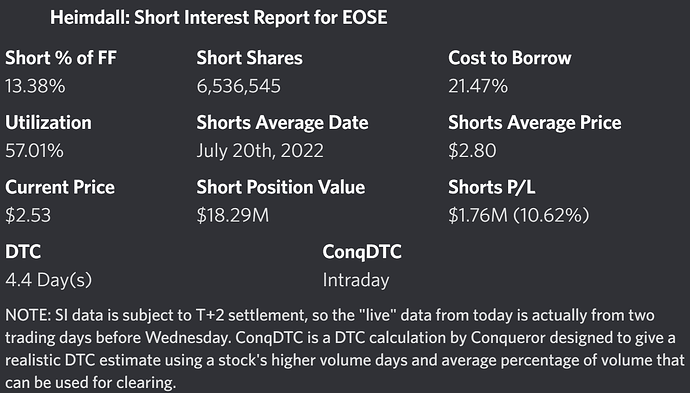

$EOSE I scalped the $2.5c 9/16 from .15 to between .20-.30 so far ranging from 50-100% gains. I only have 2 calls left after selling 80%. I think this has the potential to be a multi-day runner as a lot of chatter is comparing this to NERV which went from $4s to $11s starting back on Aug 22

https://twitter.com/realwillmeade/status/1570112020237750283

Maybe some prevailing minds could help us understand if this makes the play potentially more violent in the next few days (or rest of today?)

SPY dropping and this stock is easy to borrow is what brought this down, good dip if you wanted to enter, still think this plays out through EOW. Obviously horrible timing with the markets oy vey. Trying to swing some shares instead of options now.

Quick update for anyone looking to enter. I welcome corrections as I’m not the best at support and resistance.

- A retest of $2.80+ is super bullish

- An entry between $2.30-2.50 is ideal (I have shares at 2.64 after reading the 20 ema incorrectly yesterday)

- I think this could be a multi day runner similar to NERV due to the steve cohen effect

- I personally do not think the 9/16s are worth playing at this point but someone smarter at options may have a better idea. (For instance if you believe in the potential run you could get 5c for october)

- I also have 2 2.5c for 9/16 I’m looking to offload (had 10 yesterday at .15 cost)

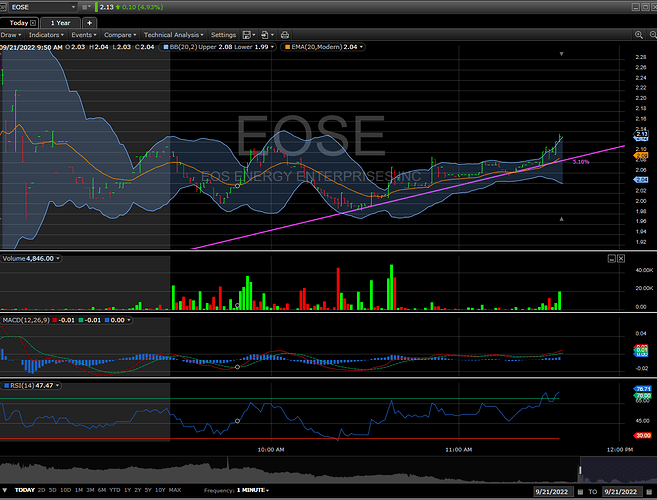

Morning profit taking seemed to get eaten up nicely on that 10:04am candle. I’d like to see it consolidate around $2.60 until we get another round of volume to come in. As long as we see continued volume this should continue to push yesterday high of $2.80. Next resistance at $3.05

Clearly getting pinned right back to the $2.50s on any upward movement. Looks like it wants to break out within days (hours?) but could retest $2.30s before doing that, so trade safe. If it does go back to the $2.30s, I will absolutely be averaging down as I’m overall net bullish on this swing if you look at the weekly/daily (check the 15 minute on the 10 day).

Grabbed a few more shares below 2.37 support anticipating a bounce and to average down into a better cost basis in the 2.50s. Days like today can get you amazing entries in long swings like this but always reserve most cash as there’s always the dip before the dip with more economic data coming out next week.

Also started a position in this. Options chains are low figures but would rather hold shares. I like a safer entry around $2 area but I agree with @DankeDeNada. Position long with entries for dips before the dips for the rips!

Not sure what the dump was at the end but I have a cost avg of 2.35

Yeah I couldn’t tell you but makes me think it had something to do with making sure the 2.5s were otm at close. That’s a great average!

Not sure but apparently Webull has the warrants blocked from trading due to “Corporate Action”

Twitter has a post that a GS trader took a 7 figure position on EOSE (unverifiable).

I saw that too and was trying to find more credibility on this because I can clearly see new orders on Fidelity… not sure what’s going on here… hopefully bullish! lmao

happy about today’s movement. was able to avg down to 2.25 (kept adding at 2.15 multiple times which showed as a relative bottom for today.).

In for the long run.

Agreed, seems like good consolidation before the next leg up. There was a “gap to fill” and as long as $2.15 holds support we should see a strong bounce over the next week or two. I was able to average down into a cost basis of $2.54

Well $2.15 did not hold

Kinda expected it would break below 2.15 with fed meeting middle of week. So far it’s pushing that 2.09 - 2.11 level multiple times, which to me sounds like it’s just market pressure overall. If people want to start a position, here would be a great start.

Well it’s going a lil wild in pre market today

I think it’s picking up from energy chatter tailwinds from the Fed along with Biden’s “speech” later, but yes those were some weird slaps premarket (was super low vol so could just be a dum dum slapping the ask before they had coffee). Need to see some volume come in. Next levels of support look like $1.80 and then a gap around $1.30 but I’d like to see a bounce from $2 as long as volume shows up.

Barely starting to show the volume we need and want to see this AM… Look for the next big resistance around $2.30s if this actually decides to pick up…