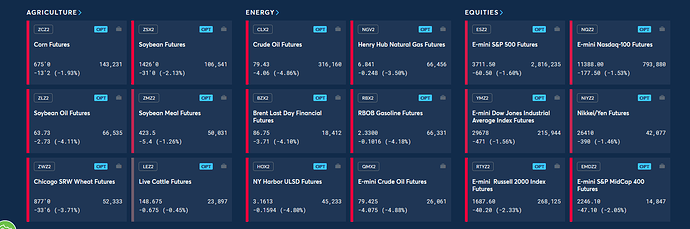

So, fertilizer companies fell along with the rest of the market. Interesting to note is that grain commodities were also down.

As was basically everything else.

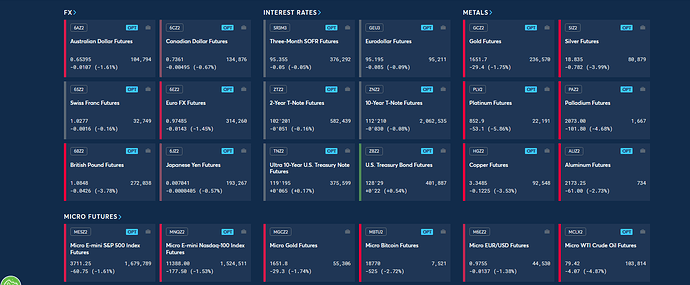

CF, NTR, and UAN have not fallen back to their recent lows however, which lagged the broader market by almost a month (6-17 vs 7-14). However they found their bottoms on days that coincided with sell-offs on grains, natural gas (and oil in general) AND the rest of the market…

CF (NTR and UAN are basically the same chart)

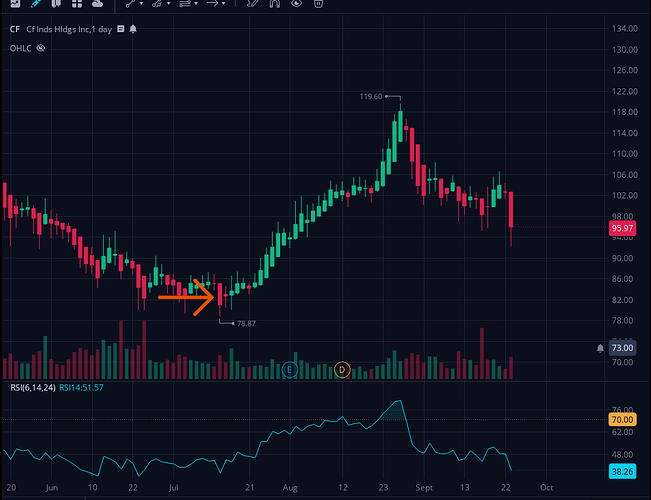

DIA

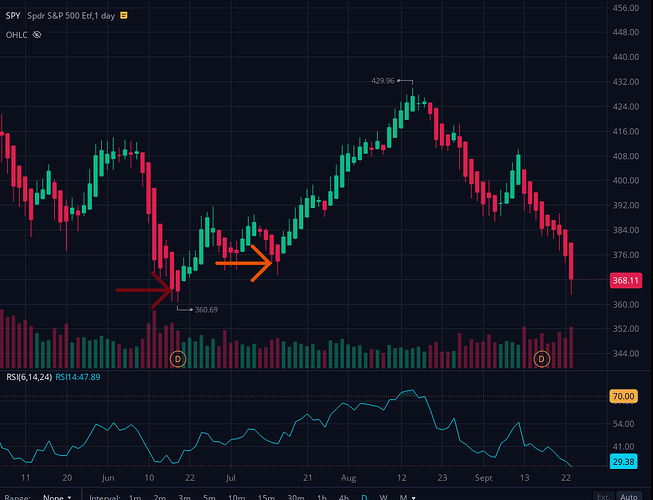

SPY

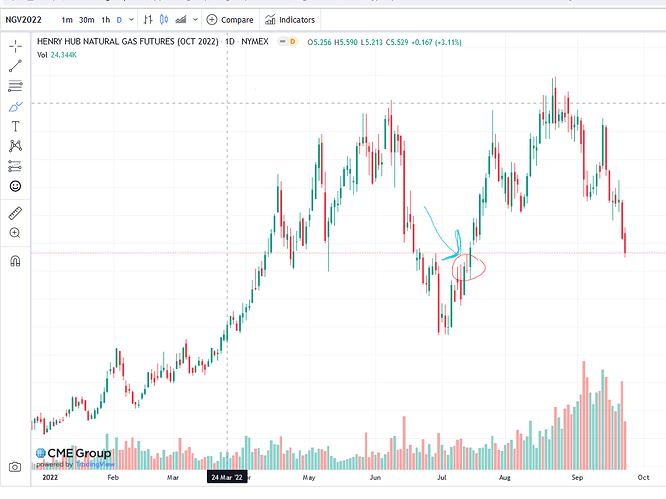

It was also a red day for Natural Gas…

Natural Gas Futures

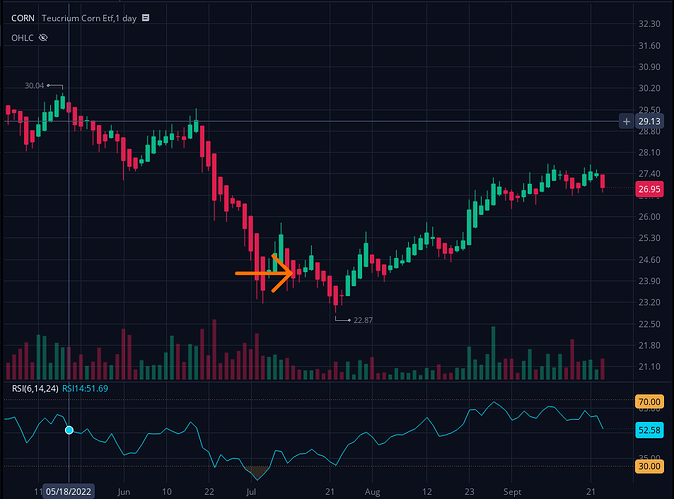

And while not the bottom, CORN was also down

CORN

OK, and?

Well, it’s going to be pretty interesting to see what happens this week, and why. Will NatGas/LP rebound? Will corn, soybeans and wheat rebound? Will the S&P, DJI, ect all rebound? Can we use these other factors to tell us when and how to trade these tickers?

I am watching these tickers to see how they behave in relation to not just the rest of the stock market but also natural gas(and oil) and grains. As of right now I don’t believe they have found the bottom of the current sell-off so I would not just start buying calls if I’m bullish for the rest of the market in the short term (which does make sense).

It’s also difficult to be overly bearish on the nitrogen stocks at least. We know that there are shortages in grains, or at least there is not the crop in the field that would send the grain markets into free-fall any time soon. I do expect a short term slight sell-off on corn and soybeans as we test the “harvest lows” but that is more of a seasonal cycle than a fundamental move. This kind of a move may help these stocks find the short term bottom and hopefully provide an opportunity to establish a long position.

Factors to watch:

natural gas and oil (winter is coming)

grains; specifically corn (but runs in soybeans or wheat can set corn off on its own)

general market movements (if everything else is pumping these probably will as well)

weather, specifically hurricanes (one of the factors that caused CF to start it’s bullish movements last fall was damage to the Gulf Coast that effected the oil and gas industry and nitrogen export facilities)

Oh, and if you have read this far here is a bonus… DE is still $50 above where it found bottom early in July. You can bet I’m watching THAT!

Good Luck Valhalla!