Slightly off topic but I’m seeing a lot of recent mentions of IRNT having a catalyst associated with the squeeze. I don’t remember there being any when we played it and I’m wondering where this narrative came from.

Some support to the above that at least CBOE won’t extend the chain.

https://twitter.com/Spacul8r/status/1479499798965370886?s=20

People don’t understand gamma squeezes to put it simply. IRNT’s catalyst was the gamma, the only company related catalyst was their awful earnings.

The most hilarious thing was after the gamma squeeze people defended the company and said how the valuation at $10 NAV was great, etc.

Look at it now

In my opinion, they can get an extension. The way it works as far as we know is that options extensions are approved by the various exchanges that options are traded on. ESSC’s extension was requested and probably approved by CBOE just before they delisted the options. So we were left with those “phantom” 30 and 35 strike options visible because they were advertised but currently do not have an exchange trading them.

This means that when necessary, the MM’s for ESSC options can request the options chain extension from the exchanges still trading the options. So on our end, one day the options will just suddenly have a bid and ask.

So while that extension in December was definitely (obviously) blocked, I don’t think that they absolutely can’t acquire another one “at all”.

I can see that.

I think it’s still worth thinking through the what if other exchanges have the same rule scenario.

Maybe worth checking if the February and further extended options are trading on other exchanges, because if they are, I don’t see why they wouldn’t for January already, since that would mean they have already requested the extension there too.

Or do you mean there is potentially a simplified process where they only request it from CBOE, and others automatically extend based on their approval?

edit: looking into this a little further, I stumbled upon this:

https://www.miaxequities.com/alerts/2021/12/14/miax-exchange-group-options-markets-delisting-east-stone-acquisition-corporation

Meaning it’s not only CBOE delisting them, we just haven’t seen (at least 1) others. I’ll try to look for other exchanges too

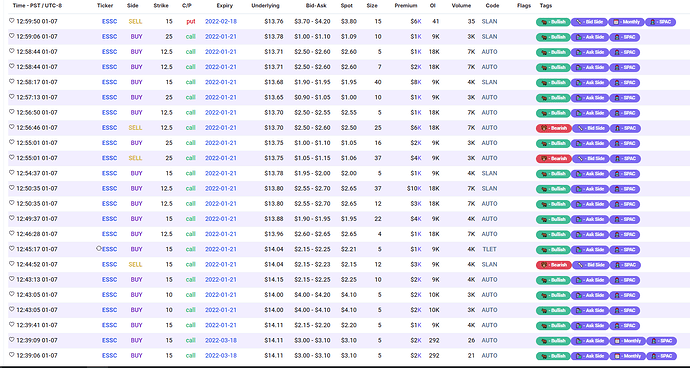

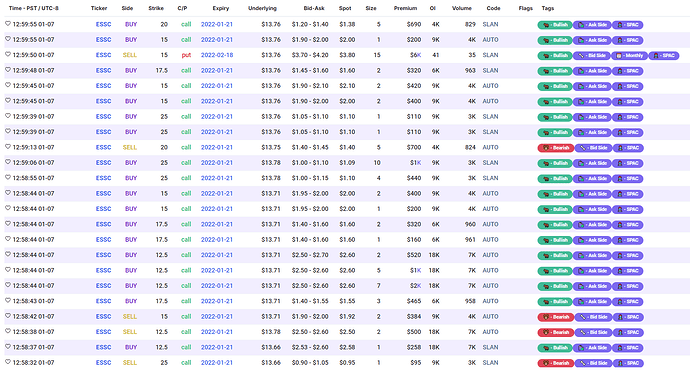

Pretty dang bullish

If we see OI increase on the 10s and 12.5s that should give a lot more confidence in this play. I’d imagine many had stop losses set on the 12.5s and 10s and yesterday’s drop shook them out and there could’ve been hesitancy to get back into due to wash sales (I get them but not an expert in them, feel free to argue otherwise). My thought is if OI increased on those then tons of people saw the buying opportunity then the canceling out of the stop losses that were hit with limit buys/postion entries is extremely bullish.

Here’s to a good Monday, didn’t realize it was Saturday.

Hitting the stop losses doesn’t necessarily mean a decrease in OI, other people could also be on the buying side.

Why is wash sale a concern? It’s beginning of the year and as long as you exit your positions by the end of the year (which is a given in this play) then everything will balance out? Do people think wash sale just means they NEVER get tax deductions on those losses? Because that’s wrong.

It’s only a problem (as mentioned earlier in this thread, I think), if you were planning on using those losses for the previous tax year, which is a situation that could come up now. If you were planning on using a loss from December, but then get back into the stock in January, before the 30 days are up, it’s no longer a loss you can deduct for the previous tax year (so you may end up paying more in taxes for that previous year). Of course, it will probably be a wash because your cost basis has increased for the current tax year, but it is something that might need to be considered if you had a substantial loss.

While people are talking about wash sales, I have heard that different strikes and expiries count as different assets. So if you took a loss on ESSC 12/17 $15s and then bought 1/21 $12.5s, it would not be considered a wash sale. This is my first year actually trading so I don’t have any experience with this but is this accurate or are any options on the same underlying in general considered a wash sale?

I’ve seen both. Your best bet is to ask an accountant.

If the options chain isn’t extended how would that affect the trajectory of the stock past $25?

In this scenario the stock would run until the options prices increase enough to cut buy volume/induce enough profit taking and reverse gamma. There was a recent example of this but I’m blanking on the ticker.

GWH but it never really pulled back much that day. Just ran forever

I like the sound of that

CPA here and also to confirm from a quick google:

“Buying another call option on the same stock within the wash sale period may be viewed as a wash sale even if the new call option has a different expiration or a different strike price. The IRS might assert that you have a wash sale if you buy XYZ stock, especially if the call was in the money when you sold it.”

Tldr; it’s all the same asset no matter the strike, not worth trying to get around this.

Would buying a put (not recommended) qualify as a wash sale?

From my quick Google, it’s more about the direction you think the stock will go. Do shares and calls (at any strike) qualify as a wash because you’re being the price increases. A put is obviously a bet in the opposite direction so it wouldn’t qualify.