[Ported verbatim from: The dirty dozen of bloated tech - a short story - #7 by The_Ni]

Earnings on: Mar 03, post-market.

Another one of those game-changer type of solutions that made search over large, distributed datasets feasible, and is seen almost as “infrastructure.”

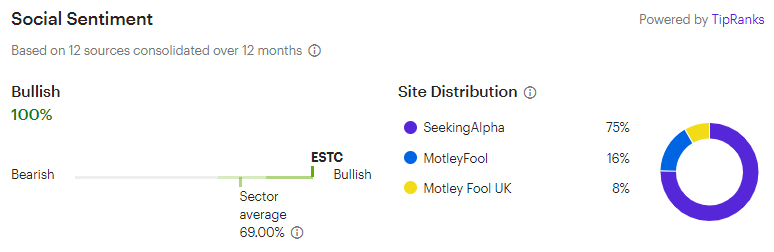

The usual stuff applies here too - sentiment is even better than ZS and PANW.

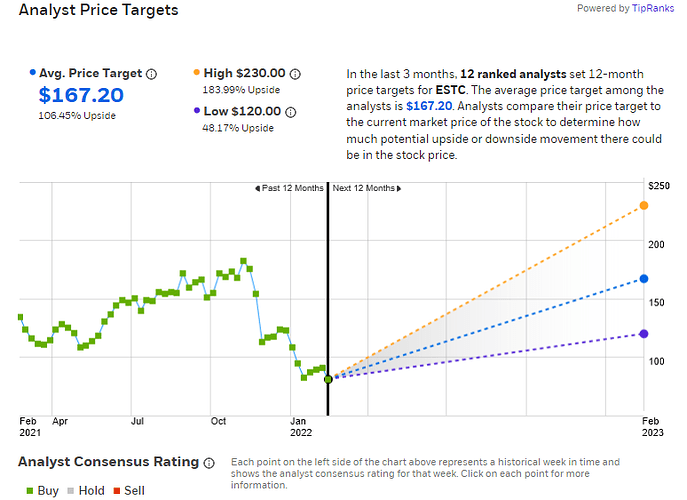

And even the lowest PT from analysts has a 48% upside.

And the commentators love, love, love this stock: Elastic N.V. (ESTC) Stock Price, Quote, News & Analysis

Yet, the market has punished ESTC’s stock price quite a bit, bringing its P/S to ~10.

Weird, right?

Well, there are three flags that showed up for ESTC:

-

ESTC won a copyright infringement lawsuit against AMZN last Wednesday, forcing AMZN to change the name of its forked ElasticSearch offering to OpenSearch. Normally, this should be bullish news, yet the stock price didn’t even flicker upward one bit.

-

About a month ago, they promoted their Chief Product Officer to CEO, and the CEO became the CTO. In itself, this is not a bad thing. Most companies do not do the founder-CEO thing too well for too long, and bringing in someone better suited for a maturing business is a good thing. The markets did not like this though, and prices fell for the next 10 days. Now, all tech spaces were falling during this time too, so hard to separate the two. At any rate, the stock price did not respond positively.

-

It turns out their product has some challenges. Now, every complex product needs some RTFM and getting hands dirty, and ESTC’s products are at the apex of their area of service. However, in these discussions others usually pitch in and balance the discussion out. That balance is missing here. To the extent that there are other competitors out there, like Solr, retention cannot be taken as a given. Although to be fair, the search that is at the heart of systems is harder to replace than other components.

Having built up this bear thesis, imagine my disappointment when I realized that liquidity in their March options is terrible. Grr

Interestingly, there seems to be a 3K OI 95/125 call spread for the April opex.

Can we tell if this is a bull or bear spread?

In summary, this feels like one that could have some more innate downside to it.