Details

Palantir Technologies Inc. $7.51

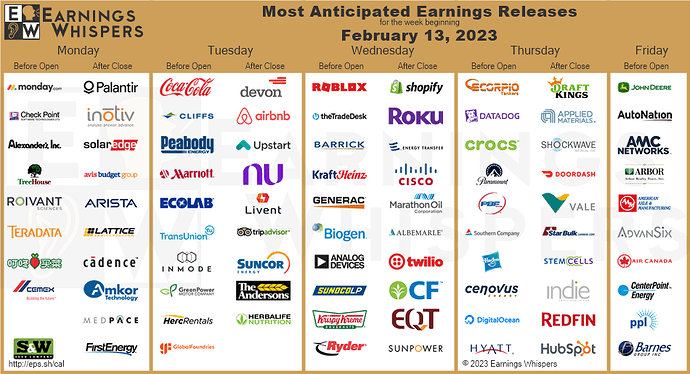

![]() Palantir Technologies Inc. (PLTR) is confirmed to report earnings after the market closes on Monday, February 13, 2023. The consensus earnings estimate is $0.03 per share on revenue of $505.95 million and the Earnings Whisper ® number is $0.03 per share. Investor sentiment going into the company’s earnings release has 46% expecting an earnings beat The company’s guidance was for revenue of $503.00 million to $505.00 million. Consensus estimates are for year-over-year earnings growth of 50.00% with revenue increasing by 16.88%. Short interest has decreased by 3.2% since the company’s last earnings release while the stock has drifted lower by 3.5% from its open following the earnings release to be 9.1% below its 200 day moving average of $8.27. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 31, 2023 there was some notable buying of 13,835 contracts of the $10.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 13.4% move on earnings and the stock has averaged a 13.9% move in recent quarters.

Palantir Technologies Inc. (PLTR) is confirmed to report earnings after the market closes on Monday, February 13, 2023. The consensus earnings estimate is $0.03 per share on revenue of $505.95 million and the Earnings Whisper ® number is $0.03 per share. Investor sentiment going into the company’s earnings release has 46% expecting an earnings beat The company’s guidance was for revenue of $503.00 million to $505.00 million. Consensus estimates are for year-over-year earnings growth of 50.00% with revenue increasing by 16.88%. Short interest has decreased by 3.2% since the company’s last earnings release while the stock has drifted lower by 3.5% from its open following the earnings release to be 9.1% below its 200 day moving average of $8.27. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 31, 2023 there was some notable buying of 13,835 contracts of the $10.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 13.4% move on earnings and the stock has averaged a 13.9% move in recent quarters.

Coca-Cola Company $59.62

![]() Coca-Cola Company (KO) is confirmed to report earnings at approximately 6:55 AM ET on Tuesday, February 14, 2023. The consensus earnings estimate is $0.45 per share on revenue of $9.92 billion and the Earnings Whisper ® number is $0.47 per share. Investor sentiment going into the company’s earnings release has 67% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 0.00% with revenue increasing by 4.82%. Short interest has decreased by 24.3% since the company’s last earnings release while the stock has drifted higher by 1.0% from its open following the earnings release to be 3.3% below its 200 day moving average of $61.64. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, February 3, 2023 there was some notable buying of 6,193 contracts of the $65.00 call expiring on Friday, January 19, 2024. Option traders are pricing in a 3.3% move on earnings and the stock has averaged a 1.5% move in recent quarters.

Coca-Cola Company (KO) is confirmed to report earnings at approximately 6:55 AM ET on Tuesday, February 14, 2023. The consensus earnings estimate is $0.45 per share on revenue of $9.92 billion and the Earnings Whisper ® number is $0.47 per share. Investor sentiment going into the company’s earnings release has 67% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 0.00% with revenue increasing by 4.82%. Short interest has decreased by 24.3% since the company’s last earnings release while the stock has drifted higher by 1.0% from its open following the earnings release to be 3.3% below its 200 day moving average of $61.64. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, February 3, 2023 there was some notable buying of 6,193 contracts of the $65.00 call expiring on Friday, January 19, 2024. Option traders are pricing in a 3.3% move on earnings and the stock has averaged a 1.5% move in recent quarters.

Shopify Inc. $48.30

![]() Shopify Inc. (SHOP) is confirmed to report earnings after the market closes on Wednesday, February 15, 2023. The consensus estimate is for a loss of $0.01 per share on revenue of $2.21 billion and the Earnings Whisper ® number is $0.00 per share. Investor sentiment going into the company’s earnings release has 73% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 106.45% with revenue increasing by 60.14%. Short interest has increased by 11.2% since the company’s last earnings release while the stock has drifted higher by 55.7% from its open following the earnings release to be 34.3% above its 200 day moving average of $35.96. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, January 4, 2023 there was some notable buying of 9,255 contracts of the $22.50 put expiring on Friday, April 21, 2023. Option traders are pricing in a 11.3% move on earnings and the stock has averaged a 11.4% move in recent quarters.

Shopify Inc. (SHOP) is confirmed to report earnings after the market closes on Wednesday, February 15, 2023. The consensus estimate is for a loss of $0.01 per share on revenue of $2.21 billion and the Earnings Whisper ® number is $0.00 per share. Investor sentiment going into the company’s earnings release has 73% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 106.45% with revenue increasing by 60.14%. Short interest has increased by 11.2% since the company’s last earnings release while the stock has drifted higher by 55.7% from its open following the earnings release to be 34.3% above its 200 day moving average of $35.96. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, January 4, 2023 there was some notable buying of 9,255 contracts of the $22.50 put expiring on Friday, April 21, 2023. Option traders are pricing in a 11.3% move on earnings and the stock has averaged a 11.4% move in recent quarters.

Cleveland-Cliffs Inc $19.94

Cleveland-Cliffs Inc (CLF) is confirmed to report earnings at approximately 7:00 AM ET on Tuesday, February 14, 2023. The consensus estimate is for a loss of $0.33 per share on revenue of $5.44 billion and the Earnings Whisper ® number is ($0.21) per share. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 118.54% with revenue increasing by 1.76%. Short interest has decreased by 22.7% since the company’s last earnings release while the stock has drifted higher by 43.4% from its open following the earnings release to be 12.2% above its 200 day moving average of $17.78. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 31, 2023 there was some notable buying of 53,010 contracts of the $5.00 put expiring on Friday, January 17, 2025. Option traders are pricing in a 8.5% move on earnings and the stock has averaged a 7.0% move in recent quarters.

Cleveland-Cliffs Inc (CLF) is confirmed to report earnings at approximately 7:00 AM ET on Tuesday, February 14, 2023. The consensus estimate is for a loss of $0.33 per share on revenue of $5.44 billion and the Earnings Whisper ® number is ($0.21) per share. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 118.54% with revenue increasing by 1.76%. Short interest has decreased by 22.7% since the company’s last earnings release while the stock has drifted higher by 43.4% from its open following the earnings release to be 12.2% above its 200 day moving average of $17.78. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 31, 2023 there was some notable buying of 53,010 contracts of the $5.00 put expiring on Friday, January 17, 2025. Option traders are pricing in a 8.5% move on earnings and the stock has averaged a 7.0% move in recent quarters.

Devon Energy Corp. $63.54

Devon Energy Corp. (DVN) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, February 14, 2023. The consensus earnings estimate is $1.77 per share on revenue of $4.57 billion and the Earnings Whisper ® number is $2.10 per share. Investor sentiment going into the company’s earnings release has 82% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 27.34% with revenue increasing by 6.95%. Short interest has decreased by 40.8% since the company’s last earnings release while the stock has drifted lower by 15.8% from its open following the earnings release to be 2.0% below its 200 day moving average of $64.87. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, February 8, 2023 there was some notable buying of 19,244 contracts of the $70.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 6.1% move on earnings and the stock has averaged a 5.5% move in recent quarters.

Devon Energy Corp. (DVN) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, February 14, 2023. The consensus earnings estimate is $1.77 per share on revenue of $4.57 billion and the Earnings Whisper ® number is $2.10 per share. Investor sentiment going into the company’s earnings release has 82% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 27.34% with revenue increasing by 6.95%. Short interest has decreased by 40.8% since the company’s last earnings release while the stock has drifted lower by 15.8% from its open following the earnings release to be 2.0% below its 200 day moving average of $64.87. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, February 8, 2023 there was some notable buying of 19,244 contracts of the $70.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 6.1% move on earnings and the stock has averaged a 5.5% move in recent quarters.

Airbnb, Inc. $108.87

![]() Airbnb, Inc. (ABNB) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, February 14, 2023. The consensus earnings estimate is $0.27 per share on revenue of $1.86 billion and the Earnings Whisper ® number is $0.31 per share. Investor sentiment going into the company’s earnings release has 53% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 237.50% with revenue increasing by 21.39%. Short interest has increased by 22.4% since the company’s last earnings release while the stock has drifted higher by 6.1% from its open following the earnings release to be 1.1% above its 200 day moving average of $107.64. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 25, 2023 there was some notable buying of 5,417 contracts of the $100.00 put and 5,136 contracts of the $100.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 9.3% move on earnings and the stock has averaged a 6.7% move in recent quarters.

Airbnb, Inc. (ABNB) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, February 14, 2023. The consensus earnings estimate is $0.27 per share on revenue of $1.86 billion and the Earnings Whisper ® number is $0.31 per share. Investor sentiment going into the company’s earnings release has 53% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 237.50% with revenue increasing by 21.39%. Short interest has increased by 22.4% since the company’s last earnings release while the stock has drifted higher by 6.1% from its open following the earnings release to be 1.1% above its 200 day moving average of $107.64. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, January 25, 2023 there was some notable buying of 5,417 contracts of the $100.00 put and 5,136 contracts of the $100.00 call expiring on Friday, February 17, 2023. Option traders are pricing in a 9.3% move on earnings and the stock has averaged a 6.7% move in recent quarters.

monday.com Ltd. $131.18

![]() monday.com Ltd. (MNDY) is confirmed to report earnings at approximately 7:00 AM ET on Monday, February 13, 2023. The consensus estimate is for a loss of $0.37 per share on revenue of $141.29 million and the Earnings Whisper ® number is ($0.21) per share. Investor sentiment going into the company’s earnings release has 63% expecting an earnings beat The company’s guidance was for revenue of $140.00 million to $142.00 million. Consensus estimates are for earnings to decline year-over-year by 54.17% with revenue increasing by 47.88%. Short interest has increased by 17.5% since the company’s last earnings release while the stock has drifted higher by 14.5% from its open following the earnings release to be 16.3% above its 200 day moving average of $112.76. Overall earnings estimates have been revised higher since the company’s last earnings release. On Thursday, February 9, 2023 there was some notable buying of 592 contracts of the $130.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 16.2% move on earnings and the stock has averaged a 17.2% move in recent quarters.

monday.com Ltd. (MNDY) is confirmed to report earnings at approximately 7:00 AM ET on Monday, February 13, 2023. The consensus estimate is for a loss of $0.37 per share on revenue of $141.29 million and the Earnings Whisper ® number is ($0.21) per share. Investor sentiment going into the company’s earnings release has 63% expecting an earnings beat The company’s guidance was for revenue of $140.00 million to $142.00 million. Consensus estimates are for earnings to decline year-over-year by 54.17% with revenue increasing by 47.88%. Short interest has increased by 17.5% since the company’s last earnings release while the stock has drifted higher by 14.5% from its open following the earnings release to be 16.3% above its 200 day moving average of $112.76. Overall earnings estimates have been revised higher since the company’s last earnings release. On Thursday, February 9, 2023 there was some notable buying of 592 contracts of the $130.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 16.2% move on earnings and the stock has averaged a 17.2% move in recent quarters.

Scorpio Tankers Inc. $57.59

![]() Scorpio Tankers Inc. (STNG) is confirmed to report earnings at approximately 7:25 AM ET on Thursday, February 16, 2023. The consensus earnings estimate is $4.38 per share on revenue of $482.17 million and the Earnings Whisper ® number is $4.41 per share. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 654.43% with revenue increasing by 225.99%. Short interest has increased by 15.7% since the company’s last earnings release while the stock has drifted higher by 17.5% from its open following the earnings release to be 35.7% above its 200 day moving average of $42.45. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, February 10, 2023 there was some notable buying of 4,401 contracts of the $65.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 8.0% move on earnings and the stock has averaged a 6.9% move in recent quarters.

Scorpio Tankers Inc. (STNG) is confirmed to report earnings at approximately 7:25 AM ET on Thursday, February 16, 2023. The consensus earnings estimate is $4.38 per share on revenue of $482.17 million and the Earnings Whisper ® number is $4.41 per share. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 654.43% with revenue increasing by 225.99%. Short interest has increased by 15.7% since the company’s last earnings release while the stock has drifted higher by 17.5% from its open following the earnings release to be 35.7% above its 200 day moving average of $42.45. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, February 10, 2023 there was some notable buying of 4,401 contracts of the $65.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 8.0% move on earnings and the stock has averaged a 6.9% move in recent quarters.

Roblox Corporation $34.82

![]() Roblox Corporation (RBLX) is confirmed to report earnings at approximately 8:00 AM ET on Wednesday, February 15, 2023. The consensus estimate is for a loss of $0.55 per share on revenue of $888.49 million and the Earnings Whisper ® number is ($0.59) per share. Investor sentiment going into the company’s earnings release has 44% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 120.00% with revenue increasing by 56.21%. Short interest has decreased by 28.4% since the company’s last earnings release while the stock has drifted lower by 1.4% from its open following the earnings release to be 5.5% below its 200 day moving average of $36.86. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 31, 2023 there was some notable buying of 8,411 contracts of the $45.00 call and 8,243 contracts of the $25.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 15.3% move on earnings and the stock has averaged a 15.9% move in recent quarters.

Roblox Corporation (RBLX) is confirmed to report earnings at approximately 8:00 AM ET on Wednesday, February 15, 2023. The consensus estimate is for a loss of $0.55 per share on revenue of $888.49 million and the Earnings Whisper ® number is ($0.59) per share. Investor sentiment going into the company’s earnings release has 44% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 120.00% with revenue increasing by 56.21%. Short interest has decreased by 28.4% since the company’s last earnings release while the stock has drifted lower by 1.4% from its open following the earnings release to be 5.5% below its 200 day moving average of $36.86. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 31, 2023 there was some notable buying of 8,411 contracts of the $45.00 call and 8,243 contracts of the $25.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 15.3% move on earnings and the stock has averaged a 15.9% move in recent quarters.

Roku Inc $54.90

![]() Roku Inc (ROKU) is confirmed to report earnings at approximately 4:05 PM ET on Wednesday, February 15, 2023. The consensus estimate is for a loss of $1.74 per share on revenue of $803.17 million and the Earnings Whisper ® number is ($1.67) per share. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat The company’s guidance was for revenue of approximately $800.00 million. Consensus estimates are for earnings to decline year-over-year by 856.52% with revenue decreasing by 7.18%. Short interest has increased by 0.8% since the company’s last earnings release while the stock has drifted higher by 22.7% from its open following the earnings release to be 21.0% below its 200 day moving average of $69.48. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 27, 2023 there was some notable buying of 3,083 contracts of the $55.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 16.1% move on earnings and the stock has averaged a 10.5% move in recent quarters.

Roku Inc (ROKU) is confirmed to report earnings at approximately 4:05 PM ET on Wednesday, February 15, 2023. The consensus estimate is for a loss of $1.74 per share on revenue of $803.17 million and the Earnings Whisper ® number is ($1.67) per share. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat The company’s guidance was for revenue of approximately $800.00 million. Consensus estimates are for earnings to decline year-over-year by 856.52% with revenue decreasing by 7.18%. Short interest has increased by 0.8% since the company’s last earnings release while the stock has drifted higher by 22.7% from its open following the earnings release to be 21.0% below its 200 day moving average of $69.48. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, January 27, 2023 there was some notable buying of 3,083 contracts of the $55.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 16.1% move on earnings and the stock has averaged a 10.5% move in recent quarters.