This thread is for signals related to the release of FOMC minutes and the pop that usually happens directly after. This is a very quick scalp play. Based on research in the following PDF: https://www.newyorkfed.org/medialibrary/media/research/epr/2013/0913rosa.pdf

SPY should track up 15 minutes before the release of the minutes at 2PM EST, then exhibit a very brief couple candle bullish movement and then choose direction based on the contents. So the play is to purchase contracts before the rise in price and cut the momentum cables that appear afterward for a profit.

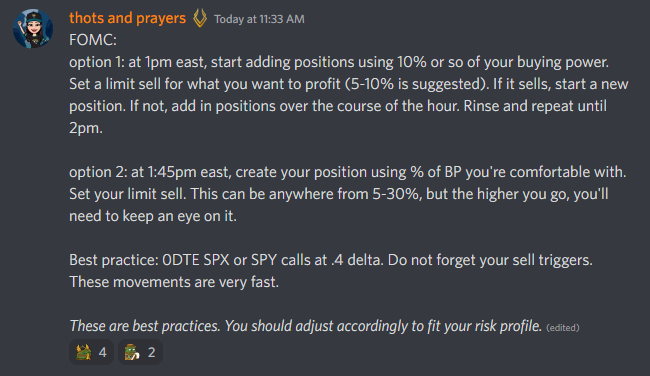

This is an updated strategy guide from @thots_and_prayers detailing the two times that positions can be taken and the two strategies. The first option is for strangles with the intent of offloading legs as they hit profitability, the second option is for taking long calls with the intent of offloading after the 2PM pop:

11 Likes

I’ve taken my first position for this FOMC minutes play. I’m taking the 447 FD because honestly it’s cheaper and I want to conserve capital to average down my other active plays and take part in #spy’s movement after the minutes drop.

6 Likes

Also just an FYI, I can’t tell time apparently so I took this a full hour beforehand. Remember kids, that’s part of why you average in… because sometimes you’re just fucking retarded.

9 Likes

Was holding 3 contracts but ended up cutting one because of the run crossing 100% profit. .66 cent buy → 1.40 sell 112% total. Still holding two.

3 Likes

That was a hell of a play.

Moved exactly as called out

4 Likes

Want to caution people expecting the interest rate decision to move as we’ve come to expect FOMC minutes to move. This is a different event which will have a different result. Take profit on the majority of your positions if you’ve got it before the announcement and then play the market when it chooses a direction which could be anywhere from immediate to overnight. SPY won’t gap to 450 if it’s bullish so you’ll have time to collect positions if need be.

In my opinion the case for !pricedin is pretty solid. Market is down and has been held down despite decent earnings in preparation for this moment. The market has likely priced in what is about to happen, you may get a quick sentiment move but don’t take that as concrete, the larger decisions will play out afterward.

One thing to keep in mind is that the market is resilient, it’s not going to crash unless it has good reason and this event is objectively not that reason. This is something that is predictable and has been factored into most everyones strategies at this point. While there is plenty of reason to be bearish about this current market, when to be is the million dollar question. This isn’t to say that this won’t be a catalyst for further selling in the market, but if you were to map it to percentages, bullish is far more likely at this juncture.

May your FDs reach the heavens

23 Likes

FOMC day has come and gone, and as widely expected, markets rallied in the hour and change after the conference call ended.

VIX fell from ~30 to ~25 mostly because the uncertainty around the FOMC was gone, and the bond market yields fell probably because JPow indicated that unless something really unexpected happens, the Fed will do a few orderly 0.50 hikes and then 0.25 ones, and no 0.75 ones.

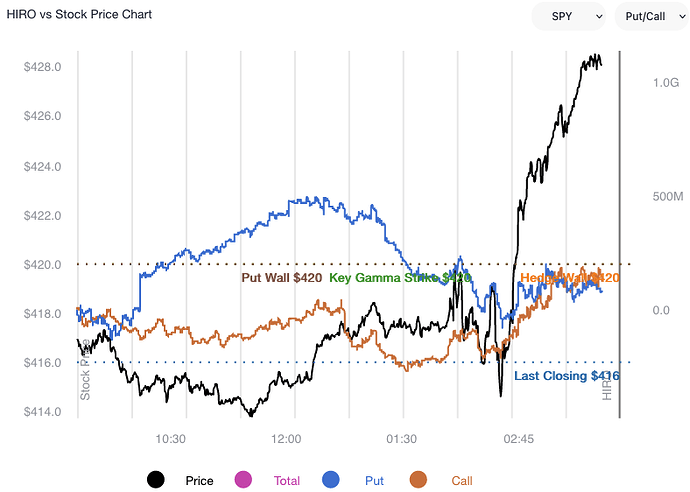

However… and there always is a “but” … this seems to have been more of a relief rally versus one driven by strong conviction, as the options market is pretty absent here.

There was very little by way of call buying or put selling (graph below from SpotGamma’s HIRO indicator), which would have been the signs of conviction/positive sentiment. It doesn’t mean that the rally won’t happen, just that it may not be as strong as the last one because the Fed did not surprise one way or the other.

(p.s. note how SPX is pinned at 4300 - when underlying fundamental drivers are exhausted, its uncanny how the heavy gamma levels keep acting as the magnet.)

7 Likes

It’s that time again. Remember that SPY doesn’t “usually” track upward until about 15 minutes before the release at 2PM. If you get the FOMC pop it usually only lasts a couple candles and then the market will choose a direction.

So acquiring calls closer to 1:45PM is suggested and cutting them quickly is also the play. You can re-acquire a position once a clear direction has been taken.

10 Likes

Be doing my usual play tomorrow - start building ATM call and put positions at 1:00, add positions when red, setting % limit sells as I go. SPX 0DTE.

My personal strategy is 5% or a trail stop - YMMV, but you’ll find 5% easy to hit while higher % profitability may be more challenging.

Godspeed.

5 Likes

Adding onto your callouts about IV creep, if theres a better time to trigger the strategy alerts let me know.

2 Likes