Probably lots of people have seen me trading futures at night, mostly because my day job has been a nightmare and I don’t want to lose the skills I’ve been building over the past two years. Just wanted to give you guys some observations, some tips, and just the things I do to make sure I’m not fighting with Chinese news drops or new Russian aggression waged against an ocean or some other shit.

Couple things I definitely keep in mind as I’m trading futes:

- News is still important and Economic Calendar is your friend. Just look for two and three star events regardless of country and try to avoid trading during those times.

- Volume is low, so technicals are your friends. I personally like to use a blend of RSI, VWAP and PSAR when making decisions on how to enter

- Keeping your support and resistance simple is key. It’s a good practice many of you have developed or are developing during normal trading hours and the same applies here. Straight lines are king, anything else is pointless complex.

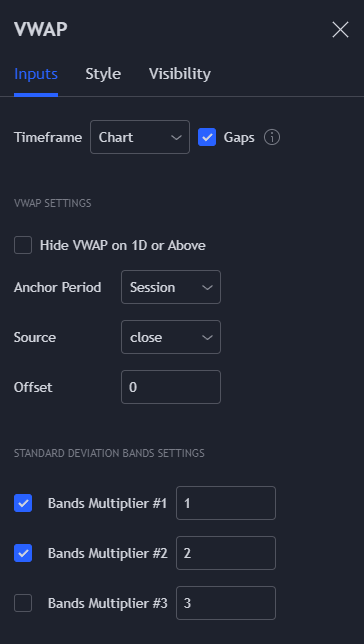

My favorite VWAP settings through Trading View are here:

I’ve found that most stocks tend to stick within two standard deviations of the volume weighted average, so if you do that you can kind of see where ranges are likely to form while you’re trading. This works well for SPY/SPX during the day as well.

RSI I like with EMA, standard 14 interval length and based on open.

PSAR I literally don’t touch when I turn it on, I just use the defaults.

I look for a few things when I’m trading off of these technicals:

- Which band of VWAP am I within, and am I near the bands or somewhere in the middle

- What is the general direction that the trend is moving, and if it’s not clear just by looking at it, which Std Dev band has it spent the most time in

- Have I seen a swapping of position of the RSI and MA lines on the RSI chart recently that would indicate a change in momentum

- Do I have telltale signs of a trend reversal on the chart in the form of bullish or bearish fractals (a v shape or a ^ shape maintained at multiple time intervals)

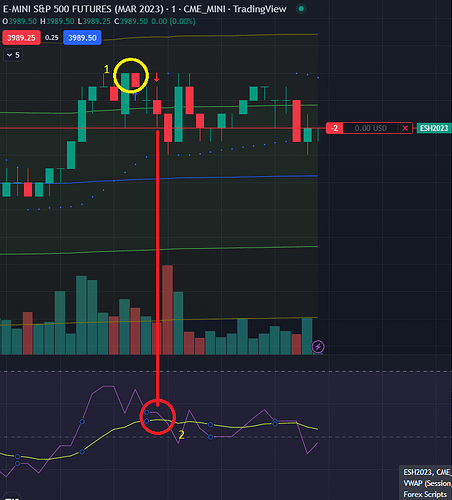

An example of a bad entry I took that I’m still in that shows where this falls apart sometimes is below. On this chart what I saw was 1) a bearish fractal in the form of a ^ shape on the chart and 2) a crossing over of the RSI line on top of the MA and to the bottom. This typically signals a change to a downtrend and was what I was expecting. I did that get motion eventually, but it took longer to get there and a couple points made it scary.

I’ll keep posting stuff when I have more thoughts on the matter, just wanted to let you guys know what I’m up to rather than just blasting the trading floor with callouts after hours.