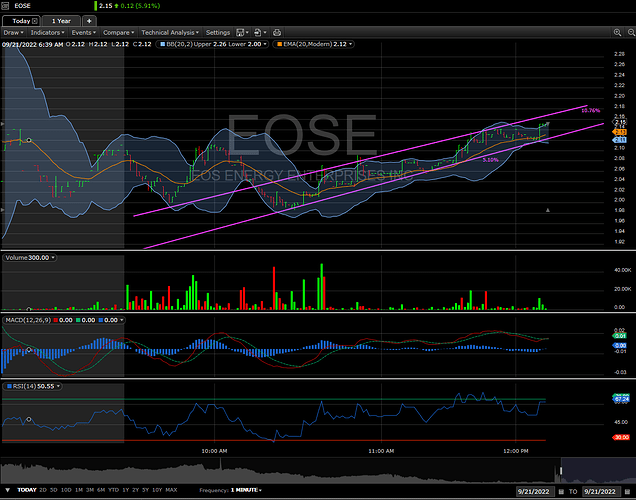

Channel still holding but volume died off for lunch Ho Lee Fuk… well let’s see this if this volume pushes us past $2.20 for a breakout towards $2.33

H&S invalided ![]() with a potential breakout after curling away from forming a right shoulder (bullish IMO)

with a potential breakout after curling away from forming a right shoulder (bullish IMO)

Algos87 posted this stock on his discord with a pt of 3.5 - 5+. Some stock furu. Might be his discord piling in.

Let us pray that they are the fools who will feed us with their money ![]()

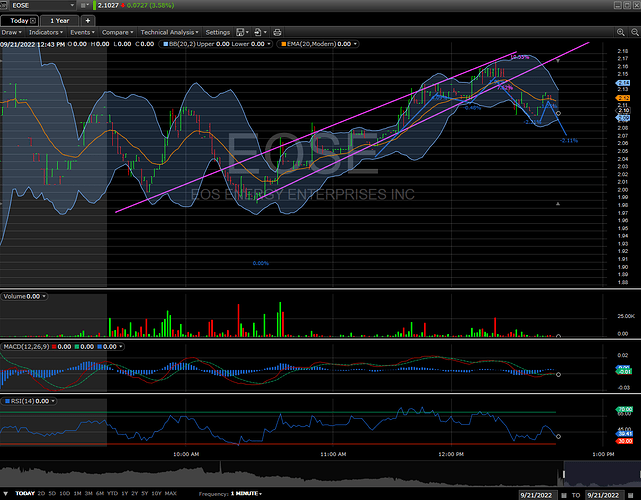

Starting to notice a negative beta correlation to SPY around $2.08… yada yada needs volume yada yada

Volume showing up right when SPY crashing is exactly what we need to continue to see… A test of $1.70-1.80 is not out of the question.

Are you expecting a timeline of 1 or 2 weeks?

Even with the markets about to tear us all a new one… I am. I was hoping even sooner but there’s aalso a big catalyst from the DOE if they get that expansion loan which could take longer to come out (maybe another month or so, but that wasn’t my original play but makes the play safer imo), so there’s a few moving pieces here and I think barring overall markets there’s still a lot to be bullish about this company in the near term.

Honestly at these levels I like the upside as a share play especially with fossil fuel energy costs increasing. I grabbed 100 shares in my boomer account with a stop loss of $1.00 just to go for a ride. If it doesn’t pan out I will lose my $70 and move on with my life. The DOE funding (with an unknown timeline) is intriguing, but just unknown enough to make my steer clear of any type of options on this play.

Saw an article floating around twitter today on EOS, seemed to mainly fly under the radar and ultimately makes my play on this even more bullish… They are basically scaling up production now in anticipation of scaling at an even larger pace if funding is granted from DOE…

The climate law “will be a catalyst for our business,” said Joe Mastrangelo, the company’s CEO.

Just not happy with my $2.54 cost average (low on powder to average down), but I think it’ll blow past this to the $3s at lease IF (when) the DOE funding is announced… I’m planning scale out in the $3s if it gets there, that’s my initial target for this swing but the next resistance after $1.80 is $2.00 imo… (then $2.30, $2.60… then $3)

This one has been the benefactor of good market days over the past couple days. Still holding the shares but up 20% since committing to it. If the market continues this uptrend while news drops this one could be exciting!

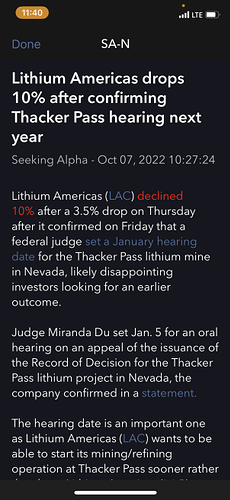

@macromicrodick posted this on the trading floor this morning and I find it very interesting for this play. Because I’m long-term boomer on this stock now, I’d like us to think about the longer term implications of Lithium manufacturing woes in the US and what it means to non-lithium innovators like EOSE (their DOE application is regarding their aqueous zinc battery).

The Biden stimulus regarding EVs mandates that they are American made parts (someone smarter can probably get into the intricacies here) including batteries. If Lithium manufacturing in the U.S. faces headwinds in the near future because of element availability, companies like Eos Energy may begin to be targeted by other automotive manufacturers looking for American made alternatives to boost sales.

I’m super bullish on this thing long term. Still don’t think it’s a great options play because of very unknown timelines, but as a boomer shares play at $1.70 per share I feel like this is a no-brainer.

I took a very small share position today. Seems like a good cost basis considering the above posts. Not a big position because I’m saving most cash for FOMC minutes this week.

Anyone who can get through the paywall gets a $5 dinner from Swole… bullish if true…

A 60 MWh long-duration storage project using vanadium flow and zinc hybrid cathode batteries received a $31 million grant from the California Energy Commission.

A 60 MWh long-duration storage project using vanadium flow and zinc hybrid cathode batteries received a $31 million grant from the California Energy Commission.

just found this old article where the two companies had a prior partnership in production… bullish indeed…

“Indian Energy LLC, a Native American-owned business, received $5 million to demonstrate a mix of long-duration energy storage technologies at Camp Pendleton, a U.S. Marine Corps base in San Diego County. The project will test different combinations of flywheels, flow batteries and zinc-based batteries from Eos Energy Storage LLC in a system with at least 400 kW and 10 hours of storage.”

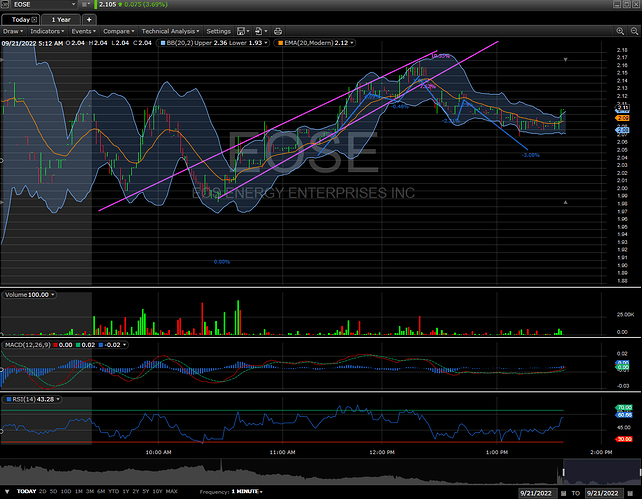

Movement this morning, watching closely

Well it ain’t 27M but at least it’s twice the volume we’ve had in the last month! ayyy!

Because I have boomer shares and a full $70 at stake, I’m still watching this guy. I’ve read through the above articles and find it silly that they’re nowhere to be found on the company’s PR site. This leads me to believe that many of these announcements will inform forward guidance come November 7, 2022.

At this time the weird strength of the market have saved my shares from getting stop loss’d, but I’m curious to see how EOSE translates these deals and loans and everything into actionable and positive guidance. They had some pretty bad coverage earlier in the year in which some analysts really didn’t see a bright future for this company, accusing them of excessive dilution and unsustainable debt.

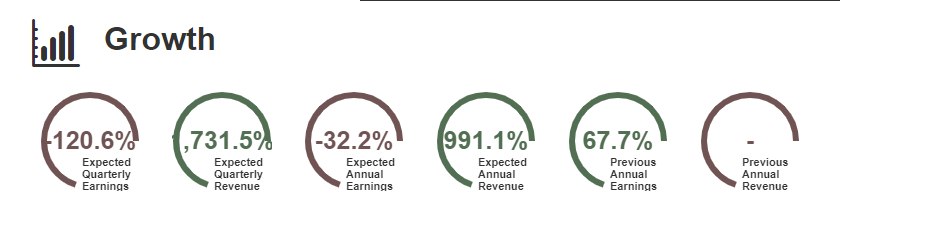

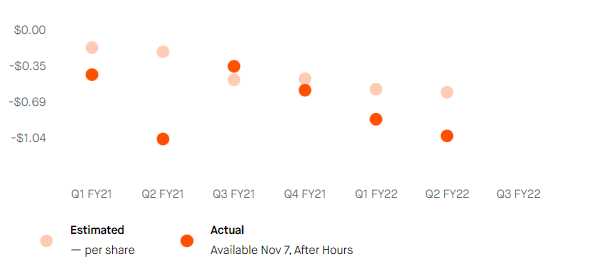

When it comes to earnings itself, the company has been underdelivering for three quarters. However Q3 last year was their best print when they exceeded analyst expectations by only losing like 30 cents a share instead of 35. With the influx of loan money, I’m not expecting their EPS to increase but I’m curious what kind of revenue they’ve gotten with the deals listed in this thread. At the moment, there is no EPS estimate but it seems that analysts are convinced the revenue will be explosive, but the earnings still minimal.

For the time being I’m looking at this now as a potential earnings play on November 7th. If they fail to deliver, if they fail to raise guidance or provide something that gets investors excited, I will probably take my shares out and use the money elsewhere (on a single GOOG, for example).