This thread is for general discussion and analysis of the listed commodity.

MOS might be a good pickup at this price level.

To summarize Tmilly’s TikTok find:

Three big chemicals Phosphorus (P) (10% from Russia), Nitrogen (N) (Made from Nat Gas, of which Russia is the world’s largest producer), Potassium (K) (25% from Russia) all going up 3-5x in the last few weeks. All fertilizer is made from one of these three chemicals. Food prices are expected to come up as farmers cannot afford to fertilize as much of their land. They’re just growing less food.

Lower supply, equal demand = higher prices on food = potential food crisis.

Coming up on yesterday’s low, seems like it’s deciding what it wants to do…looks like it’s gonna either shoot up or down like 3% tomorrow, the question is which way haha…emphasis on might?

@tedro What are your thoughts on MOS at these levels? I know you’ve been watching it closely.

I’m not Tedro, but I’m of the opinion that any dips on MOS should be bought up. It’s been a consistent winner for the year so far and I feel has more gains to come due to the war and uncertainty.

I have started to watch Corteva CTVA today. They make crop protection chemicals and nitrogen stabilizers. Nitrogen stabilizers protect applied nitrogen in the field which gives the plants a better chance of absorption before volitization, leaching and mineralization can occur. Since nitrogen prices have basically tripled since this time last year I expect producers to utilize these types of products as much as possible.

I have taken a position with 6x $60C for 04/14/22. Cost basis is .56 and they closed at .53.

MOS looks like it has resistance at $69. ATH for MOS was $88 range in 2012(I believe)

I have no idea where the market values MOS now, I thought it might cap out around 64 after it stopped there on the last two runs.

One thing I noticed that is worth sharing is the second it dropped below 56, a couple times this past week, it immediately triggered huge buy volume. Mid-high 50’s is also the price target range for a few of the more bearish covering analysts, but I also know they have approved over $1B in share buybacks (I want to say 1.4), so those are my best guesses as to the source of the buys (and/or reason for price pullback if your wear your tinfoil hat).

So I think the floor for now is roughly 56, would love to hear about any theories on upside or possible catalysts.

To follow up with a question Isaiah had on VC today, I have not found a way to track real time fertilizer quotes. I spoke with my younger brother who manages a local farmer CO-OP and he said that they receive a monthly price from their parent company that is “good” for the month.

I was able to find this article that basically confirms what we are seeing in terms of price increases. It’s about a 5 minute read.

https://agfax.com/2022/03/09/dtn-fertilizer-trends-prices-resume-climb/

One of the main points from this article is Brazil needing to source fertilizer to make up from the loss of Russian exports.

I am following these companies daily and I may take a position if I see a good entry point. I should probably start a trading journal as well. I like to try not play FDs unless we see a news catalyst pop up and I usually buy an ITM call for at least a week out.

These tickers seem to generally have bullish AH/PM movements with a pop at open then a slow bleed. Mid-day seems to be a good time to look at taking a position depending on what price action has looked like during the day.

MOS, NTR, CF all had earning Mid-February so we don’t have to worry about those potential pitfalls, although I would be interested on some input concerning pre-earnings report plays.

Thanks and good luck!

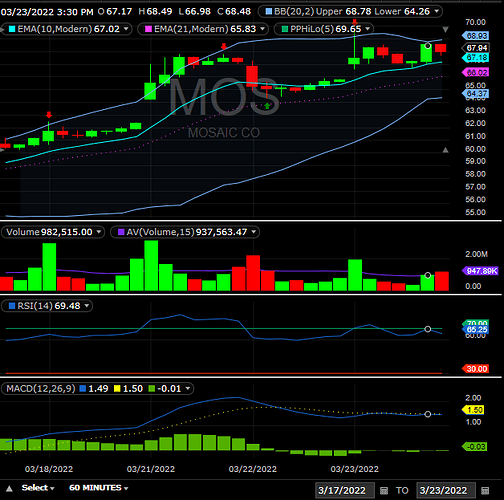

Sorry, I’ve been hit or miss due to being sick. I took a look at MOS and here’s my thoughts.

Overall, I think MOS is short term (a week) Bearish but long term Bullish.

Why I think bearish

- It’s trading above 10 EMA since last week

- It’s been trading above 21 EMA for the same time frame

- It’s been trading above 70 RSI all week, last time this happened was in February and eventually the stock fell from $66 to $52

Why I might be wrong

- Last earnings weren’t great and it’s been on a tear ever since

- Momentum does not want to stop

- More calls than puts on options chain

- It’s trading at levels it hasn’t seen since 2011 with seemingly no reason for a long term slowdown

TLDR

I agree with @HypnoDoge. Scoop up any dips you find, might be some opportunities later this week or next week but overall I don’t see any reason MOS does not maintain it’s bullish run.

are we treating IPI and MOS similarly as far as the fertilizer thesis goes?

I think IPI is a low float and acted as a lagger when compared to MOS

WSJ article posted March 24, 2022 5:33 am ET:

IPI up almost 5%, MOS up almost 3% today, so I tend to agree with @Isaiah, but it also means it will come down faster (see the dump to $56 last week). Definitely watching both, but it’s not clear how much of this is priced in. IPI has almost tripled in 2 months, with MOS almost doubling over the same time period (further confirming the low float impact to price action).

IPI has much higher options premiums, so keep that in mind. MOS might be a better way to play it, with lower premiums, albeit probably lower upside potential.

Yes, if the trend continues we may see a mid-day dip. Definitely watching them, no position at this time.

Figured it had been long enough to post this again, this little chart has played out pretty solid, and now that we are getting more rumblings about food shortages, Iwould assume the trend will continue

I want to mention CVR Partners ($UAN) again to raise awareness; it’s up about 40% since I first mentioned it here. We all know fertilizer has been on an incredible run—but I think there’s plenty more left. Many people think that the recent run is due entirely to the war… and while it’s certainly had an impact, the supply shortages and market dynamics were already setting up for a perfect storm even before Putin lost his shit. The invasion amplifies all of this.

$UAN (I’m intentionally calling it $UAN instead of UAN to disambiguate the stock from the fertilizer… UAN is a common abbreviation for urea ammonium nitrate, a liquid fertilizer product) is a master limited partnership (MLP). This has many implications, but the most important one to be aware of is that MLPs pay zero taxes—instead they distribute all of their profit to shareholders (and it’s specifically called a distribution, not a dividend). This is important to be aware of because you will be taxed on distributions received even if it’s in a tax-advantaged account (e.g. 401k, IRA, etc).

$UAN was already looking as though it could pay $40/share in distributions this year, well before the invasion. It’s certainly likely to be higher than that now. This will be a cash printing machine this year. But even with all this goodness, I do also want to warn that this stock behaves bizarrely at times—see my previous post in the link to see what I mean. It tends to plateau for long periods of time and then rockets upwards.

Im currently long many shares at an average of $106.67. I may add more in the future, but I will likely wait a bit right now to see if there’s any pullback.

I tried to look for “Hidden Gems” in the crop protection space and 1.) I didn’t find much and 2.) Most of the hidden gems have been found and purchased by the larger companies or are private companies.

The following companies manufacture herbicides(weed control), insecticides, and fungicides. Fungicide usage has increased quite a bit in the last 15-20 years and I expect this to continue. Most of these companies have a diversified portfolio of crop protection chemicals.

Top crop protection companies

BASF traded on Frankfurt SE, London SE, Zurich SE. Available OTC for US investors ticker BASFY, not sure if options are available.

Bayer AG traded on Swiss Exchange, I think it can be traded OTC under BAYRY, once again not sure on options.

Syngenta and Adama: owned by ChemChina. I cannot find any way to trade in either Syngenta, Adama or ChemChina for US investors. If you can trade on the Shenzhen Stock Exchange you may be able to trade these stocks.

DOW/DuPont spun off it’s agrochemical segment in 2019 as Corteva, ticker CTVA. I currently have some $60 04/14 calls. I think this is a pretty solid company.

FMC ticker same. U.S. based company. I took a look at it a few days ago and may start a small position. Definitely worth watching.

Sumitomo Chemical Corp, tradable on the Tokyo Stock Exchange.

Nutrien (NTR) is also involved with crop protection chemicals, I think mainly on the retail side.

Scotts Miracle-Gro, ticker SMG. This company is really recognizable to US consumers, and generally does well. I’m wondering if retail investors will turn towards this because of the brand recognition.

As I stated on TF earlier the 2022 North American growing season will be the most important one in probably the last 15-20 years. I think producers will do all they can to grow the best crop they can. Normally producers need to be mindful of the added expenses that come from the usage of these products but with the increase in grain prices I feel like producers will “throw the kitchen sink” at growing and protecting their crops this year.

Hopefully this is helpful, please keep any position size responsible. Good luck!

SMG might be interesting because it can double up as a cannabis play