[size=4]Everything Concerning Crypto & Bitcoin Price Prediction[/size]

By: UnknownPhilosopher

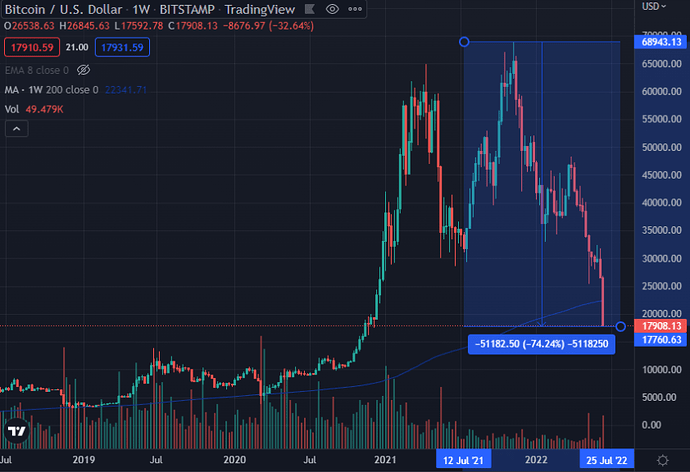

I first encountered this chart at 40K btc after seeing it on Twitter and it made me really consider our macro-environment to see whether this is a possibility. (Price talk after macro)

==Table of Contents==:

1- Macro Environment + Crypto Enron

2- Institution + Government Involvement

3- 5 Price Theories + Other macro influences

4- Further Price Predictions

5- How To Survive Crypto Winter

6- When To Sell

7- Final Thoughts and Disclosures

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++

1- This is going to be a short list of macro influence.

MACRO risks:

Vacuum Cleaner: (Large overall market outflows = speculative decimation)

-

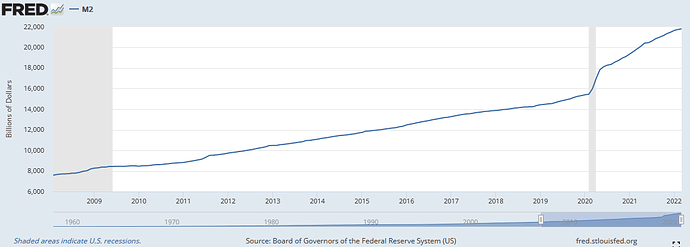

Fed QT- Quantitative Tightening. The 12 year bull market since 08 as a result of large monetary printing has come to an end (temporarily). https://www.stlouisfed.org/open-vault/2019/july/what-is-quantitative-tightening

-

Higher Rates- 0.75- 1 basis points and increasing by a rate of 0.25-0.5. “nearly 2% on average by the end of this year, and close to 3% by the end of 2023” . The Fed raises interest rates by the most in over 20 years : NPR

-

Liquidity Contraction- The slush of excess liquidity can be seen from over 2/3 of stocks under 200 MA and speculative assets such as spacs, ipo’s, and alt coins down 50-80%.

Global Economic Problems

- High Gas prices- Average Mid $4’s

- High Inflation- 8.3% (Average supposed to be 2%)

- Food Shortages & On-Going Supply Chain Issues- I’ll link my report to Nvidia’s financial and strategic analysis at some point which will highlight some effects of supply chain on chip and semiconductor shortages. But less mining equipment and higher prices generally means less bitcoin will be mined= Bitcoin chain slowed down and lower prices.

Hate or love Charles Hoskinson, he had an amazing summary of the direction that the world economy is moving and the future of money in general in this 18 minute video that I recommend everyone to watch. Just ignore the ADA stuff. x.com

CBDC - Very important and fits within Macro + Monetary problems, i’ll talk about that after this.

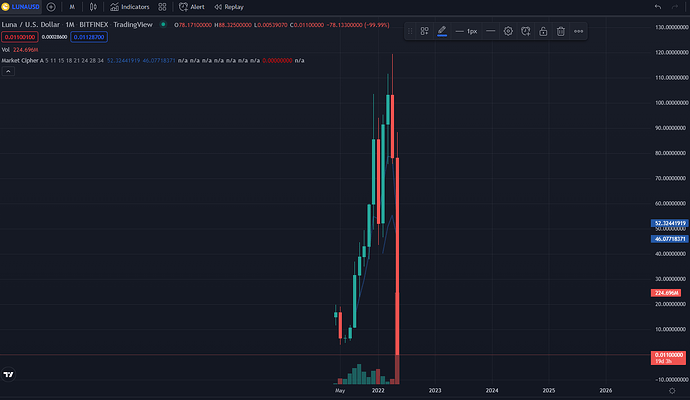

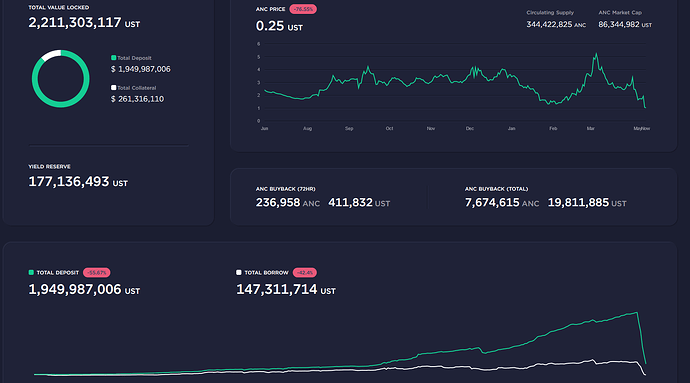

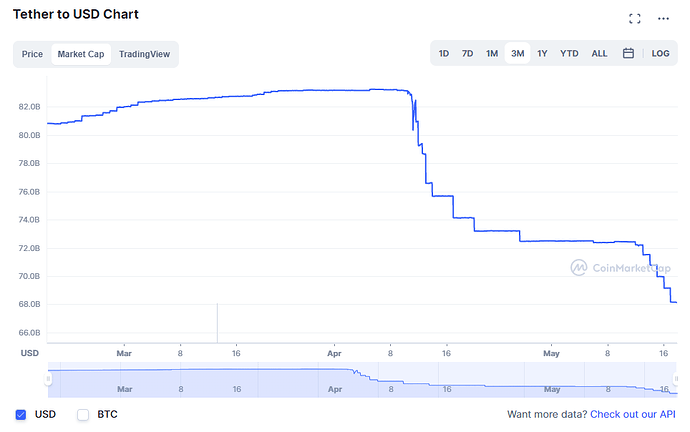

Enron or Bernie Madoff

Luna collapsing which represents a 40B type rug and 16B from Anchor. This includes UST de-pegging. Ultimately LFG (Luna Foundation Guard) or (Let’s freaking go) had to dump 2B BTC onto markets although their ultimate plan was to accumulate 10B which would help to stabilize peg. They had to dump this to buy UST (ironic right) which brought luna even further down. Attack or not, this is VERY important because billions upon billions lost money and liquidity comes out of crypto… or goes to new projects. I called this Enron or Madoff because they both had around $65B at their top, close to Luna at it’s peak.

This is a problem as briefly mentioned above because this was a top top 5 coin in the crypto space and besides the BTC correlation, it represents a HUGE chunk of defi and stablecoins- one that we use everyday to trade with. I won’t waste much time talking about why it failed but I’ll summarize it briefly (I’m aware of how many already know about this). The reason algo backed stablecoins don’t work is because you need 350 exchanges (as example) at once to accept the tradeoff between the token and $1 at ALL times That’s a big lesson on all of crypto. Tether works because it’s backed by fiat - even if it’s infinitely printed. Backing one imaginary asset by another token then allowing people to leverage it has a reverse gamma effect when the peg comes off. (GUHH)

And here’s the last of UST Common

2- What is CBDC?

Government wants to issue digital assets rather than buy into a stablecoin or crypto as a way to keep consumers and citizens in the country’s native currency for tax purposes, financial stability, and transparency into crime.The problem is that while crypto and blockchain are meant for transparency… CBDC is like a black tinted Mercedez window, you can only see the outside not the inside. Ultimately “you will own nothing and be happy”. Read more here Your Money and Your Life

How do Institutions Short Crypto:

Since 2021, numerous Bitcoin Futures vehicles came public such as BITO on October 18. That marked the top of Bitcoin.

Futures are derivatives that can leverage an underlying asset without actually owning spot (Partially why SEC allows big funds to manipulate crypto without facing underlying risk of bitcoin price appreciating). Valkyrie WAGMI Futures vehicle went public on October 22, 3 days later which was even closer to the top. Goldman recently did an OTC Bitcoin options trade which will help them to ==leverage the short-side even more and then look like hero’s when they eventually pick up the supply during liquidations== (talked about later) Goldman Sachs’ OTC Bitcoin options trade 'doesn’t mean much,' but can pave way for more institutional involvement | TechCrunch

Okay so now we know there’s macro risks, global economic problems, an Enron type crash in crypto and institutions short, is there any HOPE for crypto?

The answer is maybe.

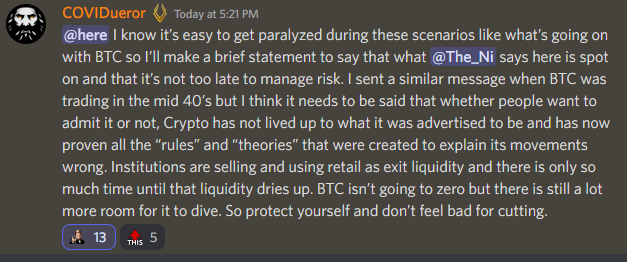

Fast Forward 1-2 months…

25K hit at 5/12/22 3:35 AM EST

Boom!

So is this the bottom or will get a bogdanoff style rug? https://www.youtube.com/watch?v=61Q6wWu5ziY (watch this)

Here was my initial thesis…

I will present a variety of ideas to which you can choose one, two, or even all to incorporate into your price predictions.

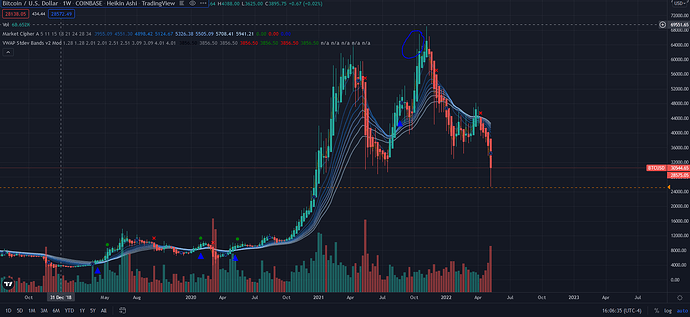

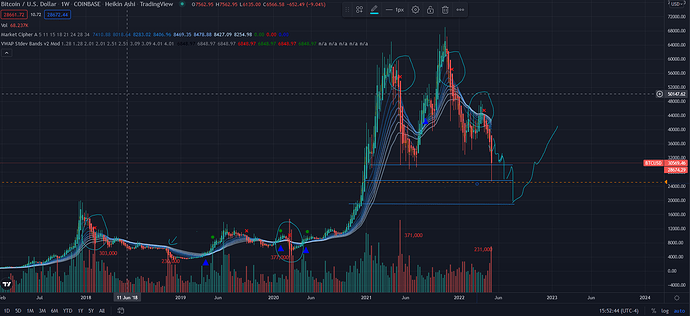

3- Five Price Theory

Focus carefully on one thing only:

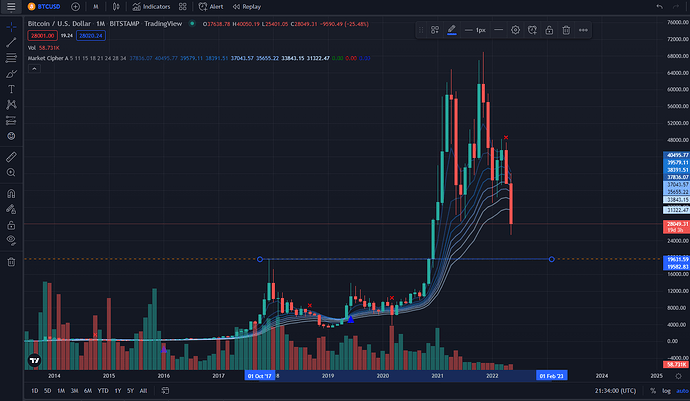

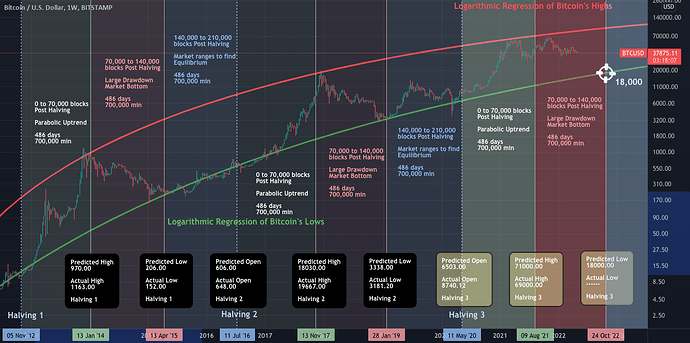

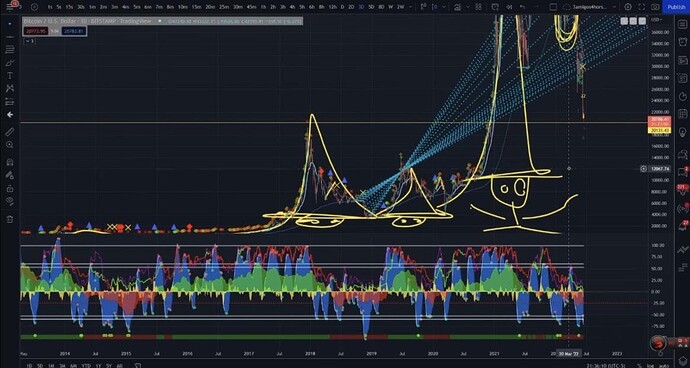

- The X marks of death that I have circled in light blue from 2018. Using Market Cipher indicator, these have statistically shown very strong accuracy in giving out mega short targets. At 45,000 I gave out this warning and began to sell bitcoin to which I fully exited my position at 42,000.

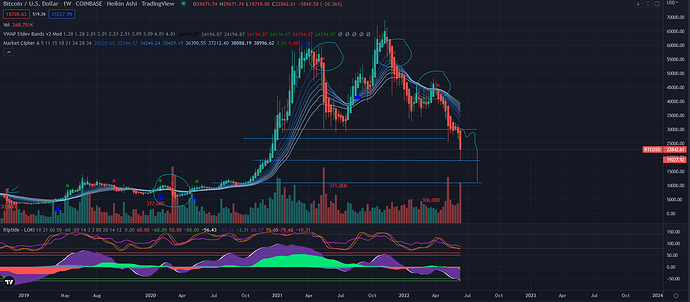

Now crypto is known to fall 80% on every cycle and top to bottom from 69k would be 14k. But this would cause mass liquidations. It’s also known to have a period of sideways movement to which many claim “crypto ponzi has died” and to their surprise, on the next FED magic trick… money goes back into markets and bitcoin pulls a 5-10x. Now we can notice from the chart that after crypto drops, a strong entry point which completely misses the bottom will be the blue check-like arrow indicator. I will use this in hindsight to confirm my thesis that I will present shortly.

Wizard Math stuff

- Now scroll up all the way to the chart at the beginning of the post. This is called a “fractal”.

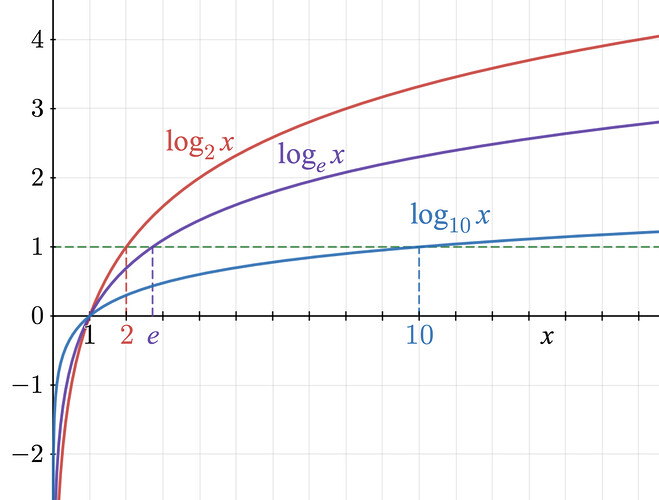

What is a fractal? I don’t really know to be honest. By definition this is a “recurring pattern that occurs amid larger more chaotic price movements”. Basically this is mathematical computer generated probabilities that will direct the most possible outcome for bitcoin. This is a tool that comes with someone’s manual inputs and they just combine to form a possible price movement. This chart shows one crucial local bottom : 25k.

Volume Thesis:

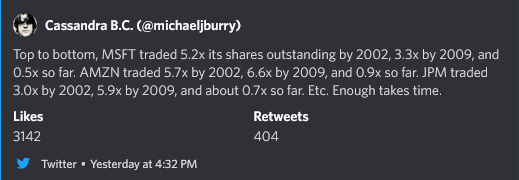

- Take a closer look at the chart above and zoom as much as you can in (sorry I didn’t realize how small the font will be but it’s fine, trust me). Notice how frequently from 2018 to the present day all the major jumps have had volumes in the range of 303-370k which indicated a bottom. The smaller fast wicks but not bottoms had ranges from 230k-303k. On the most recent drop yesterday, we had a volume of 231,000 indicating a 2018 type slide down (more room to go down). Very interesting considering Michael Burry from the Great Short made this connection to stocks recently:

Do me a favor one more time please and scroll to the chart to the top of the page (I promise this is the last time).

Let’s take one optimistic look into the future before we question whether 25k was the bottom.

-

Notice how in 2023-2024, the chart just rips as if Musk just tweeted about Doge back in the day. That’s the result of the fourth Bitcoin Halving which will take place on March 2, 2024 and I think it will be the time that Bitcoin will finally have a shot at that 100k mark. I believe that Bitcoin will ultimately run up into this event after a longer accumulation period from 2022-late 2023.

-

Due to overall macro-economic weakness and the FED’s role in tightening the economy, I spoke to numerous pro-traders who all came into consensus that ==the high for this year is in and in late 2023 will be when the Fed will re-implement their monetary tools== which will result in growth and speculative assets such as Bitcoin to come back to life.

==Now here is my theory on why I think Bitcoin will go below 20k and briefly wick 18k.==

4- Saylor Liquidation Event:

If your like me you’ll find the fact that Saylor auctioned off MicroStrategy, a tech company that was founded in 1989 that lost $13B during dot-com bubble to buy Bitcoin pretty funny.

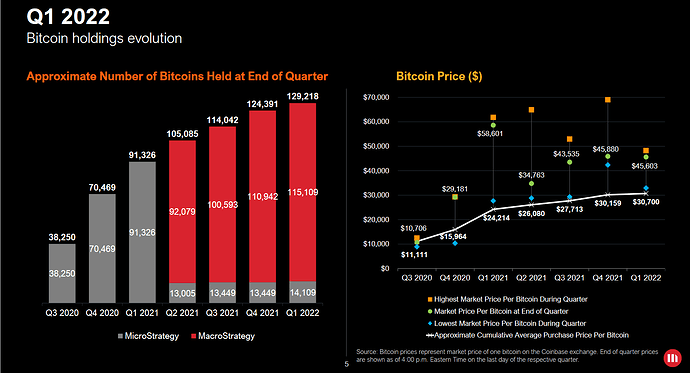

Okay back to the point… He has 129,218 bitcoin valued around 3.6B on 5/12/22 while his company is valued at $1.9B.==His liquidation price is $21,000 for which he will have to pay serious margin to maintain his stack, (even tho he cash to average down to 3,800 before he goes bankrupt). Regardless if he loses bitcoin or money in the process, this burst of liquidity is 3X as much as Elon Musk has in crypto at 42,902 bitcoins and is exactly what is needed to start a new bull market.== This will be the ultimate form of capitulation not just for retail.

Fellow MicroStrat Thread $MSTR stock and bitcoin - #7 by The_Ni

Furthermore, I believe Bitcoin will go below this price and retest the previous support at $19,000-20,000 while wicking down to $18,000 and touch 2018 highs.

==Over time crypto drops become less volatile as there are more buyers in the market so I believe that rather than falling to $15,000 we will stay strong at $18,000 unless we get a black swan event.==

Right now Bitcoin has the same 45% down candles as it had in 2018 and the subsequent drops prior to the 2020 run-up which gives me even more confirmation about the upcoming drop that I expect. In addition, notice the money-flow coming out (this is a measure of how much real-money is flowing into the markets which helps people differentiate between algo’s moving prices up and down and people buying to gauge real demand).

Side Note: These charts and part-analysis are from Crypto Face on YouTube

5- Crypto Winter

Warning: I sound like a Bitcoin Maxi, but in reality I’m a money Maxi (My goal is to maximize $)

Here are a list of ideas, take them as you will but there are some valuable lessons in these which have come from personal experiences that I have learned painfully over the past few crypto cycles.

-

Bitcoin will always be the biggest, period. There is no alternative. You will not find an alt-coin that will be the next Bitcoin.

-

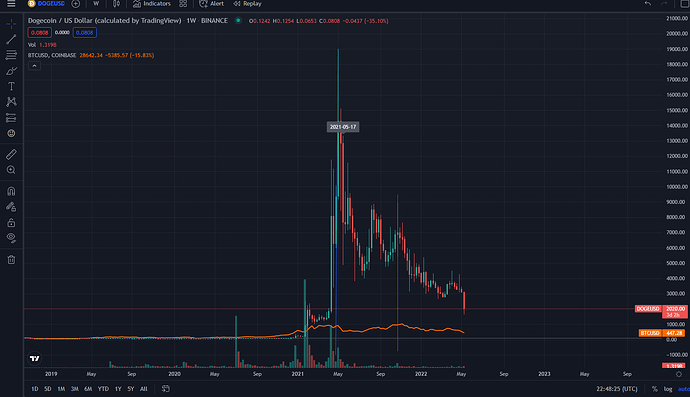

Bitcoin will not give you the best return but it ==will fall the least== during a crypto winter which is why I always convert to Bitcoin in times of uncertainty. You want to sell Bitcoin when alt-season starts and go into ETH or some other shit-coin. (Alt-season starts when Bitcoin has not made an exponential move but is on an uptrend and goes sideways).==The parabolic coins peaking is the sign of the top== You will have up to half a year if your lucky for this gambling period before crypto winter starts.

-

==Shit coins always go to 0 or near 0 during crypto winter== so they are NOT a long-term hold, make money and get out. If Bitcoin has started its descend, sell them for a loss and buy Bitcoin or get out of the crypto market, with exception of ETH, very few come back and take years.

-

Probably my most important one: ==There is a new coin every-cycle, what is popular now will not be popular in the future==. Luna was popular this season (a few pennies to $120 and back there). Yes this concerns JPEGS, NFT’s and everyhing related to crypto. Looking back, I had the largest losses when I held accounts filled with Bitcoin Cash, Cardano, Matic, etc… Exception: You did your DD and your willing to stomach deep losses.

-

Do not treat Crypto the same way you treat stocks, there is a real fundamental risk of regulation and your coin getting rugged. Crypto might not exist in 10 years when there is CBDC. ==Do not join a cult when your in crypto and think you have to hold because everyone else is. Do not associate yourself with a project personally, and always have the assumption that if you wake up the next morning and sell it you will not feel any different then before you bought it.== Even if you are up against the world central banks by holding crypto, if the fight really starts, be prepared to exit and have a strategy on how to pull out your money from exchanges fast. Always have a back-up plan.

Side note on exchanges:

- Coinbase-==In a bear market in the very extremes, exchanges can go under== because they receive less revenue from commissions as have to spend more on sponsorships. Although cryptocurrency has received a lot more adoption from Mt.Gox days, it is still possible for you to lose all your digital assets on a CEX (Centralized Exchange). Here is an article of them talking about this legal liability https://www.barrons.com/articles/coinbase-customers-crypto-bankruptcy-51652302126. As crypto prices go up, the risk becomes lower as they earn more money from their holdings. That’s why if you are putting your life savings into crypto (why would you?), you want to keep it in a ==cold storage or a ledger wallet and make sure you never forget your password.==

Regulation problem:

- In the case of regulation, one theory is that there are some ==stablecoins that will be attacked== like UST and USDN and if the protocols and ecosystem is weak, you will lose money while waiting to invest in a coin. No-one fully knows why this happens but I suspect the Fed or whichever government entity wants to implement a “stress test” to show the public the real risks of crypto to scare people out of it (just a theory).

Inflationary vs Deflationary:

-

This is very important as it goes to the core of why shitcoins and alts fall in a bear market. The reason is that if you have an inflationary token like DOGE,==supply is increased exponentially every single day and once demand decreases and doesn’t meet supply== that’s exponentially increasing, price rapidly falls. The exception to this is bitcoin because demand increases non-linearly.

-

==Deflationary Tokens== on the other hand aim to burn as much supply as possible which ultimately increases the price. Ethereum is a popular example as it burned supply numerous times, although it still does this at a pretty slow rate. Keep in mind it’s possible that if it’s too deflationary, it’s a ponzi like Luna but if it’s too inflationary it’s a shitco like Doge.==It’s important to find a middle balance here and preferably for it to be burning supply at a steady rate.==

-

==Do not assume something is undervalued just because it fell down a lot, crypto or stocks can always go lower. There is no basis for “under” or “over” valuation because everything moves in unison.== Its important to either get a large volume change in direction such as a smooth uptrend after a large liquidation or a period of consolidation. I haven’t really gotten to the point of day-trading and I only buy what I believe in so I do not have much to say about stop-losses. I guess if something drastic changes I might sell for a loss which I did at 42k.

-

==Do not buy crypto miners for exposure to crypto==. A majority of them have their own financing issues like COIN, RIOT, MARA, and instead it makes a lot more sense to buy the actual underlying coin itself. This gives you leverage and 24 hour ability to sell/buy. Why would you buy a stock that is only open from 9:30 AM to 4:00 PM when you can buy crypto instead?

Scaling in:

- One of the hardest things to do is to scale into a position when it’s falling because the farther it goes down, the larger percentages you’ll need to reach back to break-even. One of the core mistakes that I have personally done is to avoid holding cash and thinking that I always have to employ capital somewhere. ==Many times it’s best to sit on your hands and just wait until you get a clear picture.== One cool method that I learned to time the bottom is to AVOID DCA, instead do logarithmic DCA, ==rather than dropping $100 every week at a random price or $100 every $1000 down on bitcoin, incrementally increase the amount you will add by the % it goes down. For example, if Bitcoin goes down 2% add $50, if 5% then $50, 100% $200 and so on.== ==This does not mean put more money into a position, it means to allocate your capital efficiently== because the lower it goes, technically the lower risk you have and more upside. But it’s important to not start counting % at a random point but rather after you have the technical analysis straightened out such as to start adding from $25,000 down as one example.==It’s important to avoid catching falling knives in shitcoins as opposed to Bitcoin.==

(I hope this makes me look smart)

6- When To Sell

I’ll share a little story because this one resonated with me personally. I have a friend who is deeply into business and helped to run an auto shop for his family. He’s a smart guy and completely changed his life around by working hard. When Bitcoin was at 30k at the start of 2021 I told him to buy both Bitcoin and Ethereum which was around 1700-1900 at that time. He told me “it’s too risky, I think I’d like to hold off for now.” Half a year goes by and he rings me up and tells me “I’m getting into crypto, I was told Ethereum was going to 10k.” A week later the crypto market tops. I will never forget that day because this is the job of exchanges, funds, influencers and others. The moment you start to hear everyone talking about it, that’s when you know it’s the top. Reminds me of Jim Cramer a lot, he just uses retail for exit liquidity on everything he suggests. The lesson is this: When it’s too crowded, be the first out.

I really should’ve put this higher but I think it’s equally important when deciding to sell. There is a massive shift in the crypto industry from being a quiet trader-driven environment by whales to an algo based indicator for Nasdaq and the broader markets. Wall Street has gotten their hands on this and as a result it moves with almost 90% correlation to indexes.== If SPY and QQQ keep falling due to inflationary concerns, so will Bitcoin. It is NOT an inflationary hedge==. It is tied to the M2 Money Supply which is why it has been increasing for so long. This is because excess money in the system goes to speculative assets and when Fed contracts economy to tackle inflation, Bitcoin sells off. Furthermore, one way to know when to sell Bitcoin will be your equal reasoning for when you should sell your stocks. If they are in a bubble valuation and have been declining, it is possible for that to cause Bitcoin to go lower. Likewise, I believe that once Bitcoin bottoms, so will Tesla and Nvidia and other correlated assets that have connections to crypto.

Technicals wise I incorporate moments from market weakness. When there is a lot of media attention and bitcoin isn’t going up anymore, it’s more likely than not going to start to decline. Also, Bitcoin almost always will have a double top, it will just float around the peak until the whales distributed their tokens to retail. This head and shoulders formation occurs more often then not. Here is an example, we call this the 4 Amigos. Besides money flow this is one of the things you should look out for.

7- Final Thoughts

I have created this thread as a way to collect my thoughts over the past few years. I have both lost and learned a lot, I feel as if it’s important to have a database where you can constantly look back and observe information and lessons like laws. I may not be right and I have been wrong in the past and I am not a financial advisor in anyway and I do not wish to present myself that way. It does not matter to me if no-one reads this or if 1 million people do, I simply wish to seek the truth in this emerging industry of crypto and want to maximize money to myself, my family, and my friends. If this helped you, I am very pleased to hear so. Please let me know if you have any thoughts on this thread or you wish to add anything that might be helpful to others, and to correct any errors or assumptions I may have made that could have been wrong.

I will keep updating this thread as I get more information.

My original PT for Bitcoin was at $25,000 and second at $18,000 and to start scaling from 20,000.

If Bitcoin breaks 18k then it’s time to re-evaluate my thesis.

Ultimately I think Bitcoin and blockchain will be the future but a majority of altcoins and shitcoins will not make it there.