Overview of eVTOL sector presented by Raymond James.

![]() Electrification is the next advancement in aircraft technology.

Electrification is the next advancement in aircraft technology.

![]() Initially thought of by analysts as a science experiment that will take many, many years. However, the SPAC craze brought a lot of talent and money to this industry.

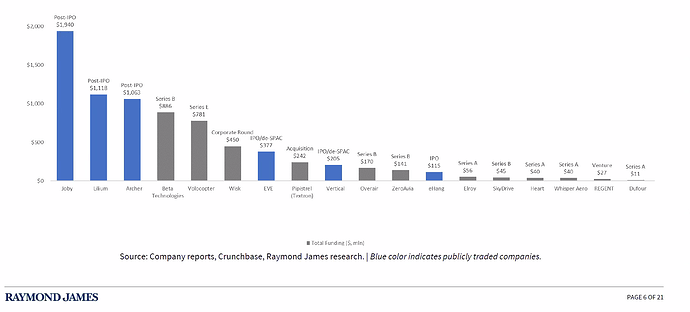

Initially thought of by analysts as a science experiment that will take many, many years. However, the SPAC craze brought a lot of talent and money to this industry.

![]() Cash flow positive for Joby not expected until 2029.

Cash flow positive for Joby not expected until 2029.

![]() Likely get to scale in regions outside the US (Sao Paulo, Middle East, etc.)

Likely get to scale in regions outside the US (Sao Paulo, Middle East, etc.)

![]() : The expectation is that each flight will need four pax for profitability, as 3 is likely to only get to breakeven.

: The expectation is that each flight will need four pax for profitability, as 3 is likely to only get to breakeven.

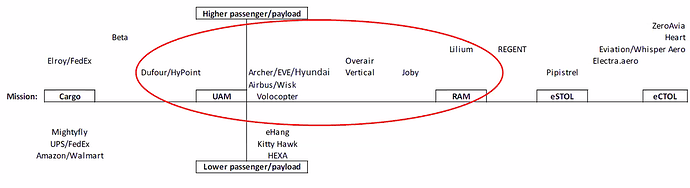

The focus of the presentation was on the manufacturers in the red oval, with emphasis on the publicly traded companies.

Capital boost:

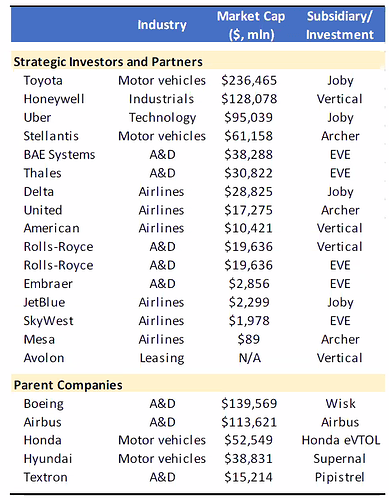

Strategic investors:

Lots of discussion on tilt rotor (the most complex - Archer, Joby, LIlium, Vertican, and Volopter Voloregion) vs. lift & cruise (unique thrusters for takeoff/landing and others for horizontal flight - EVE, Wisk, Airbus, Beta, Volocopter VoloConnect).

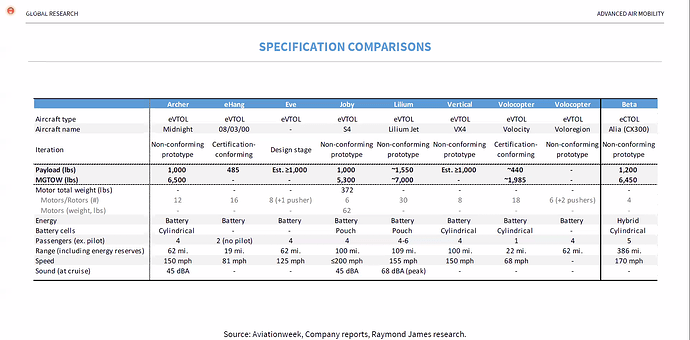

These are the goal specs, nothing is set in stone for any of them.

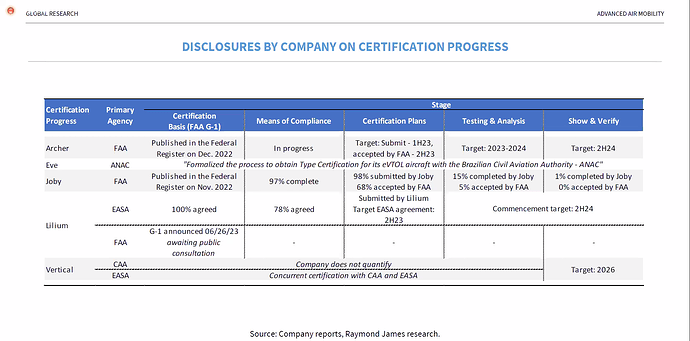

Timelines:

Production rates are expected to be quite low, for example, Ferrari made around 11,655 cars in 1Q22 - Archer, Joby, and EVE combined are estimated to build 5,417 in 2030.

In regard to who will be first to market, JOBY and Archer are further ahead than the others, but a lot depends on if FAA stays ahead of EASA for setting up regulations for this new type / authorizing additional takeout/landing sites, etc.

Most aircraft manufacturers (Boeing, Airbus, Embraer) require the buyers of the aircraft to pay predelivery payments (PDPs) years in advance of delivery (depending on the creditworthiness of the airline, 50-70% of the aircraft purchase price is in the manufacturers hands before the delivery.) Due to the way Joby is structured and plans to operate the aircraft themselves, they will not have the benefit of PDPs and will need to rely more on capital markets, compared to the other eVTOL manufacturers.

Personal thoughts:

I understand the desire for this market segment to be successful, but I’m not sure it will be without HUGE advancements in batteries (types, charging, and thermal runaway.) Personally, I would not feel comfortable flying or being a passenger on this type of aircraft. The tilt rotor concept is significantly more complicated than other engine types. I see the appeal of taking this mode of transport from a huge city to the nearest international airport (i.e., JFK, GRU, LHR), but having done that by helicopter, I don’t see the need to get off fossil fuels in the next 7 years.