.81 billion and the Earnings Whisper ® number is $1.15 per share. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 39.24% with revenue increasing by 10.40%. Short interest has decreased by 11.7% since the company’s last earnings release while the stock has drifted higher by 5.7% from its open following the earnings release to be 9.4% above its 200 day moving average of $89.08. Overall earnings estimates have been revised higher since the company’s last earnings release. Option traders are pricing in a 3.8% move on earnings and the stock has averaged a 2.1% move in recent quarters.

Neogen Corp. $15.23

![]() Neogen Corp. (NEOG) is confirmed to report earnings at approximately 8:45 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.03 per share on revenue of $233.79 million. Investor sentiment going into the company’s earnings release has 80% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 82.35% with revenue increasing by 79.13%. Short interest has decreased by 53.6% since the company’s last earnings release while the stock has drifted higher by 3.5% from its open following the earnings release to be 27.5% below its 200 day moving average of $21.00. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, December 27, 2022 there was some notable buying of 971 contracts of the $16.00 call expiring on Friday, January 20, 2023. Option traders are pricing in a 10.2% move on earnings and the stock has averaged a 3.2% move in recent quarters.

Neogen Corp. (NEOG) is confirmed to report earnings at approximately 8:45 AM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.03 per share on revenue of $233.79 million. Investor sentiment going into the company’s earnings release has 80% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 82.35% with revenue increasing by 79.13%. Short interest has decreased by 53.6% since the company’s last earnings release while the stock has drifted higher by 3.5% from its open following the earnings release to be 27.5% below its 200 day moving average of $21.00. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, December 27, 2022 there was some notable buying of 971 contracts of the $16.00 call expiring on Friday, January 20, 2023. Option traders are pricing in a 10.2% move on earnings and the stock has averaged a 3.2% move in recent quarters.

Aehr Test Systems $20.10

![]() Aehr Test Systems (AEHR) is confirmed to report earnings at approximately 4:05 PM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.04 per share on revenue of $12.01 million. Investor sentiment going into the company’s earnings release has 73% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 33.33% with revenue increasing by 24.96%. Short interest has increased by 99.1% since the company’s last earnings release while the stock has drifted higher by 35.7% from its open following the earnings release to be 42.1% above its 200 day moving average of $14.14. On Thursday, December 22, 2022 there was some notable buying of 2,005 contracts of the $30.00 call expiring on Friday, June 16, 2023. Option traders are pricing in a 19.7% move on earnings and the stock has averaged a 22.0% move in recent quarters.

Aehr Test Systems (AEHR) is confirmed to report earnings at approximately 4:05 PM ET on Thursday, January 5, 2023. The consensus earnings estimate is $0.04 per share on revenue of $12.01 million. Investor sentiment going into the company’s earnings release has 73% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 33.33% with revenue increasing by 24.96%. Short interest has increased by 99.1% since the company’s last earnings release while the stock has drifted higher by 35.7% from its open following the earnings release to be 42.1% above its 200 day moving average of $14.14. On Thursday, December 22, 2022 there was some notable buying of 2,005 contracts of the $30.00 call expiring on Friday, June 16, 2023. Option traders are pricing in a 19.7% move on earnings and the stock has averaged a 22.0% move in recent quarters.

SMART Global Holdings, Inc. $14.88

![]() SMART Global Holdings, Inc. (SGH) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, January 3, 2023. The consensus earnings estimate is $0.57 per share on revenue of $449.99 million and the Earnings Whisper ® number is $0.61 per share. Investor sentiment going into the company’s earnings release has 73% expecting an earnings beat The company’s guidance was for earnings of $0.45 to $0.75 per share on revenue of $425.00 million to $475.00 million. Short interest has decreased by 0.3% since the company’s last earnings release while the stock has drifted lower by 5.1% from its open following the earnings release to be 22.4% below its 200 day moving average of $19.17. On Thursday, December 29, 2022 there was some notable buying of 502 contracts of the $12.50 put expiring on Friday, June 16, 2023. Option traders are pricing in a 20.3% move on earnings and the stock has averaged a 13.4% move in recent quarters.

SMART Global Holdings, Inc. (SGH) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, January 3, 2023. The consensus earnings estimate is $0.57 per share on revenue of $449.99 million and the Earnings Whisper ® number is $0.61 per share. Investor sentiment going into the company’s earnings release has 73% expecting an earnings beat The company’s guidance was for earnings of $0.45 to $0.75 per share on revenue of $425.00 million to $475.00 million. Short interest has decreased by 0.3% since the company’s last earnings release while the stock has drifted lower by 5.1% from its open following the earnings release to be 22.4% below its 200 day moving average of $19.17. On Thursday, December 29, 2022 there was some notable buying of 502 contracts of the $12.50 put expiring on Friday, June 16, 2023. Option traders are pricing in a 20.3% move on earnings and the stock has averaged a 13.4% move in recent quarters.