Oh hey guys, we’re back. ![]()

Given the recent announcement of another vote on the extension of the merger, we’ve reviewed the filings to catch up on the progression of this setup.

Catching Up

For a quick overview of the most recent filing, you can see @tedro’s comment here:

For a long form DD on the setup you can see my “Expanded Signal” from run #2 here:

Our Analysis of the Filings

To sum it up briefly, we believe everything has remained the same.

- The float is still somewhere between 340,000K and 1.19M shares.

- We don’t expect any further dilution as everything still points towards the remaining BIs being incentivized to hold.

- We still believe SeaOtter will have to reacquire their position before the Business Combination Meeting. However, they also may still have to reacquire before the extension meeting as well to prevent those shares from being redeemed.

- The most recent filings provide founders shares to the BIs which cannot be sold, but there is language to prevent them from selling them anyway so

This extension meeting makes this setup even more interesting considering it essentially means that this ticker will remain a hyper small float optionable stock for the foreseeable future. The reason for the extension was I think correctly highlighted by @The_Ni, which is essentially that there is some regulatory red tape that they don’t anticipate being able to clear before the merger.

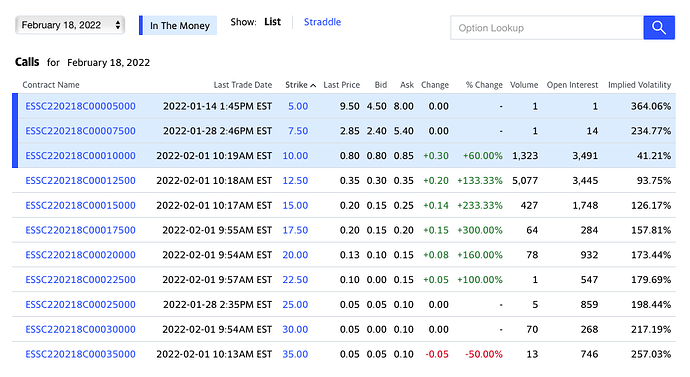

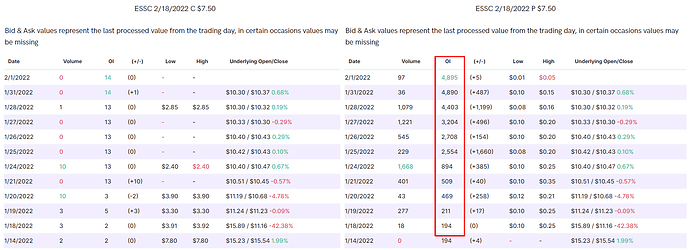

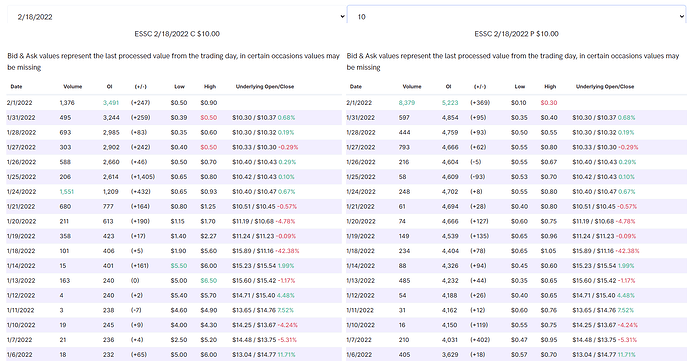

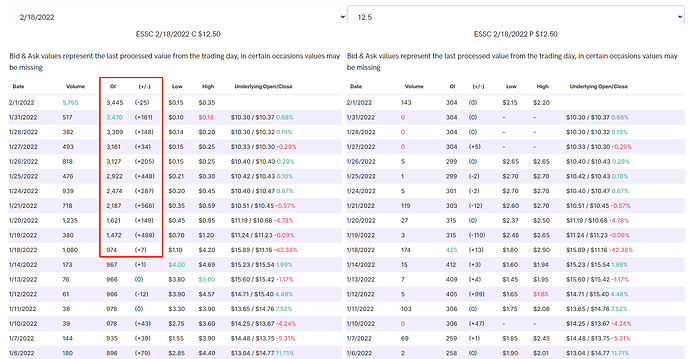

The Chain

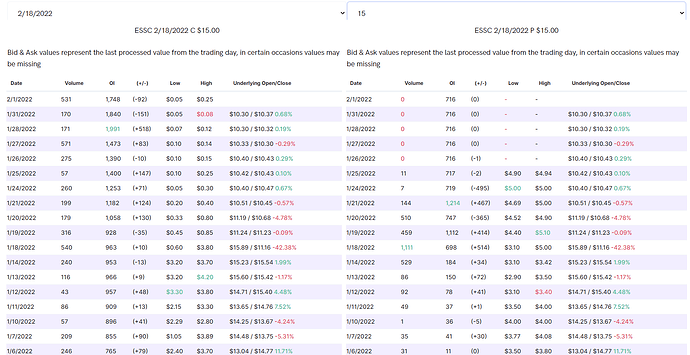

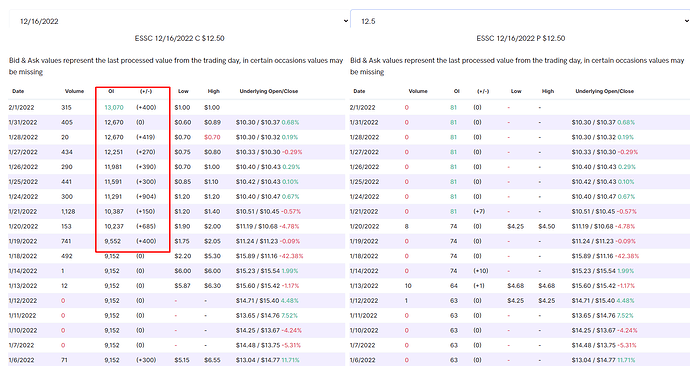

Currently ITM OI rests at 29% of float (using 1.19M), becomes 58% over the 12.5 and the full chain is 104%.

While there are the beginnings of a ramp, and the OI will undoubtedly open higher tomorrow. There presently isn’t a prime setup at the moment. I would expect some further consolidation and accumulation before anything would come of this. For this reason, as of this posting, this is only a watch. We’ll begin covering the OI updates in this thread again and should a meaningful setup develop, we’ll acknowledge it here as well.

So with all of that said, if you choose to take part in a potential 3rd run, don’t over leverage yourself and don’t rush to buy your options right here or you’ll just be running up the entry prices for each other and will get shit fills as a result. Slow and steady wins the gamma squeeze.

Reminder

Remember, things are a bit different this time around. Members of Valhalla are actively discouraged from discussing our plays and DD on other forms of social media such as Reddit and Twitter. These plays develop organically on their own and we’re just along for the ride.