Details

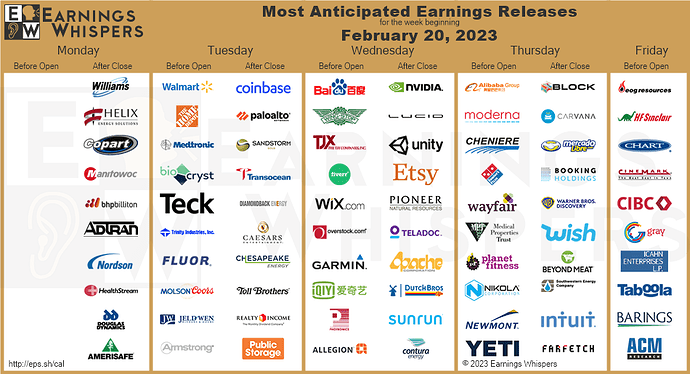

NVIDIA Corp. $213.88

![]() NVIDIA Corp. (NVDA) is confirmed to report earnings at approximately 4:20 PM ET on Wednesday, February 22, 2023. The consensus earnings estimate is $0.81 per share on revenue of $6.01 billion and the Earnings Whisper ® number is $0.85 per share. Investor sentiment going into the company’s earnings release has 51% expecting an earnings beat The company’s guidance was for earnings of $0.76 to $0.86 per share. Consensus estimates are for earnings to decline year-over-year by 40.00% with revenue decreasing by 21.37%. Short interest has increased by 26.2% since the company’s last earnings release while the stock has drifted higher by 36.1% from its open following the earnings release to be 31.7% above its 200 day moving average of $162.41. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, February 15, 2023 there was some notable buying of 18,188 contracts of the $275.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 8.2% move on earnings and the stock has averaged a 5.1% move in recent quarters.

NVIDIA Corp. (NVDA) is confirmed to report earnings at approximately 4:20 PM ET on Wednesday, February 22, 2023. The consensus earnings estimate is $0.81 per share on revenue of $6.01 billion and the Earnings Whisper ® number is $0.85 per share. Investor sentiment going into the company’s earnings release has 51% expecting an earnings beat The company’s guidance was for earnings of $0.76 to $0.86 per share. Consensus estimates are for earnings to decline year-over-year by 40.00% with revenue decreasing by 21.37%. Short interest has increased by 26.2% since the company’s last earnings release while the stock has drifted higher by 36.1% from its open following the earnings release to be 31.7% above its 200 day moving average of $162.41. Overall earnings estimates have been revised lower since the company’s last earnings release. On Wednesday, February 15, 2023 there was some notable buying of 18,188 contracts of the $275.00 call expiring on Friday, March 17, 2023. Option traders are pricing in a 8.2% move on earnings and the stock has averaged a 5.1% move in recent quarters.

Walmart Inc. $146.44

Walmart Inc. (WMT) is confirmed to report earnings at approximately 7:10 AM ET on Tuesday, February 21, 2023. The consensus earnings estimate is $1.52 per share on revenue of $159.08 billion and the Earnings Whisper ® number is $1.58 per share. Investor sentiment going into the company’s earnings release has 69% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 0.65% with revenue increasing by 4.06%. Short interest has decreased by 14.5% since the company’s last earnings release while the stock has drifted higher by 0.6% from its open following the earnings release to be 7.4% above its 200 day moving average of $136.31. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, February 17, 2023 there was some notable buying of 6,475 contracts of the $155.00 call expiring on Friday, February 24, 2023. Option traders are pricing in a 4.8% move on earnings and the stock has averaged a 4.9% move in recent quarters.

Walmart Inc. (WMT) is confirmed to report earnings at approximately 7:10 AM ET on Tuesday, February 21, 2023. The consensus earnings estimate is $1.52 per share on revenue of $159.08 billion and the Earnings Whisper ® number is $1.58 per share. Investor sentiment going into the company’s earnings release has 69% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 0.65% with revenue increasing by 4.06%. Short interest has decreased by 14.5% since the company’s last earnings release while the stock has drifted higher by 0.6% from its open following the earnings release to be 7.4% above its 200 day moving average of $136.31. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, February 17, 2023 there was some notable buying of 6,475 contracts of the $155.00 call expiring on Friday, February 24, 2023. Option traders are pricing in a 4.8% move on earnings and the stock has averaged a 4.9% move in recent quarters.

Alibaba Group Holding Ltd. $100.01

![]() Alibaba Group Holding Ltd. (BABA) is confirmed to report earnings at approximately 6:40 AM ET on Thursday, February 23, 2023. The consensus earnings estimate is $2.28 per share on revenue of $35.48 billion and the Earnings Whisper ® number is $2.56 per share. Investor sentiment going into the company’s earnings release has 62% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 19.43% with revenue decreasing by 6.79%. Short interest has decreased by 32.2% since the company’s last earnings release while the stock has drifted higher by 31.6% from its open following the earnings release to be 7.7% above its 200 day moving average of $92.83. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, February 15, 2023 there was some notable buying of 12,050 contracts of the $195.00 put expiring on Friday, June 16, 2023. Option traders are pricing in a 6.8% move on earnings and the stock has averaged a 6.3% move in recent quarters.

Alibaba Group Holding Ltd. (BABA) is confirmed to report earnings at approximately 6:40 AM ET on Thursday, February 23, 2023. The consensus earnings estimate is $2.28 per share on revenue of $35.48 billion and the Earnings Whisper ® number is $2.56 per share. Investor sentiment going into the company’s earnings release has 62% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 19.43% with revenue decreasing by 6.79%. Short interest has decreased by 32.2% since the company’s last earnings release while the stock has drifted higher by 31.6% from its open following the earnings release to be 7.7% above its 200 day moving average of $92.83. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, February 15, 2023 there was some notable buying of 12,050 contracts of the $195.00 put expiring on Friday, June 16, 2023. Option traders are pricing in a 6.8% move on earnings and the stock has averaged a 6.3% move in recent quarters.

Home Depot, Inc. $317.95

![]() Home Depot, Inc. (HD) is confirmed to report earnings at approximately 6:00 AM ET on Tuesday, February 21, 2023. The consensus earnings estimate is $3.26 per share on revenue of $35.97 billion and the Earnings Whisper ® number is $3.28 per share. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 1.56% with revenue increasing by 0.70%. Short interest has increased by 49.1% since the company’s last earnings release while the stock has drifted higher by 4.6% from its open following the earnings release to be 6.0% above its 200 day moving average of $299.87. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 31, 2023 there was some notable buying of 6,024 contracts of the $360.00 call expiring on Friday, April 21, 2023. Option traders are pricing in a 4.6% move on earnings and the stock has averaged a 4.4% move in recent quarters.

Home Depot, Inc. (HD) is confirmed to report earnings at approximately 6:00 AM ET on Tuesday, February 21, 2023. The consensus earnings estimate is $3.26 per share on revenue of $35.97 billion and the Earnings Whisper ® number is $3.28 per share. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 1.56% with revenue increasing by 0.70%. Short interest has increased by 49.1% since the company’s last earnings release while the stock has drifted higher by 4.6% from its open following the earnings release to be 6.0% above its 200 day moving average of $299.87. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, January 31, 2023 there was some notable buying of 6,024 contracts of the $360.00 call expiring on Friday, April 21, 2023. Option traders are pricing in a 4.6% move on earnings and the stock has averaged a 4.4% move in recent quarters.

Coinbase Global, Inc. $65.20

![]() Coinbase Global, Inc. (COIN) is confirmed to report earnings at approximately 4:10 PM ET on Tuesday, February 21, 2023. The consensus estimate is for a loss of $2.39 per share on revenue of $586.23 million. Investor sentiment going into the company’s earnings release has 31% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 171.99% with revenue decreasing by 76.54%. Short interest has increased by 31.7% since the company’s last earnings release while the stock has drifted higher by 7.9% from its open following the earnings release to be 6.4% above its 200 day moving average of $61.28. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, February 3, 2023 there was some notable buying of 10,687 contracts of the $75.00 put expiring on Friday, March 17, 2023. Option traders are pricing in a 19.7% move on earnings and the stock has averaged a 8.7% move in recent quarters.

Coinbase Global, Inc. (COIN) is confirmed to report earnings at approximately 4:10 PM ET on Tuesday, February 21, 2023. The consensus estimate is for a loss of $2.39 per share on revenue of $586.23 million. Investor sentiment going into the company’s earnings release has 31% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 171.99% with revenue decreasing by 76.54%. Short interest has increased by 31.7% since the company’s last earnings release while the stock has drifted higher by 7.9% from its open following the earnings release to be 6.4% above its 200 day moving average of $61.28. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, February 3, 2023 there was some notable buying of 10,687 contracts of the $75.00 put expiring on Friday, March 17, 2023. Option traders are pricing in a 19.7% move on earnings and the stock has averaged a 8.7% move in recent quarters.

Palo Alto Networks, Inc. $169.28

![]() Palo Alto Networks, Inc. (PANW) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, February 21, 2023. The consensus earnings estimate is $0.78 per share on revenue of $1.65 billion and the Earnings Whisper ® number is $0.82 per share. Investor sentiment going into the company’s earnings release has 78% expecting an earnings beat The company’s guidance was for earnings of $0.76 to $0.78 per share. Consensus estimates are for year-over-year earnings growth of 64.79% with revenue increasing by 25.29%. Short interest has decreased by 12.5% since the company’s last earnings release while the stock has drifted lower by 1.2% from its open following the earnings release to be 3.7% above its 200 day moving average of $163.30. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, February 7, 2023 there was some notable buying of 10,502 contracts of the $135.00 put expiring on Friday, January 17, 2025. Option traders are pricing in a 7.9% move on earnings and the stock has averaged a 8.3% move in recent quarters.

Palo Alto Networks, Inc. (PANW) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, February 21, 2023. The consensus earnings estimate is $0.78 per share on revenue of $1.65 billion and the Earnings Whisper ® number is $0.82 per share. Investor sentiment going into the company’s earnings release has 78% expecting an earnings beat The company’s guidance was for earnings of $0.76 to $0.78 per share. Consensus estimates are for year-over-year earnings growth of 64.79% with revenue increasing by 25.29%. Short interest has decreased by 12.5% since the company’s last earnings release while the stock has drifted lower by 1.2% from its open following the earnings release to be 3.7% above its 200 day moving average of $163.30. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, February 7, 2023 there was some notable buying of 10,502 contracts of the $135.00 put expiring on Friday, January 17, 2025. Option traders are pricing in a 7.9% move on earnings and the stock has averaged a 8.3% move in recent quarters.

Block, Inc. $75.02

![]() Block, Inc. (SQ) is confirmed to report earnings at approximately 4:05 PM ET on Thursday, February 23, 2023. The consensus earnings estimate is $0.30 per share on revenue of $4.53 billion and the Earnings Whisper ® number is $0.35 per share. Investor sentiment going into the company’s earnings release has 64% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 15.38% with revenue increasing by 11.07%. Short interest has increased by 0.8% since the company’s last earnings release while the stock has drifted higher by 24.3% from its open following the earnings release to be 7.4% above its 200 day moving average of $69.84. Overall earnings estimates have been revised higher since the company’s last earnings release. On Thursday, February 9, 2023 there was some notable buying of 9,940 contracts of the $84.00 call expiring on Friday, February 24, 2023. Option traders are pricing in a 11.1% move on earnings and the stock has averaged a 9.1% move in recent quarters.

Block, Inc. (SQ) is confirmed to report earnings at approximately 4:05 PM ET on Thursday, February 23, 2023. The consensus earnings estimate is $0.30 per share on revenue of $4.53 billion and the Earnings Whisper ® number is $0.35 per share. Investor sentiment going into the company’s earnings release has 64% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 15.38% with revenue increasing by 11.07%. Short interest has increased by 0.8% since the company’s last earnings release while the stock has drifted higher by 24.3% from its open following the earnings release to be 7.4% above its 200 day moving average of $69.84. Overall earnings estimates have been revised higher since the company’s last earnings release. On Thursday, February 9, 2023 there was some notable buying of 9,940 contracts of the $84.00 call expiring on Friday, February 24, 2023. Option traders are pricing in a 11.1% move on earnings and the stock has averaged a 9.1% move in recent quarters.

Moderna, Inc., $166.60

![]() Moderna, Inc., (MRNA) is confirmed to report earnings before the market opens on Thursday, February 23, 2023. The consensus earnings estimate is $4.66 per share on revenue of $5.09 billion and the Earnings Whisper ® number is $4.55 per share. Investor sentiment going into the company’s earnings release has 32% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 58.72% with revenue decreasing by 29.41%. Short interest has decreased by 12.6% since the company’s last earnings release while the stock has drifted higher by 20.1% from its open following the earnings release to be 6.4% above its 200 day moving average of $156.54. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, February 13, 2023 there was some notable buying of 4,012 contracts of the $240.00 call expiring on Friday, July 21, 2023. Option traders are pricing in a 8.0% move on earnings and the stock has averaged a 9.4% move in recent quarters.

Moderna, Inc., (MRNA) is confirmed to report earnings before the market opens on Thursday, February 23, 2023. The consensus earnings estimate is $4.66 per share on revenue of $5.09 billion and the Earnings Whisper ® number is $4.55 per share. Investor sentiment going into the company’s earnings release has 32% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 58.72% with revenue decreasing by 29.41%. Short interest has decreased by 12.6% since the company’s last earnings release while the stock has drifted higher by 20.1% from its open following the earnings release to be 6.4% above its 200 day moving average of $156.54. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, February 13, 2023 there was some notable buying of 4,012 contracts of the $240.00 call expiring on Friday, July 21, 2023. Option traders are pricing in a 8.0% move on earnings and the stock has averaged a 9.4% move in recent quarters.

Medtronic, Inc. $84.80

Medtronic, Inc. (MDT) is confirmed to report earnings at approximately 6:45 AM ET on Tuesday, February 21, 2023. The consensus earnings estimate is $1.26 per share on revenue of $7.50 billion and the Earnings Whisper ® number is $1.29 per share. Investor sentiment going into the company’s earnings release has 24% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 8.03% with revenue decreasing by 3.39%. Short interest has increased by 19.7% since the company’s last earnings release while the stock has drifted higher by 8.7% from its open following the earnings release to be 2.4% below its 200 day moving average of $86.92. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, February 9, 2023 there was some notable buying of 4,060 contracts of the $82.00 put expiring on Friday, February 24, 2023. Option traders are pricing in a 4.4% move on earnings and the stock has averaged a 3.9% move in recent quarters.

Medtronic, Inc. (MDT) is confirmed to report earnings at approximately 6:45 AM ET on Tuesday, February 21, 2023. The consensus earnings estimate is $1.26 per share on revenue of $7.50 billion and the Earnings Whisper ® number is $1.29 per share. Investor sentiment going into the company’s earnings release has 24% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 8.03% with revenue decreasing by 3.39%. Short interest has increased by 19.7% since the company’s last earnings release while the stock has drifted higher by 8.7% from its open following the earnings release to be 2.4% below its 200 day moving average of $86.92. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, February 9, 2023 there was some notable buying of 4,060 contracts of the $82.00 put expiring on Friday, February 24, 2023. Option traders are pricing in a 4.4% move on earnings and the stock has averaged a 3.9% move in recent quarters.

Lucid Group $10.93

![]() Lucid Group (LCID) is confirmed to report earnings at approximately 4:05 PM ET on Wednesday, February 22, 2023. The consensus estimate is for a loss of $0.39 per share on revenue of $302.61 million and the Earnings Whisper ® number is ($0.42) per share. Investor sentiment going into the company’s earnings release has 49% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 5.41% with revenue increasing by 1,046.60%. Short interest has increased by 9.5% since the company’s last earnings release while the stock has drifted lower by 12.5% from its open following the earnings release to be 22.8% below its 200 day moving average of $14.15. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, February 16, 2023 there was some notable buying of 16,029 contracts of the $12.00 call expiring on Friday, February 24, 2023. Option traders are pricing in a 17.4% move on earnings and the stock has averaged a 13.6% move in recent quarters.

Lucid Group (LCID) is confirmed to report earnings at approximately 4:05 PM ET on Wednesday, February 22, 2023. The consensus estimate is for a loss of $0.39 per share on revenue of $302.61 million and the Earnings Whisper ® number is ($0.42) per share. Investor sentiment going into the company’s earnings release has 49% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 5.41% with revenue increasing by 1,046.60%. Short interest has increased by 9.5% since the company’s last earnings release while the stock has drifted lower by 12.5% from its open following the earnings release to be 22.8% below its 200 day moving average of $14.15. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, February 16, 2023 there was some notable buying of 16,029 contracts of the $12.00 call expiring on Friday, February 24, 2023. Option traders are pricing in a 17.4% move on earnings and the stock has averaged a 13.6% move in recent quarters.