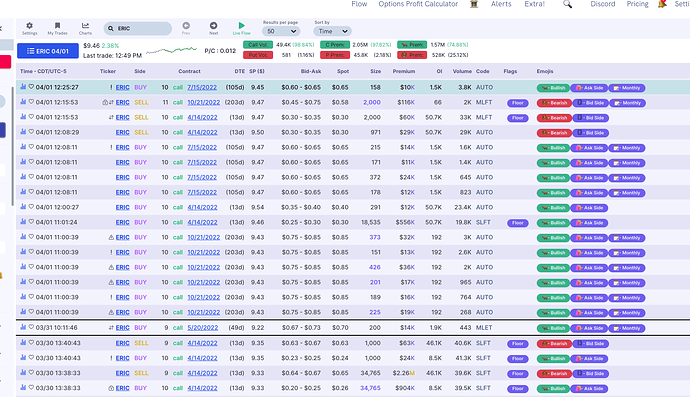

Current placeholder to start DD. In short I saw a unusual twitter post on ERIC about the heavy OI on April 14 $10 calls. After bringing it up to the chat there was a recent debacle with ISIS relationships and CEO / payments. After this dip from 7 it has recovered and seem to consolidate. MY initial no research thesis is the bullish case is that the ISIS connection made it drop under its fundamental value and the earnings report will help remind the value of the company.

Nice find, @Isaiah!

Unless they report on more skeletons in the closet during their 4/14 earnings, this seems like a sensible reversion-to-the-means play. Ericsson is a key player in global telecom infrastructure, are vested in 5G and their log term prospects seem to be solid. Despite the bribery allegations, the CEO almost losing his job, and some doubts around their acquisition of Vonage. Because markets might frown on them longer than options will hold value, might get some commons and wait.

Looks like earnings is set to release on April 14 premarket. Interesting that the large 556K flow on Friday and the 900K and 2M flows were for April 14 expiration…

Would we be looking for a gap fill up to $12 here with a pre earnings pump?

Looks like Nokia is reporting April 28th and may catch some sympathy pumps if Eric does well. I think Nokia and Ericsson have a windfall with all the turbulence Huwaei has had the past couple years.

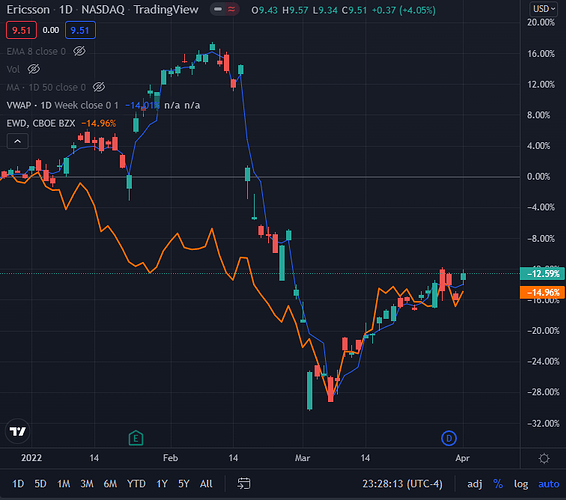

This is a developing situation so it is always risky, but prices dropped from $12.50 in mid-Feb after earnings beat (Jan 24) to $11 when the first reports of bribery came out, to $9.50 when a more detailed report came out. This is also where the timeline gets mixed with the Russian invasion, and prices plummet to $7.50.

Since though, it has been moving up with the Swedish markets (superposition with EWD - the Swedish ETF below).

Earnings probably creates a two-part story here:

- Up to earnings, it will probably track EWD. If we think Sweden will not see a shock in the next few weeks, this will probably drift up a bit.

- After earnings, it will depend on what is disclosed around the CEO’s future, the bribery scandal, and anything related to Vonage. If they don’t drop a bombshell or two, the earnings themselves should not disappoint. They did pretty well last time, and they are doing ok as a company.

Because I don’t know enough about the Swedish market or the specifics of how the bribery scandal will play out, I’m going to stay away from trying to price those things.

However, what I do feel though is here’s this behemoth of a telecom infrastructure company valued at 31B, on 230B of revenue and 20B of income that will continue to be a key player in the 5G economy. The factors that made prices drop 33% should not translate to body blows over the long term, and so it should recover over time.

So will probably get a starter position before earnings, and then top up if earnings go well. And then hold for the long term. If ERIC tanks after earnings though and I get stopped out, then it goes on the watchlist for later.

I opened a position in for the April 14s today.

Weak markets allowed for Jan 20 2023 10C fills @ $1 per.

And now we wait for the Swedes to deliver.

This topic was automatically closed 3 days after the last reply. New replies are no longer allowed.