Tl;dr Bullish on Brazil ETF, EWZ, because rate cuts are likely coming as inflation cools.

Carnival in Rio is going to take place in Rio in Feb 2024. There’s a good chance we might see excitement in the Brazilian stock market by that time too.

Here’s the train of thought behind being bullish on EWZ:

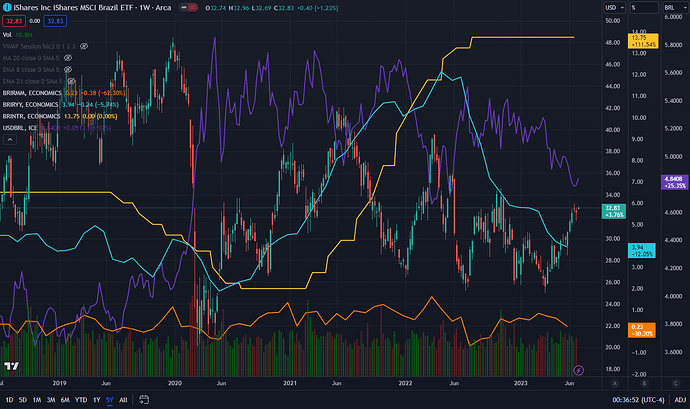

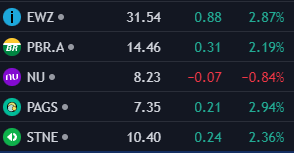

- Brazil’s markets are doing quite well, after the Lula election scare. (barchart in image below)

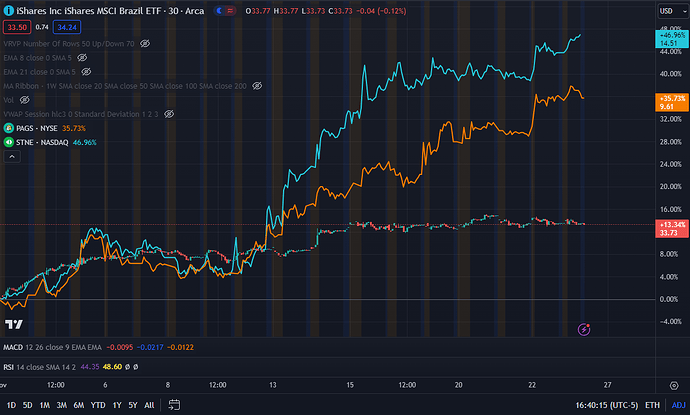

- Brazil started the year with high inflation, but has been able to bring that down recently. (YoY is teal, MoM is orange)

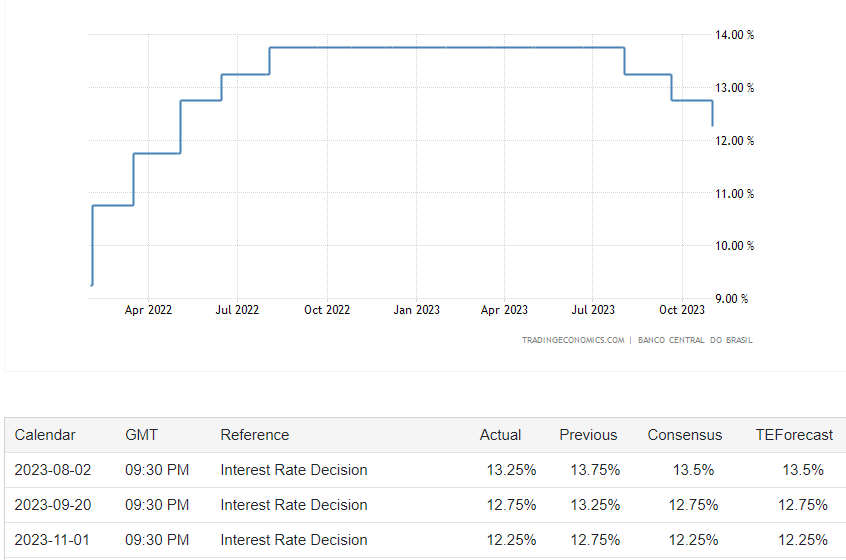

- This has largely been due to their interbank rate, Selic, being at 13.75%, and holding (yellow line)

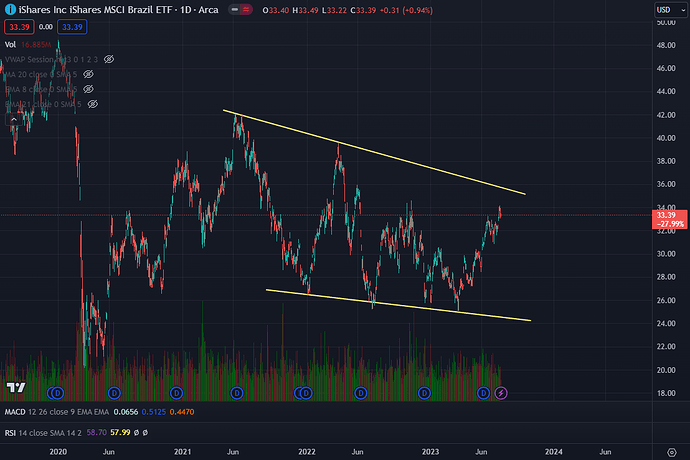

- We know when lending rates fall, markets moon. There is chatter of the Selic being cut as soon as August. And next meeting is early Aug.

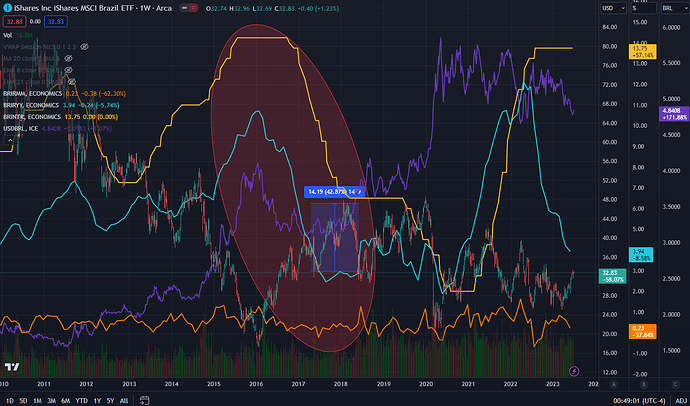

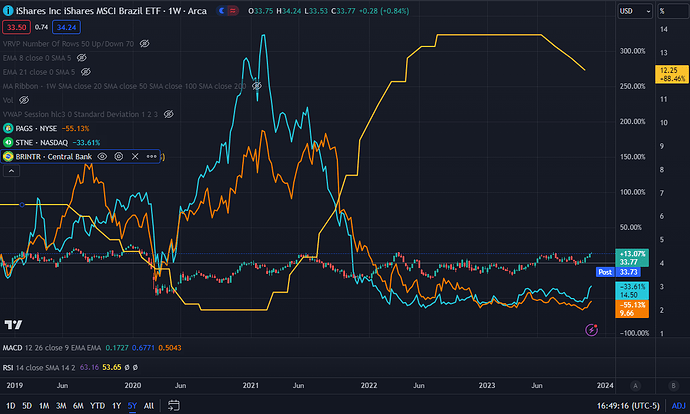

We have see this play out 7 years ago, when markets went up ~40%:

Two confounding macro factors to this:

- The Brazilian Real (BRL) appreciating depresses the EWZ, and depreciating makes it go up. It is depreciating right now, so working in favor of this play. I know f*ck all about BRL, so won’t guess where it’s going in the future, though will note that as interest rates go down, currencies tend to fall, so feel like the core thesis is bullish with regard to BRL.

- A significant chunk of Brazil’s GDP, and fate of listed companies, is tied to commodities. That’s been working out well for Brazil so far, but if there is a global recession, this could hurt EWZ a bit. Long term though, there usually is a commodity upcycle on the other side of recession, so eventually this should be bullish.

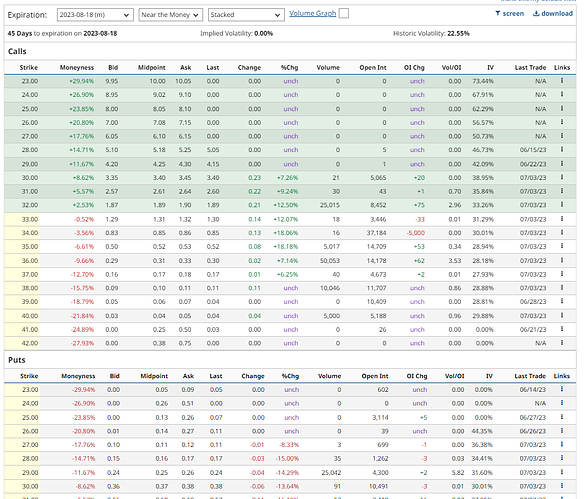

And one option-based encouragiing sign - folks bought up a brickton of calls for Aug 18, along with 25K puts that are likely a hedge:

Incidentally, EWZ also pays a decent 8-9% dividend, based on recent returns.

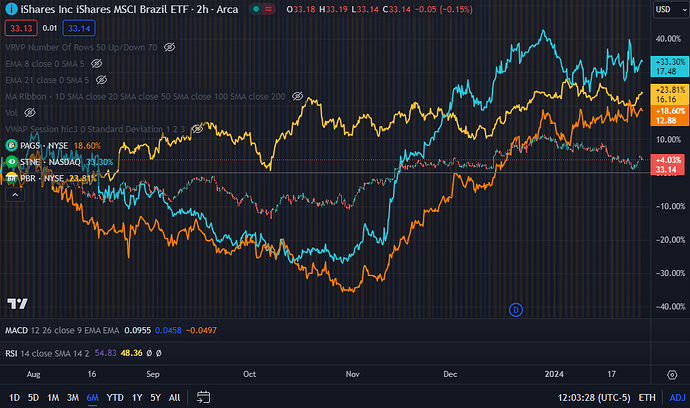

This does cause some overlap with PBR, which I’ve been playing separately, but will ignore that for now ![]()

Finally, may hedge a bit of this with 18th Aug puts in case stock falls to $30, which will where I’ll have the stop.