Today I achieved a personal trading goal of mine and wanted to share with the community to encourage those who are in a similar situation I was in, give thanks to plays I’ve used, share lessons I’ve learned and things I am still working on.

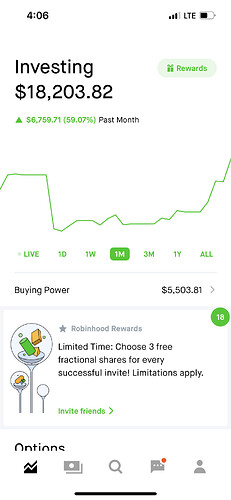

At end of market trading today I have fully recouped all losses from ESSC and have a higher account balance than before. All in all from my bottoming out at $2341.95 it took 18 Trading days to get here which feels like both an eternity and incredibly fortunate how fast it went.

How I did it

I would not describe myself as an amazing trader by any stretch of the imagination but I mainly did this by reading and following plays on both the Trading floor and the forums which I like to frequent and read up on. If you are struggling to find plays in the Trading floor because it is moving too quick I suggest using the forum for popular plays and using the search bar for tickers mentioned to quickly get up to speed.

Trades I successfully played by myself were mainly TSLA day trade scalps. One of the things that this community has encouraged me to do is to actually look at the underlying aspects that make a stock move. What I discovered was that TSLA really responded when the RSI went below 30 and MACD was above -1.00 this generally signaled a good time to buy.

Trades I followed

Shoutouts to some of the following traders whose plays I followed:

@No_Bags_No_Swag for the ASTR runup play which was a nice 20%

@cbohouston for the original SST DD that I was able to follow as well as @Kevin for the TF post around 5Rivers pumping that allowed for me to time my entries and exits for a 40% gain

@Mr_L for the trading floor callout of NVCT. Idk if anyone was expecting over 100% gains but sometimes its better to be lucky than smart.

@SuckyMayor for the earnings callouts which helped me hedge against some of my own plays and minimize losses.

Lessons Learned

This community is all about one thing which I love: Taking Profit and that’s one thing I have really learned to do. If its good enough to brag about its good enough to sell.

Be ok with singles and doubles:

Not every play or callout will be 100’s of % gain and its better to accumulate 5% wins over time rather than holdout for the hopes of retiring on 1 play. I’ve tried to set a goal of 10% account gain per week when I was at my lowest dollar amount. That helped me mentally break it down to 3 day trades where 3% was the goal rather than trying to hit 50% every time.

Don’t Trade what you don’t know:

Part of what I tried to do and failed was play strategies I didn’t really understand. Specifically Calendar Spreads on earnings. I didn’t understand the magnitude of IV crush for earnings and got burned for it. Trading both Stocks and strategies you are comfortable with will give you the best results.

Don’t Over Trade:

Probably the most critical lesson I learned is not to overtrade. there were several days when I was up big only to enter a trade without thinking it through and then proceed to lose most or all of my gains. Minimizing my number of trades drastically improved my performance and it will be a lesson I keep with me.

I wrote this post because everyone who is active in this community can have similar if not better gains than I have had if they learn the same lessons I did and to genuinely thank @Conqueror for the community he’s built and the other great traders that I’ve gotten to learn from. Anyone who is following his challenge should focus on the DD that he’s following and learn the same trading discipline he displays rather than copy the moves.

For me: my next goal is 30K which represents the amount needed to have unlimited day trades as well as a 5k day trading limit. I’ll update on progress as it comes but I am more interested in seeing others achieve even greater success in the future.