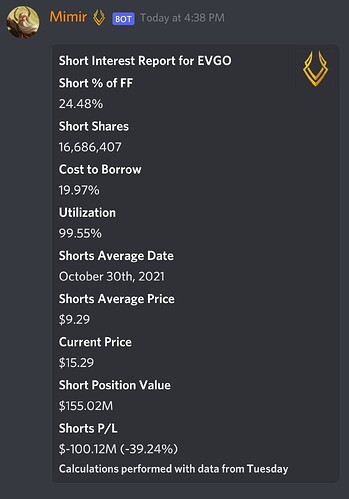

Starting thread to not forget this. Shares will be unlocked at the end of this month and a lot more in December. Buying puts at that peak last week would have been best but if it pops again I may start collecting puts, assuming the shares getting unlocked tanks the stock. I also think they are overvalued as everyone is getting ev and charger greedy. Read text in photo for numbers. Please chime in on how you think this will affect the stock.

Tripling the number of shares currently available should yank the stock price.

Buying puts around thanksgiving would be the okay, right?

I think it’s fairly clear that this stick is not going to stay at this level for much longer especially with this dilution that hasn’t been priced in yet. There could be another run or two before the lockup expires and buying puts on runup like that seems like a good strategy to me. Or it could just keep falling.

I’ve only ever worked with calls, when buying puts what PT’s should I look for? Like only a few dollars below the current or a bigger gap?

Can’t argue with this logic - keeping my eye out for entry point

So what am I missing?..I am looking at the Dec puts and there isnt much volume or OI and they are relatively cheap. Is this DD that much ahead of the curve? Waiting till holiday may be too late IMO. What say you?

Since a majority of the share lock ups expire late December, you probably want to look into the February Puts currently $10,$7.5 2/18/22 puts have a decent OI.

Is the short interest shown by Mimir a concern here? Like, if you bought puts now could it rip before the shares dilute everything?

Edit: wrong ss

utilization is probably gonna drop hard with dilution, so it will be easier for shorts to get out if it did go up.

also thats for GOEV not EVGO

I am still watching this as I would like a run up then some longer puts like mentioned for Jan or Feb as the share unlocking occurred December 28th. Watch as it also gets near the Nov 28 date too

Great call on this JB. I bought puts at the peak last week because I thought it was over extended and didn’t know about the lockup expiration; unfortunately mine are too far OTM ($11) and expire this Friday.

I am thinking about taking a position today JB. I am skeptical as there could be more room to run. Any thoughts?

I got in for Feb at $10 and up over 100%. Thinking about grabbing more for the late dec unlock.

it’s down so much, should we look for recovery and then go back in for dec unlock?

I never took a position and it already has fallen a lot. Maybe wait to see if it spikes up before share unlock but everything is falling so play May have already passed.

Anyone play this recently or looking at this. We should revisit this for good entry if we still think its a play due to shares unlocking and tripling the float.

Unlocks 12/28? I’m hoping for more of a run up before puts.

Been in these for a couple weeks now. It’s the top performing holding I have currently.

Feb. $10P’s don’t cost much theta and catch most of the rundown going towards the 28th. Will probably go out 1st or 2nd week of Jan. depending on how the share unlock performs.

I have been in since the original call out and got in more on the 12/9 pop. I should have took profits sub 10.30 and 10, but now I am looking to cash out all but a few if it gets near 9.30 thats my bottom pre 12/28 for a bounce.

I started adding puts each pop it gets to see how it plays next week. Glad this worked for most as I waited to long.