Retirement can be defined as achieving financial independence. It is the stage in life when one chooses to leave the work force and live off sources of income or savings that do not require active work. The age at which a person retires, their lifestyle during retirement, and the way they fund that lifestyle, will vary from one person to the next, depending on individual preferences and financial planning.

Retirement is actually a relatively new concept, as a little over a century ago, people regularly worked until they died (life expectancy was much lower and there was no such thing as a pension plan / 401k / social security. (Please note this will be US focused as I’m not knowledgeable enough about how retirement works in other countries.)

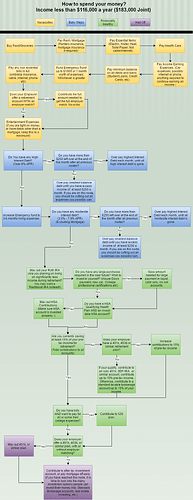

For the majority of people, this flowchart will get you on the financial independence path:

If you made it to the green section in the flowchart, congratulations! You finally have enough money to start investing (outside of a 401k).

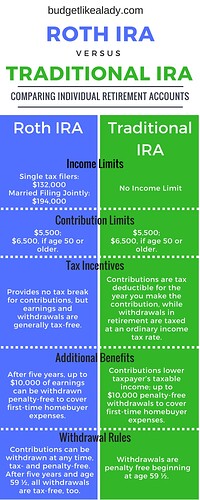

There are two types of IRA: the traditional IRA and the Roth IRA. Though their goals are similar, traditional and Roth IRAs differ in some key ways.

The traditional IRA allows you to contribute a portion of pre-tax dollars. That reduces your taxable income for the year while setting aside the money for retirement. The taxes will be due as you withdraw the money. The Roth IRA allows you to contribute post-tax dollars. There are no immediate tax savings, but once you retire, the amount you paid in and the money it earns are tax-free.

If you withdraw money from a traditional IRA before age 59½, you’ll pay taxes and a 10% early withdrawal penalty. You can avoid the penalty (but not the taxes) in some specialized circumstances like when you use the money to pay for qualified first-time homebuyer expenses (up to $10,000) or qualified higher education expenses.

Unlike a traditional IRA, you can withdraw sums equivalent to your Roth IRA contributions penalty- and tax-free before the due date of your tax return, for any reason, even before age 59½.

Here’s a chart for visual learners (the numbers in the chart are $6,500 for the contribution limits in 2023):

Using myself as an example, I want to retire at 52. As my retirement funds aren’t accessible without penalty until a number of years later, I spend a lot of time focusing on growing my taxable brokerage account and my Roth IRA.

I tend to lean toward long term holds in the taxable account so they grow until I need them, so it tends to be heavy VGT, MGK, and VO, and a LOT of individual stocks that I bought at a low cost basis (XOM, MCK, MAR, MSFT) and a few deep in the red that I believe in (PLTR, SAVA). I also sell CSPs for either AAPL or TSLA in my Roth and if assigned wheel them.

I’d like this to be a discussion, so please feel free to share how you’re funding your retirement.