TLDR: not to rub it in anyone’s face, but here’s a suggested outline for how to cover cost-basis and come out green on server-wide play.

Didn’t know where this fit, was gonna put it under Conq’s “Strong Hands” or glick’s “Gamma Squeeze”? But I saw lots of comments during ESSC#2 where members were asking about exit strategies. I thought I would start a thread that we could build on to help each other out.

Every server-wide play allows us to reassess, refine, and rediscover our trading strategies. While there are a lot of big accounts in Valhalla, ESSC#2 has shown me that there are a lot of people who have small trading accounts like mine (less than 5k) might benefit from laying out a framework for playing server-wide squeezes. This thread is very mechanical - and trading should not be - as you have to account for changes in the market and adjust quickly and accordingly.

I’m not claiming to be experienced, or even a good trader, but I thought this would help some of us visualize exactly how we could have executed this trade. I didn’t even follow this play on ESSC#2 and came out less green (but something close to this) then this on my 12.5c’s. ESSC#1 was not profitable for me, but just barely, because I did cover my cost-basis but bought back in. So please don’t take this as “You should have done this!” I’m hoping to make this a wiki so we could all learn from each other. Maybe it’s a bit too soon and fresh but I want to get this down now while it’s still fresh in my memory.

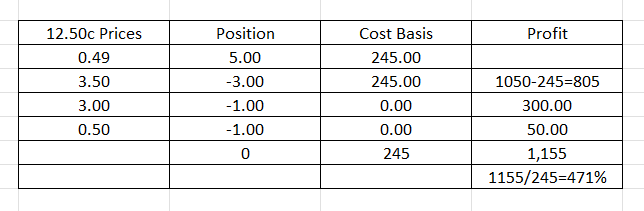

Here’s a crude graph of what a 5k account could have done on ESSC#2 if it devoted 5% (which is still a lot) to this trade as it played out. This would be a “hold, don’t roll up, and cover your cost-basis” idea that Valhalla was trying to promote. That’s why no matter what some say about ESSC#2 being a pump-and-dump, the raw-beef truth of it is is that there was the opportunity for this type of trade to materialize and I wish I had followed this method more closely.

-

So here you have when it was first called out a small account could have bought 5 calls at 12.50 strikes for $0.49 for a cost basis of $245.

-

When the price rose to the 15 range, the price for 12.50c were trading at $3.50 for about a week. This is an aggressive strategy of holding, but selling 3 calls here would gross $1,050. Minus cost basis would be $805 profit.

-

Last Friday, Jan. 14, we could have sold one more call for 3.00 and net $300 in profit. This would be to insulate ourselves from anything happening in the week of OPEX. Dumps, or changes in sentiments, or share dilution (not applicable here, but as an example) and still let one call ride to see if it gamma squeezes.

-

After the dump on Tuesday, we could have still sold our last call at $0.50. The total would have been $1,155 or 471% gains.

You can tweak the changes and prices so that it can be a more/less profitable trade if you tend to be more/less risk-adverse. But trimming like this helps us to take in healthy profits while still holding a position to a possible gamma squeeze that is a speculative event in and of itself. Couple that with a dump, stop-loss triggering, or general loss in sentiment, trading like this insulates (or at least minimizes) these risks.

I’ve often times just seen “unrealized gains” without actually breaking down how I could have exited the trade with gains and minimized my risk going into OPEX. When the gods/mods say “cover your cost-basis and let a few options ride it out” I actually had to show it to myself as to how that was executed instead of just remembering my brokerage app said I was up 500% at one point. Something like this helps ingrain in me this strategy instead of an “unrealized gain/loss” metric that encompasses all of my trades.

Obviously this doesn’t fit into trades of folks who go into the squeeze late. And it’s a fair criticism. Late entry points, and those that got in late, weren’t able to realize these gains. I’ve been there - noticing a play late and jumping in with the expectation that I could 4x or 5x in a short amount of time. But maybe it can be addressed more clearly that although there are certain “good entry points” closer to OPEX, they should be met with diminished expectations of returns given that it doesn’t allow for as much time to cover cost-basis than earlier entries.

Also, while deep down I’m looking for the next IRNT (or GME, or AMC), grand slams like those are rare. But if accumulate enough singles and doubles like ESSC#2, I’m coming out pretty green on the batting average.

Every trade helps me to learn more about myself, and in return, more about my trading. Although I was a bit more disciplined this time around, I can still do better. But I’m definitely going to be strategic in trading. Hope there’s others with more informed opinions that can add to this thread.