I, like most of you, am completely burned out on earnings plays. Alas, I’m throwing one out here based on the response retail has had this earnings season.

Five Below is not a store for very cold things. It sells assorted shit you don’t need at mostly $5 or under. They have a small smattering of things a bit more expensive than that.

To my eye, Five Below stores have started popping up everywhere. In my area, the stores are located in high traffic, higher end shopping centers. Their stores target a youngerish audience, but the variety of items they sell is vast, so you’ll see all generations in them. They also sell things that are brand name and/or generally more appealing than the stuff found at your usual dollar stores (they even have electronics and clothes). Like TJ Maxx, they always have different stuff, so customers cycle through more often.

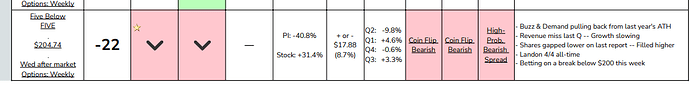

Anywho, back to the stock. At $216 today, FIVE is a bit off its 52-week high of $237. They have beat earnings in their last four quarters, and some growth estimates are showing over 100% growth expectation next year. Earnings are being reported 12/1 afterhours. The stock declined fairly hard through September and October, but seems to be crawling back up.

Based purely on sentiment, I could see this stock performing very well at earnings, especially forward looking as we go into the holiday season. My biggest concern would be supply chain issues, but since they don’t have to sell any specific items, I’d think they could cycle through whatever items are more easily available. Based on what I’ve been seeing out in the world, I’m expecting these stores to have heavy traffic over the holiday season. Plus, at the price of the items, there’s hopefully less concern about inflation and economic issues.

Today is a red day, so I’m planning on picking up some Dec 220s. Interestingly, OI on puts for this date are quite low at the moment.