Futu Holdings Ltd $50.62

![]() Futu Holdings Ltd (FUTU) is confirmed to report earnings at approximately 4:00 AM ET on Monday, November 21, 2022. Investor sentiment going into the company’s earnings release has 59% expecting an earnings beat. Short interest has increased by 7.6% since the company’s last earnings release while the stock has drifted higher by 12.5% from its open following the earnings release to be 27.3% above its 200 day moving average of $39.76. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, November 11, 2022 there was some notable buying of 5,076 contracts of the $20.00 put expiring on Friday, December 16, 2022. Option traders are pricing in a 11.8% move on earnings and the stock has averaged a 4.9% move in recent quarters.

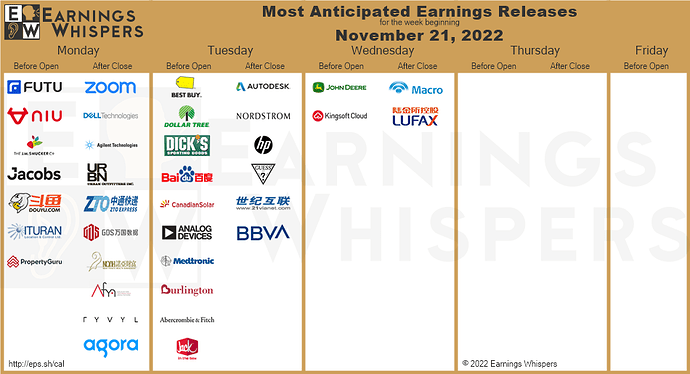

Futu Holdings Ltd (FUTU) is confirmed to report earnings at approximately 4:00 AM ET on Monday, November 21, 2022. Investor sentiment going into the company’s earnings release has 59% expecting an earnings beat. Short interest has increased by 7.6% since the company’s last earnings release while the stock has drifted higher by 12.5% from its open following the earnings release to be 27.3% above its 200 day moving average of $39.76. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, November 11, 2022 there was some notable buying of 5,076 contracts of the $20.00 put expiring on Friday, December 16, 2022. Option traders are pricing in a 11.8% move on earnings and the stock has averaged a 4.9% move in recent quarters.

Niu Technologies $3.53

![]() Niu Technologies (NIU) is confirmed to report earnings at approximately 4:05 AM ET on Monday, November 21, 2022. Investor sentiment going into the company’s earnings release has 61% expecting an earnings beat The company’s guidance was for revenue of $172.10 million to $199.28 million. Short interest has increased by 46.6% since the company’s last earnings release while the stock has drifted lower by 49.5% from its open following the earnings release to be 51.7% below its 200 day moving average of $7.30. Overall earnings estimates have been revised lower since the company’s last earnings release. The stock has averaged a 8.5% move on earnings in recent quarters.

Niu Technologies (NIU) is confirmed to report earnings at approximately 4:05 AM ET on Monday, November 21, 2022. Investor sentiment going into the company’s earnings release has 61% expecting an earnings beat The company’s guidance was for revenue of $172.10 million to $199.28 million. Short interest has increased by 46.6% since the company’s last earnings release while the stock has drifted lower by 49.5% from its open following the earnings release to be 51.7% below its 200 day moving average of $7.30. Overall earnings estimates have been revised lower since the company’s last earnings release. The stock has averaged a 8.5% move on earnings in recent quarters.

Dollar Tree Stores, Inc. $163.36

![]() Dollar Tree Stores, Inc. (DLTR) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, November 22, 2022. The consensus earnings estimate is $1.17 per share on revenue of $6.84 billion and the Earnings Whisper ® number is $1.24 per share. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat The company’s guidance was for earnings of $1.05 to $1.20 per share. Consensus estimates are for year-over-year earnings growth of 21.88% with revenue increasing by 6.62%. Short interest has decreased by 10.3% since the company’s last earnings release while the stock has drifted higher by 9.6% from its open following the earnings release to be 6.3% above its 200 day moving average of $153.72. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, November 10, 2022 there was some notable buying of 18,000 contracts of the $140.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 9.9% move on earnings and the stock has averaged a 10.2% move in recent quarters.

Dollar Tree Stores, Inc. (DLTR) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, November 22, 2022. The consensus earnings estimate is $1.17 per share on revenue of $6.84 billion and the Earnings Whisper ® number is $1.24 per share. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat The company’s guidance was for earnings of $1.05 to $1.20 per share. Consensus estimates are for year-over-year earnings growth of 21.88% with revenue increasing by 6.62%. Short interest has decreased by 10.3% since the company’s last earnings release while the stock has drifted higher by 9.6% from its open following the earnings release to be 6.3% above its 200 day moving average of $153.72. Overall earnings estimates have been revised lower since the company’s last earnings release. On Thursday, November 10, 2022 there was some notable buying of 18,000 contracts of the $140.00 put expiring on Friday, February 17, 2023. Option traders are pricing in a 9.9% move on earnings and the stock has averaged a 10.2% move in recent quarters.

Zoom Video Communications, Inc. $81.64

![]() Zoom Video Communications, Inc. (ZM) is confirmed to report earnings at approximately 4:05 PM ET on Monday, November 21, 2022. The consensus earnings estimate is $0.84 per share on revenue of $1.10 billion and the Earnings Whisper ® number is $0.89 per share. Investor sentiment going into the company’s earnings release has 18% expecting an earnings beat The company’s guidance was for earnings of $0.82 to $0.83 per share. Consensus estimates are for earnings to decline year-over-year by 23.64% with revenue increasing by 4.69%. Short interest has increased by 44.7% since the company’s last earnings release while the stock has drifted lower by 3.5% from its open following the earnings release to be 18.9% below its 200 day moving average of $100.61. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, November 8, 2022 there was some notable buying of 20,800 contracts of the $160.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 14.5% move on earnings and the stock has averaged a 10.2% move in recent quarters.

Zoom Video Communications, Inc. (ZM) is confirmed to report earnings at approximately 4:05 PM ET on Monday, November 21, 2022. The consensus earnings estimate is $0.84 per share on revenue of $1.10 billion and the Earnings Whisper ® number is $0.89 per share. Investor sentiment going into the company’s earnings release has 18% expecting an earnings beat The company’s guidance was for earnings of $0.82 to $0.83 per share. Consensus estimates are for earnings to decline year-over-year by 23.64% with revenue increasing by 4.69%. Short interest has increased by 44.7% since the company’s last earnings release while the stock has drifted lower by 3.5% from its open following the earnings release to be 18.9% below its 200 day moving average of $100.61. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, November 8, 2022 there was some notable buying of 20,800 contracts of the $160.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 14.5% move on earnings and the stock has averaged a 10.2% move in recent quarters.

J.M. Smucker Co. $146.14

![]() J.M. Smucker Co. (SJM) is confirmed to report earnings at approximately 7:00 AM ET on Monday, November 21, 2022. The consensus earnings estimate is $2.19 per share on revenue of $2.17 billion and the Earnings Whisper ® number is $2.24 per share. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 9.88% with revenue increasing by 5.85%. Short interest has decreased by 19.4% since the company’s last earnings release while the stock has drifted higher by 3.5% from its open following the earnings release to be 7.7% above its 200 day moving average of $135.72. Overall earnings estimates have been revised higher since the company’s last earnings release. Option traders are pricing in a 5.4% move on earnings and the stock has averaged a 4.2% move in recent quarters.

J.M. Smucker Co. (SJM) is confirmed to report earnings at approximately 7:00 AM ET on Monday, November 21, 2022. The consensus earnings estimate is $2.19 per share on revenue of $2.17 billion and the Earnings Whisper ® number is $2.24 per share. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 9.88% with revenue increasing by 5.85%. Short interest has decreased by 19.4% since the company’s last earnings release while the stock has drifted higher by 3.5% from its open following the earnings release to be 7.7% above its 200 day moving average of $135.72. Overall earnings estimates have been revised higher since the company’s last earnings release. Option traders are pricing in a 5.4% move on earnings and the stock has averaged a 4.2% move in recent quarters.

DICK’S Sporting Goods, Inc. $109.09

![]() DICK’S Sporting Goods, Inc. (DKS) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, November 22, 2022. The consensus earnings estimate is $2.24 per share on revenue of $2.68 billion and the Earnings Whisper ® number is $2.32 per share. Investor sentiment going into the company’s earnings release has 33% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 29.78% with revenue decreasing by 2.46%. Short interest has decreased by 19.2% since the company’s last earnings release while the stock has drifted lower by 4.0% from its open following the earnings release to be 9.1% above its 200 day moving average of $99.99. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, November 18, 2022 there was some notable buying of 2,044 contracts of the $95.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 10.3% move on earnings and the stock has averaged a 7.8% move in recent quarters.

DICK’S Sporting Goods, Inc. (DKS) is confirmed to report earnings at approximately 7:30 AM ET on Tuesday, November 22, 2022. The consensus earnings estimate is $2.24 per share on revenue of $2.68 billion and the Earnings Whisper ® number is $2.32 per share. Investor sentiment going into the company’s earnings release has 33% expecting an earnings beat. Consensus estimates are for earnings to decline year-over-year by 29.78% with revenue decreasing by 2.46%. Short interest has decreased by 19.2% since the company’s last earnings release while the stock has drifted lower by 4.0% from its open following the earnings release to be 9.1% above its 200 day moving average of $99.99. Overall earnings estimates have been revised higher since the company’s last earnings release. On Friday, November 18, 2022 there was some notable buying of 2,044 contracts of the $95.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 10.3% move on earnings and the stock has averaged a 7.8% move in recent quarters.

Deere & Company $414.26

Deere & Company (DE) is confirmed to report earnings at approximately 6:45 AM ET on Wednesday, November 23, 2022. The consensus earnings estimate is $7.09 per share on revenue of $13.39 billion and the Earnings Whisper ® number is $7.21 per share. Investor sentiment going into the company’s earnings release has 70% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 72.09% with revenue increasing by 18.21%. Short interest has increased by 12.1% since the company’s last earnings release while the stock has drifted higher by 15.5% from its open following the earnings release to be 13.1% above its 200 day moving average of $366.23. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, November 2, 2022 there was some notable buying of 1,019 contracts of the $350.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 5.7% move on earnings and the stock has averaged a 4.4% move in recent quarters.

Deere & Company (DE) is confirmed to report earnings at approximately 6:45 AM ET on Wednesday, November 23, 2022. The consensus earnings estimate is $7.09 per share on revenue of $13.39 billion and the Earnings Whisper ® number is $7.21 per share. Investor sentiment going into the company’s earnings release has 70% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 72.09% with revenue increasing by 18.21%. Short interest has increased by 12.1% since the company’s last earnings release while the stock has drifted higher by 15.5% from its open following the earnings release to be 13.1% above its 200 day moving average of $366.23. Overall earnings estimates have been revised higher since the company’s last earnings release. On Wednesday, November 2, 2022 there was some notable buying of 1,019 contracts of the $350.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 5.7% move on earnings and the stock has averaged a 4.4% move in recent quarters.

Baidu, Inc. $95.97

![]() Baidu, Inc. (BIDU) is confirmed to report earnings at approximately 4:55 AM ET on Tuesday, November 22, 2022. The consensus earnings estimate is $2.16 per share on revenue of $4.48 billion and the Earnings Whisper ® number is $2.24 per share. Investor sentiment going into the company’s earnings release has 36% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 2.37% with revenue decreasing by 9.57%. Short interest has increased by 10.2% since the company’s last earnings release while the stock has drifted lower by 35.1% from its open following the earnings release to be 26.4% below its 200 day moving average of $130.44. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, November 8, 2022 there was some notable buying of 5,940 contracts of the $170.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 10.0% move on earnings and the stock has averaged a 6.1% move in recent quarters.

Baidu, Inc. (BIDU) is confirmed to report earnings at approximately 4:55 AM ET on Tuesday, November 22, 2022. The consensus earnings estimate is $2.16 per share on revenue of $4.48 billion and the Earnings Whisper ® number is $2.24 per share. Investor sentiment going into the company’s earnings release has 36% expecting an earnings beat. Consensus estimates are for year-over-year earnings growth of 2.37% with revenue decreasing by 9.57%. Short interest has increased by 10.2% since the company’s last earnings release while the stock has drifted lower by 35.1% from its open following the earnings release to be 26.4% below its 200 day moving average of $130.44. Overall earnings estimates have been revised lower since the company’s last earnings release. On Tuesday, November 8, 2022 there was some notable buying of 5,940 contracts of the $170.00 put expiring on Friday, January 20, 2023. Option traders are pricing in a 10.0% move on earnings and the stock has averaged a 6.1% move in recent quarters.

Jacobs $126.04

![]() Jacobs (J) is confirmed to report earnings at approximately 6:40 AM ET on Monday, November 21, 2022. The consensus earnings estimate is $1.78 per share on revenue of $3.84 billion and the Earnings Whisper ® number is $1.81 per share. Investor sentiment going into the company’s earnings release has 46% expecting an earnings beat The company’s guidance was for earnings of $1.75 to $1.85 per share. Consensus estimates are for year-over-year earnings growth of 12.66% with revenue increasing by 7.07%. Short interest has decreased by 2.0% since the company’s last earnings release while the stock has drifted lower by 5.1% from its open following the earnings release to be 0.6% below its 200 day moving average of $126.78. Overall earnings estimates have been revised lower since the company’s last earnings release. Option traders are pricing in a 4.7% move on earnings.

Jacobs (J) is confirmed to report earnings at approximately 6:40 AM ET on Monday, November 21, 2022. The consensus earnings estimate is $1.78 per share on revenue of $3.84 billion and the Earnings Whisper ® number is $1.81 per share. Investor sentiment going into the company’s earnings release has 46% expecting an earnings beat The company’s guidance was for earnings of $1.75 to $1.85 per share. Consensus estimates are for year-over-year earnings growth of 12.66% with revenue increasing by 7.07%. Short interest has decreased by 2.0% since the company’s last earnings release while the stock has drifted lower by 5.1% from its open following the earnings release to be 0.6% below its 200 day moving average of $126.78. Overall earnings estimates have been revised lower since the company’s last earnings release. Option traders are pricing in a 4.7% move on earnings.

Looking at BBY on EPS beat sales down but upped guidance and 1 billion buyback.

Also DKS EPS beat Sales up and upped guidance as well hasn’t moved as much as BBY. And initial reaction was due. Their call is at 10 during market hours which always makes these tougher. Might be better to wait for call reaction.

DE- was a beat EPS sales and revenue beat. Sales were up in every segment they offer except one. In my opinion these are some really strong numbers. Upped their 23 guidance.

Close to their highs currently so not sure how far it can go. Also call is at 9 central time so half hour after open. Remember market is closed tomorrow and half day Friday so don’t go to far OTM if you play this.

Wanted to real quick touch on the ADSK play today. Because I think it’s important to I hope most of server ti ultimately be profitable. And because I’m not always able to post callouts or plays. Because of real world stuff. Frankly taking calls on a stock that’s down 10 percent premarket would largely be dumb. However they hit their EPS and were mostly successful. In current times with many companies being at precovid lows and beat down. If they are meeting expectation they can run. Exhibit A. Take a peak at BURL they missed but were down so much their EPS and earnings apparently warranted a higher share price and it ran for 2 days.

But As always I watch nearly every ticker premarket that had earnings either the day before or in premarket. As cringy as it is I actually use RH to watch because it’s easy mobile app and can see the general charts all on main screen. I always put SPY right next to all the ER tickers on my list. I noticed ADSK pushing up or recovering. This is most important part to me for post ER plays. SPY was running down when Econ numbers were released and ADSK was still recovering.

I also am always searching for fills on these at open. This particular case I got a not so great fill but almost 5 minutes into open was up good. Missed my opportunity to sell. However since I position myself at open candles with ability to average down and always leave myself that ability I was able to get my cost to .70 and sell at 1.75. These touched over 2.50 at one point.

Moral of story is get good fills at open if you miss and don’t be able to average. Also if it’s beat down already there is likely people buying that think it’s a bargain. Watch the premarket moves more than anything.

This topic was automatically closed 14 days after the last reply. New replies are no longer allowed.