I’m curating a list of small cap oil and gas companies that look to be very profitable in the upcoming quarters. I’m going to be focusing on Canadian small caps first as that’s what I’ve been researching.

VET - Canadian oil and natural gas producer but globally diversified with presence in Australia, Ireland, France, Netherlands. Exposure to EU during Ukraine war makes this ticker attractive as natgas in EU is selling at a huge premium. Be warned though that war could end and geopolitics being double edged sword can work against it too.

BTE - Canadian oil sand producer with presence in USA. They have one of the best wells in clearwater area and is looking to clear their debt by 2023 and issue dividends in Q2. Their hedging strategy has some losses but going forward at current WTI price at $120 and higher, they could see some very nice profit margins.

TVE - This is NinePoint’s top rated ticker. Also has presence in clearwater, but I am not entirely sure of their moat. Needs more research.

I’ve been following Shubham Garg’s videos on valuations and discussions on youtube on these. Also, Eric Nuttall who manages NinePoint is good source to listen.

The general agreement among them seems to be that oil and gas companies are not expecting to increase their capital expenditure due to what happened in 2015 with US shale gas oversupply. They appear to be focused on paying down debt and returning value to investors by buybacks and dividends.

6 Likes

Another worthy mention is CVE (mid-ish cap). Recent news was that they were approved for drilling new coastal areas in Newfoundland. They also approved increased dividends.

At the moment I am only in shares for BTE and TVE, but leaps could be very attractive for BTE. I believe it has three things going for it. It projects no dividends until 2023 Q2 (this could be bad for those that want a quicker pop, as divvy announcement usually gives more pop, but good for longer term option play as calls don’t get divvys). There is possibility of listing on US market. Currently it shows as pink sheet but listing on bigger exchange could be another catalyst to propel it forward. Lastly, their valuation at 2.28 EV/EBITDA makes it one of the better value plays compared to others. Experts may use different valuation model like using FCF/EV. Spread on options appears to be better on BTE too over TVE.

1 Like

Big caps jumping in the natgas feeding to EU. maybe bad outlook for existing players like VET, EQNR.

This is great. I just posted that I’m watching BRENT and WTi.

Will follow this thread.

Thanks, bud.

1 Like

The analyst in that vid expects oil price to peak in Q4.

3 Likes

grabbed 40x 9c mar17 2023 for BTE.to

BTE pushed above $9 twice today, being one of the few winners in energy sector. I think it definitely has momentum over other competitors.

trend continued today with bte being green despite almost everything being red.

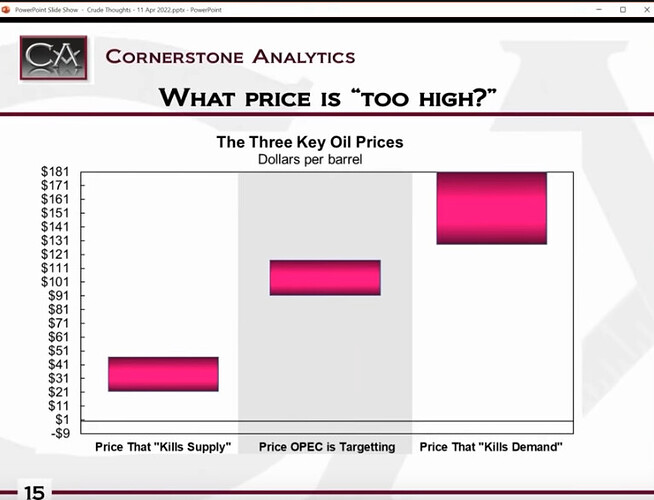

Energy was pulled down by basically everything coming down after CPI report. PPI report on monday PM is another bomb that could drive down prices. WTI continues to hold $120 and Biden speech was hawkish on oil companies like Exxon. I considered hedging my position but decided against it as BTE only moved 2% off the CPI. I am still bullish on oil companies as long as there is no macro news that affects oil price significantly which would be significant capex from companies (which I think is still unlikely) and Ukraine war comes to an end and Russia returns to full production (also seems unlikely). I do advise people in oil plays to consider hedging or reducing exposure when WTI approaches $100.

After being 40% down in brutal market pullback on energy sector (who knows if hedge funds shorted it heavily), bte.to bounced back ~10% (strongest in my watchlist) today buoyed by insider buys after reaching sub $5.5#. Oil shortage thesis still holds as fundamentals haven’t shifted – that there is years of underinvestment in oil & gas production and there will be massive oil shortage when we run out of buffers and there will be multi-year oil bull run. SPR is slated to run out in 66 weeks at 7mboe/wk draw.

EIA report came out today detailing 2 weeks worth of crude and gas & distillate inventories. Both WTI and equities down for no clear reason. flip tables

1 Like

another messed up day. WTI dip below $100, now showing to be resistance.

Macro conditions haven’t changed, so I am still holding.

News of instability in Libya made their oil productions plummet: https://twitter.com/chigrl/status/1544036792533409792?s=20&t=DSzWcYn0UxJzSYMmURNMLQ