Details

Amazon.com, Inc. $102.24

![]() Amazon.com, Inc. (AMZN) is confirmed to report earnings at approximately 4:00 PM ET on Thursday, February 2, 2023. The consensus earnings estimate is $0.19 per share on revenue of $145.40 billion and the Earnings Whisper ® number is $0.19 per share. Investor sentiment going into the company’s earnings release has 57% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 86.31% with revenue increasing by 5.81%. Short interest has decreased by 8.9% since the company’s last earnings release while the stock has drifted higher by 4.4% from its open following the earnings release to be 9.2% below its 200 day moving average of $112.61. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 27, 2023 there was some notable buying of 55,728 contracts of the $110.00 call expiring on Friday, February 3, 2023. Option traders are pricing in a 8.6% move on earnings and the stock has averaged a 9.1% move in recent quarters.

Amazon.com, Inc. (AMZN) is confirmed to report earnings at approximately 4:00 PM ET on Thursday, February 2, 2023. The consensus earnings estimate is $0.19 per share on revenue of $145.40 billion and the Earnings Whisper ® number is $0.19 per share. Investor sentiment going into the company’s earnings release has 57% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 86.31% with revenue increasing by 5.81%. Short interest has decreased by 8.9% since the company’s last earnings release while the stock has drifted higher by 4.4% from its open following the earnings release to be 9.2% below its 200 day moving average of $112.61. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 27, 2023 there was some notable buying of 55,728 contracts of the $110.00 call expiring on Friday, February 3, 2023. Option traders are pricing in a 8.6% move on earnings and the stock has averaged a 9.1% move in recent quarters.

Apple, Inc. $145.93

![]() Apple, Inc. (AAPL) is confirmed to report earnings at approximately 4:30 PM ET on Thursday, February 2, 2023. The consensus earnings estimate is $1.93 per share on revenue of $122.05 billion and the Earnings Whisper ® number is $1.96 per share. Investor sentiment going into the company’s earnings release has 42% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 8.10% with revenue decreasing by 1.53%. Short interest has increased by 12.2% since the company’s last earnings release while the stock has drifted lower by 1.5% from its open following the earnings release to be 1.1% below its 200 day moving average of $147.61. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 23, 2023 there was some notable buying of 41,828 contracts of the $140.00 put expiring on Friday, April 21, 2023. Option traders are pricing in a 4.8% move on earnings and the stock has averaged a 4.1% move in recent quarters.

Apple, Inc. (AAPL) is confirmed to report earnings at approximately 4:30 PM ET on Thursday, February 2, 2023. The consensus earnings estimate is $1.93 per share on revenue of $122.05 billion and the Earnings Whisper ® number is $1.96 per share. Investor sentiment going into the company’s earnings release has 42% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 8.10% with revenue decreasing by 1.53%. Short interest has increased by 12.2% since the company’s last earnings release while the stock has drifted lower by 1.5% from its open following the earnings release to be 1.1% below its 200 day moving average of $147.61. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 23, 2023 there was some notable buying of 41,828 contracts of the $140.00 put expiring on Friday, April 21, 2023. Option traders are pricing in a 4.8% move on earnings and the stock has averaged a 4.1% move in recent quarters.

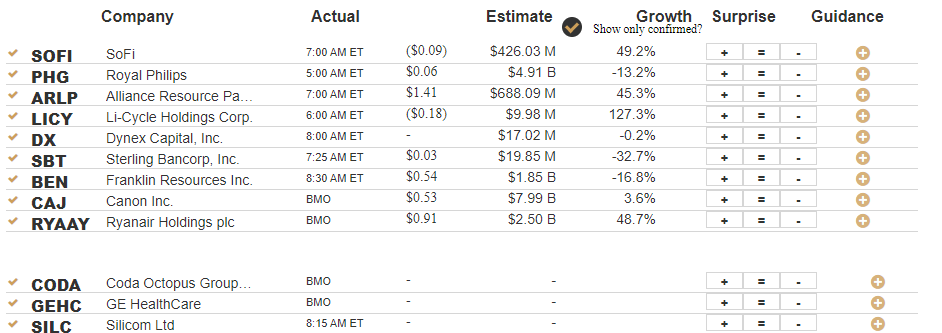

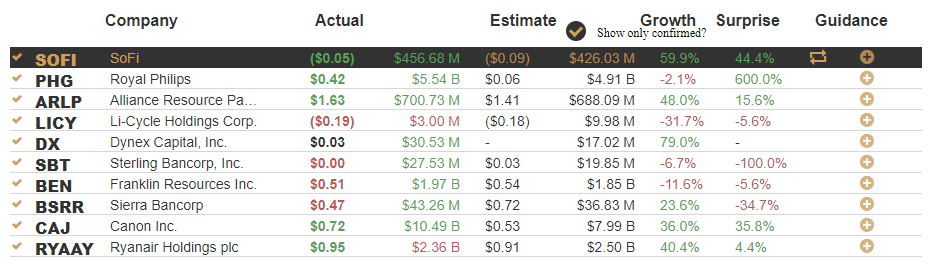

SoFi $5.94

![]() SoFi (SOFI) is confirmed to report earnings at approximately 7:00 AM ET on Monday, January 30, 2023. The consensus estimate is for a loss of $0.09 per share on revenue of $426.03 million and the Earnings Whisper ® number is ($0.08) per share. Investor sentiment going into the company’s earnings release has 64% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 40.00% with revenue increasing by 49.17%. Short interest has decreased by 7.0% since the company’s last earnings release while the stock has drifted lower by 8.0% from its open following the earnings release to be 1.8% above its 200 day moving average of $5.84. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 27, 2023 there was some notable buying of 27,087 contracts of the $6.00 call expiring on Friday, February 3, 2023. Option traders are pricing in a 15.2% move on earnings and the stock has averaged a 12.6% move in recent quarters.

SoFi (SOFI) is confirmed to report earnings at approximately 7:00 AM ET on Monday, January 30, 2023. The consensus estimate is for a loss of $0.09 per share on revenue of $426.03 million and the Earnings Whisper ® number is ($0.08) per share. Investor sentiment going into the company’s earnings release has 64% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 40.00% with revenue increasing by 49.17%. Short interest has decreased by 7.0% since the company’s last earnings release while the stock has drifted lower by 8.0% from its open following the earnings release to be 1.8% above its 200 day moving average of $5.84. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 27, 2023 there was some notable buying of 27,087 contracts of the $6.00 call expiring on Friday, February 3, 2023. Option traders are pricing in a 15.2% move on earnings and the stock has averaged a 12.6% move in recent quarters.

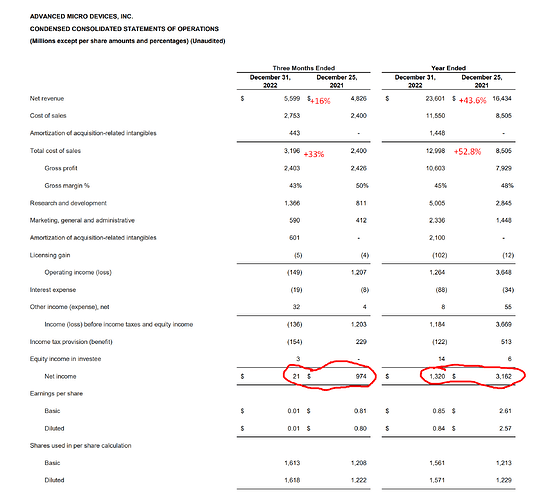

Advanced Micro Devices, Inc. $75.40

![]() Advanced Micro Devices, Inc. (AMD) is confirmed to report earnings at approximately 4:15 PM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $0.67 per share on revenue of $5.51 billion and the Earnings Whisper ® number is $0.66 per share. Investor sentiment going into the company’s earnings release has 49% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 25.56% with revenue increasing by 14.17%. Short interest has decreased by 18.0% since the company’s last earnings release while the stock has drifted higher by 19.7% from its open following the earnings release to be 5.1% below its 200 day moving average of $79.42. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 12, 2023 there was some notable buying of 34,113 contracts of the $70.00 call and 15,199 contracts of the $70.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 8.4% move on earnings and the stock has averaged a 4.2% move in recent quarters.

Advanced Micro Devices, Inc. (AMD) is confirmed to report earnings at approximately 4:15 PM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $0.67 per share on revenue of $5.51 billion and the Earnings Whisper ® number is $0.66 per share. Investor sentiment going into the company’s earnings release has 49% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 25.56% with revenue increasing by 14.17%. Short interest has decreased by 18.0% since the company’s last earnings release while the stock has drifted higher by 19.7% from its open following the earnings release to be 5.1% below its 200 day moving average of $79.42. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 12, 2023 there was some notable buying of 34,113 contracts of the $70.00 call and 15,199 contracts of the $70.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 8.4% move on earnings and the stock has averaged a 4.2% move in recent quarters.

Meta Platforms, Inc. $151.74

![]() Meta Platforms, Inc. (META) is confirmed to report earnings at approximately 4:05 PM ET on Wednesday, February 1, 2023. The consensus earnings estimate is $2.32 per share on revenue of $31.80 billion and the Earnings Whisper ® number is $2.25 per share. Investor sentiment going into the company’s earnings release has 39% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 36.78% with revenue decreasing by 5.56%. Short interest has increased by 11.8% since the company’s last earnings release while the stock has drifted higher by 54.9% from its open following the earnings release to be 0.4% below its 200 day moving average of $152.37. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 9, 2023 there was some notable buying of 13,125 contracts of the $127.00 put and 13,047 contracts of the $134.00 call expiring on Friday, February 24, 2023. Option traders are pricing in a 10.0% move on earnings and the stock has averaged a 13.6% move in recent quarters.

Meta Platforms, Inc. (META) is confirmed to report earnings at approximately 4:05 PM ET on Wednesday, February 1, 2023. The consensus earnings estimate is $2.32 per share on revenue of $31.80 billion and the Earnings Whisper ® number is $2.25 per share. Investor sentiment going into the company’s earnings release has 39% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 36.78% with revenue decreasing by 5.56%. Short interest has increased by 11.8% since the company’s last earnings release while the stock has drifted higher by 54.9% from its open following the earnings release to be 0.4% below its 200 day moving average of $152.37. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 9, 2023 there was some notable buying of 13,125 contracts of the $127.00 put and 13,047 contracts of the $134.00 call expiring on Friday, February 24, 2023. Option traders are pricing in a 10.0% move on earnings and the stock has averaged a 13.6% move in recent quarters.

Alphabet Inc. $99.37

![]() Alphabet Inc. (GOOGL) is confirmed to report earnings at approximately 4:00 PM ET on Thursday, February 2, 2023. The consensus earnings estimate is $1.17 per share on revenue of $76.60 billion and the Earnings Whisper ® number is $1.14 per share. Investor sentiment going into the company’s earnings release has 54% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 23.75% with revenue increasing by 1.69%. Short interest has decreased by 22.7% since the company’s last earnings release while the stock has drifted higher by 3.0% from its open following the earnings release to be 5.8% below its 200 day moving average of $105.45. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 23, 2023 there was some notable buying of 28,429 contracts of the $100.00 call and 26,800 contracts of the $100.00 put expiring on Friday, March 17, 2023. Option traders are pricing in a 6.0% move on earnings and the stock has averaged a 6.0% move in recent quarters.

Alphabet Inc. (GOOGL) is confirmed to report earnings at approximately 4:00 PM ET on Thursday, February 2, 2023. The consensus earnings estimate is $1.17 per share on revenue of $76.60 billion and the Earnings Whisper ® number is $1.14 per share. Investor sentiment going into the company’s earnings release has 54% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 23.75% with revenue increasing by 1.69%. Short interest has decreased by 22.7% since the company’s last earnings release while the stock has drifted higher by 3.0% from its open following the earnings release to be 5.8% below its 200 day moving average of $105.45. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 23, 2023 there was some notable buying of 28,429 contracts of the $100.00 call and 26,800 contracts of the $100.00 put expiring on Friday, March 17, 2023. Option traders are pricing in a 6.0% move on earnings and the stock has averaged a 6.0% move in recent quarters.

Exxon Mobil Corp. $115.61

Exxon Mobil Corp. (XOM) is confirmed to report earnings at approximately 6:30 AM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $3.32 per share on revenue of $99.65 billion and the Earnings Whisper ® number is $3.41 per share. Investor sentiment going into the company’s earnings release has 74% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 61.95% with revenue increasing by 17.28%. Short interest has decreased by 9.7% since the company’s last earnings release while the stock has drifted higher by 5.6% from its open following the earnings release to be 18.5% above its 200 day moving average of $97.56. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 26, 2023 there was some notable buying of 7,500 contracts of the $115.00 put expiring on Friday, February 3, 2023. Option traders are pricing in a 3.9% move on earnings and the stock has averaged a 3.1% move in recent quarters.

Exxon Mobil Corp. (XOM) is confirmed to report earnings at approximately 6:30 AM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $3.32 per share on revenue of $99.65 billion and the Earnings Whisper ® number is $3.41 per share. Investor sentiment going into the company’s earnings release has 74% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 61.95% with revenue increasing by 17.28%. Short interest has decreased by 9.7% since the company’s last earnings release while the stock has drifted higher by 5.6% from its open following the earnings release to be 18.5% above its 200 day moving average of $97.56. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 26, 2023 there was some notable buying of 7,500 contracts of the $115.00 put expiring on Friday, February 3, 2023. Option traders are pricing in a 3.9% move on earnings and the stock has averaged a 3.1% move in recent quarters.

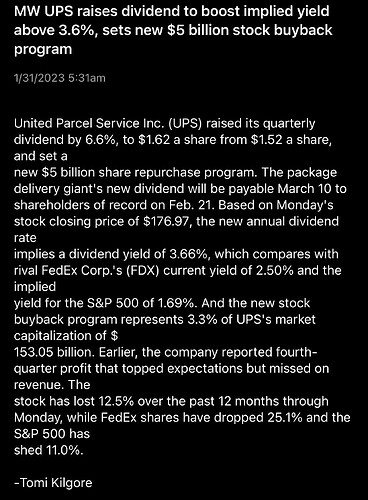

United Parcel Service, Inc. $182.09

![]() United Parcel Service, Inc. (UPS) is confirmed to report earnings at approximately 6:00 AM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $3.58 per share on revenue of $28.17 billion and the Earnings Whisper ® number is $3.66 per share. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 0.28% with revenue increasing by 1.44%. Short interest has increased by 20.9% since the company’s last earnings release while the stock has drifted higher by 5.7% from its open following the earnings release to be 1.1% above its 200 day moving average of $180.18. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 23, 2023 there was some notable buying of 5,014 contracts of the $165.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 6.5% move on earnings and the stock has averaged a 5.9% move in recent quarters.

United Parcel Service, Inc. (UPS) is confirmed to report earnings at approximately 6:00 AM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $3.58 per share on revenue of $28.17 billion and the Earnings Whisper ® number is $3.66 per share. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 0.28% with revenue increasing by 1.44%. Short interest has increased by 20.9% since the company’s last earnings release while the stock has drifted higher by 5.7% from its open following the earnings release to be 1.1% above its 200 day moving average of $180.18. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, January 23, 2023 there was some notable buying of 5,014 contracts of the $165.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 6.5% move on earnings and the stock has averaged a 5.9% move in recent quarters.

General Motors Corp. $37.95

![]() General Motors Corp. (GM) is confirmed to report earnings at approximately 6:30 AM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $1.65 per share on revenue of $40.30 billion and the Earnings Whisper ® number is $1.74 per share. Investor sentiment going into the company’s earnings release has 51% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 22.22% with revenue increasing by 20.00%. Short interest has decreased by 16.1% since the company’s last earnings release while the stock has drifted higher by 4.1% from its open following the earnings release to be 3.5% above its 200 day moving average of $36.67. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 10, 2023 there was some notable buying of 15,439 contracts of the $40.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 7.0% move on earnings and the stock has averaged a 4.0% move in recent quarters.

General Motors Corp. (GM) is confirmed to report earnings at approximately 6:30 AM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $1.65 per share on revenue of $40.30 billion and the Earnings Whisper ® number is $1.74 per share. Investor sentiment going into the company’s earnings release has 51% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 22.22% with revenue increasing by 20.00%. Short interest has decreased by 16.1% since the company’s last earnings release while the stock has drifted higher by 4.1% from its open following the earnings release to be 3.5% above its 200 day moving average of $36.67. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 10, 2023 there was some notable buying of 15,439 contracts of the $40.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 7.0% move on earnings and the stock has averaged a 4.0% move in recent quarters.

Pfizer, Inc. $43.79

![]() Pfizer, Inc. (PFE) is confirmed to report earnings at approximately 6:45 AM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $1.04 per share on revenue of $24.43 billion and the Earnings Whisper ® number is $1.05 per share. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 3.70% with revenue increasing by 2.48%. Short interest has decreased by 40.5% since the company’s last earnings release while the stock has drifted lower by 8.8% from its open following the earnings release to be 10.1% below its 200 day moving average of $48.71. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 26, 2023 there was some notable buying of 67,449 contracts of the $43.00 put expiring on Friday, February 3, 2023. Option traders are pricing in a 4.5% move on earnings and the stock has averaged a 2.9% move in recent quarters.

Pfizer, Inc. (PFE) is confirmed to report earnings at approximately 6:45 AM ET on Tuesday, January 31, 2023. The consensus earnings estimate is $1.04 per share on revenue of $24.43 billion and the Earnings Whisper ® number is $1.05 per share. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 3.70% with revenue increasing by 2.48%. Short interest has decreased by 40.5% since the company’s last earnings release while the stock has drifted lower by 8.8% from its open following the earnings release to be 10.1% below its 200 day moving average of $48.71. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, January 26, 2023 there was some notable buying of 67,449 contracts of the $43.00 put expiring on Friday, February 3, 2023. Option traders are pricing in a 4.5% move on earnings and the stock has averaged a 2.9% move in recent quarters.

Big week!

Made the descriptions hidden with a dropdown this time. Better?

I’m going to try adding a chart like Beaker use to do, this weekend.