Details

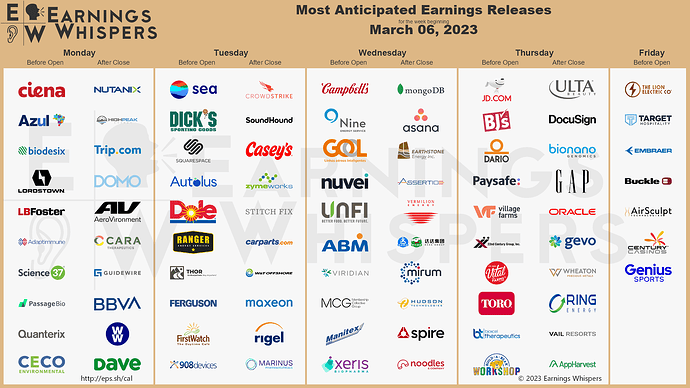

CrowdStrike is Expected to Beat Estimates

CrowdStrike (CRWD) is confirmed to report earnings on Tuesday, March 7, 2023 at approximately 4:05 PM ET. The consensus earnings estimate is $0.43 per share on revenue of $625.00 million, respresenting 45.0% year-over-year revenue growth, and the Earnings Whisper ® number is $0.45 per share. The company’s guidance was for earnings of $0.42 to $0.45 per share on revenue of $619.10 million to $628.20 million. Investors are bullish going into the company’s earnings release with 77.0% expecting a beat. Short interest has decreased by 16.0% since the company’s last earnings release while the stock has drifted higher by 12.2% from its open following the earnings release to be 15.4% below its 200 day moving average of $149.05. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 11.4% move on earnings and the stock has averaged a 7.9% move in recent quarters.

Sea Limited is Expected to Beat Estimates

Sea Limited (SE) is confirmed to report earnings on Tuesday, March 7, 2023 at approximately 6:30 AM ET. The consensus estimate is a loss of $0.78 per share on revenue of $3.12 billion, respresenting 99.2% year-over-year revenue growth, and the Earnings Whisper ® number is a loss of $0.68 per share. Investors are bearish going into the company’s earnings release but with 69.2% expecting a beat. Short interest has decreased by 11.4% since the company’s last earnings release while the stock has drifted higher by 17.9% from its open following the earnings release to be 1.5% above its 200 day moving average of $64.67. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 13.8% move on earnings and the stock has averaged a 14.5% move in recent quarters.

Ciena is Expected to Beat Estimates

Ciena (CIEN) is confirmed to report earnings on Monday, March 6, 2023 at approximately 7:00 AM ET. The consensus earnings estimate is $0.36 per share on revenue of $959.40 million, respresenting 13.6% year-over-year revenue growth, and the Earnings Whisper ® number is $0.39 per share. The company’s guidance was for revenue of $910.00 million to $990.00 million. Investors are bullish going into the company’s earnings release with 61.6% expecting a beat. Short interest has decreased by 7.6% since the company’s last earnings release while the stock has drifted lower by 2.8% from its open following the earnings release to be 3.9% above its 200 day moving average of $47.23. Overall earnings estimates have been revsied lower since the company’s last earnings release. Option Traders are pricing in a 12.7% move on earnings and the stock has averaged a 10.2% move in recent quarters.

DICK’S Sporting Goods is Expected to Beat Estimates

DICK’S Sporting Goods (DKS) is confirmed to report earnings on Tuesday, March 7, 2023 at approximately 7:30 AM ET. The consensus earnings estimate is $2.86 per share on revenue of $3.44 billion, respresenting 2.6% year-over-year revenue growth, and the Earnings Whisper ® number is $2.94 per share. Investors are bullish going into the company’s earnings release with 58.4% expecting a beat. Short interest has decreased by 28.7% since the company’s last earnings release while the stock has drifted higher by 22.8% from its open following the earnings release to be 23.7% above its 200 day moving average of $106.79. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 9.4% move on earnings and the stock has averaged a 6.7% move in recent quarters.

JD.com is Expected to Beat Estimates

JD.com (JD) is confirmed to report earnings on Thursday, March 9, 2023 at approximately 5:15 AM ET. The consensus earnings estimate is $0.51 per share on revenue of $43.05 billion, a decline of 0.6% year-over-year, and the Earnings Whisper ® number is $0.55 per share. Investors are bullish going into the company’s earnings release with 66.7% expecting a beat. Short interest has decreased by 34.2% since the company’s last earnings release while the stock has drifted lower by 19.1% from its open following the earnings release to be 14.9% below its 200 day moving average of $55.77. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 7.1% move on earnings and the stock has averaged a 5.9% move in recent quarters.

Azul S.A. is Scheduled to Report on Monday, March 6, 2023

Azul S.A. (AZUL) is confirmed to report earnings on Monday, March 6, 2023 at approximately 0:00 AM ET. The consensus estimate is a loss of $0.26 per share on revenue of $895.55 million, respresenting 34.0% year-over-year revenue growth. Investors are bearish going into the company’s earnings release but with 63.2% expecting a beat. Short interest has increased by 41.0% since the company’s last earnings release while the stock has drifted lower by 47.6% from its open following the earnings release to be 49.5% below its 200 day moving average of $8.23. Overall earnings estimates have been revsied higher since the company’s last earnings release. and the stock has averaged a 8.5% move in recent quarters.

Biodesix is Expected to Beat Estimates

Biodesix (BDSX) is confirmed to report earnings on Monday, March 6, 2023 at approximately 6:00 AM ET. The consensus estimate is a loss of $0.26 per share on revenue of $10.77 million, respresenting 49.1% year-over-year revenue growth, and the Earnings Whisper ® number is a loss of $0.25 per share. Investors are bullish going into the company’s earnings release with 51.9% expecting a beat. Short interest has increased by 17.1% since the company’s last earnings release while the stock has drifted higher by 94.2% from its open following the earnings release to be 11.5% above its 200 day moving average of $1.79. Overall earnings estimates have been revsied higher since the company’s last earnings release. The stock has averaged a 9.1% move in recent quarters.

ULTA Beauty is Expected to Beat Estimates

ULTA Beauty (ULTA) is confirmed to report earnings on Thursday, March 9, 2023 at approximately 4:05 PM ET. The consensus earnings estimate is $5.53 per share on revenue of $3.01 billion, respresenting 10.3% year-over-year revenue growth, and the Earnings Whisper ® number is $5.87 per share. Investors are bullish going into the company’s earnings release with 65.8% expecting a beat. Short interest has decreased by 16.1% since the company’s last earnings release while the stock has drifted higher by 11.8% from its open following the earnings release to be 21.2% above its 200 day moving average of $430.62. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 7.0% move on earnings and the stock has averaged a 3.2% move in recent quarters.

DocuSign is Expected to Beat Estimates

DocuSign (DOCU) is confirmed to report earnings on Thursday, March 9, 2023 at approximately 4:05 PM ET. The consensus earnings estimate is $0.52 per share on revenue of $632.78 million, respresenting 8.9% year-over-year revenue growth, and the Earnings Whisper ® number is $0.57 per share. The company’s guidance was for revenue of $637.00 million to $641.00 million. Investors are bearish going into the company’s earnings release but with 62.2% expecting a beat. Short interest has decreased by 13.4% since the company’s last earnings release while the stock has drifted higher by 36.9% from its open following the earnings release to be 10.0% above its 200 day moving average of $59.18. Overall earnings estimates have been revsied higher since the company’s last earnings release. Option Traders are pricing in a 13.3% move on earnings and the stock has averaged a 19.2% move in recent quarters.

Lordstown Motors is Scheduled to Report on Monday, March 6, 2023

Lordstown Motors (RIDE) is confirmed to report earnings on Monday, March 6, 2023 at approximately 6:00 AM ET. The consensus estimate is a loss of $0.26 per share on revenue of $1.29 million. Investors are bearish going into the company’s earnings release but with 30.9% expecting a beat. Short interest has decreased by 7.8% since the company’s last earnings release while the stock has drifted lower by 50.8% from its open following the earnings release to be 47.3% below its 200 day moving average of $2.12. Overall earnings estimates have been revsied lower since the company’s last earnings release. and the stock has averaged a 9.0% move in recent quarters.

Bakkt Holdings is Scheduled to Report on Thursday, March 9, 2023

after the market closes. The consensus estimate is a loss of $0.21 per share on revenue of $15.88 million. Investors are bullish going into the company’s earnings release with 50.0% expecting a beat. Short interest has increased by 4.5% since the company’s last earnings release while the stock has drifted lower by 23.8% from its open following the earnings release to be 44.4% below its 200 day moving average of $2.48. Overall earnings estimates have been revsied lower since the company’s last earnings release. Option Traders are pricing in a 28.6% move on earnings and the stock has averaged a 14.3% move in recent quarters.