This signal is outdated, it has now been replaced with: ESSC - Fully Expanded Gamma Squeeze Signal

ESSC has met our criteria to generate a signal for an imminent gamma squeeze. Our conditions require that a stock have the following:

- Significant OI ITM

- Organic bullish momentum pushing the underlying towards a breaking point

- Increasing sentiment

- Enough of an established “ramp” to propel the price movement upward without additional buying as OpEx draws closer.

Considering the format change, I will state again that we have discontinued PTs. We find them to be generally harmful since traders focus on them and not the play for exits.

The Setup

- This is a pre-deSPAC play. ESSC had redemptions triggered before actually merging, therefore there is no danger of PIPE related dilution at this juncture. There is a risk of backstop investor dilution however which is covered below.

- The redemptions initially left the float at 340K, however, with a confirmed sale by one of the SPAC’s backstop investors, the float rests at ~1,100,000 shares. For sake of our calculations, we’re using a slightly larger figure than this to provide padding, our float is 1,500,000 shares.

- ITM OI is at 60.5% of float (up from 54.9%), the $12.50 bring it to 169.7% (up from 157.7%) and the whole chain is up to 264% (up from 239.6%)

The Backstop Investors

There has been a lot of debate about backstop investors and what they can and cannot do. Here is a completely clarified rundown after our thorough review of the filings:

- Backstop investors can sell per the agreements, this means there are potentially ~2M shares that can be sold.

- One investor did sell during the run in early December (not the $26 run), however, there is currently no evidence other investors have.

- If backstop investors sell, they can require shares from the trust account in the first instance. This means that they can only sell their shares one time and have a “get out of sale free pass”, the second time they sell, they are required to purchase back the shares before the meeting at the market.

Our take on this is that while backstop investors could sell we’re unsure whether or not they still can. That is to say that if the rest of the 2M shares weren’t sold during the $26 run, it’s likely that there is a reason backstop investors cannot sell their position, the most likely scenario (and what we believe to be true) is that the positions are already boxed, meaning they’ve shorted at market and plan to cover with the shares they’re already holding post merger.

Wrapping Up

This play is very risky so only partake with money that you can afford to lose. We can be wrong, we have been wrong.

Updates will be posted to this thread every morning and evening until we believe the play is over at which time we will call an end.

Good luck and godspeed gentlemen.

71 Likes

Evening Update #1

Today we saw continued confirmation of an imminent gamma squeeze. We currently anticipate that the ITM OI will open tomorrow significantly higher than it opened today and that another move upward is extremely likely. We are confident that the expected move has not happened at this point.

Will update tomorrow morning when OI numbers are available. Have a good night.

60 Likes

Morning Update #1

Today the chain looks as follows:

| Strike |

OI |

Change |

%Change |

| 10c |

10491 |

+1586 |

+17.8% |

| 12.5c |

17027 |

+658 |

+4% |

| 15c |

6382 |

+1248 |

+24.3% |

| 17.5c |

3306 |

+163 |

+5.2% |

| 20c |

2777 |

+148 |

+5.6% |

| 22.5c |

1186 |

+289 |

+32.2% |

| 25c |

4621 |

+2279 |

+97.3% |

ITM OI is at 184.3% of float (up from 60.5%), the $15 bring it to 226.8% and the whole chain is up to 306.1% (up from 264%)

After crossing the 12.5 strike as projected yesterday, ITM OI has rapidly increased with sentiment leading us with over double the ITM OI today at open that we had yesterday. We’re seeing the OTM volume spread throughout the strikes creating a fairly robust ramp and the entire chain is now 3X our “safe” projected float. Today’s slight gap upward is a good sign and we’d expect continued upward momentum today and continued accumulation of OI.

More this evening.

28 Likes

Evening Update #2

Well that was a fun day. The low volume drop today offered a solid buying opportunity, as stated in my updates I believe this was most likely someone with a poorly set stop that was triggered. The day of consolidation was unexpected, but not out of the norm. As I highlighted on Twitter, IRNT famously had a red day before it’s run and I think anyone who tracks these movements is aware of the nightmare ride that plays like GME and AMC were.

Gamma squeezes are an event where you’re waiting for buy volume from a certain entity. Absent the buy volume, the stock will move a bit erratically. What matters at this specific juncture is holding over the 12.5. Days like this are typically good for these movements as they offer better entry points for traders looking to get in while not losing enough value for a substantial amount of positions to be offloaded. The end result is a quick “breather” which allows for a little more accumulation of OI before the run.

The underlying rallied in the later day and closed near support of around $13.30 and options volumes remained bullish. We’re thinking that we’ll either see OI close to or higher than yesterday at open tomorrow. Per our estimates, if that’s the case, a run should be triggered over the 15 strike. This play is still absolutely an imminent squeeze.

This is a really interesting play given the amount of time still remaining until expiration and how jacked the chain already is. Should the accumulation keep even half its pace, this could get crazy pretty fast.

Curious to see the OI tomorrow at open, will update when it’s out. Have a good night.

51 Likes

Morning Update #2

Today the chain looks as follows:

| Strike |

OI |

Change |

%Change |

| 10c |

10083 |

-408 |

-3.9% |

| 12.5c |

17172 |

+145 |

+0.9% |

| 15c |

7276 |

+894 |

+14% |

| 17.5c |

4509 |

+1203 |

+36.4% |

| 20c |

3638 |

+861 |

+31% |

| 22.5c |

1546 |

+360 |

+30.4% |

| 25c |

6528 |

+1907 |

+41.3% |

ITM OI is at 182.5% of float (down from 184.3%), the $15 bring it to 231% of float (up from 226.8%) and the whole chain is up to 339.1% (up from 306.1%)

Impressively yesterday saw ITM OI drop negligibly, but still increase substantially throughout the chain. These movements are pretty common and somewhat necessary to further establish a ramp. This play still has a lot of time left so some consolidation could be expected.

21 Likes

Evening Update #3

Today saw consolidation as we expected. The underlying is firmly holding above the 12.50 strike as it trades sideways. Options volumes indicate that we will see another substantial whole chain OI increase tomorrow and that ITM OI losses are again negligible.

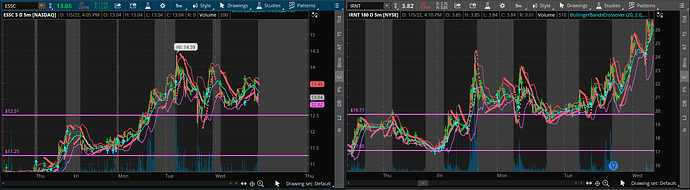

This play is fast approaching “go time”. The chain is adding meaningful OI day after day and most of the volumes are concentrated in areas that are already ITM or near ITM. This time is extremely reminiscent of when we made a callout for IRNT. We’d watched it make extremely similar moves to this with a completely loaded chain and then suddenly it just popped off as most gammas do:

A lot of retail gets shaken out during boring days because they think “it’s over” simply because a stock has stopped moving, when this couldn’t be further from the truth. Gamma movements are propelled by hedging which is not always immediate. So the underlying will usually do a bunch of random things while waiting for that buy volume to eventually come through.

I can confidently say at this point that at face value, this setup is better than IRNT when we called it on /r/wallstreetbets in September:

https://www.reddit.com/r/wallstreetbets/comments/pnff3b/irnt_gamma_squeeze_with_213_of_float_claimed_by/

Back when this was posted, every single one of those Twitter/Reddit “DD” guys we all love was in my inbox or in that post telling me “it’s over, give up”. Those same people are now listing IRNT as their “own callout” after having been wrong about the movement everyone remembers.

Time to set the table, we’ll soon dine in Valhalla.

64 Likes

Morning Update #4

| Strike |

OI |

Change |

%Change |

| 10c |

9739 |

-344 |

-3.4% |

| 12.5c |

17875 |

+703 |

+4.1% |

| 15c |

7363 |

+87 |

+1.2% |

| 17.5c |

4954 |

+445 |

+9.9% |

| 20c |

3677 |

+39 |

+1.1% |

| 22.5c |

1556 |

+10 |

+0.6% |

| 25c |

7035 |

+507 |

+7.8% |

ITM OI is at 184.9% of float (up from 182.5%), the $15 bring it to 233.9% of float (up from 231%) and the whole chain is up to 348.8% (up from 339.1%)

Today we’ve seen the resumption of building ITM OI. As I’ve said previously, considering how early this setup is developing, this is an absolutely incredible amount of ITM OI accumulation. At this juncture all that is needed is time. Sentiment can speed up the process, but regardless, even at or below 12.50, this runs before OpEx. I think we genuinely have one of those plays that people will reflect back on with regret over having missed the absolutely massive entry window and neon sign saying it’s going to run.

38 Likes

Evening Update #4

Moon. That’s it. That’s the post.

84 Likes

Morning Update #5

| Strike |

OI |

Change |

%Change |

| 10c |

9622 |

-117 |

-1.2% |

| 12.5c |

17504 |

-371 |

-2.1% |

| 15c |

7363 |

+1211 |

+19.7% |

| 17.5c |

4954 |

+445 |

+16.5% |

| 20c |

3906 |

+229 |

+6.2% |

| 22.5c |

1798 |

+242 |

+15.6% |

| 25c |

8530 |

+1495 |

+21.2% |

ITM OI is at 181.5% of float (down from 184.9%), the $15 bring it to 238.6% of float (up from 233.9%) and the whole chain is up to 373.4% (up from 348.8%)

Slight decrease in ITM OI but another substantial jump in overall chain OI. Again, we’re incredibly far from OpEx on this so seeing this much accumulation throughout the chain is insane.

Also, commenting on caddude42069’s post real quick: HE DOESN’T KNOW WHAT HEDGING IS LMAO. That is all. This is a legit play and if you don’t understand that, oof.

38 Likes

Evening Update #5

We are the ones who knock.

Friday, our community showed that we are not to be trifled with and by extension that we will not let the retail community continue to be harmed by false prophets enriching themselves from the misplaced trust of average traders. We all watched, in plain sight, as someone made a selfish and coordinated effort to derail a popular play because of their own pride and the benefit of their own pockets. They failed.

This week, all focus is on ESSC which remains an incredible gamma squeeze setup that gets crazier with each passing day while most of retail is still asleep at the wheel. I believe that this week, the hype momentum will pick up dramatically heading into OpEx.

Tomorrow will see the resumption of our normal updates on the signal. OI is expected to have grown once again and with the stock on short sale restriction (SSR) the skies are clear. In fact, you can almost see Valhalla. Don’t worry, we’ll be there soon.

See you guys in the morning.

64 Likes

Morning Update #6

Apologize for the lack of updates yesterday, had a personal emergency.

IMPORTANT UPDATE

Yesterday was a big day for this play, in not only what was filed, but in what wasn’t filed. Yesterday an updated preliminary Proxy was filed which indicated, well, nothing new besides confirming that the merger is unlikely to go through before OpEx (which was already known). However, the bigger part was that there wasn’t any filings indicating Backstop Investors sold on the $26 run (yesterday was the deadline). So what this confirms is:

- The float is actually 1.1M at this point

- The assumption that the remaining Backstop Investors won’t sell (because they’re legally and contractually unable to) is correct.

- You can infer that if the other Backstop Investors are holding, SeaOtter likely is going to have to reacquire the shares they sold at the market and before the meeting (soon).

So with this said, the final pieces to the puzzle are in place. We’re a week and a half out from OpEx with rapidly accumulating OI and now have confirmation that this float is smaller than IRNT’s with more OI than IRNT.

So, given that we have confirmation that the float is 1.1M, we’ll be using that float calculation for our numbers from here on out, so with that in mind they are:

| Strike |

OI |

Change |

%Change |

| 10c |

9664 |

+83 |

+.9% |

| 12.5c |

17673 |

+12 |

+0% |

| 15c |

9364 |

+188 |

+1% |

| 17.5c |

6087 |

+107 |

+1.8% |

| 20c |

4045 |

+103 |

+2.6% |

| 22.5c |

1728 |

-70 |

-3.9% |

| 25c |

9682 |

+357 |

+3.8% |

ITM OI is 230.3% of the float. The 15c makes it 333% of float and the entire chain accounts for 489.9% of the float.

We’re now fast approaching “go time”. This is the exact same point where we picked up on IRNT, which was a week before it ran to $60 between Wednesday and Thursday the week of OpEx.

More soon.

62 Likes

Morning Update #7

| Strike |

OI |

Change |

%Change |

| 10c |

9690 |

+26 |

+.3% |

| 12.5c |

18094 |

+421 |

+2.4% |

| 15c |

10110 |

+746 |

+8% |

| 17.5c |

6194 |

+107 |

+1.8% |

| 20c |

4089 |

+44 |

+1.1% |

| 22.5c |

1750 |

+22 |

+1.3% |

| 25c |

9998 |

+316 |

+3.3% |

ITM OI is 253.2% (up from 230.3%) of the float. The 15c makes it 344% (up from 333%) of float and the entire chain accounts for 545.4% (up from 489%) of the float.

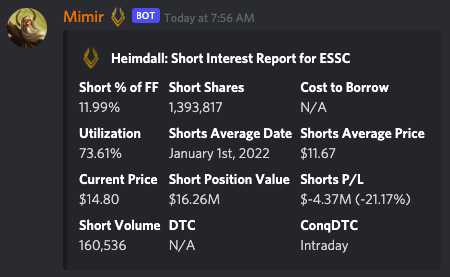

We’ll be tracking a new metric today which is SI % of free float. Keep in mind that SI sources are using an incorrect float estimate that doesn’t properly account for BI investors, so we’ll be manually recalculating the figure:

SI has seen another significant increase overnight. SI is now 126% of free float (up from 27%)

I think it goes without saying that we’re now seeing the process pick up steam heading into options expiration (OpEx) as predicted. With each passing day, hedging requirements and buy volume will continue to propel the stock upward creating the chain reaction which culminates in a gamma squeeze. ESSC is progressing faster and to a much greater extent than IRNT did and retail still has largely not picked up on it. This one is wild.

39 Likes

Update #8

- ITM OI is 340% (up from 253.2%) of the float. The 17.5 makes it 399% and the entire chain accounts for 550% (up from 545.4%) of the float.

- SI is at 198% (up from 126%)

After closing above the 15 strike yesterday, ITM OI has seen a massive +100% jump today alongside short interest which has also gone up 72%.

Everything we’re seeing is absolutely in line with a gamma movement happening incredibly soon. Next stop, FOMO.

34 Likes

Update #9

- ITM OI is 332% (down from 340%) of the float. The 17.5 makes it 392% (down from 399%) and the entire chain accounts for 559% (up from 550%) of the float.

- SI is at 197% (down from 198%)

After yesterdays day of consolidation when “IRNT would’ve been down 12%”, I’m not at all surprised to have see OI across the chain increase once again. There are negligible amounts of “rolling” (selling off ITM strikes in favor of OTM ones) but that is normal in these movements since retail likes to get a little greedy.

ESSC has a more loaded chain than IRNT did after it hit /r/wallstreetbets heading into next week. Insane.

35 Likes