Oracle Corp. $79.86

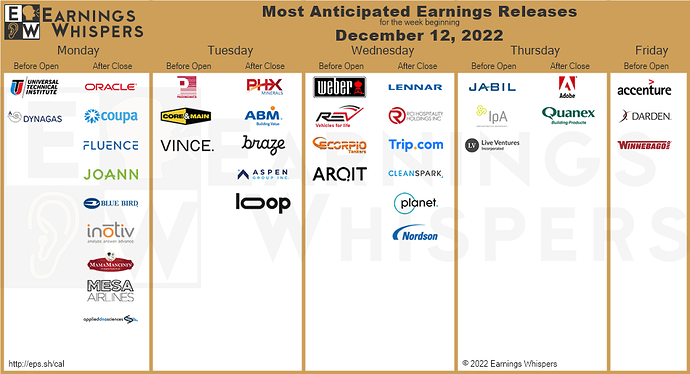

Oracle Corp. (ORCL) is confirmed to report earnings at approximately 4:05 PM ET on Monday, December 12, 2022. The consensus earnings estimate is $1.18 per share on revenue of $12.04 billion and the Earnings Whisper ® number is $1.24 per share. Investor sentiment going into the company’s earnings release has 49% expecting an earnings beat The company’s guidance was for earnings of $1.23 to $1.27 per share. Consensus estimates are for earnings to decline year-over-year by 11.28% with revenue increasing by 16.22%. Short interest has increased by 25.2% since the company’s last earnings release while the stock has drifted higher by 5.0% from its open following the earnings release to be 7.9% above its 200 day moving average of $74.00. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, December 5, 2022 there was some notable buying of 4,881 contracts of the $85.00 call expiring on Friday, December 16, 2022. Option traders are pricing in a 8.2% move on earnings and the stock has averaged a 6.2% move in recent quarters.

Oracle Corp. (ORCL) is confirmed to report earnings at approximately 4:05 PM ET on Monday, December 12, 2022. The consensus earnings estimate is $1.18 per share on revenue of $12.04 billion and the Earnings Whisper ® number is $1.24 per share. Investor sentiment going into the company’s earnings release has 49% expecting an earnings beat The company’s guidance was for earnings of $1.23 to $1.27 per share. Consensus estimates are for earnings to decline year-over-year by 11.28% with revenue increasing by 16.22%. Short interest has increased by 25.2% since the company’s last earnings release while the stock has drifted higher by 5.0% from its open following the earnings release to be 7.9% above its 200 day moving average of $74.00. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, December 5, 2022 there was some notable buying of 4,881 contracts of the $85.00 call expiring on Friday, December 16, 2022. Option traders are pricing in a 8.2% move on earnings and the stock has averaged a 6.2% move in recent quarters.

Adobe Inc. $330.64

![]() Adobe Inc. (ADBE) is confirmed to report earnings at approximately 4:05 PM ET on Thursday, December 15, 2022. The consensus earnings estimate is $3.50 per share on revenue of $4.53 billion and the Earnings Whisper ® number is $3.53 per share. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat The company’s guidance was for earnings of approximately $3.50 per share. Consensus estimates are for year-over-year earnings growth of 7.03% with revenue increasing by 10.22%. Short interest has decreased by 7.6% since the company’s last earnings release while the stock has drifted higher by 2.3% from its open following the earnings release to be 12.6% below its 200 day moving average of $378.42. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, November 28, 2022 there was some notable buying of 1,935 contracts of the $360.00 call expiring on Friday, December 16, 2022. Option traders are pricing in a 8.8% move on earnings and the stock has averaged a 7.2% move in recent quarters.

Adobe Inc. (ADBE) is confirmed to report earnings at approximately 4:05 PM ET on Thursday, December 15, 2022. The consensus earnings estimate is $3.50 per share on revenue of $4.53 billion and the Earnings Whisper ® number is $3.53 per share. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat The company’s guidance was for earnings of approximately $3.50 per share. Consensus estimates are for year-over-year earnings growth of 7.03% with revenue increasing by 10.22%. Short interest has decreased by 7.6% since the company’s last earnings release while the stock has drifted higher by 2.3% from its open following the earnings release to be 12.6% below its 200 day moving average of $378.42. Overall earnings estimates have been revised lower since the company’s last earnings release. On Monday, November 28, 2022 there was some notable buying of 1,935 contracts of the $360.00 call expiring on Friday, December 16, 2022. Option traders are pricing in a 8.8% move on earnings and the stock has averaged a 7.2% move in recent quarters.

Coupa Software $62.09

![]() Coupa Software (COUP) is confirmed to report earnings at approximately 4:00 PM ET on Monday, December 12, 2022. The consensus earnings estimate is $0.10 per share on revenue of $213.33 million and the Earnings Whisper ® number is $0.13 per share. Investor sentiment going into the company’s earnings release has 59% expecting an earnings beat The company’s guidance was for earnings of $0.08 to $0.10 per share on revenue of $211.00 million to $214.00 million. Consensus estimates are for earnings to decline year-over-year by 71.43% with revenue increasing by 14.81%. Short interest has increased by 45.0% since the company’s last earnings release while the stock has drifted lower by 1.3% from its open following the earnings release to be 12.5% below its 200 day moving average of $70.94. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, December 7, 2022 there was some notable buying of 9,216 contracts of the $150.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 15.4% move on earnings and the stock has averaged a 9.2% move in recent quarters.

Coupa Software (COUP) is confirmed to report earnings at approximately 4:00 PM ET on Monday, December 12, 2022. The consensus earnings estimate is $0.10 per share on revenue of $213.33 million and the Earnings Whisper ® number is $0.13 per share. Investor sentiment going into the company’s earnings release has 59% expecting an earnings beat The company’s guidance was for earnings of $0.08 to $0.10 per share on revenue of $211.00 million to $214.00 million. Consensus estimates are for earnings to decline year-over-year by 71.43% with revenue increasing by 14.81%. Short interest has increased by 45.0% since the company’s last earnings release while the stock has drifted lower by 1.3% from its open following the earnings release to be 12.5% below its 200 day moving average of $70.94. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, December 7, 2022 there was some notable buying of 9,216 contracts of the $150.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 15.4% move on earnings and the stock has averaged a 9.2% move in recent quarters.

Universal Technical Institute Inc $7.15

![]() Universal Technical Institute Inc (UTI) is confirmed to report earnings at approximately 6:55 AM ET on Monday, December 12, 2022. The consenus estimate is for breakeven results on revenue of $111.47 million. Investor sentiment going into the company’s earnings release has 54% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 100.00% with revenue increasing by 14.35%. Short interest has decreased by 21.7% since the company’s last earnings release while the stock has drifted lower by 9.8% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release.

Universal Technical Institute Inc (UTI) is confirmed to report earnings at approximately 6:55 AM ET on Monday, December 12, 2022. The consenus estimate is for breakeven results on revenue of $111.47 million. Investor sentiment going into the company’s earnings release has 54% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 100.00% with revenue increasing by 14.35%. Short interest has decreased by 21.7% since the company’s last earnings release while the stock has drifted lower by 9.8% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release.

Accenture Ltd. $288.41

![]() Accenture Ltd. (ACN) is confirmed to report earnings at approximately 6:45 AM ET on Friday, December 16, 2022. The consensus earnings estimate is $2.91 per share on revenue of $15.58 billion and the Earnings Whisper ® number is $2.95 per share. Investor sentiment going into the company’s earnings release has 51% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 4.68% with revenue increasing by 4.11%. Short interest has increased by 16.7% since the company’s last earnings release while the stock has drifted higher by 9.2% from its open following the earnings release to be 1.4% below its 200 day moving average of $292.37. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, November 25, 2022 there was some notable buying of 1,076 contracts of the $190.00 put expiring on Friday, December 16, 2022. Option traders are pricing in a 5.6% move on earnings and the stock has averaged a 2.4% move in recent quarters.

Accenture Ltd. (ACN) is confirmed to report earnings at approximately 6:45 AM ET on Friday, December 16, 2022. The consensus earnings estimate is $2.91 per share on revenue of $15.58 billion and the Earnings Whisper ® number is $2.95 per share. Investor sentiment going into the company’s earnings release has 51% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 4.68% with revenue increasing by 4.11%. Short interest has increased by 16.7% since the company’s last earnings release while the stock has drifted higher by 9.2% from its open following the earnings release to be 1.4% below its 200 day moving average of $292.37. Overall earnings estimates have been revised lower since the company’s last earnings release. On Friday, November 25, 2022 there was some notable buying of 1,076 contracts of the $190.00 put expiring on Friday, December 16, 2022. Option traders are pricing in a 5.6% move on earnings and the stock has averaged a 2.4% move in recent quarters.

Jabil Inc. $71.47

Jabil Inc. (JBL) is confirmed to report earnings at approximately 8:00 AM ET on Thursday, December 15, 2022. The consensus earnings estimate is $2.24 per share on revenue of $9.33 billion and the Earnings Whisper ® number is $2.31 per share. Investor sentiment going into the company’s earnings release has 63% expecting an earnings beat The company’s guidance was for earnings of $2.00 to $2.40 per share. Consensus estimates are for year-over-year earnings growth of 21.08% with revenue increasing by 8.91%. Short interest has decreased by 17.7% since the company’s last earnings release while the stock has drifted higher by 22.2% from its open following the earnings release to be 19.9% above its 200 day moving average of $59.61. Overall earnings estimates have been revised higher since the company’s last earnings release. Option traders are pricing in a 4.3% move on earnings and the stock has averaged a 5.2% move in recent quarters.

Jabil Inc. (JBL) is confirmed to report earnings at approximately 8:00 AM ET on Thursday, December 15, 2022. The consensus earnings estimate is $2.24 per share on revenue of $9.33 billion and the Earnings Whisper ® number is $2.31 per share. Investor sentiment going into the company’s earnings release has 63% expecting an earnings beat The company’s guidance was for earnings of $2.00 to $2.40 per share. Consensus estimates are for year-over-year earnings growth of 21.08% with revenue increasing by 8.91%. Short interest has decreased by 17.7% since the company’s last earnings release while the stock has drifted higher by 22.2% from its open following the earnings release to be 19.9% above its 200 day moving average of $59.61. Overall earnings estimates have been revised higher since the company’s last earnings release. Option traders are pricing in a 4.3% move on earnings and the stock has averaged a 5.2% move in recent quarters.

Dynagas LNG Partners LP $2.95

![]() Dynagas LNG Partners LP (DLNG) is confirmed to report earnings before the market opens on Monday, December 12, 2022. The consensus earnings estimate is $0.08 per share on revenue of $30.49 million. Investor sentiment going into the company’s earnings release has 5% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 66.67% with revenue decreasing by 12.11%. Short interest has decreased by 86.8% since the company’s last earnings release while the stock has drifted lower by 6.9% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release.

Dynagas LNG Partners LP (DLNG) is confirmed to report earnings before the market opens on Monday, December 12, 2022. The consensus earnings estimate is $0.08 per share on revenue of $30.49 million. Investor sentiment going into the company’s earnings release has 5% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 66.67% with revenue decreasing by 12.11%. Short interest has decreased by 86.8% since the company’s last earnings release while the stock has drifted lower by 6.9% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release.

Photronics, Inc. $18.27

![]() Photronics, Inc. (PLAB) is confirmed to report earnings at approximately 6:00 AM ET on Tuesday, December 13, 2022. The consensus earnings estimate is $0.48 per share on revenue of $210.00 million. Investor sentiment going into the company’s earnings release has 72% expecting an earnings beat The company’s guidance was for earnings of $0.44 to $0.52 per share on revenue of $205.00 million to $215.00 million. Consensus estimates are for year-over-year earnings growth of 45.45% with revenue increasing by 15.84%. Short interest has decreased by 27.9% since the company’s last earnings release while the stock has drifted lower by 4.0% from its open following the earnings release to be 1.3% above its 200 day moving average of $18.04. Overall earnings estimates have been revised lower since the company’s last earnings release. Option traders are pricing in a 16.4% move on earnings and the stock has averaged a 12.8% move in recent quarters.

Photronics, Inc. (PLAB) is confirmed to report earnings at approximately 6:00 AM ET on Tuesday, December 13, 2022. The consensus earnings estimate is $0.48 per share on revenue of $210.00 million. Investor sentiment going into the company’s earnings release has 72% expecting an earnings beat The company’s guidance was for earnings of $0.44 to $0.52 per share on revenue of $205.00 million to $215.00 million. Consensus estimates are for year-over-year earnings growth of 45.45% with revenue increasing by 15.84%. Short interest has decreased by 27.9% since the company’s last earnings release while the stock has drifted lower by 4.0% from its open following the earnings release to be 1.3% above its 200 day moving average of $18.04. Overall earnings estimates have been revised lower since the company’s last earnings release. Option traders are pricing in a 16.4% move on earnings and the stock has averaged a 12.8% move in recent quarters.

Darden Restaurants, Inc. $142.57

Darden Restaurants, Inc. (DRI) is confirmed to report earnings at approximately 7:00 AM ET on Friday, December 16, 2022. The consensus earnings estimate is $1.42 per share on revenue of $2.42 billion and the Earnings Whisper ® number is $1.45 per share. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 4.05% with revenue increasing by 6.50%. Short interest has decreased by 25.5% since the company’s last earnings release while the stock has drifted higher by 10.5% from its open following the earnings release to be 10.8% above its 200 day moving average of $128.69. Overall earnings estimates have been revised higher since the company’s last earnings release. On Tuesday, December 6, 2022 there was some notable buying of 1,001 contracts of the $160.00 call expiring on Friday, January 20, 2023. Option traders are pricing in a 6.1% move on earnings and the stock has averaged a 3.4% move in recent quarters.

Darden Restaurants, Inc. (DRI) is confirmed to report earnings at approximately 7:00 AM ET on Friday, December 16, 2022. The consensus earnings estimate is $1.42 per share on revenue of $2.42 billion and the Earnings Whisper ® number is $1.45 per share. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 4.05% with revenue increasing by 6.50%. Short interest has decreased by 25.5% since the company’s last earnings release while the stock has drifted higher by 10.5% from its open following the earnings release to be 10.8% above its 200 day moving average of $128.69. Overall earnings estimates have been revised higher since the company’s last earnings release. On Tuesday, December 6, 2022 there was some notable buying of 1,001 contracts of the $160.00 call expiring on Friday, January 20, 2023. Option traders are pricing in a 6.1% move on earnings and the stock has averaged a 3.4% move in recent quarters.

Core & Main, Inc. $20.68

![]() Core & Main, Inc. (CNM) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, December 13, 2022. The consensus earnings estimate is $0.60 per share on revenue of $1.71 billion and the Earnings Whisper ® number is $0.63 per share. Investor sentiment going into the company’s earnings release has 58% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 7.14% with revenue increasing by 21.73%. Short interest has increased by 95.7% since the company’s last earnings release while the stock has drifted lower by 18.7% from its open following the earnings release to be 9.3% below its 200 day moving average of $22.81. Overall earnings estimates have been revised higher since the company’s last earnings release. Option traders are pricing in a 4.4% move on earnings and the stock has averaged a 3.4% move in recent quarters.

Core & Main, Inc. (CNM) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, December 13, 2022. The consensus earnings estimate is $0.60 per share on revenue of $1.71 billion and the Earnings Whisper ® number is $0.63 per share. Investor sentiment going into the company’s earnings release has 58% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 7.14% with revenue increasing by 21.73%. Short interest has increased by 95.7% since the company’s last earnings release while the stock has drifted lower by 18.7% from its open following the earnings release to be 9.3% below its 200 day moving average of $22.81. Overall earnings estimates have been revised higher since the company’s last earnings release. Option traders are pricing in a 4.4% move on earnings and the stock has averaged a 3.4% move in recent quarters.