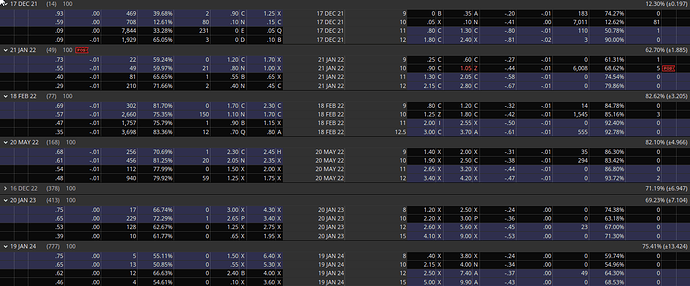

Etoro is going public under the through Fintech Acquisition, under the expectation that the merger would close in Q3. Unfortunately, this has shown to not be the case FTCV is currently trading just above its NAV of $10. I Currently, the January $10 puts can be sold at .90, for a whopping 15% return on buying power you have to set aside (assuming you can sell naked puts) or a 9.8% return if you can only sell CSPs. I recommend selling the January 10s, as that is the best ROI.

from seeking alpha:

eToro is an investment platform with over two million funded accounts that is about to go public via a SPAC deal with FTCV (Fintech Acquisition Corp V.). The SPAC is led by legendary fintech investor Betsy Cohen who has as good a record as anyone in the space. Her hits include CardConnect which was bought out for $15 per share and International Money Express (IMXI) which is also over $15. Her misses like Payoneer (PAYO) and Paya (PAYA), are only minor blemishes considering both are still within striking distance of their original $10 price.

In eToro she is catching a company in a fast growing industry at a discounted price.

The core offering of the business is the ability for users to trade and invest in equities, commodities, crypto assets, and currencies. Secondary features are based around the idea of community, like the ability to follow higher profile investors and automatically copy their trades. Soon eToro will be expanding its offerings further with a debit card that links directly to their investment accounts.

The most recent results of the company are promising. Company revenues were $222 million in the third quarter keeping eToro on track to reach a billion dollars for the year. Additionally, and arguably most importantly, the number of funded accounts rose to 2.14 million.

There are some unusual things to note on the options chain. There is almost no volume on calls expiring in the month of January, leading me to believe that there may still be time before the merger gets approved, OR that there might be some bad news on the horizon. The $10 strike put on the other hand has 6000 volume, which leads me to believe that either other investors have seen this opportunity to make low risk high returns on capital OR someone knows something about the merger that hasn’t been made public yet. I’m willing to take that risk.

A unique feature of SPACs is what makes this attractive as a trade, even if you’re not convinced of the company’s long term viability. Until their redemption period, there is effectively a $10 floor on share price. So unlike in a normal stock where a counter argument could be, ‘why put capital at risk when the Robinhood comp or the Betway analogy show a scenario of limited upside’? - Here, that trade makes more sense because the downside is even more limited. Investors will just have to pay very close attention to company filings if they’re in it for the short run. The floor will be removed and at that point the risk reward equation will shift.

Current positions: