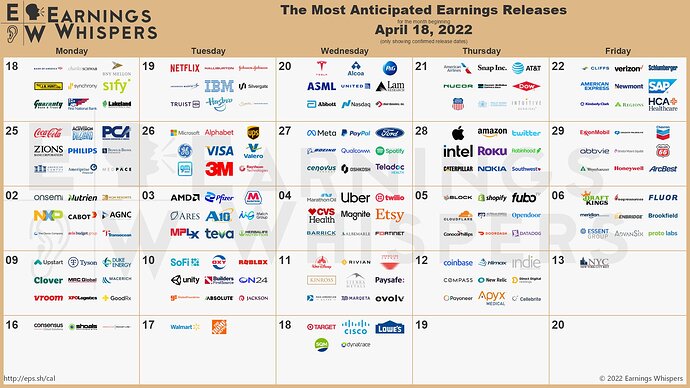

I didn’t see a thread and people keep asking for these so I figured it was about time. Earnings Whispers posts these calendars every sat/sun on their twitter feed & email. I’ll do my best to post these every weekend, but anyone else feel free to do so too if you see them before I do. Earnings Whispers

Please note that the monthly calendars can change as more companies make announcements for their exact earnings dates.

Here’s the next 5 weeks at a glance:

And the upcoming week (Apr-18):

1 Like

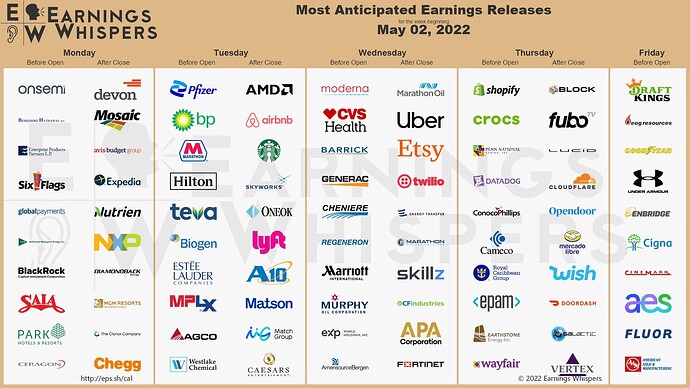

Week of 5/9/2022. Overall there are ~950 companies with earnings this week.

2 Likes

Lots more big names this week, gonna be fun!

4 Likes

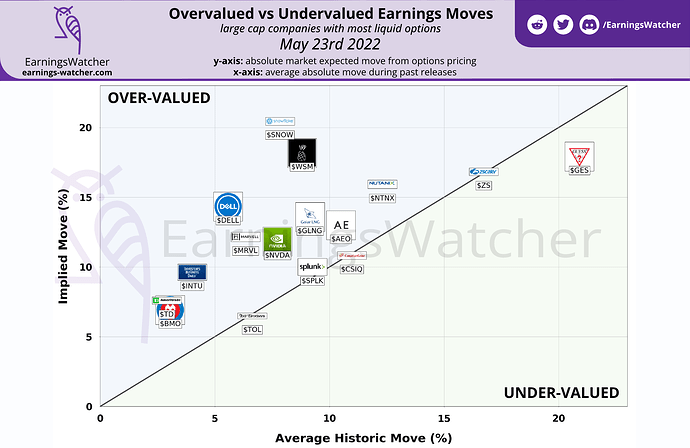

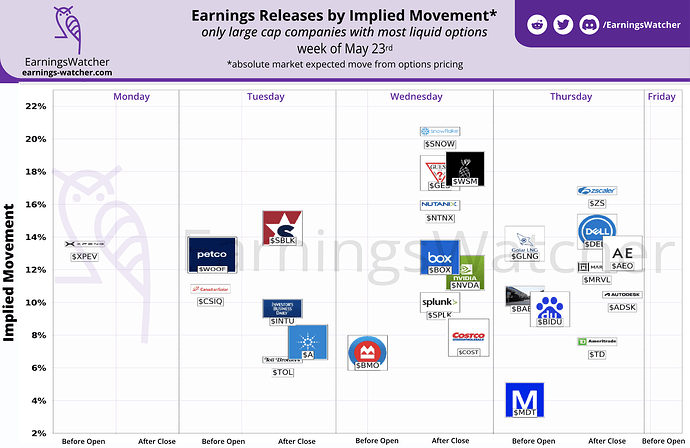

Gonna post this here and probably the “what are you watching thread”

I’ve been playing post earnings plays a lot recently and had great success.

Here’s some things I’m seeing for next week.

$ZM has the potential to be the biggest mover. Based on past earnings, likely due to covid inflated price, there have been violent swings.

$ZM:

Number of past releases: 12

Average absolute move : 16.92% +/- 11.2%

=> range of previous moves 5.720000000000002% to 28.12%

Percentage of higher-than-expected moves: 33.33%

Correlation with SPY on release day: -0.3%

Same sector correlation with SPY on release day: 9.3%

So, based on the numbers we see ZM likes to go wild around earnings. Good for IV based plays.

Here’s some cool calendars with Info as well

There are many threads here involving pre earnings IV ride plays and post earnings scalps like I play. I’m going to do my best to stay active and post what I’m looking at day of if people want to follow along. But these are cool resources to help decide tickers to play

7 Likes

With retail getting railed, how much best buy puts be. They have earnings tomorrow PM. I don’t have any research but throwing it out there if anyone has ideas

I’ll check some things out, but it’s already been fucked. A post earnings movement play would be safest

1 Like

Main focus I’m seeing this week from an earnings perspective is on ZM, SNOW, and NVDA. Not seeing much on it.

I agree with your overall assessment of retail moves in general and believe it to be even more bearish based on the fact that it’s a non necessity store.

I’ll add it to a watch list to play post earnings if it meets my criteria for a volatile enough move

Gonna add some more info here on NVDA and SNOW

$NVDA:

Number of past releases: 25

Average absolute move : 7.83% +/- 7.22%

=> range of previous moves 0.6100000000000003% to 15.05%

Percentage of higher-than-expected moves: 28.0%

Stock moved in same direction for 1.2 days on average on past releases.

Stock reversed direction during day of release 64% of the time on past releases.

Correlation with SPY on release day: 31.0%

Same sector correlation with SPY on release day: 5.0%

$SNOW:

Number of past releases: 7

Average absolute move : 6.74% +/- 5.61%

=> range of previous moves 1.13% to 12.350000000000001%

Percentage of higher-than-expected moves: 42.86%

Stock moved in same direction for 1.25 days on average on past releases.

Stock reversed direction during day of release 75% of the time on past releases.

Correlation with SPY on release day: 48.6%

Same sector correlation with SPY on release day: 5.0%

$WSM:

Number of past releases: 25

Average absolute move : 9.06% +/- 10.47%

=> range of previous moves -1.4100000000000001% to 19.53%

Percentage of higher-than-expected moves: 48.0%

Stock moved in same direction for 1.6 days on average on past releases.

Stock reversed direction during day of release 54% of the time on past releases.

Correlation with SPY on release day: 35.8%

Same sector correlation with SPY on release day: 8.0%

WSM will be interesting as well

Since Zoom beat earnings, is it on your radar to play calls at open?

1 Like

Looks like it’s tracked back down, for me it’s not a big enough move so far to determine a direction for sure to play at open. Will watch for a big move premarket but will likely play snap instead

1 Like

I’m guessing SNAP puts at open?

MMs prolly win on ZM… thanks SNAP

ZM may see some buying at open since it came back down but I likely won’t touch it now

If premarket doesn’t hold surprises, yes likely my plan.

SBLK earnings after hours. Greece based transport company so could be interesting to see what that may do for that sector

American Eagle was mentioned today on TF so here’s some past earnings data for that ticker, which reports Thursday I believe

$AEO:

Number of past releases: 25

Average absolute move : 8.63% +/- 5.27%

=> range of previous moves 3.360000000000001% to 13.9%

Percentage of higher-than-expected moves: 32.0%

Stock moved in same direction for 2.4 days on average on past releases.

Stock reversed direction during day of release 32% of the time on past releases.

Correlation with SPY on release day: 17.8%

Same sector correlation with SPY on release day: 7.9%

1 Like