Hey everybody! This is my first DD, so please criticize and help me improve. I have been lurking on the forums and discord for a bit, so I figured I would make an appearance finally. This is a position I have been bullish on for a good chunk of the year and wanted to share my thoughts.

Introduction

Oil & Gas… We all love to use it and hate to buy it. While rising oil prices may be hurting your pockets on the road, this may be a good way for you to put some of that money back in your pockets via the market.

Enter Exxon-Mobil. XOM is one of the world’s largest publicly traded oil and gas companies in the world. Having faced a lot of trouble due to the COVID pandemic, they are on the road to recovery and trading slightly below January 2020 levels. While their recovery has been significant, I believe that there is still a lot of room for growth and that the stock is undervalued currently. I believe that there are also some catalysts/events that can help push it higher.

How is XOM Undervalued?

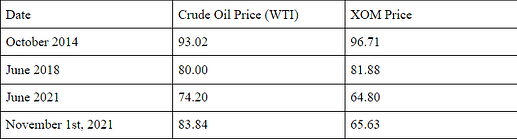

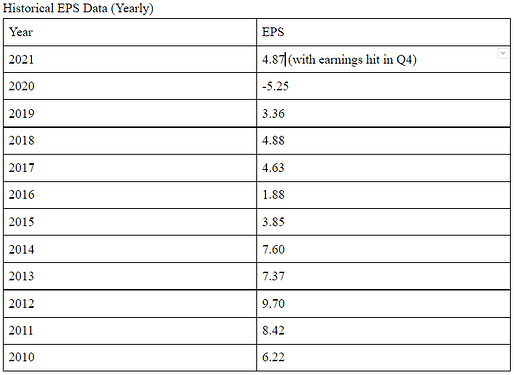

My main reason behind XOM being undervalued lies with the stock price in relation to crude oil prices. Historically, at similar crude oil prices, XOM has been priced higher, despite similar EPS’s being reported. I will provide some data about historical crude oil prices and XOM stock prices.

I chose to present these dates because they represent either times when crude oil was over 80$/barrel or in the case of June 2021, when XOM was close to the current price with a different WTI price. I believe these data points show that with current oil prices, the XOM stock is undervalued.

In addition to crude oil pricing, I believe looking at the yearly EPS’s of XOM can add to this data, by showing that XOM is not lacking in securing profit. In fact, their performance is similar to the years where their stock price was much higher. This data can be seen in the following table:

The important dates to look at are the yearly EPS for 2021, 2018, and 2014. The EPS for 2021 looks to beat many previous years, and is very similar to that of 2018. The reasoning I have worked out for the EPS of 2021 being lower compared to 2014 (the other year where oil was >80) is that in 2014, oil prices ranged from 63$ to 104$, hovering above 80$ for most of the year. In 2021, we have experienced a range of oil prices from 54$ to current prices of 84$. So, while the yearly EPS of 2021 may seem rather lack-luster, it is quite phenomenal considering the oil prices of the year and recovering from the pandemic.

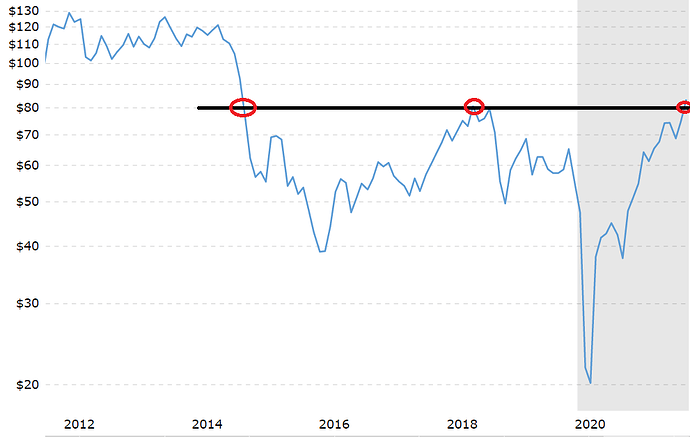

Graphs for Historical Oil Prices & XOM Stock Prices

Crude Oil Price (past 10 years)

Red circles outline when it crossed 80$

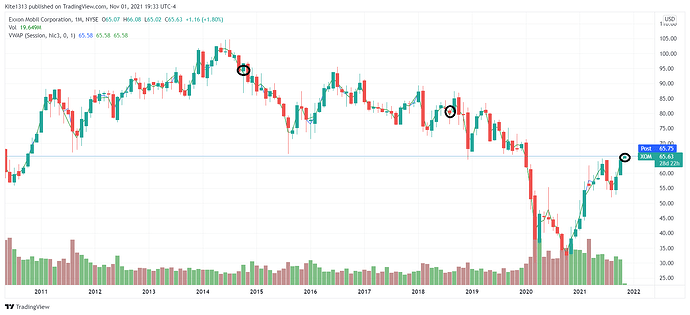

XOM Stock Price

Black circles outline XOM stock price when oil was around 80$

Technical Analysis (Still Learning, Sorry)

On top of the fundamentals of XOM and its undervalued position, it has a decent technical setup. It has been in an upward channel since the beginning of September, with no moves to breakoutside of it.

Catalysts/Good PR

- XOM announced a 10billion dollar stock buy back for 2022

- Oil prices look like they will continue to rise due to:

- the upcoming winter months (increased demand)

- OPEC refusing to increase production

- Decreasing inventories (due to demand, supply chain issues, and disasters from earlier in year)

Possible Negatives/Roadblocks

- Big Oil has been getting some negative publicity recently due to climate change issues

- XOM stock price is largely tied to crude oil prices, so if there was a sudden increase in supply, this thesis would be obsolete.

Conclusion

Overall, I am looking for a sustained rise in XOM stock price going into the end of the year. I am looking for it to reach into the mid-high 70s by EOY. I hold shares and some options expiring in Jan 2022 currently.

Looking forward to any questions or comments people have.

~ Kite