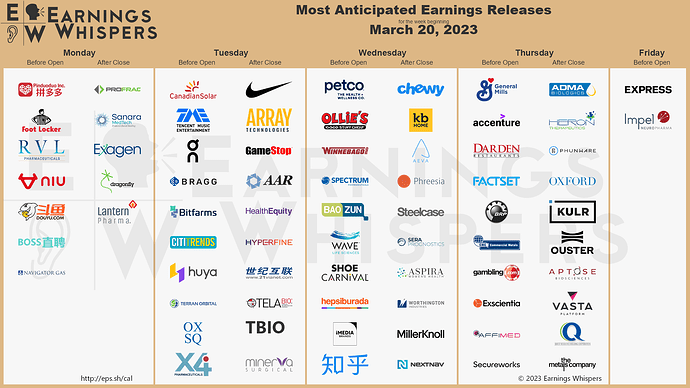

Details

Pinduoduo is Expected to Beat Estimates

Pinduoduo (PDD) is confirmed to report earnings on Monday, March 20, 2023 at approximately 6:30 AM ET. The consensus earnings estimate is $1.20 per share on revenue of $5.88 billion, respresenting 37.6% year-over-year revenue growth, and the Earnings Whisper ® number is $1.38 per share. Investors are bullish going into the company’s earnings release with 70.9% expecting a beat. Short interest has increased by 0.4% since the company’s last earnings release while the stock has drifted higher by 22.9% from its open following the earnings release to be 29.8% above its 200 day moving average of $70.81. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 11.2% move on earnings and the stock has averaged a 14.5% move in recent quarters.

Nike is Expected to Beat Estimates

Nike (NKE) is confirmed to report earnings on Tuesday, March 21, 2023 at approximately 4:15 PM ET. The consensus earnings estimate is $0.51 per share on revenue of $11.45 billion, respresenting 5.3% year-over-year revenue growth, and the Earnings Whisper ® number is $0.60 per share. Investors are bearish going into the company’s earnings release but with 79.4% expecting a beat. Short interest has decreased by 27.5% since the company’s last earnings release while the stock has drifted higher by 3.1% from its open following the earnings release to be 9.8% above its 200 day moving average of $109.69. Overall earnings estimates are unchanged since the company’s last earnings release. Option Traders are pricing in a 8.9% move on earnings and the stock has averaged a 7.8% move in recent quarters.

Foot Locker is Expected to Beat Estimates

Foot Locker (FL) is confirmed to report earnings on Monday, March 20, 2023 at approximately 6:45 AM ET. The consensus earnings estimate is $0.52 per share on revenue of $2.14 billion, a decline of 8.6% year-over-year, and the Earnings Whisper ® number is $0.57 per share. The company’s guidance was for earnings of $0.45 to $0.53 per share on revenue of $2.11 billion to $2.15 billion. Investors are bearish going into the company’s earnings release but with 26.1% expecting a beat. The stock has drifted higher by 10.5% from its open following the earnings release to be 20.3% above its 200 day moving average of $35.13. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 11.2% move on earnings and the stock has averaged a 13.7% move in recent quarters.

Array Technologies is Expected to Report In-line with Estimates

Array Technologies (ARRY) is confirmed to report earnings on Tuesday, March 21, 2023 at approximately 4:00 PM ET. The consensus earnings estimate is $0.08 per share on revenue of $366.77 million, respresenting 66.8% year-over-year revenue growth, and the Earnings Whisper ® number is $0.08 per share. Investors are bullish going into the company’s earnings release with 85.1% expecting a beat. Short interest has decreased by 13.1% since the company’s last earnings release while the stock has drifted lower by 16.7% from its open following the earnings release to be 5.8% below its 200 day moving average of $18.12. Overall earnings estimates have been revsied lower since the company’s last earnings release. Option Traders are pricing in a 22.0% move on earnings and the stock has averaged a 14.8% move in recent quarters.

GameStop is Expected to Miss Estimates

GameStop (GME) is confirmed to report earnings on Tuesday, March 21, 2023 at approximately 4:05 PM ET. The consensus estimate is a loss of $0.16 per share on revenue of $2.18 billion, a decline of 3.3% year-over-year, and the Earnings Whisper ® number is a loss of $0.20 per share. Investors are bullish going into the company’s earnings release with 58.6% expecting a beat. Short interest has increased by 4.0% since the company’s last earnings release while the stock has drifted lower by 24.5% from its open following the earnings release to be 37.5% below its 200 day moving average of $26.57. Overall earnings estimates are unchanged since the company’s last earnings release. Option Traders are pricing in a 16.6% move on earnings and the stock has averaged a 7.2% move in recent quarters.

Canadian Solar is Expected to Beat Estimates

Canadian Solar (CSIQ) is confirmed to report earnings on Tuesday, March 21, 2023 at approximately 5:45 AM ET. The consensus earnings estimate is $0.76 per share on revenue of $1.93 billion, respresenting 26.2% year-over-year revenue growth, and the Earnings Whisper ® number is $0.84 per share. The company’s guidance was for revenue of $1.80 billion to $1.90 billion. Investors are bearish going into the company’s earnings release but with 75.6% expecting a beat. Short interest has increased by 6.4% since the company’s last earnings release while the stock has drifted lower by 6.1% from its open following the earnings release to be 3.7% below its 200 day moving average of $36.39. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 11.0% move on earnings and the stock has averaged a 5.0% move in recent quarters.

Tencent Music Entertainment Group is Expected to Beat Estimates

Tencent Music Entertainment Group (TME) is confirmed to report earnings on Tuesday, March 21, 2023 at approximately 4:00 AM ET. The consensus earnings estimate is $0.12 per share on revenue of $1.05 billion, a decline of 12.1% year-over-year, and the Earnings Whisper ® number is $0.14 per share. Investors are bullish going into the company’s earnings release with 74.6% expecting a beat. Short interest has decreased by 21.6% since the company’s last earnings release while the stock has drifted higher by 63.5% from its open following the earnings release to be 29.2% above its 200 day moving average of $6.08. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 11.0% move on earnings and the stock has averaged a 8.9% move in recent quarters.

Chewy is Expected to Beat Estimates

Chewy (CHWY) is confirmed to report earnings on Wednesday, March 22, 2023 at approximately 4:05 PM ET. The consensus estimate is a loss of $0.12 per share on revenue of $2.64 billion, respresenting 10.5% year-over-year revenue growth, and the Earnings Whisper ® number is a loss of $0.08 per share. The company’s guidance was for revenue of $2.63 billion to $2.65 billion. Investors are bullish going into the company’s earnings release with 73.1% expecting a beat. Short interest has decreased by 1.9% since the company’s last earnings release while the stock has drifted lower by 4.2% from its open following the earnings release to be 1.1% below its 200 day moving average of $39.05. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 12.0% move on earnings and the stock has averaged a 11.6% move in recent quarters.

RVL Pharmaceuticals plc is Scheduled to Report on Monday, March 20, 2023

before the market opens. The consensus estimate is a loss of $0.15 per share on revenue of $12.60 million, respresenting 340.6% year-over-year revenue growth. The company’s guidance was for revenue of $12.00 million to $14.00 million. Investors are bearish going into the company’s earnings release but with 66.0% expecting a beat. Short interest has decreased by 58.7% since the company’s last earnings release while the stock has drifted lower by 6.4% from its open following the earnings release. Overall earnings estimates have been revsied higher since the company’s last earnings release.

Niu Technologies is Scheduled to Report on Monday, March 20, 2023

Niu Technologies (NIU) is confirmed to report earnings on Monday, March 20, 2023 at approximately 2:30 AM ET. The company’s guidance was for revenue of $110.10 million to $137.59 million. Investors are bearish going into the company’s earnings release but with 36.5% expecting a beat. Short interest has increased by 8.6% since the company’s last earnings release while the stock has drifted higher by 19.5% from its open following the earnings release to be 24.1% below its 200 day moving average of $5.24. Overall earnings estimates have been revsied lower since the company’s last earnings release. and the stock has averaged a 11.8% move in recent quarters.

Heron Therapeutics is Scheduled to Report on Thursday, March 23, 2023

Heron Therapeutics (HRTX) is confirmed to report earnings on Thursday, March 23, 2023 at approximately 4:05 PM ET. The consensus estimate is a loss of $0.25 per share on revenue of $26.90 million, respresenting 30.2% year-over-year revenue growth. Investors are bullish going into the company’s earnings release with 61.5% expecting a beat. Short interest has decreased by 20.3% since the company’s last earnings release while the stock has drifted lower by 29.7% from its open following the earnings release to be 28.6% below its 200 day moving average of $3.25. Overall earnings estimates have been revsied lower since the company’s last earnings release. Option Traders are pricing in a 24.8% move on earnings and the stock has averaged a 10.4% move in recent quarters.