I’ve decided to open a new thread for this play to better track it in the coming days and to make the information a little easier to digest.

ESSC - IRNTwo.0?

ESSC is a SPAC that is taking a somewhat unusual path to merger. A vote occurred and during that vote a large amount of the outstanding shares were redeemed. At the same time, the merger date was pushed back to 2022-02-16T05:00:00Z. This means that it’s left with an extremely tiny optionable float for over two months.

After redemptions, ESSC has been left with just 340,000 shares in the float. Meaning, that just 3,400 options contracts account for the entire thing. For reference, IRNT had 1,300,000 shares in its float. Another point is that ESSC has not actually merged yet, while IRNT had. This means that there is no impending PIPE unlocks or dilution on the horizon until February.

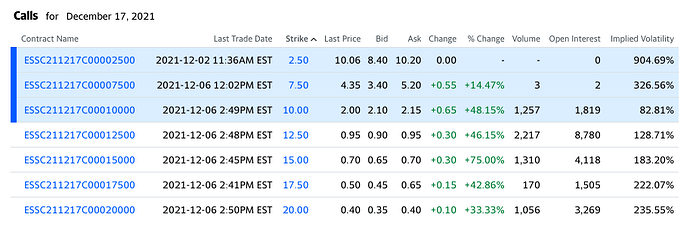

Let’s look at the options chain at the time of posting:

The current ITM OI is at 53% of float on ESSC. The $12.50 strike however, puts the ITM OI if it were to be crossed at 311% of float. This chain is already set up to run and it is in our opinion that it will probably do so in the coming days.

For complete transparency, this setup is better than IRNT but it is missing a key thing: sentiment. IRNT ran again because the sentiment had been drummed up enough to run it once. What we called on the second run was that a new setup had been created, the original authors of the DD had just exited their positions too early and the chain was left with enough OI to power a second run, which it was going to do on its own within a few days.

So knowing this, there is a universe where ESSC doesn’t do anything. We’re in this early and watching it, similar to how we were before IRNT and before BKKT. But for every one of those plays, as we all know, there are several more that don’t do anything. So if you choose to play this, take responsible positions, don’t FOMO, and wait for proper entries.

I’m going to try something new with this. This thread is going to be locked upon creation, which means that only upper-crust members can contribute to it. All posts in this topic I ask be informational about the play

I’m going to open a Chat on this topic and I ask that all questions related to this play be asked and answered there. If we do it right, I think this may be a really solid method of managing these threads since we can directly move useful contributions from members to the thread should they need to be added. ← Don’t pay attention to this yet, looks like closed threads can’t have chats. Uno momento.

As I stated earlier today, this play is my top watch at the moment. As always though, I’m playing multiple things and I definitely encourage everyone to still engage in the other topics in this form as putting all your eggs in once basket is retarded. I will keep this thread updated with thoughts and analysis and I ask that the upper-crust members do the same.

We might just have to set the table in Valhalla once again.