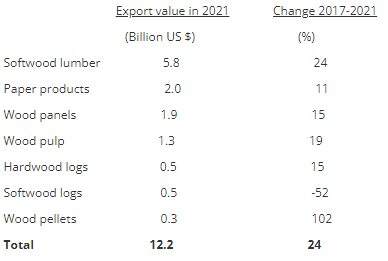

I’m creating this thread as a starting point to discuss the possible impacts of potential sanctions against Russia’s lumbar and forestry industry, or even the effects on this industry due to other trade sanctions and Russia’s removal from SWIFT. Russia is now the worlds second largest exporter of softwood lumbar, surpassing Canada in 2018

Russia has surpassed Canada to become the world’s largest exporter of softwood lumber, and was on track to ship almost 32 million m3 of lumber in 2019 (23% of globally traded lumber in 2019), reports the Wood Resource Quarterly in its latest issue.

The invasion of Ukraine will likely halt planned investments in it’s forest industry according to the Wood Resources International (WRI).

Increased sanctions against trading with Russia, and difficulty with financial transactions, will probably interrupt and re-direct shipments of forest products throughout the world, WRI has cautioned.

Countries like China and India, who have reluctantly supported Russia in the conflict, may also be affected by limited trade sanctions. This development would mainly affect China, which relies on the importation of forest products, including logs, wood chips, lumber, pulp, and paper from North America, Europe, Oceania, and Latin America for domestic use. These world regions are considering expanded sanctions for Russia and countries that directly or indirectly support Russia’s attack on Ukraine.

Russia is the largest exporter globally of forest products worldwide and these exports have increased rapidly in the last 5 years, much of this is under jeopardy given the potential sanctions and being cut off from SWIFT will make it more difficult to trade internationally. This comes at a time where Russia implemented initiatives to meet the growing international demand.

Russia has vastly under-utilized forest resources and has the potential to increase timber harvests to supply its domestic industry. To meet increased global demand for forest products, the Russian government recently initiated programs to encourage investments in the sector to both expand/modernize existing manufacturing plants and build greenfield facilities.

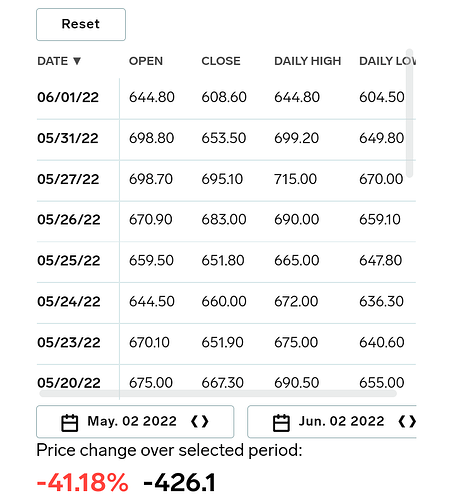

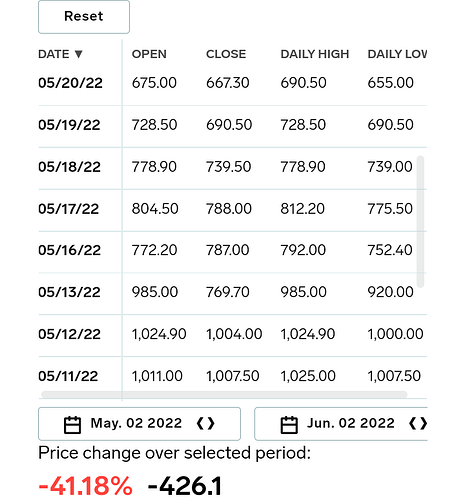

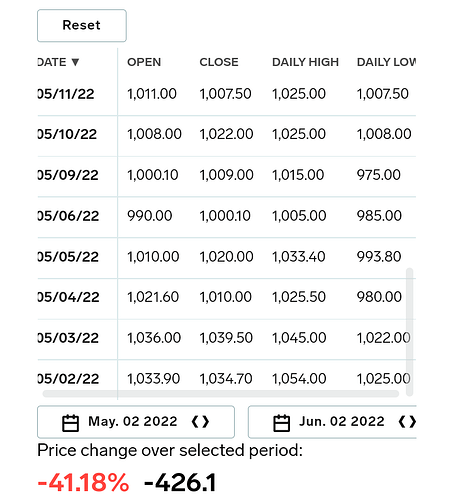

I’m currently looking at the Invesco MSCI Global Timber ETF (CUT) which gives investors indirect exposure to the price of timber through a basket of global equities which own or lease forested land and harvest the timber for commercial use and sale of wood-based products, but I will also be looking at individual holdings too.